| |

|

|

Chinese RFID technology was rationally applied and essentially developed in 2005, and various applications and trial practices have arrived in an ever-more competitive market. The standards for RFID represent a burning issue and a decision needs to be made.

Currently, in China, RFID applications centralize in non-logistics fields, while in logistics, RFID is still experimentally adopted instead of being extensively applied, which is attributable to the following two factors. To start with, there are no definite frequency allocation and technical standards for RFID so far. RFID applications in logistics are mostly within the 860-960 MHz, which stands in contradiction with the frequency band adopted in China telecom industry. This problem can not be satisfactorily settled in a short time. Secondly, RFID industry lacks of a sound foundation and RFID technology requires improvements.

Compared with developed countries, the technology and application of RFID in China are still in their early stages, especially in UHF (ultra-high frequency) applications. China does not master well core technologies in chip designing & manufacturing, antenna designing, packaging and equipments, etc.

Low and high-frequency RFID application markets have low technical requirement and many enterprises involved. Those two frequency bands are fully developed and widely promoted, with a market share of more than 80%. Even so, RFID products are mostly of same quality. Comparatively, there are higher technical requirements for ultra-high frequency RFID application in which few enterprises set foot. The application of UHF RFID is progressing rapidly in spite of higher costs.

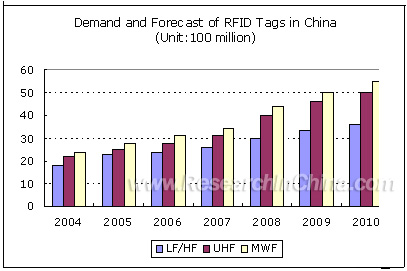

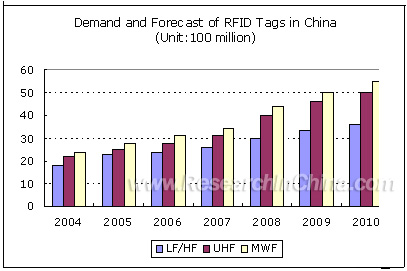

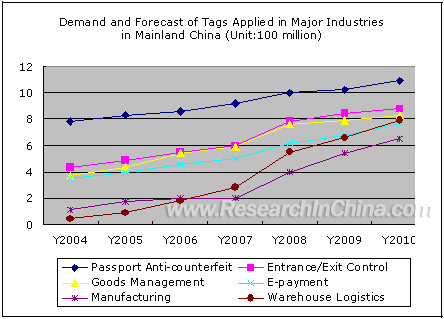

There will be massive applications of ultra-high frequency RFID in 2008, with well-developed standards and technologies then. The gross demand for RFID tags will amount to 4.4 billion units, of which the demand for UHF RFID will be 3.64 times that of 2005. It is estimated that the total demand for RFID tags will get to 5.5 billion units by 2010.

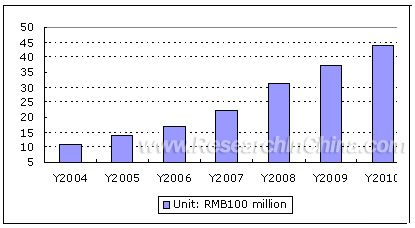

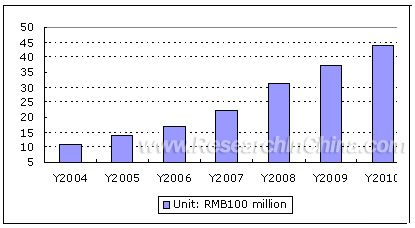

Scale and Forecast of RFID Industry in China

At present, there are more than 100 RFID enterprises in China and the most essential elements of an industrial chain have been established. Most of companies, however, do have not their own core technologies especially in super-high frequency. Among them, there are over forty various agents and branches of foreign-funded enterprises, accounting for two fifth of the total number. In contrast, the number of chip and antenna designing and manufacturing enterprises only share less than 10 percent. Companies involved in system integration and developing application systems are making the fastest progress in Chinese RFID industrial chains, with a 50% share.

What's more, less than thirty five enterprises have their own intellectual property. 75% of the firms are involved in LF/HF band which is well technically developed in early days and widely applied in hardware including chips, antennas, tags and readers. Only 12 % of the companies specialize in MWF band now that micro-wave frequency products have confined applications. When it comes to UHF band, only four enterprises undertake 433MHz products with proprietary intellectual property.

