| |

|

|

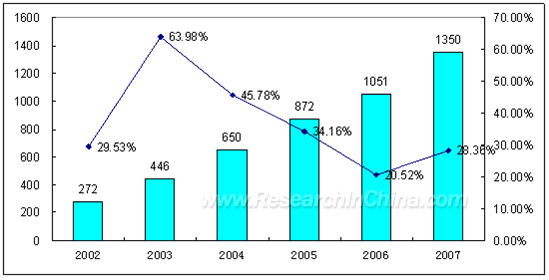

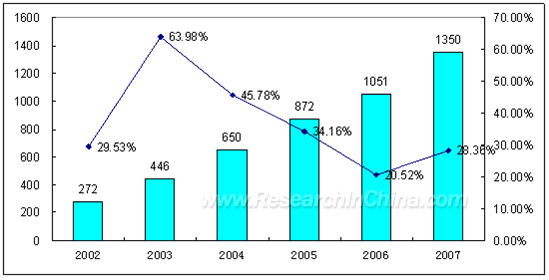

In the year of 2007, global Li-ion battery market was shared by three powers of China, Japan and Korea. The three nations all had rapid expansion of production capacity in the year and China had the fastest growth in capacity expansion, followed by South Korea. In 2007, China surpassed Japan for the first time in Li-ion batter production and became the world's largest Li-ion battery producer with an output of 1.35 billion units, up 28.36% against the previous year.

China Li-ion Battery Output and Growth, 2002-2007

(Unit: million, %)

Source: China Industrial Association of Power Sources

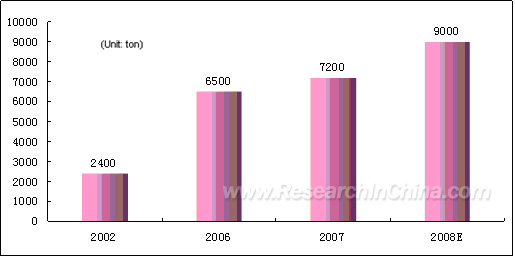

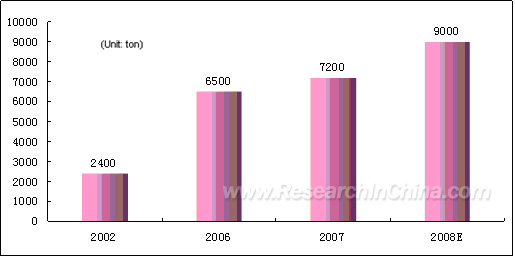

With respect to the raw material of Li-ion battery, China's production of cathode material for Li-ion battery in 2007 was around 9000 tons, 80% of which are lithium cobaltate. In September 2006, China adjusted upwards its export rebates on lithium cobaltate and Li-ion battery, and its export rebate on Lithium cobaltate and Li-ion battery were raised to 13% from 5% and 17% from 13% respectively. Encourage by the policy, Chinese export of lithium cobaltate and Li-ion battery both increased.

Based on the authoritative statistics from the China Battery Industry Association, and the China Industrial Association of Power Sources, this report makes an in-depth study on the current situation, competition pattern and key producers of China Li-ion battery industry and raw material market, and makes forecasts on China's Li-ion battery industry and raw material market.

Changes in Market Demand for Lithium Cobaltate, 2006-2008

Source: ResearchInChina

|

|

|

|

|

If this report could not still meet your requirement, or

you have any comments or suggestions on it, please leave a

message to us.

|

2005-2008 www.researchinchina.com All Rights Reserved

| |

|

|

| |

|

In the year of 2007, global Li-ion battery market was shared by three powers of China, Japan and Korea. The three nations all had rapid expansion of production capacity in the year and China had the fastest growth in capacity expansion, followed by South Korea. In 2007, China surpassed Japan for the first time in Li-ion batter production and became the world's largest Li-ion battery producer with an output of 1.35 billion units, up 28.36% against the previous year.

China Li-ion Battery Output and Growth, 2002-2007

(Unit: million, %)

Source: China Industrial Association of Power Sources

With respect to the raw material of Li-ion battery, China's production of cathode material for Li-ion battery in 2007 was around 9000 tons, 80% of which are lithium cobaltate. In September 2006, China adjusted upwards its export rebates on lithium cobaltate and Li-ion battery, and its export rebate on Lithium cobaltate and Li-ion battery were raised to 13% from 5% and 17% from 13% respectively. Encourage by the policy, Chinese export of lithium cobaltate and Li-ion battery both increased.

