Autonomous Driving Simulation Industry Chain Report, 2020-2021 (II)

In addition to simulation closed-loop platform and vehicle dynamics simulation mentioned in the Autonomous Driving Simulation Industry Chain Report, 2020-2021 (I), autonomous driving simulation also involves traffic flow simulation, scenario simulation and sensor simulation modules. The Autonomous Driving Simulation Industry Chain Report, 2020-2021 (II) sorts through companies in these areas.

Product Distribution of Some Autonomous Driving Simulation Companies

Acquisitions (or mergers and acquisitions) are, beyond doubt, a shortcut for companies to better technology layout. Autonomous driving simulation is no exception. Ansys’ acquisition of the optical simulation software provider OPTIS and Siemens’ purchase of TASS have been milestones in their development histories of autonomous driving simulation technology.

The more mature the autonomous driving simulation industry becomes, the higher barriers the industry poses. Technology and capital walls put up by simulation giants have been a big hindrance to the growth of start-ups. Players that just specialize in their own field may end up with being acquired or introducing external support. They cannot escape from tycoons at last.

Acquiring these specialized leaders has been an easy way for giants to perfect their layout

1. VectorZero, the owner of the scenario editor RoadRunner, was acquired by MathWorks, an integrated simulation platform, and its simulation tools were included in MATLAB/Simulink product system.

RoadRunner owned by VectorZero is a scene editor. It can create environments and roads, generate complex road networks composed of roundabouts, intersections and bridges, and custom traffic signs and markings.

Benefits of RoadRunner:

①A variety of editing tools: road tools, junction tools, lane tools, marking tools, prop tools, etc.;

②Quick 3D scene modeling: RoadRunner Asset Library lets users quickly populate their 3D scenes with 3D models.

MathWorks just settles on RoadRunner’s 3D scene capabilities.

In April 2020, the integrated simulation platform MathWorks acquired VectorZero, and brought RoadRunner tools for designing 3D scenes for automated driving simulation, into its MATLAB/Simulink product system.

In May 2020, MATLAB R2020a Version added RoadRunner tools to Automated Driving Toolbox.

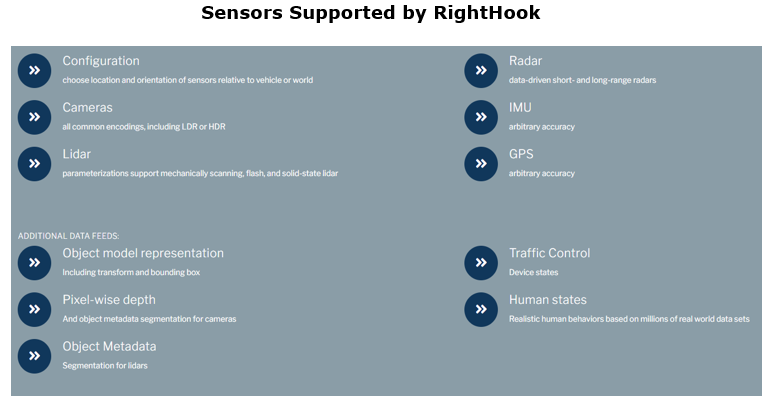

2. The integrated simulation platform Spectris plc acquired VI-grade (vehicle dynamics simulation) and RightHook (sensor simulation).

In July 2018, Spectris plc acquired VI-grade, a vehicle dynamics and driving simulator player, for a foray into the vehicle testing and simulation field.

In February 2019, Spectris plc bought RightHook, a sensor simulation firm, and then merged it into VI-grade.

Benefits of RightHook:

①Provide a complete simulation tool chain including RightWorld and RightWorldHD, RightWorldHIL;

②Enable HD map-based simulation, and rebuild the whole simulation environment according to the HD maps used by autonomous driving companies. The test environment is real driving environment.

VI-CarRealTime, VI-grade’s vehicle dynamics model, provides a set of dynamics simulation services such as hardware/software in the loop.

In November 2020, VI-grade introduced VI-WorldSim that provides urban and public road test environments for ADAS and autonomous vehicles. VI-WorldSim features include traffic, pedestrians, lighting, weather, and sensors to enable users to create and test scenarios for vehicle development programs through an intuitive and easy-to-use desktop editor.

