Research on JV-brand Telematics: Digitization and localization help the rise of joint venture brands

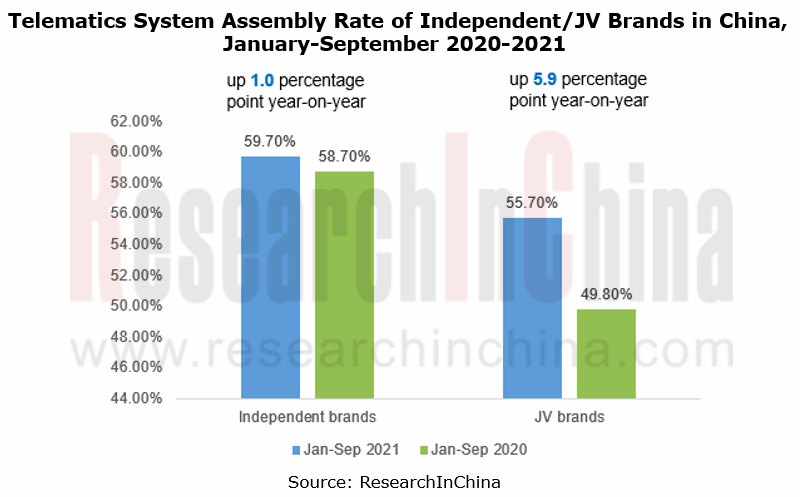

With the development of intelligence and connectivity, automobiles have become a "third space" integrating mobility, life, entertainment and business. In order to meet this demand, OEMs have increased their investment in and application of Telematics systems. Among them, independent brands have achieved leading advantages. From January to September 2021, independent brands secured the Telematics assembly rate of 59.7%, while joint venture brands only achieved 55.7%. However, joint venture brands saw a faster year-on-year growth rate in the assembly rate, namely 5.9 percentage points, while independent brands witnessed 1.0 percentage point, which shows that joint venture brands are catching up.

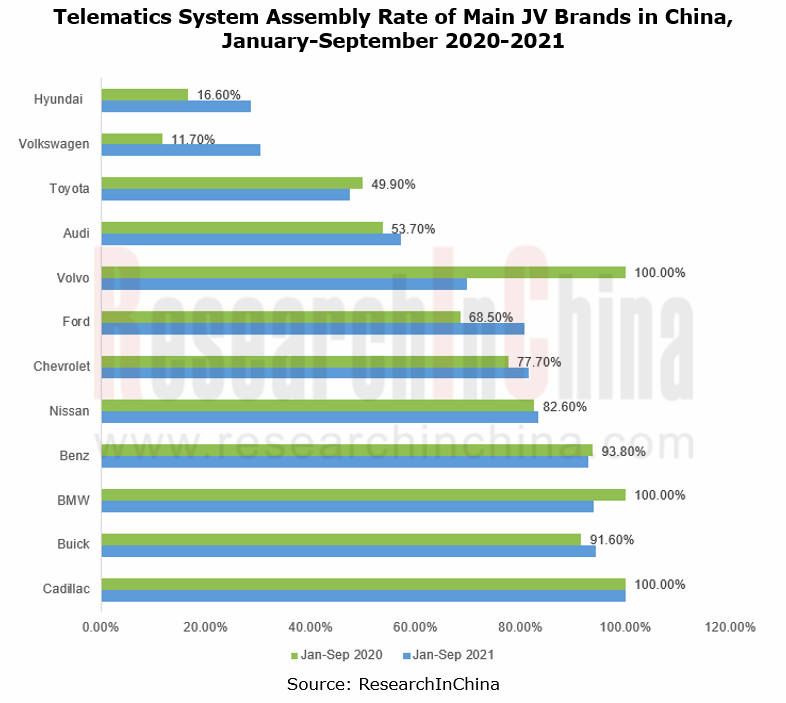

Among JV brands, BMW, Mercedes-Benz, Buick, Ford and so on have accelerated their transformation to Internet mobility service providers, bringing users brand-new digital experience. At the same time, Volkswagen, Toyota, Honda, etc. emerge by strengthening cooperation with BATH (Baidu, Alibaba, Tencent and Huawei), etc..

On the whole, JV brands are accelerating. OEMs represented by BMW and Mercedes-Benz are injecting new concepts (such as "zero layer", AR HUD) into the development of Telematics, and strive to create smarter all-round people-car-life interconnection solutions.