Based on the authoritative statistics from the China Battery Industry Association, and the China Industrial Association of Power Sources, this report makes an in-depth study on the current situation, competition pattern and key producers of China Li-ion battery industry and raw material market, and makes forecasts on China's Li-ion battery industry and raw material market.

Changes in Market Demand for Lithium Cobaltate, 2006-2008

Source: ResearchInChina |

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

1. General Introduction to Li-ion Battery Development

1.1 Definition of Li-ion Battery

1.2 Development Course of Li-ion Battery

1.3 Raw Materials for Li-ion Battery

1.3.1 Cathode Material

1.3.2 Anode Material

1.3.3 Electrolyte Material

1.3.4 Separator

1.4 Classification of Li-ion Battery

1.5 Main Evaluating Indicators of Li-ion Battery2. Global Li-ion Battery Industry Pattern

2.1 World Scale

2.2 Japan

2.3 China

2.4 Korea

2.5 Comparison between China, Japan and Korea 3. China Li-ion Battery Industry Development

3.1 Production

3.1.1 Production Scale

3.1.2 Production Distribution

3.2 Demand

3.3 Import and Export

3.3.1 Import

3.3.2 Export

3.4 Existing Problems

3.4.1 Market Problems

3.4.2 Standard Problems

3.4.3 Product Problems 4. Main Li-ion Battery Manufacturers

4.1 Japanese Companies

4.1.1 Sanyo Electric Co., Ltd

4.1.2 Sony

4.2 Chinese Companies

4.2.1 Shenzhen BYD

4.2.2 Shenzhen Bak

4.2.3 Tianjin Lishen

4.3 Korean Companies

4.3.1 Samsung SDI

4.3.2 LG Chemical and Others 5. Li-ion Battery Raw Materials Market

5.1 Cathode Material Market

5.1.1 Global Cathode Material Market

5.1.2 Cathode Material Industry at Home and Abroad

5.2 Main Cathode Material Manufacturers in China

5.2.1 CITIC GUOAN Mengguli New Energy Technology Co., Ltd

5.2.2 Reshine New Material Co., Ltd

5.2.3 Beijing Easpring Material Technology Co., Ltd

5.2.4 Pulead Technology Industry Co., Ltd

5.2.5 Hunan Shanshan advanced material Co., Ltd

5.2.6 Development Trend of Lithium Cobaltate Market

5.2.7 Prospect of China cathode Material Market

5.3 Anode Material

5.3.1 Anode Material Industry at Home and Abroad

5.3.2 Main Anode Material Manufacturers in China

5.4 Li-ion Battery Separator

5.4.1 Global Separator Industry

5.4.2 Separator R&D and Production Procedure in China

5.4.3 Development Trend and Prospect of Separator Market

5.4.4 Introduction to Separator Producers

5.5 Electrolyte Market

5.5.1 Electrolyte Industry at Home and Abroad

5.5.2 Main Electrolyte Producers

5.6 PVDF Market

5.6.1 Foreign PVDF Market

5.6.2 Domestic PVDF Market 6. Main Application Field of Li-ion Battery

6.1 Mobile Phones

6.1.1 China Mobile Phone Market

6.1.2 Production and Sales of Mobile Phone Li-ion Battery in China and Competition Status

6.1.3 Development Trend of Mobile Phone Li-ion Battery in China

6.2 Laptops

6.2.1 Global Laptop Li-ion Battery Market

6.2.2 China Laptop Li-ion Battery Market

6.2.3 Competition Pattern of Laptop Li-ion Battery

6.2.4 Development Trend of Laptop Li-ion Battery

6.3 Electric Bicycles

6.4 Electric Vehicles and Others

6.5 Development Outlook, 2007-2010 7. Conclusion

7.1 Demands for Li-ion Battery

7.2 Li-ion Battery Market Pattern in China

7.3 Li-ion Battery Raw Material Market

|

|

|

|

|

2005-2008 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

Li-ion Battery Production Flow

Comparison of Performance between Various Types of Batteries

Comparison of Structure between LIB and PLIB

Growth in the World Li-ion Battery Market, 2001-2007

Growth in Global PLIB Output, 2001-2007

Global Market Share of Japanese Li-ion Battery Producers, 2001-2007

Comparison of Products between Main Japanese PLIB Producers

