Cockpit-parking integration research: cockpit-parking vs. driving-parking, which one is the optimal solution for cockpit-driving integration?

Cockpit-parking vs. driving-parking, which one is the optimal solution for cockpit-driving integration?

Currently, automotive E/E architecture is evolving from the distributed to domain centralized architecture, and will eventually be integrated into a central computing platform. In this process both cockpit-parking integration and driving-parking integration are products of domain centralized E/E architecture, and the ultimate form in the future is cockpit-driving integration.

Subject to the maturity of current chip and software technologies, the cockpit-parking solution is a transitional form to cockpit-driving integration. The solution integrates the parking function into the cockpit and allows the cockpit domain controller to receive parking signals, eliminating the cost of parking controllers.

The cockpit-parking integration offers the following benefits: first, cost reduction: the implementation of APA in the cockpit domain only needs addition of ultrasonic sensor (USS) and connector, bringing little cost pressure; second, better human-computer interaction design: the integration of the parking function into the cockpit enable the cockpit domain controller to gain more parking signals and use the rendering capability of the cockpit to improve the overall user experience of HMI; third, the computing power on the cockpit can be brought into full play.

From the comparison between the cockpit chip and the intelligent driving chip, it can be seen that the cockpit domain controller main SoC more highlights CPU and GPU, favoring the realization of such functions as environment puzzle and 3D rendering.

In terms of application fields, the cockpit-parking integrated solution is fitter to integrate basic parking functions, while for advanced parking functions like HPA and AVP, the driving-parking integrated solution is more suitable due to the needs for the driving perception system, and the functional safety level requirements.

Considering cost, lowly configured vehicle models are thus more likely to use the cockpit-parking solution, while medium and highly configured models with medium- and high-compute domain controller platforms will apply the driving-parking integrated solution.

The cockpit-parking integration track is heating up, and there are already more than ten Tier 1 players.

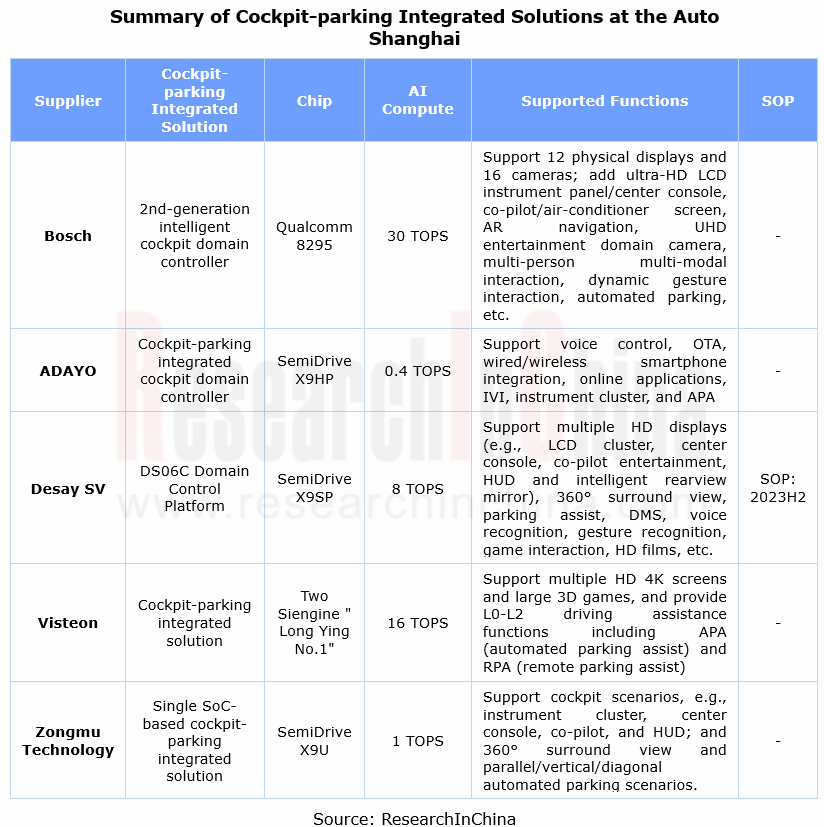

At present, more than ten Tier 1 suppliers have launched cockpit-parking integrated solutions. At the Auto Shanghai, six players introduced their solutions, including Bosch, ADAYO, Zongmu Technology and Voyager Technology. Among them, Bosch's Intelligent Cockpit Technology Interaction Experience 4.0, equipped with Qualcomm's high-compute chip, enables an infotainment domain platform providing seamless cockpit experience, and supports the cross-domain function of the "cockpit-parking integration".