Noticeably, for this product, RightHook provides integrated visual environment for driving simulators, which means the two companies have merged in terms of operation and products.

Start-ups double down on financing, hoping to change the fate of “being acquired”.

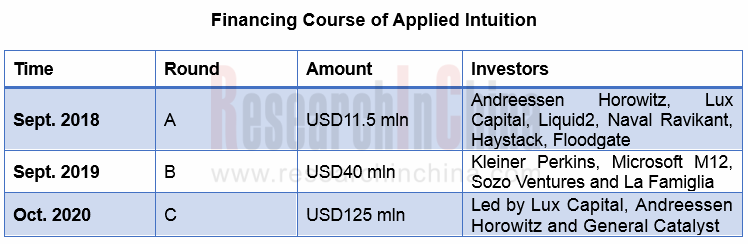

1. Applied Intuition raised USD125 million.

Applied Intuition was founded by Qasar Younis and Peter Ludwig (former workers of Google) in 2017. The company recorded roughly USD26 million in revenue in 2020. The edge of Applied Intuition lies in the ability to use real/synthesized data to build complex scene interactions in a short time and generate thousands of permutations to cover edge scenarios. Meanwhile, in the simulation process, the dashboard of the virtual vehicle can display “the impact of virtual intersections and obstacles on vehicle acceleration and passenger comfort”, and other information.

On October 22, 2020, Applied Intuition raised USD125 million in a Series C funding round led by Lux Capital, Andreessen Horowitz, and General Catalyst, which took its market capitalization to USD1.25 billion.

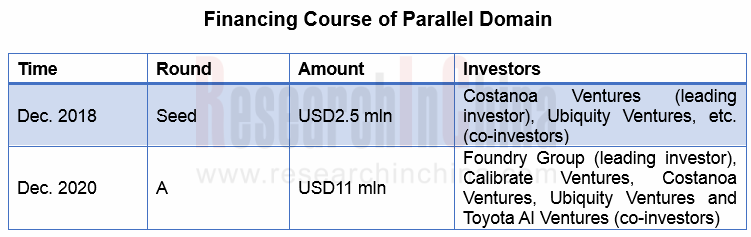

2. The scenario simulation startup Parrallel Domain raised USD11 million in a Series A funding round where Toyota was a co-investor.

Parallel Domain was founded by Kevin McNamara (with a background in Apple autonomous driving technology) in 2017. Parallel Domain can synthesize a variety of scenes (e.g., day, night, fog, rain and city) for sensors (including LiDAR and camera), and also can embed complex elements (e.g., traffic lights, vehicles, pedestrians and animals) in scenes. Its simulation platform provides abundant metadata for users to test various new sensors and technical configurations.

In October 2020, Parallel Domain raised USD11 million in a Series A funding round led by Foundry Group and co-invested by Calibrate Ventures, Costanoa Ventures, Ubiquity Ventures and Toyota AI Ventures.

3. The scenario simulation company Cognata added partners including Hyundai Mobis, Atlatec and Ouster between 2020 and 2021 for accelerating commercialization of products.

Combining artificial intelligence, deep learning and computer vision, Cognata reproduces cities on its 3D simulation platform, providing customers with a range of test scenarios that simulate real-world test driving. In 2020, Cognata increased several partners, gathering pace in product application and variety.

①In November 2020, Cognata teamed up with Atlatec to support Atlatec’s HD maps on the Cognata simulation platform, providing customers with the ability to extend the catalogs of accurate environments available for large-scale virtual validation;

②In January 2021, Cognata and Ouster partnered up in order to develop an accurate virtual LiDAR model in Cognata’s simulation software.

According to the 2020 Blue Paper on Autonomous Driving Simulation of China, the current distribution of autonomous driving algorithm tests is as follows: around 90% tests are completed on simulation platforms, 9% in test fields and 1% on public roads. As simulation technology advances and becomes widespread, the industry aims at 99.9% tests carried out on simulation platforms, 0.09% in closed scenarios and 0.01% on real roads. In the second half of autonomous driving, the commercial use will bring soaring demand for testing, which may catalyze a new round of shuffle in the simulation industry.

China L2/L2+ Smart Car Audio Market Report, 2022

Car audio research: ranking of L2+ smart car audio suppliers by market share

The National Development and Reform Commission has upgraded the development of intelligent vehicles to a national strategy...