Main highlights:

1. Multi-screen, combined screens and (ultra) large screens tend to prevail. The "zero layer" design is beginning to show its edge

In early 2021, Mercedes-Benz revealed the MBUX Hyperscreen, whose 6 displays merge almost seamlessly into one another to create an impressive screen band over 141 centimeters wide and 2,432 cm2 area: Driver display (screen diagonal: 12.3 inch), central display (17.7 inch) and front passenger display (12.3 inch) appear as one visual unit. Three screens sit under a common bonded irregular curved cover glass, enabling the interconnection of navigation, entertainment, audio and video. In addition, there are two 11.6-inch rear passenger entertainment screens and a rear center armrest car control screen, which can realize multi-screen interaction. The MBUX Hyperscreen was first seen in EQS.

What attracts attention is that the MBUX Hyperscreen introduces the "zero layer" operation concept for the first time. Thanks to the so-called zero layer, the user does not have to scroll through submenus or give voice commands. The most important applications are always offered in a situational and contextual way at the top level in view.

Mercedes-Benz's "zero layer" design coincides with Volvo's next-generation IVI system concept. In June 2021, Volvo Cars announced its strategic collaboration with Google to take infotainment and connectivity to the next level. Future Volvo cars will also come with a large, centralized touch screen that provides rich content, easy-to-see information and responsive interaction. The principle is that everything customers need should always be easily accessible, either by touch or by voice command. No immediate needs or information are buried deep inside menus, many clicks away.

2. The “touch + voice” functions are further refined, and new interactive methods such as voiceprints, fingerprints, gestures and faces emerge

Touch + voice have been included into the standard configuration of new cars on the market; but in terms of functions, automakers continue to refine their functions, such as voice interaction systems, additional voice avatars, AI active learning, four-sound-zone pickup and greetings.

In early 2021, BMW launched the new iDrive 8 system, which will first land in the BMW iX. Compared with iDrive 7, iDrive 8 visualizes the Intelligent Personal Assistant. Light-emitting spheres of different sizes and brightness can breathe and move with voice and dialogue. The BMW Intelligent Personal Assistant can distinguish who is talking to it and appears on the relevant screen area. Through the camera, it judges the status of the target, predicts the behavior and intelligently gives reminder. For Chinese users, iDrive 8 provides both male and female customized voices, and send blessings on holidays and more.

In the new Mercedes-Benz S-Class, the voice assistant "Hey Mercedes" can not only be controlled by driver and co-driver, but also be controlled from the rear. Several microphones help to tell the system which seat the voice is coming from. The active ambient lighting flashes at this position and identifies the current speaker. "Hey Mercedes" now supports 27 languages with natural language understanding (NLU). Moreover, certain actions like navigation can be performed even without the activation keyword "Hey Mercedes". The back row can also share navigation, "heart-wake-up", music and other functions with the front row.

The new Mercedes-Benz S-Class uses the voice assistant "Hey Mercedes" in the rear for the first time

New interactive methods such as gesture recognition and face recognition have been applied to the new generation IVI systems of Mercedes-Benz, Ford, BMW, and Volkswagen. Using cameras in the overhead control panel and learning algorithms, MBUX Interior Assist recognizes and anticipates the wishes and intentions of the occupants. It does this by interpreting head direction, hand movements and body language, and responds with corresponding vehicle functions. MBUX Interior Assist can recognize up to 12 commands. For example, the driver or passengers can open the sliding sunroof with a wave of the hand.

The SYNC+2.0 system which is first available in Ford EVOS can recognize 10 gestures, including nodding, shaking head, hushing, OK sign, thumbing up, V sign, waving, gripping, etc.

