| |

|

|

Status Quo of the Industry:

As macro-economy keeps growing and demands downstream continue increasing since 2007, the price of chemical products takes a sustained ascending trend and the industrial profit has risen steadily. From Jan to Aug 2007, China chemical industry achieved the sales revenue of RMB 1,653 billion, up 31.61% year on year. Its growth rate doubled that the same period of 2006.

Policy and Plan:

1. Advantages:

Some related policies were made and enforced to promote orderly and healthily development of chemical industry. Through optimizing industry structure constantly, resource value is reflected by market, so as to prevent the waste of resources and achieve the steady development of the intensive economy. After comprehensive consideration of chemical companies' affordability and cost transfer ability, China launched these policies, but these policies will not affect the profitability of the chemical industry too much on cost. Since definite policies are executed, estimated market pressure on chemical industry would be released gradually.

2. Disadvantages:

Since 2007, the increase of policy cost has accordingly brought loss to the profitability of listed chemical enterprises; in the mean time, the country reduced the energy consumption sharply. Consequently, overproduction will take place on chemical market in the following two years and we are a little anxious about the future trend of the chemical industry. Another concern is that, the future policy of the chemical industry is still uncertain, adding doubts to our anxiety.

Analysis of the Industrial Chains:

As prices of petroleum and natural gas hike, the global demands for coal increase rapidly. It is inevitable that prices generally go up, which means that more costs will be spent to make chemical products. In recent years, China’s national economy sustains rapid development. Along with the development of downstream industries such as the rubber and the plastic industry, increase of the demand for chemical products sharply, hence the cost pressure of the chemical industry was scattered and transferred.

Competition Environment:

Now that industries with high energy waste and serious pollution are improving, the competitive structure of the chemical industry will change as well. The reform of the market would increase the entry barriers to chemical industry, so small chemical enterprises lacking advantages on resources were hard to sustain their businesses while the large chemical enterprises will get strengthened in competitiveness, and company assets and profitability will change accordingly.

Since 2007, thanks to the rapid development of macro economy and increasing demands of the chemical downstream industries, the comprehensive price of the chemical products has increased continuously and the industrial profit also has had a steady increase. From Jan to Aug 2007, the national chemical industry achieved sales revenue of RMB 1653 billion totally, up 69.81% year on year. But affected by the price of the petroleum and the natural gas in the third quarter, the growth rate was about 2% lower than the same period of 2006.

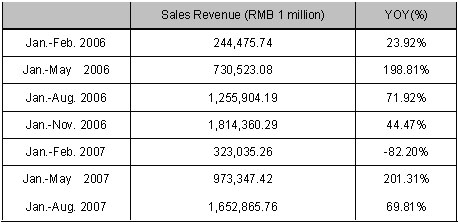

Increase of Sales Revenue

Through high-speed development in recent years, China chemical industry already has a certain scale. But in comparison with that of the developed countries, the technology was relatively low and the industrial structure was not quite reasonable and even some sub-industries with advantages perform not so well, as their development still depend on energy wasting industries, causing serious pollution. Under such situation, the only way to enhance China chemical industrial competitiveness is to change the increment form through independent innovation and adjustment on industrial structure.

The effect of the country's macroeconomic control will become more and more obvious in 2008. The growth rate of capacity and the total volume of chemical industry as well as the overall profitability are all predicted to decline. In addition, the growth rate of revenue and net profit of the industry are expected to be higher than that of GDP, and the YOY growth rates will both fall.

|

|

|

|

|

If this report could not still meet your requirement, or

you have any comments or suggestions on it, please leave a

message to us.

|

2005-2007 www.researchinchina.com All Rights Reserved

| |

|

|

| |

|

Status Quo of the Industry:

As macro-economy keeps growing and demands downstream continue increasing since 2007, the price of chemical products takes a sustained ascending trend and the industrial profit has risen steadily. From Jan to Aug 2007, China chemical industry achieved the sales revenue of RMB 1,653 billion, up 31.61% year on year. Its growth rate doubled that the same period of 2006.

Policy and Plan:

1. Advantages:

Some related policies were made and enforced to promote orderly and healthily development of chemical industry. Through optimizing industry structure constantly, resource value is reflected by market, so as to prevent the waste of resources and achieve the steady development of the intensive economy. After comprehensive consideration of chemical companies' affordability and cost transfer ability, China launched these policies, but these policies will not affect the profitability of the chemical industry too much on cost. Since definite policies are executed, estimated market pressure on chemical industry would be released gradually.

2. Disadvantages:

Since 2007, the increase of policy cost has accordingly brought loss to the profitability of listed chemical enterprises; in the mean time, the country reduced the energy consumption sharply. Consequently, overproduction will take place on chemical market in the following two years and we are a little anxious about the future trend of the chemical industry. Another concern is that, the future policy of the chemical industry is still uncertain, adding doubts to our anxiety.

Analysis of the Industrial Chains:

As prices of petroleum and natural gas hike, the global demands for coal increase rapidly. It is inevitable that prices generally go up, which means that more costs will be spent to make chemical products. In recent years, China’s national economy sustains rapid development. Along with the development of downstream industries such as the rubber and the plastic industry, increase of the demand for chemical products sharply, hence the cost pressure of the chemical industry was scattered and transferred.

Competition Environment:

Now that industries with high energy waste and serious pollution are improving, the competitive structure of the chemical industry will change as well. The reform of the market would increase the entry barriers to chemical industry, so small chemical enterprises lacking advantages on resources were hard to sustain their businesses while the large chemical enterprises will get strengthened in competitiveness, and company assets and profitability will change accordingly.