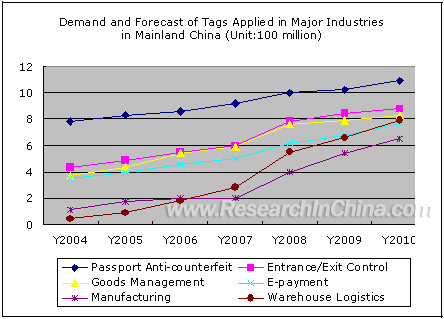

Chinese RFID industry will be progressing steadily in 2006. With the gradual implementation of RFID plan by Wal-Mart, more Chinese enterprises will accelerate RFID applications domestically. As for industrial application, anti-counterfeiting 2nd-generation cards are still in leading position. Nowadays, more and more applications are expected in dangerous goods management and food follow-ups. Besides, breakthroughs will be made in industrial process control as well.

|

|

|

|

|

If this report could not still meet your requirement, or

you have any comments or suggestions on it, please leave a

message to us.

|

2005-2007 www.researchinchina.com All Rights Reserved

| |

|

|

| |

|

Chinese RFID technology was rationally applied and essentially developed in 2005, and various applications and trial practices have arrived in an ever-more competitive market. The standards for RFID represent a burning issue and a decision needs to be made.

Currently, in China, RFID applications centralize in non-logistics fields, while in logistics, RFID is still experimentally adopted instead of being extensively applied, which is attributable to the following two factors. To start with, there are no definite frequency allocation and technical standards for RFID so far. RFID applications in logistics are mostly within the 860-960 MHz, which stands in contradiction with the frequency band adopted in China telecom industry. This problem can not be satisfactorily settled in a short time. Secondly, RFID industry lacks of a sound foundation and RFID technology requires improvements.

Compared with developed countries, the technology and application of RFID in China are still in their early stages, especially in UHF (ultra-high frequency) applications. China does not master well core technologies in chip designing & manufacturing, antenna designing, packaging and equipments, etc.

Low and high-frequency RFID application markets have low technical requirement and many enterprises involved. Those two frequency bands are fully developed and widely promoted, with a market share of more than 80%. Even so, RFID products are mostly of same quality. Comparatively, there are higher technical requirements for ultra-high frequency RFID application in which few enterprises set foot. The application of UHF RFID is progressing rapidly in spite of higher costs.

There will be massive applications of ultra-high frequency RFID in 2008, with well-developed standards and technologies then. The gross demand for RFID tags will amount to 4.4 billion units, of which the demand for UHF RFID will be 3.64 times that of 2005. It is estimated that the total demand for RFID tags will get to 5.5 billion units by 2010.

Scale and Forecast of RFID Industry in China

At present, there are more than 100 RFID enterprises in China and the most essential elements of an industrial chain have been established. Most of companies, however, do have not their own core technologies especially in super-high frequency. Among them, there are over forty various agents and branches of foreign-funded enterprises, accounting for two fifth of the total number. In contrast, the number of chip and antenna designing and manufacturing enterprises only share less than 10 percent. Companies involved in system integration and developing application systems are making the fastest progress in Chinese RFID industrial chains, with a 50% share.

What's more, less than thirty five enterprises have their own intellectual property. 75% of the firms are involved in LF/HF band which is well technically developed in early days and widely applied in hardware including chips, antennas, tags and readers. Only 12 % of the companies specialize in MWF band now that micro-wave frequency products have confined applications. When it comes to UHF band, only four enterprises undertake 433MHz products with proprietary intellectual property.

Chinese RFID industry will be progressing steadily in 2006. With the gradual implementation of RFID plan by Wal-Mart, more Chinese enterprises will accelerate RFID applications domestically. As for industrial application, anti-counterfeiting 2nd-generation cards are still in leading position. Nowadays, more and more applications are expected in dangerous goods management and food follow-ups. Besides, breakthroughs will be made in industrial process control as well.