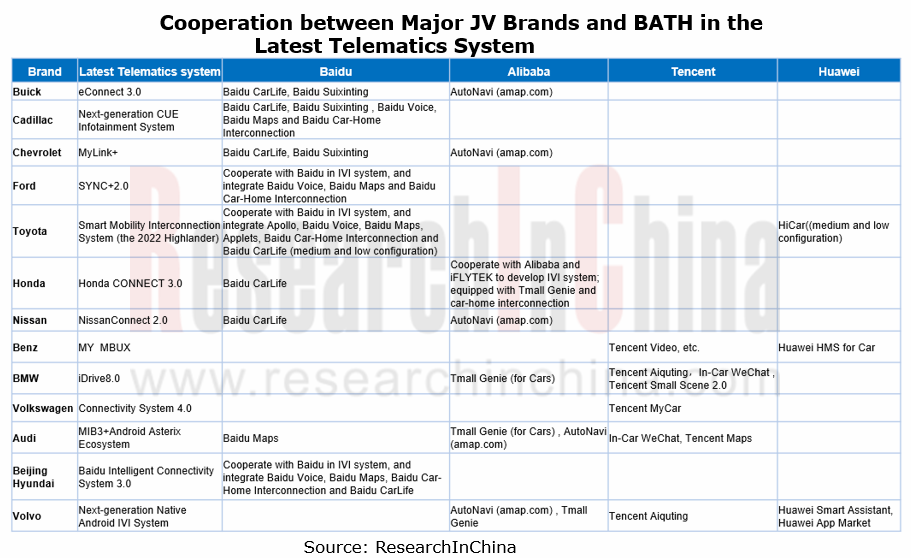

3. Local cooperation strengthens. Baidu, Tencent, Alibaba and others speed up the installation of automotive ecology in vehicles

Toyota and Honda, which are always cautious, accelerated the localization of Telematics in 2021, and are striving to catch up in terms of IVI R&D, ecological applications and future planning.

Toyota: In 2021, Toyota cooperated with Tencent and Baidu to introduce TAI and Apollo. For example, the 2021 Camry is deeply integrated with TAI, equipped with in-vehicle WeChat, Tencent Aiquting, and Tencent Maps. The 2022 Highlander will cooperate with Baidu in depth to integrate Duer, including Baidu Voice, Baidu Maps (for Cars), Baidu Car-Home Interconnection, Baidu CarLife, Suixinkan (watch as you like) (iQiyi, etc.), Suixinting (listen to whatever you want) (QQ music, audiobooks, news), etc.; at the same time, interactive features such as face recognition and active recommendation (“I know you” mode) are introduced.

Honda: On June 10, 2020, Honda Motor (China) Investment Co., Ltd., a wholly-owned Honda subsidiary in China, announced the establishment of Hynex Mobility Service Co., Ltd., a new joint venture company with Neusoft Reach Automotive Technology (Shanghai) Co., Ltd. (Neusoft Reach). Honda holds 51% stake of the joint venture. Hynex Mobility Service will strive to advance connected services and offer new value users can enjoy through their connected experiences, while placing the primary focus on Honda CONNECT, Honda’s on-board connected system.

In March 2021, Hynex Mobility Service released its first R&D result - Honda CONNECT 3.0, which introduced local resources such as iFLYTEK and Tmall Genie to greatly improve speech recognition and semantic understanding (it supports more than 1,000 semantic analysis modes and can recognize dialects, including Mandarin, Sichuan dialect and Cantonese; it offers interest-based search, intelligent recommendation, etc.) and car-home life services (two-way car-home interconnection, online shopping, food ordering, etc.).

In October 2021, Honda held a virtual press conference on its electrification strategy in China. Honda will introduce the first 10 Honda-brand EV models in China, namely the “e:N Series,” in the next five years. Honda envisions exporting these models from China. The e:N Series is being developed with the series concept of “Dynamic, Intelligence and Beauty.” In terms of intelligence, the e:N OS, an integrated system consisting of Honda SENSING, Honda CONNECT and a smart Digital Cockpit, creates a safe and pleasant “space” for mobility. Toyota is ready to make a full breakthrough in the fields of electrification, intelligence, and connectivity in China.

4. More personalized and exclusive experiences

In order to improve the driving experience, OEMs have created unique services and make services reach people. Under normal circumstances, users log in to their exclusive ID through password (or fingerprint) + face recognition + voiceprint recognition, etc., and connect to the ecosystem and mobile phone APP to configure different functions, such as seats, rearview mirrors and personal preferences, etc. On this basis, services such as personalized voice, personalized driving modes, personalized holiday greetings, and exclusive spaces are emerging in an endless stream.

For example, the new "Space-Time Secret Message" function of Ford SYNC+2.0 can present personalized information, such as “Happy New Year”, at a specified time. In addition, the "Free Secret Realm" function has four picture modes: "Forest Secret Realm", "Stars & Sea", "Summer Night with Fireflies" and "Sky Secret Realm", with soothing music, ambient lights, and the best seating position to soothe body and mind, relieve fatigue.

5. The linkage between HMI system and assisted driving has become a trend

The second generation of MBUX (Mercedes-Benz User Experience) debuts in the new S-Class. The active ambient lighting with around 250 LEDs is now integrated into the driving assistance systems, is linked with HMI system and the "heart-wake-up" function and is able to reinforce warnings visually. For example, when there is a car on the left overtaking, or when the passenger wants to push the door to get off the car, the ambient lighting will flash red to remind the driver.