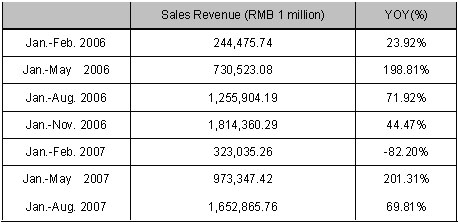

Since 2007, thanks to the rapid development of macro economy and increasing demands of the chemical downstream industries, the comprehensive price of the chemical products has increased continuously and the industrial profit also has had a steady increase. From Jan to Aug 2007, the national chemical industry achieved sales revenue of RMB 1653 billion totally, up 69.81% year on year. But affected by the price of the petroleum and the natural gas in the third quarter, the growth rate was about 2% lower than the same period of 2006.

Increase of Sales Revenue

Through high-speed development in recent years, China chemical industry already has a certain scale. But in comparison with that of the developed countries, the technology was relatively low and the industrial structure was not quite reasonable and even some sub-industries with advantages perform not so well, as their development still depend on energy wasting industries, causing serious pollution. Under such situation, the only way to enhance China chemical industrial competitiveness is to change the increment form through independent innovation and adjustment on industrial structure.

The effect of the country's macroeconomic control will become more and more obvious in 2008. The growth rate of capacity and the total volume of chemical industry as well as the overall profitability are all predicted to decline. In addition, the growth rate of revenue and net profit of the industry are expected to be higher than that of GDP, and the YOY growth rates will both fall.

|

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

1 Analysis of the Industrial Development in 2007

1.1 Industrial policy

1.1.1 Effect of the policy

1.1.2 Eleven-Five Plan of chemical industry

1.2 Overview of industrial operation

1.2.1 Capacity

1.2.2 Sales

1.2.3 Import and export

1.2.4 Industrial operation2 Analysis of Business Performance in 2007

2.1 Industrial comprehensive situation

2.1.1 Comprehensive benefit

2.1.2 Profiles of enterprises

2.2 Industrial operation

2.2.1 Link relative ratio of operating scale

2.2.2 Profitability

2.2.3 Working ability

2.2.4 Solvency

2.3 Enterprises with different scales of chemical industry in China

2.3.1 Per capita index

2.3.2 Profitability

2.3.3 Working ability

2.3.4 Solvency 3 Analysis of Industrial Chains in 2007

3.1 Comprehensive analysis of industrial chains

3.1.1 General situation of industrial chains

3.1.2 Target clients

3.2 Related industries

3.2.1 Effect of upstream industries

3.2.2 Demand of downstream industries

3.2.3 Profit situation of downstream industries 4 Comprehensive Analysis of Industrial Development and Trend in 2007

4.1 Development and trend of segment market

4.1.1 Sales

4.1.2 Profitability

4.2 Industrial development trend

4.2.1 Comprehensive developmental environment

4.2.2 Development trend of segment industries 5 Analysis of Credit Investment in 2007

5.1 Investment opportunities

5.1.1 Investment direction

5.2 Launch of bank's credit funds

5.3 Target sub-industries and key clients

5.3.1 Key marketing clients

5.3.2 Cases of planned projects and projects being built 6 Industrial Forecast and Analysis in 2008

6.1 Industrial struggle due to high oil price in 2008

6.1.1 Oil price expected to be above 80 dollars/barrel

6.1.2 Increasing cost pressure, fierce market competition, goes forward in the struggle

6.1.2 Strict export policy, RMB appreciation, anxiety about export condition

6.1.4 Profit growth rate may slow down; structure adjustment is urgent and necessary

6.2 Industrial breakthrough at high oil price

6.2.1 Chemical processing of coal is necessary

6.2.2 Increase energy efficiency comprehensively

6.3 Investment strategy and risks in 2008

6.3.1 Investment strategy

6.3.2 Risks |

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

Output of inorganic chemicals (unit: ton)

Output agricultural chemicals (unit: ton)

Output of organic chemicals (unit: ton)

Output of chemical products with synthetic materials (unit: ton)

Increase of sales revenue

Increase of sales revenue of national chemical industry, Q3

Comparison of profitability index of chemical materials and chemicals manufacturing in China, Jan.-Aug. 2007

Solvency index of chemical enterprises with different scales in China, Jan.-Aug. 2007

Profit increase of China plastic industry, Q3 (unit: 1000 yuan)

Increase of sales revenue of chemical fertilizer industry (unit: 1000 yuan)

Profit increase of primary chemical materials manufacturing (unit: 1000 yuan)

Profit increase of pesticide industry

Profit increase of synthetic materials manufacturing (unit: 1000 yuan)

Key marketing of large chemical enterprises

Key marketing of medium-sized chemical enterprises

Key marketing of small chemical enterprises

Shandong Luxi chemical series projects

Equivalent heating value of crude oil, natural gas and coal

Listed companies supported by large shareholders and government

Gross industrial production of national chemical materials and chemicals manufacturing

Top ten provinces and cities with unprofitable firms of chemical materials and chemicals manufacturing, Jan.-Aug. 2007

Link relative ratio of operation scale of national chemical materials and chemicals manufacturing

Profit increase of China rubber industry, Q3

Energy consumption structure and fossil reserves structure in China, 2006

GDP energy consumption of some state-owned enterprises

|

2005-2008 www.researchinchina.com All Rights Reserved

|