T-Box industry research: the market will be worth RMB10 billion and the integration trend is increasingly clear.

ResearchInChina released "Global and China Passenger Car T-Box Market Report, 2023", which combs through and summarizes the status quo, size, industry chain, and competitive pattern of the global and China passenger car T-Box markets, and provides an outlook on future trends.

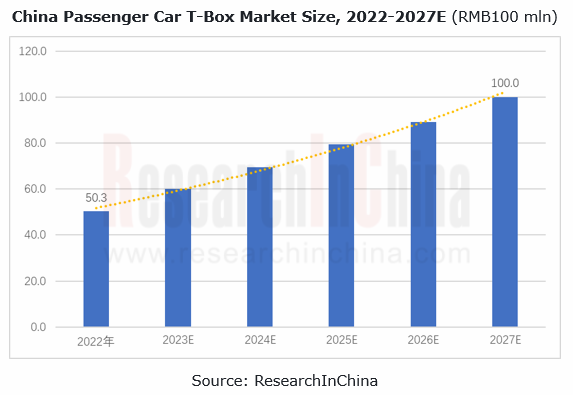

China passenger car T-Box market will be valued at RMB10 billion in 2027

As more vehicles get connected and the demand for communication from functions like OTA, remote vehicle control and digital key increases, the demand for automotive T-Box is further expanding. In terms of market value, China's passenger car T-Box market was worth about RMB5.03 billion in 2022, a figure projected to reach about RMB10 billion in 2027, sustaining an AAGR of 14.8% in the next five years.

The competition among T-Box suppliers intensifies, and the market becomes more concentrated.

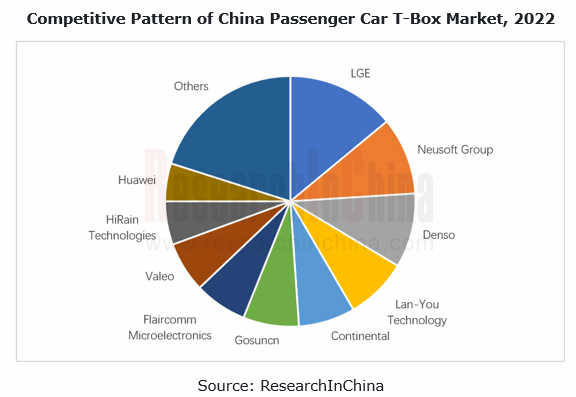

In terms of the competitive pattern, in 2022 the top ten passenger car T-Box suppliers in China took a combined share of about 80%, an increase of 16 percentage points over 2021. The market featured a higher concentration and the scale effect of companies became obvious.

Foreign suppliers mainly supply foreign brands:

LGE is still the largest T-Box supplier in China, positioned first in the Chinese T-Box market in recent years, and supplies such brands as Volkswagen, GM and Hyundai Kia;

LGE is still the largest T-Box supplier in China, positioned first in the Chinese T-Box market in recent years, and supplies such brands as Volkswagen, GM and Hyundai Kia;

Denso is the supplier of two Japanese brands, Toyota and Honda;

Denso is the supplier of two Japanese brands, Toyota and Honda;

Continental mainly supplies Mercedes-Benz and Cadillac among others;

Continental mainly supplies Mercedes-Benz and Cadillac among others;

In addition to BMW, Valeo has also secured orders from some Chinese independent brands such as Changan Auto and Great Wall Motor.

In addition to BMW, Valeo has also secured orders from some Chinese independent brands such as Changan Auto and Great Wall Motor.

China’s local suppliers are making an expansion from local companies to foreign brands:

Neusoft Group ranked first among China’s local T-Box suppliers in 2022, supplying not only independent brands such as Haval, Hongqi, Tank, Lynk & Co and ORA, but also foreign brands like BMW, Mercedes-Benz, Volvo and Audi;

Neusoft Group ranked first among China’s local T-Box suppliers in 2022, supplying not only independent brands such as Haval, Hongqi, Tank, Lynk & Co and ORA, but also foreign brands like BMW, Mercedes-Benz, Volvo and Audi;

Lan-You Technology mainly supplies the Dongfeng family, including Dongfeng’s own brands like Dongfeng Aeolus and Dongfeng Forthing and also its joint venture brands such as Dongfeng Nissan and Dongfeng Infiniti.

