| |

|

|

In 2007, China national macro-economy continued to maintain a rapid growth momentum. A further increase of residents' income and price cut of passenger vehicles stimulated consumption demand to a great extent. Influenced by the factor, the auto industry continued to keep the good momentum of development recorded in the previous year. The year of 2007 witnessed a new record high in both production and consumption of auto, with auto production and consumption reaching 8.88 million units and 8.79 million units respectively.

Rapid development of China's auto industry has provided a broad space for auto parts industry. In recent years, China's auto parts industry has made a great progress and some innovative auto parts producers have grown up rapidly, fully demonstrating the vitality of self-brand producers of auto parts, such as, Wanxiang Group, Shaanxi Fast, Fuyao Glass, Xinyi Glass and Nanjing Aotecar.

With the fast development of auto parts production base in Changchun, capital of Jilin province, Shiyan, a city in Hubei province, Wuhu, a city in Anhui province, Huadu, a city in Guangdong province and Beijing-Tianjin-Hebei Bohai Economic Circle, auto parts industry clusters and regional economic development have undoubtedly become the new hot spots in the recent years. According to incomplete statistics, China has around 1,000 auto parts based industrial parks across the country and among them 100 parks are key regional clusters or development zones.

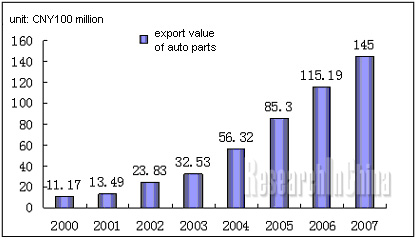

Export Value of China Auto Parts, 2000-2007

Note: engine and tire not included

Source: China Association of Automobile Manufactures

China's export of auto parts reached CNY14.5 billion in 2007. International auto giants have become more and more confident of the quality of China's auto parts. Sales revenue of China's auto parts producers reached CNY403.5 billion in 2006. It is estimated that the output value of China's auto parts is expected to reach CNY800 billion in 2010.

The data in this report are the authoritative statistics from the China Association of Automobile Manufactures, the Machinery Industry Association, the China Automotive Technology and Research Center, the General Administration of Customs, the State Information Center, and the National Bureau of Statistics. Data about some key auto parts producers are from their financial reports.

|

|

|

|

|

If this report could not still meet your requirement, or

you have any comments or suggestions on it, please leave a

message to us.

|

2005-2007 www.researchinchina.com All Rights Reserved

| |

|

|

| |

|

In 2007, China national macro-economy continued to maintain a rapid growth momentum. A further increase of residents' income and price cut of passenger vehicles stimulated consumption demand to a great extent. Influenced by the factor, the auto industry continued to keep the good momentum of development recorded in the previous year. The year of 2007 witnessed a new record high in both production and consumption of auto, with auto production and consumption reaching 8.88 million units and 8.79 million units respectively.

Rapid development of China's auto industry has provided a broad space for auto parts industry. In recent years, China's auto parts industry has made a great progress and some innovative auto parts producers have grown up rapidly, fully demonstrating the vitality of self-brand producers of auto parts, such as, Wanxiang Group, Shaanxi Fast, Fuyao Glass, Xinyi Glass and Nanjing Aotecar.

With the fast development of auto parts production base in Changchun, capital of Jilin province, Shiyan, a city in Hubei province, Wuhu, a city in Anhui province, Huadu, a city in Guangdong province and Beijing-Tianjin-Hebei Bohai Economic Circle, auto parts industry clusters and regional economic development have undoubtedly become the new hot spots in the recent years. According to incomplete statistics, China has around 1,000 auto parts based industrial parks across the country and among them 100 parks are key regional clusters or development zones.

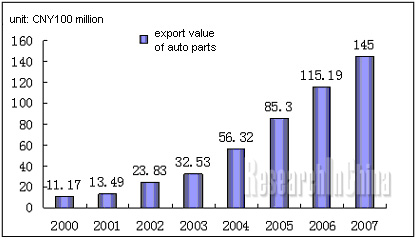

Export Value of China Auto Parts, 2000-2007

Note: engine and tire not included

Source: China Association of Automobile Manufactures

China's export of auto parts reached CNY14.5 billion in 2007. International auto giants have become more and more confident of the quality of China's auto parts. Sales revenue of China's auto parts producers reached CNY403.5 billion in 2006. It is estimated that the output value of China's auto parts is expected to reach CNY800 billion in 2010.