Global Market Share of Chinese Li-ion Battery Producers, 2002-2007

South Korean Li-ion Battery Production, 2002-2007

Global Market Share of South Korean Li-ion Battery Producers, 2002-2007

Comparison of Global LIB Market Share between China, Japan and South Korea, 2007

China Li-ion Battery Output and Its Growth, 2002-2007

China Li-ion Battery Production Distribution in 2007

Features of Li-ion Battery Producers in Shenzhen

Li-ion Battery Application Structure in China, 2007

China Total Number of Mobile Phone Subscribers, 2002-2007

Performance of Mobile Phone Li-ion Batteries in Different Stages

Growth in China Li-ion Battery Exports, 2002-2007

Global Market Shares of Top 8 LIB Producers in the World, 2007

Japanese Li-ion Battery Companies in 2007

Branches of Batter Departments of Sanyo Electric (China) Co.

Comparison of Global Market Share between Sanyo and Other LIB Producers in 2007

Sony Li-ion Battery Business Market

Business Scale of Sony (China) Co.

Sony (China)'s Branch Companies

Comparison of Global Market Share between Sony and Other LIB Producers in the World

Domestic Li-ion Battery Producers in China

Domestic Li-ion Battery Producers and their Market Shares in 2007

BYD Li-ion Battery Output Growth, 2002-2007

Revenue of BYD Battery Business in 2007

Growth in Sales Revenue of BYD Li-ion Battery Business, 2002-2007

Operation Revenue of BYD in 2007

LIB Market Development of Shenzhen Bak Battery Co.

Shenzhen BAk Li-ion Battery Output Growth, 2001-2007

Shenzhen LIB Sales Revenue and Growth, 2004-2007

LIB Battery Output Growth of Tianjin Lishen Battery Joint-Stock Co. Ltd., 2002-2007

Tianjin Lishen LIB Sales Revenue Growth, 2002-2007

South Korea Li-ion Battery Producers and the Market Structure in 2007

Sales Revenue and Net Revenue of Samsung SDI, 2001-2007

Sales Volume and Value of Samsung SDI LIB Business, 2006-2007

Forecast of Samsung SDI LIB Sales Volume in 2008

Comparison between Samsung SDI and Other LIB Producers in the World in 2007

Comparison of Performance between Three Main Cathode Materials

Comparison of Raw Material Prices between Three Main Cathode Materials

Changes in Demand for Lithium Cobaltate, 2006-2008

Application Structure of Lithium Cobaltate in China, 2007

Lithium Cobaltate Market Shares of Domestic and Foreign Companies, 2007

Main Lithium Cobaltate Producers in China and their Production Capacity in 2007

Main Research Direction of CITIC GUOAN Mengguli Corporation

Cathode Material of Hunan Reshine New Material Co. Ltd.

Main Products of Beijing Easpring Material Technology Co. Ltd.

Beijing Easpring Production Capacity, 2002-2009

Beijing Easpring Sales Value Growth, 1998-2007

Beijing Easpring Cathode Material Market Development, 1992-2007

Cathode Material Market Development of Pulead Technology Industry Co. Ltd.

Demand for Lithium Cobaltate at Home and Abroad, 2002-2010

Comparison of Performance between Main Anode Materials in the Market

Product Performance and Application Field of Shanshan Tech Co. Ltd.

Brief Introduction to Japanese Tonen Chemical Corp., (Data dated Dec. 31, 2007)

Some LIB Electrolyte Products of Zhejiang Guotai-Huarong New Materials Co.

Some LIB Electrolyte Products of Shanshan (Dongguan)

Chinese Mobile Phone Shipment and Growth, 2005-20011

Chinese Mobile Phone Li-ion Battery Producers and Their Output, 2004-2007

After-sales Market Growth of China Mobile Phone Li-ion Battery Industry, 2003-2008

Growth of LIB OEM Market, 2003-2008

Growth in Electric Bicycle Output in Each Provinces/Autonomous Region/Municipality, 2007

Development of Substitutes for Polymer Li-ion Battery in China, Japan and Korea

Forecast of China Demand for Laptop Li-ion Battery, 2008-2012

|

2005-2008 www.researchinchina.com All Rights Reserved

|