Lan-You Technology mainly supplies the Dongfeng family, including Dongfeng’s own brands like Dongfeng Aeolus and Dongfeng Forthing and also its joint venture brands such as Dongfeng Nissan and Dongfeng Infiniti.

Integration trends of T-Box

As well as data collection and forwarding, T-Box tends to offer many other functions including data cleansing, analysis, control, OTA, and integration and analysis of data from multiple ECUs. The trend for software and hardware integration is more obvious. From the prospective of hardware integration, the key trends cover the following.

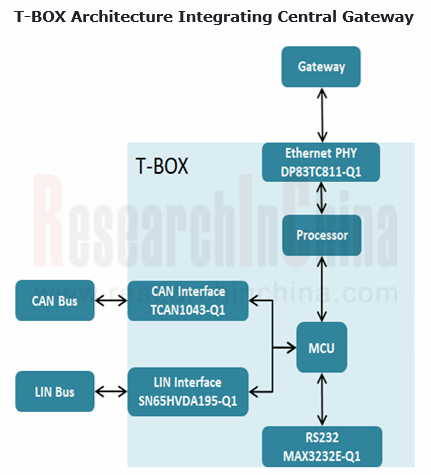

1. T-Box integrates central gateway

T-Box and central gateway both process enormous amounts of data and have similar functions. The integration of them saves cost and improves data processing efficiency.

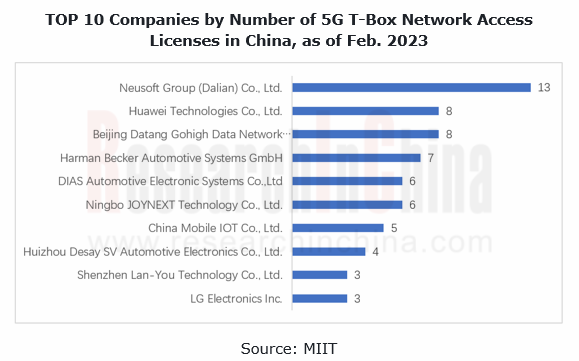

2. T-Box integrates 5G module

Since the commercial use of 5G in 2019, T-Box has started upgrading to 5G communication.

The passenger cars equipped with 5G as a standard configuration reached 279,000 units in 2022, accounting for 1.4%, a figure jumping to 4.2% in 2023Q1. In terms of T-Box manufacturers, as of February 2023, the Ministry of Industry and Information Technology (MIIT) has issued a total of 90 5G T-Box network access licenses, including 13 to Neusoft, 8 to Huawei and 8 to Datang Gohigh.

Product form trends of T-Box

In terms of product form, conventional T-Box is heading in the directions of smart antenna, V-Box and communication domain controller.

1. Smart antenna

Smart antennas such as 4G/GPS/BT antenna improve communication quality with fewer wire harnesses, thus saving costs.

Continental's new-generation T-Box for Mercedes-Benz, Volvo and PSA integrates a shark fin antenna;

Continental's new-generation T-Box for Mercedes-Benz, Volvo and PSA integrates a shark fin antenna;

Neusoft’s smart antenna adopts the all-in-one design concept, integrating Tuner, GPS, Wi-Fi and other software and hardware. The integration of conventional shark fin and T-BOX and the collection and digitalization of the wireless signals of the whole vehicle are a way to overcome the difficulty of conventional wiring on the vehicle, functionally improving the communication quality, enabling the smooth, safe and integrated intelligent connection experience and all-scenario coverage, and effectively saving wiring cost. Neusoft’s smart antenna has been widely used in Hongqi H9/HQ9 and other models. Meanwhile, the product fully supports 5G and 5G+V2X applications.