The data in this report are the authoritative statistics from the China Association of Automobile Manufactures, the Machinery Industry Association, the China Automotive Technology and Research Center, the General Administration of Customs, the State Information Center, and the National Bureau of Statistics. Data about some key auto parts producers are from their financial reports.

|

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

1. Analysis of China's Auto Parts Industry Chain

1.1 Current Situation of China Auto Industry Development

1.1.1 Characteristics of Production & Sales of China Auto Industry in 2007

1.1.2 Production and Sales of China's Auto Industry in 2007

1.1.3 Import and Export of Automobiles in China, 2007

1.2 Auto Parts Industry Chain

1.2.1 Upstream Industry of Auto Parts

1.2.2 Downstream Industry of Auto Parts

1.2.3 Proportion of Auto Parts Industry to National Economy

1.2.4 Influence of Auto Parts Industry on other Industries

1.2.5 Main Forms of Auto Parts Clusters2. Current Situation of China's Auto Parts Industry

2.1 China Auto Parts Industry Development in 2007

2.1.1 Characteristics of China Auto Parts Industry Development in 2007

2.1.2 Imports and Exports of Auto Parts in 2007

2.2 Classification of Auto Parts Enterprises in China

2.3 Competitiveness of China Auto Parts Producers

2.3.1 Competitive Advantage of China Auto Parts Enterprises

2.3.2 Development Bottleneck of China Auto Parts Enterprises

2.4 Development Strategies of China Auto Parts Enterprises

2.4.1 Competition Strategy

2.4.2 Technology Strategy

2.4.3 Market Strategy

2.4.4 Policy Support 3. Supply and Demand of China Auto Parts

3.1 China Auto Parts Industry Demand

3.1.1 Sales Revenue of China Auto Parts Producers

3.1.2 Influencing Factors for Market Demand of Auto Parts

3.2 China Auto Parts Industry Supply

3.2.1 Investment of China Auto Parts Industry

3.2.2 Supply Status of China Auto Parts Industry 4 China Auto Parts Market by Region

4.1 Auto Parts Market in Yangtze River Delta

4.1.1 Auto Industry in Yangtze River Delta

4.1.2 Forecast of Auto Parts Market Development in Yangtze River Delta

4.1.3 Shanghai Auto Parts Market Development

4.2 Auto Parts Market in Pearl River Delta

4.2.1 Auto Industry in Pearl River Delta

4.2.2 Forecast of Auto Parts Market Development in Pearl River Delta

4.2.3 Guangzhou Auto Parts Market Development

4.3 Auto Parts Market in North China

4.3.1 Auto Industry in North China

4.3.2 Forecast of Auto Parts Market Development in North China

4.3.3 Auto Parts Market in Beijing

4.4 Auto Parts Market in Northeast China

4.4.1 Auto Industry in Northeast China

4.4.2 Forecast of Auto Parts Market Development in Northeast China

4.4.3 Auto Parts Market in Jilin Province

4.5 Auto Parts Market in Central China

4.5.1 Auto Industry in Central China

4.5.2 Forecast of Auto Parts Market Development in Central China

4.5.3 Auto Parts Market in Wuhan 5 External Environments for China Auto Parts Industry

5.1 China's Economic Environment in 2007

5.1.1 GDP in 2007

5.2 Policy Environment for China Auto Parts Industry Development

5.2.1 Developing Opportunities for China Auto Parts Industry

5.2.2 Technology Policy for China Auto Parts Industry

5.2.3 Industrial Policy for China Auto Parts Industry in 2007

5.3 Development Trend of Global Auto Parts Industry 6 Key Auto Parts Markets in China

6.1 Auto Engine Market

6.1.1 Auto Engine Market in 2007

6.1.2 Features of China Auto Engine Development

6.1.3 Engine Demand in 2007

6.2 Auto Chassis Market

6.2.1 Auto Chassis Market in 2007

6.2.2 Development Trend of Auto Chassis Sector

6.4 Car Body and Accessories Market

6.4.1 Auto Exterior Design

6.4.2 Auto Structure