At the Auto Shanghai, Desay SV introduced DS06C, its cockpit domain control platform based on SemiDrive's latest chip X9SP. The single chip can support multiple HD displays such as LCD cluster, center console, co-pilot entertainment, HUD and intelligent rearview mirror, and are available to application scenarios like 360° surround view, parking assist, DMS, voice recognition, gesture recognition, game interaction, and HD films.

High-end intelligent cockpit platform master chips show the trend of replacing foreign counterparts.

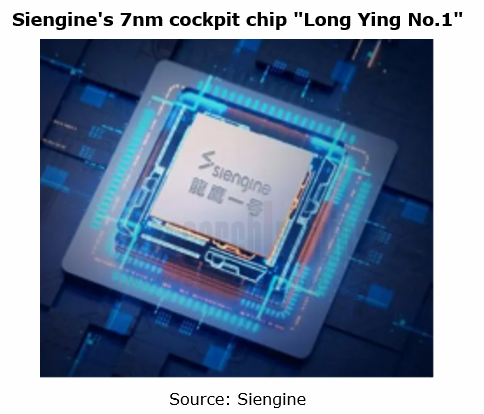

In the field of high-end intelligent cockpit platform master chip, there is a trend of replacing foreign products. For example, the "Long Ying No.1", a 7nm cockpit chip that Siengine launched in 2021, has broken the monopoly of Samsung, Qualcomm and Nvidia in this field.

The chip is equipped with Arm China's self-developed "Zhouyi" NPU and Arm IP. It adopts the ultra-large multi-core heterogeneous SoC design and integrates 87-layer circuits with 8.80 billion transistors. It packs an 8-core CPU with integral computing power up to 90K, of which the large core is Cortex-A76; a 14-core GPU with up to 900G floating-point operations; integrated programmable NPU core with the INT8 computing power up to 8TOPS; high-bandwidth low-latency LPDDR5 memory channel. It features a built-in cyber security engine that complies with national cryptographic algorithms, and the ASIL-D-compliant safety island design. At present, the chip has been installed in cockpit-parking integrated solutions of Visteon and ECARX.

2023 is the first year of mass production of cockpit-parking integrated solutions, and software capability building facilitates an upgrade to the cockpit-driving integration.

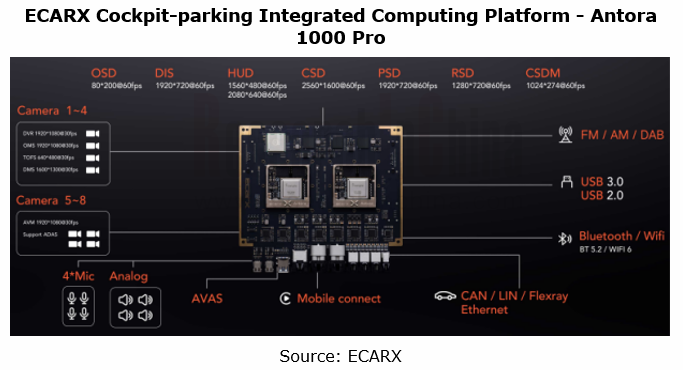

At present, the cockpit-parking integrated solution has been spawned and designated, including the cockpit-parking integrated platform jointly developed by Aptiv and ZEEKR and expected to debut in late 2023. Lynk 08 will carry ECARX’s Antora 1000 Pro computing platform with total NPU compute of 16 TOPS and total GPU compute of 1800G FLOPS, and is expected to be rolled out in August 2023. Dongfeng Forthing flagship MPV and Forthing Leiting will bear Yuanfeng Technology's intelligent cockpit platform based on Qualcomm 8155. In terms of production time, 2023 can be called the first year of volume production of cockpit-parking integrated solutions.

In response to the future trend for centralized architecture, Tier 1 suppliers work hard on planning and have even launched cockpit-driving integrated products. One example is Trinity Series, a cockpit-driving integrated product Zongmu Technology announced at the Auto Shanghai. SemiDrive is exploring centralized computing and has created a driving-parking-cockpit integrated solution which uses SemiDrive’s EMOS Platform to connect the centralized computing, cockpit and autonomous driving domains. The solution is based on service-oriented architecture (SOA) and introduces DDS communication.

The cockpit-driving integration requires an entire vehicle OS that manages all the tasks of the clusters for intelligent cockpit and autonomous driving. For this purpose, ECARX together with Volvo founded HaleyTek, an operating system company (with a 100-people team), and in March 2023 unveiled CloudPeak, an intelligent cockpit OS that features cross-domain system capabilities, is available to the Antora platform and also has access to 22 markets worldwide.