China Commercial Vehicle T-Box Report, 2022

TOP10 commercial vehicle T-Box suppliers: using terminal data to build telematics platforms will become a megatrend.

1. From the perspective of market size, the pace of popularizing T-Box accelerates...

Electric Drive and Power Domain Industry Report, 2022

Electric drive and power domain research: efficient integration becomes a megatrend, and integration with other domains makes power domain stronger.

Electric drive systems have gone through several ...

China Autonomous Retail Vehicle Industry Report, 2022

Research on Autonomous Retail Vehicles: Lower Costs Accelerate Mass Production with Ever-spreading Retail Scenarios Autonomous retail vehicles integrate technologies such as 5G, artificial intelligenc...

China Passenger Car Driving and Parking Integrated Solution Industry Report, 2022

Driving and parking integrated solutions stand out in high-level intelligent driving, and the mass adoption is around the corner. According to ResearchInChina, in the first four months of 2022, China'...

Autonomous Driving and Cockpit Domain Control Unit (DCU) Industry Report, 2022(II)

Domain Controller Research: Exploration of Five Business Models, Tier1, Tier0.5, Tier1.5 or ODM?

Automakers accelerate the mass production of new E/E architecture platforms, and the penetration rate...

Autonomous Driving and Cockpit Domain Control Unit (DCU) Industry Report, 2022 (I)

Domain Controller Research: Exploration of Five Business Models, Tier1, Tier0.5, Tier1.5 or ODM?

Automakers accelerate the mass production of new E/E architecture platforms, and the penetration rate...

China Minicar Industry Report, 2022

Minicars, also known as mini passenger cars, are suitable for short-distance transportation and are positioned as entry-level vehicles. Thanks to low cost, convenient parking and low usage cost, minic...

China Automotive Ultrasonic Radar and OEM Parking Roadmap Research Report, 2022

In 2021, ultrasonic radar shipments hit 100 million units, and intelligent parking became a crucial engine.1. In 2025, China’s ultrasonic radar installations will exceed 140 million units.

According...

DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022

DENSO CASE Research: The semiconductor business will help it go "from Toyota to the world”

ResearchInChina has released DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Resea...

China Roadside Edge Computing Industry Report, 2022

Roadside Edge Computing Research: how edge computing enables intelligent connected vehicles?

Policies and standards for roadside edge computing are implementing one after another, favoring the boom o...

Chinese ADAS and Autonomous Driving Tier 1 Suppliers Report, 2021-2022

Autonomous Driving Tier 1 Suppliers Research: the installation rate of L2 and above autonomous driving functions in passenger cars hit over 30% in 2022Q1.

In 2022Q1, the installation rate of L2 and a...

Global and China Electronic Rearview Mirror Industry Report, 2021-2022

Electronic rearview mirror research: the streaming rearview mirror installations soared by 73% in 2021.

This report combs through and summarizes the global and Chinese electronic rearview mirror mark...

Global and Chinese Automakers’ Modular Platforms and Technology Planning Research Report, 2022

Research on Automakers’ Platforms and Their Planning: the Strategic Layout Directions of 32 Automakers

At present, global automotive industry is in the midst of profound changes unseen in a century....

Automotive Intelligent Cockpit Platform Research Report, 2022

Research on Intelligent Cockpit Platforms: Intelligent cockpits rush into a new era of "cross-domain integration and layered software design"

Cockpit hardware platform field: Faster cross-domain inte...

Global and China Flying Car Industry Research Report, 2022

ResearchInChina has released “Global and China Flying Car Industry Research Report, 2022".

A flying car is a three-dimensional vehicle. Broadly speaking, it is a low-altitude intelligent autonomous t...

Global and China Passenger Car T-Box Market Report, 2022

Passenger car T-BOX research: T-Box OEM installation rate will reach 83.5% in China in 2025

ResearchInChina has published Global and China Passenger Car T-Box Market Report 2022 to summarize and ana...

Global and China Purpose Built Vehicle (PBV) and Robocar Report, 2022

PBV and Robocar research: new idea of building brick cars, a new car type for future mobility Building brick cars moves the cheese of traditional OEMs.

Purpose built vehicle (PBV) refers to special ...