6.4.3 Auto Internal Decoration

6.5 Auto Acoustics and Air-conditioner Markets

6.5.1 Auto Air-Conditioner Market

6.5.2 Auto Acoustics Market

6.6 Auto Electronics Market

6.6.1 Auto Electronic Products

6.6.2 Development Trend of Auto Electronic Products

6.6.3 Difficulties Encountered by Auto Electronic Product Producers

6.6.4 Focus of Auto Electronic Product Development

6.7 Tire Market 7 Development Trend of China Auto Parts Industry

7.1 Development Trend of Global Auto Parts Industry

7.1.1 Development Trend of Auto Parts Industry Structure

7.1.2 Development Trend of Auto Parts Processing Technology

7.1.3 Competition Status of Global Auto Parts Industry

7.2 Development Trend of China Auto Parts Industry

7.2.1 Development Model of China Auto Parts Industry

7.2.2 Five Developing Trends of China Auto Parts Industry

7.2.3 Forecast of Market Scale

7.3 Countermeasures on China Auto Parts Industry

7.3.1 Influence Factors for China Auto Parts Enterprises Development

7.3.2 Unfavorable Factors for Auto Parts Production and Export

7.3.3 Relations between China Auto Parts Enterprises and Auto Producers 8 Investment Opportunities of China Auto Parts Industry

8.1 Entry/Exit Barriers of China Auto Parts Industry

8.2 Core Competitiveness of China Auto Parts Industry

8.3 Relations between Auto Industry Investment and Auto parts

8.4 Investment Opportunities for China Auto Parts Market

8.4.1 China Auto Parts Investment in 2007

8.4.2 Prospect of Investment in China Auto Parts Industry

8.5 Proposals for Operation of China Auto Parts Industry

8.6 Market Risk of China Auto Parts Industry |

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

Sales of the Main Passenger Car Enterprises in China, 2007

Statistics and Analyses of China's Automobile Import, 2005-2007

China's Export Values of Automobile Parts from Various Kind of Enterprises, 2007Q1-Q3

Auto Parts Industry Chain

Changes of Automobile Industry's Steel Consumption, 1999-2020

Trend of China's Automobile and Finished Steel Yields, 1996-2007

The Yields and Automobile Consumption of China's Gasoline and Diesel, 1990-2007

China's Automobile Yield and Automotive Fuel Yield, 1995-2007

China Complete Automobiles Exports Volume, 20071Q-3Q

Automobile Yield and Mileage of the Newly Built Road, 1999-2007

Proportion of China's Output Value for Auto Parts Industry to the National Economy

Working Population of Auto Parts Industry over the Years

Quantity of Automobiles and Quantity of Individual Automobiles, 2002-2007

Accumulative Export Varieties of Auto Parts, 2006-2007 Q1-Q3

Accumulative Export Varieties of Auto Parts, 2007 Q1-Q3

Export Trade Way and Characters of Auto Parts enterprises, 20071Q-3Q

China's Export Values of Auto Parts, 2000-2007

China's Export Values of Auto Parts from Various Kind of Enterprises, 2007Q1-Q3

Statistics of the Import Situations for China's Auto Parts Products, 2007Q1-Q3

China's Import Values of Auto Parts from Various Kind of Enterprises, 2007Q1-Q3

Quantity of Various kind of Enterprises from China's Auto Parts Industry

Rates of Sales Revenues of Various Kinds of Enterprises from Auto Parts Industry, 2006

Sales Revenue Situations of China's Auto Parts, 1997-2007

Investment Values of Auto Parts over the Years

Major Automobile Bases in China

Demand of Parts and Components in Yangtze River Delta, 2003-2010

Demand of Auto Parts and Components in Pearl River Delta, 2003-2010

Demand forecast of Automobile Parts and Components in North China, 2003-2010

Demand of Auto Parts and Components in Northeast, 2003-2010

Demand of Auto Parts and Components in Central China, 2003-2010

|

2005-2008 www.researchinchina.com All Rights Reserved

|