Monthly Monitoring Report on China Automotive Intelligent Driving Technology and Data Trends (Issue 2, 2024)

Insight into intelligent driving: ECARX self-develops intelligent driving chips, and L2.5 installation soared by 175% year on year.

Based on the 2023 version, the 2024 version of Monthly...

Monthly Monitoring Report on China Automotive Intelligent Cockpit Technology and Data Trends (Issue 2, 2024)

Insight into intelligent cockpit: the trend towards large screens is obvious, with >10" center console screens sweeping over 80%.

Based on the 2023 Edition, the 2024 Edition of Monthly Monitoring...

China Intelligent Driving Fusion Algorithm Research Report, 2024

Intelligent Driving Fusion Algorithm Research: sparse algorithms, temporal fusion and enhanced planning and control become the trend.

China Intelligent Driving Fusion Algorithm Research Report, 2024 ...

Automotive Electronics OEM/ODM/EMS Industry Report, 2024

Automotive electronics OEM/ODM/EMS research: top players’ revenue has exceeded RMB10 billion, and new entrants have been coming in.

At present, OEMs in the Chinese automotive electronics indus...

Analysis on Xpeng’s Layout in Electrification, Connectivity, Intelligence and Sharing, 2023

Research on Xpeng’s layout in electrification, connectivity, intelligence and sharing: in the innovation-driven rapid development, secured orders for 100 flying cars.

NIO, Xp...

Automotive Cockpit SoC Research Report, 2024

Automotive Cockpit SoC Research: Automakers quicken their pace of buying SoCs, and the penetration of domestic cockpit SoCs will soar

Mass production of local cockpit SoCs is accelerating, and the l...

Automotive Integrated Die Casting Industry Report, 2024

Integrated Die Casting Research: adopted by nearly 20 OEMs, integrated die casting gains popularity.

Automotive Integrated Die Casting Industry Report, 2024 released by ResearchInChina summari...

China Passenger Car Cockpit Multi/Dual Display Research Report, 2023-2024

In intelligent cockpit era, cockpit displays head in the direction of more screens, larger size, better looking, more convenient interaction and better experience. Simultaneously, the conventional “on...

Automotive Microcontroller Unit (MCU) Industry Report, 2024

With policy support, the localization rate of automotive MCU will surge.

Chinese electric vehicle companies are quickening their pace of purchasing domestic chips to reduce their dependence on impor...

Automotive Digital Key Industry Trends Research Report, 2024

Automotive Digital Key Industry Trends Research Report, 2024 released by ResearchInChina highlights the following: Forecast for automotive digital key market;Digital key standard specifications and co...

Automotive XR (VR/AR/MR) Industry Report, 2024

Automotive XR (Extended Reality) is an innovative technology that integrates VR (Virtual Reality), AR (Augmented Reality) and MR (Mixed Reality) technologies into vehicle systems. It can bring drivers...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2024

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2024 released by ResearchInChina systematically analyzes the iteration process of IVI systems of mainstream automakers in Chin...

Global and China Automotive Lighting System Research Report, 2023-2024

Installations of intelligent headlights and interior lighting systems made steady growth.

From 2019 to 2023, the installations of intelligent headlights and interior lighting systems grew steadily. I...

Automotive Display, Center Console and Cluster Industry Report, 2024

Automotive display has become a hotspot major automakers compete for to create personalized and differentiated vehicle models. To improve users' driving experience and meet their needs for human-compu...

Global and China Passenger Car T-Box Market Report, 2024

Global and China Passenger Car T-Box Market Report, 2024 combs and summarizes the overall global and Chinese passenger car T-Box markets and the status quo of independent, centralized, V2X, and 5G T-B...

AI Foundation Models’ Impacts on Vehicle Intelligent Design and Development Research Report, 2024

AI foundation models are booming. The launch of ChapGPT and SORA is shocking. Scientists and entrepreneurs at AI frontier point out that AI foundation models will rebuild all walks of life, especially...

Analysis on Geely's Layout in Electrification, Connectivity, Intelligence and Sharing

Geely, one of the leading automotive groups in China, makes comprehensive layout in electrification, connectivity, intelligence and sharing.

Geely boasts more than ten brands. In 2023, it sold a tota...

48V Low-voltage Power Distribution Network (PDN) Architecture Industry Report, 2024

Automotive low-voltage PDN architecture evolves from 12V to 48V system.

Since 1950, the automotive industry has introduced the 12V system to power lighting, entertainment, electronic control units an...