Neusoft’s smart antenna adopts the all-in-one design concept, integrating Tuner, GPS, Wi-Fi and other software and hardware. The integration of conventional shark fin and T-BOX and the collection and digitalization of the wireless signals of the whole vehicle are a way to overcome the difficulty of conventional wiring on the vehicle, functionally improving the communication quality, enabling the smooth, safe and integrated intelligent connection experience and all-scenario coverage, and effectively saving wiring cost. Neusoft’s smart antenna has been widely used in Hongqi H9/HQ9 and other models. Meanwhile, the product fully supports 5G and 5G+V2X applications.

2. V-Box

T-Box communication modules evolve from single modules to integrated modules such as 4G+V2X and 5G+V2X, offering increasingly diversified functions, and bring out independent V-Box product forms.

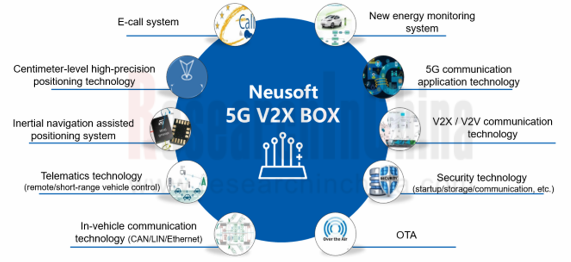

Neusoft 5G V2X BOX supports 5G NSA/SA communication, L1+L5 GNSS, C-V2X communication, Gigabit Ethernet technology, CAN FD communication, LIN communication, Bluetooth 5.0+ communication, WiFi 6 communication, RKE, TPMS communication, and ETC. Currently, Neusoft 5G V2X BOX has been mass-produced for Geely, Great Wall and other auto brands, and will be installed in dozens of mid- and high-end models of well-known OEMs, making it possible for more intelligent vehicles to achieve high quality, stable intelligent communication.

3. Communication domain controller

As the automotive E/E architecture evolves from the distributed to the centralized, T-Box not only supports vehicle interior and exterior communication technologies such as 4G/5G, C-V2X, Bluetooth, UWB, and even 6G and satellite communications in the future, but also gradually integrates gateway, domain controller and other functions, evolving from a single electronic unit to an information communication domain controller and high-performance computing (HPC) platform.

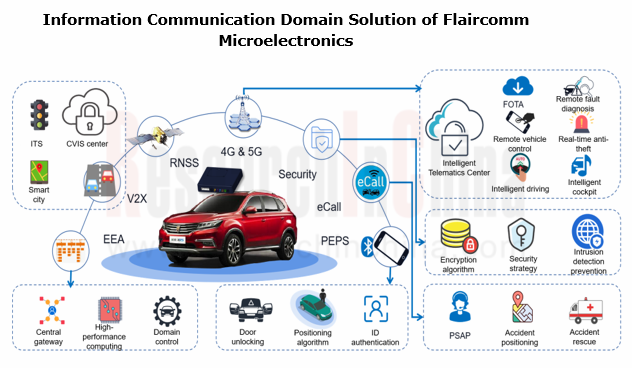

Flaircomm Microelectronics started the information communication domain controller project in 2018, which has been installed by SAIC and other OEMs. With continuous efforts on iteration and upgrade, the company introduced a new-generation self-developed connection computing platform (CCP) in 2021, which not only supports information and communication domain capabilities (e.g., 4G/5G, C-V2X, gateway routing and FOTA), but also offers high-performance computing and data & communication security capabilities. This product can be used as an entry-level HPC product.

Monthly Monitoring Report on China Automotive Intelligent Driving Technology and Data Trends (Issue 2, 2024)

Insight into intelligent driving: ECARX self-develops intelligent driving chips, and L2.5 installation soared by 175% year on year.

Based on the 2023 version, the 2024 version of Monthly...

Monthly Monitoring Report on China Automotive Intelligent Cockpit Technology and Data Trends (Issue 2, 2024)

Insight into intelligent cockpit: the trend towards large screens is obvious, with >10" center console screens sweeping over 80%.