In addition, the intelligent digital headlights of the Mercedes-Benz S-Class are also integrated into the driving assistance system, which can automatically adjust the lighting method, angle, and brightness according to environment, climate, light and driving conditions.

China L2 and L2+ Autonomous Passenger Car Research Report, 2022

L2 and L2+ research: The installation rate of L2 and L2+ is expected to exceed 50% in 2025.So far, L2 ADAS has achieved mass production, and L2+ ADAS has seen development opportunities as the layout f...

Global and China L4 Autonomous Driving and Start-ups Report, 2022

L4 autonomous driving research: the industry enters a new development phase, "dimension reduction + cost reduction".

L3/L4 autonomous driving enjoys much greater policy support.

...

Software-defined vehicle Research Report 2022- Architecture Trends and Industry Panorama

Software-defined vehicle research: 40 arenas, hundreds of suppliers, and rapidly-improved software autonomyThe overall architecture of software-defined vehicles can be divided into four layers: (1) Th...

Emerging Automaker Strategy Research Report, 2022 - Li Auto

Research on Emerging Automaker Strategy: the strategic layout of Li Auto in electric vehicles, cockpits and autonomous driving

Li Auto will shift from the single extended-range route to the “extended...

Commercial Vehicle Intelligent Chassis Industry Report, 2022

Commercial vehicle industry is characterized by large output value, long industry chain, high relevance, high technical requirements, wide employment and large consumer pull, and is a barometer of nat...

China TSP and Ecological Construction Research Report, 2022

TSP research: the coverage of TSPs has spread from IVI, cockpits to vehicles.

With the emergence of Internet of Vehicles, telematics service providers (TSPs) take on the roles of operation platforms,...

Global and China Automotive Seating Industry Report, 2022

Automotive seating research: automotive seating enjoys an amazing boom in the context of autonomous driving.

As autonomous driving develops, vehicles, a simple mobility tool, are tending to be positi...

Automotive Smart Surface Industry Research Report, 2022

Smart Surface Research: As an important medium for multimodal interaction, smart surfaces lead the trend of smart cockpits.Smart surfaces represent the development trend of automotive interiors and ex...

China Passenger Car Cockpit Multi and Dual Display Research Report, 2022

Cockpit multi and dual display research: 51.5% year-on-year growth in center console multi and dual display installation from January to July 2022

ResearchInChina released "China Passenger Car Cockpi...

China Automotive Cybersecurity Hardware Research Report, 2022

Cybersecurity hardware research: security chip and HSM that meet the national encryption standards will build the automotive cybersecurity hardware foundation for China.

1. OEMs generally adopt the s...

China Automotive Cybersecurity Software Research Report, 2022

Chinese in-vehicle terminal PKI market will be worth RMB1.89 billion in 2025.

The working principle of PKI (Public Key Infrastructure) is: the infrastructure that provides security services establish...

Global and China HD Map Industry Report, 2022

HD maps have been applied on a large scale, spreading from freeways to cities

According to ResearchInChina, more than 100,000 Chinese passenger cars were equipped with HD maps by OEMs in the first ha...

Automotive Software Providers and Business Models Research Report, 2022

Research on software business models: four business forms and charging models of automotive software providers.

In an age of software-defined vehicles, automotive software booms, and providers step u...

China Automotive Integrated Die Casting Industry Research Report, 2022

Integrated Die Casting Research: Upstream, midstream and downstream companies are making plans and layouts in this booming field

Automotive integrated die casting is an automotive manufacturing proce...

Emerging Automakers Strategy Research Report, 2022--Xpeng Motors

XPeng Motors Strategy Research: Landing Urban NGP and Expanding Three Branch BusinessesXPeng P7 drives overall sales growth, and three new models will be launched from 2022 to 2023 to drive new growth...

Global Passenger Car Vision Industry Report, 2022

Foreign automotive vision research: leading Tier 1 suppliers vigorously deploy DMS/OMS, and vital sign detection becomes a standard configuration for OMS.

1. The revenues of major Tier 1 suppliers in...

China Automotive Vision Industry Report, 2022

China automotive vision research: DMS is booming, with the installations soaring 141.8% year-on-year

1. China will install 75.4 million cameras in 2025

According to ResearchInChina, China installed ...

C-V2X (Cellular Vehicle to Everything) and CVIS (Cooperative Vehicle Infrastructure System) Industry Report, 2022

C-V2X industry research: C-V2X was pre-installed in more than 20 production passenger car models, with a penetration rate of over 0.5%.

More than 20 production passenger car models were equipped wit...