Based on the 2023 Edition, the 2024 Edition of Monthly Monitoring...

China Intelligent Driving Fusion Algorithm Research Report, 2024

Intelligent Driving Fusion Algorithm Research: sparse algorithms, temporal fusion and enhanced planning and control become the trend.

China Intelligent Driving Fusion Algorithm Research Report, 2024 ...

Automotive Electronics OEM/ODM/EMS Industry Report, 2024

Automotive electronics OEM/ODM/EMS research: top players’ revenue has exceeded RMB10 billion, and new entrants have been coming in.

At present, OEMs in the Chinese automotive electronics indus...

Analysis on Xpeng’s Layout in Electrification, Connectivity, Intelligence and Sharing, 2023

Research on Xpeng’s layout in electrification, connectivity, intelligence and sharing: in the innovation-driven rapid development, secured orders for 100 flying cars.

NIO, Xp...

Automotive Cockpit SoC Research Report, 2024

Automotive Cockpit SoC Research: Automakers quicken their pace of buying SoCs, and the penetration of domestic cockpit SoCs will soar

Mass production of local cockpit SoCs is accelerating, and the l...

Automotive Integrated Die Casting Industry Report, 2024

Integrated Die Casting Research: adopted by nearly 20 OEMs, integrated die casting gains popularity.

Automotive Integrated Die Casting Industry Report, 2024 released by ResearchInChina summari...

China Passenger Car Cockpit Multi/Dual Display Research Report, 2023-2024

In intelligent cockpit era, cockpit displays head in the direction of more screens, larger size, better looking, more convenient interaction and better experience. Simultaneously, the conventional “on...

Automotive Microcontroller Unit (MCU) Industry Report, 2024

With policy support, the localization rate of automotive MCU will surge.

Chinese electric vehicle companies are quickening their pace of purchasing domestic chips to reduce their dependence on impor...

Automotive Digital Key Industry Trends Research Report, 2024

Automotive Digital Key Industry Trends Research Report, 2024 released by ResearchInChina highlights the following: Forecast for automotive digital key market;Digital key standard specifications and co...

Automotive XR (VR/AR/MR) Industry Report, 2024

Automotive XR (Extended Reality) is an innovative technology that integrates VR (Virtual Reality), AR (Augmented Reality) and MR (Mixed Reality) technologies into vehicle systems. It can bring drivers...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2024

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2024 released by ResearchInChina systematically analyzes the iteration process of IVI systems of mainstream automakers in Chin...

Global and China Automotive Lighting System Research Report, 2023-2024

Installations of intelligent headlights and interior lighting systems made steady growth.

From 2019 to 2023, the installations of intelligent headlights and interior lighting systems grew steadily. I...

Automotive Display, Center Console and Cluster Industry Report, 2024

Automotive display has become a hotspot major automakers compete for to create personalized and differentiated vehicle models. To improve users' driving experience and meet their needs for human-compu...

Global and China Passenger Car T-Box Market Report, 2024

Global and China Passenger Car T-Box Market Report, 2024 combs and summarizes the overall global and Chinese passenger car T-Box markets and the status quo of independent, centralized, V2X, and 5G T-B...

AI Foundation Models’ Impacts on Vehicle Intelligent Design and Development Research Report, 2024

AI foundation models are booming. The launch of ChapGPT and SORA is shocking. Scientists and entrepreneurs at AI frontier point out that AI foundation models will rebuild all walks of life, especially...

Analysis on Geely's Layout in Electrification, Connectivity, Intelligence and Sharing

Geely, one of the leading automotive groups in China, makes comprehensive layout in electrification, connectivity, intelligence and sharing.

Geely boasts more than ten brands. In 2023, it sold a tota...

48V Low-voltage Power Distribution Network (PDN) Architecture Industry Report, 2024

Automotive low-voltage PDN architecture evolves from 12V to 48V system.

Since 1950, the automotive industry has introduced the 12V system to power lighting, entertainment, electronic control units an...