|

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

1. Brief introduction to RFID technology

1.1. Development history of RFID technology

1.2. Relevant standards of RFID Technology

1.2.1. EPCglobal

1.2.2. UID in Japan

1.2.3. ISO/IEC

1.3. Main applications of RFID technology2. RFID system

2.1. Basic structure of RFID system

2.2. Working principle of RFID system

2.3. Tags

2.3.1. Tag buildup

2.3.2. Tag features

2.3.3. Classification and application of tags

2.3.4. Tag encapsulation

2.3.4.1. Packaging methods of tags

2.3.4.2. Key packaging techniques of tags

2.3.4.3. RFID tag packaging equipment

2.3.5. Latest developments

2.4. Reader

2.4.1. Reader buildup

2.4.2. Classification of readers

2.4.3. Reader collision

2.5. Antenna

2.5.1. Tag antenna

2.5.2. Reader antenna

2.5.3. Technologies for antenna manufacturing 3. Application progression and the trend of RFID technology worldwide

3.1. Application progression of RFID technology worldwide

3.2. RFID development in America

3.2.1. Wal-Mart

3.2.2. US Department of Defense

3.2.3. Food and Drug Administration (FDA)

3.3. Development of RFID technology in Europe

3.3.1. Overview of RFID development in Europe

3.3.2. RFID development in Germany

3.3.3. RFID development in U.K

3.3.4. RFID development in other countries

3.4. Development of RFID technology in Asia-Pacific region

3.4.1. Overview of RFID development in Asia-Pacific region

3.4.2. RFID development in Japan

3.4.3. RFID development in South Korea

3.4.4. RFID development in Singapore

3.4.5. RFID development in Hong Kong

3.4.6. RFID development in Taiwan

3.5. In other countries and regions

3.6. Analysis on development trend of RFID technology worldwide

3.6.1. Strong growth of active tag application

3.6.2. Application progression of RFID supply chains

3.6.3. RFID mobile phone 4. Current status of RFID industry in Mainland China

4.1. Overview of RFID industry in Mainland China

4.1.1. Late start and behindhand industrial development

4.1.2. Deficiency of UHF technologies and behindhand applications

4.1.3. Fierce competition in the chaotic UHF market

4.2. Current status of RFID technology and application in Mainland China

4.2.1. Outstanding benefit of the industrial application

4.2.2. Gradual addition of miniature applications

4.2.3. Mere inception of non-stop highway charge system

4.2.4. Analysis of RFID application in Mainland China

4.3. Current status of RFID standards in Mainland China

4.3.1. Frequency standards in Mainland China

4.3.2. Technical standards in Mainland China

4.4. Current status of RFID market in Mainland China

4.4.1. Market size

4.4.2. Market layout

4.5. Overview of RFID enterprises in Mainland China

4.5.1. Current status of RFID industry chains in Mainland China

4.5.2. Analysis of product frequencies of RFID enterprises in Mainland China

4.5.3. Regional analysis of RFID enterprises in Mainland China 5. Development trend of RFID industry in Mainland China

5.1. Development trend of RFID market in Mainland China

5.1.1. RFID market development in Mainland China

5.1.2. Application development of RFID industry in Mainland China

5.2. Advantageous analysis of RFID market in Mainland China

5.2.1. Close attention from the Government and relevant departments

5.2.2. Strong demand and big market potential

5.3. Obstacles to the development of UHF RFID market in Mainland China

5.3.1. Absence of unified standards hampers the fast-growing market

5.3.2. Weak foundation of the industry lacking of core intellectual property

5.3.3. The high cost restricts large-scale applications

5.4. Brief summary 6. Study on RFID chip manufacturing enterprises in Mainland China

6.1. Datang Microelectronics Technology Co., Ltd.

6.2. China Huada Integrated Circuit Design (Group) Co., Ltd

6.3. Beijing Huahong IC Design Co., Ltd.

6.4. THTF Microelectronics Co., Ltd.

6.5. CED Huada Electronic Design Co., Ltd.

6.6. Hangzhou Silan Microelectronics Co., Ltd.

6.7. Shandong Shanlv Electronic Technology Co., Ltd.

6.8. Shanghai Huahong Integrated Circuit Co., Ltd.

6.9. Shanghai Belling Co., Ltd.

6.10. Shanghai Fudan Microelectronics Co., Ltd.

6.11. Atmel

6.12. ST

6.13. Infineon

6.14. Impinj

6.15. Philips

6.16. TI

6.17. NEC 7. Study on domestic manufacturing enterprises in RFID antennas, tags and readers

7.1 Enterprises in manufacturing LF/HF products

7.1.1 Jinmuyu Electronics Co., Ltd.

7.1.2 Beijing Lanyarfid Technology Co., Ltd.

7.1.3 Tsinghua Tongfang Co., Ltd.

7.1.4 Beijing StrongLink Technology Co., Ltd.

7.1.5 Beijing Perfect Science & Technology Research Institute

7.1.6 Guangdong Tecsun Science and Technology Co., Ltd.

7.1.7 Guangzhou Dongyuan Smartcard Technology Co., Ltd.

7.1.8 Tatwah Smartech Co., Ltd.

7.1.9 Guangzhou Bluewind Technology Co., Ltd.

7.1.10 Guangzhou Rhombus Science &Technology Co., Ltd.

7.1.11 Shenzhen Huayang Microelectronics Co., Ltd.

7.1.12 Guangzhou Yaxin BrainPower Card System Co., Ltd.

7.1.13 ELID (GZ) Electronics & Information Technology Ltd.

7.1.14 Living Electronic Co., Ltd.

7.1.15 Nanjing Fangtong Technology Co., Ltd.

7.1.16 Delifu Smartcard Technology Co., Ltd.

7.1.17 Zhuhai Zhitong Electronic Technology Co., Ltd.

7.1.18 Shenzhen Smartcard Technology Co., Ltd (Smart Able)

7.1.19 Shenzhen Mingwah Aohan High Technology Co., Ltd.

7.1.20 Shenzhen CenturyTideSmart Technology Co., Ltd.

7.1.21 Cantechs Technology (Shenyang) Co., Ltd.

7.1.22 Wuxi Fuhua Technology Co., Ltd.

7.1.23 Wuhan Public Electronics Engineering Co., Ltd.

7.1.24 Shenzhen LanTag Intelligence Identification Systems Co., Ltd.

7.1.25 Zhuhai Jaunt Electronic Co., Ltd.

7.2 Enterprises in manufacturing UHF products

7.2.1 FLID (GZ) Electronics & Information Technology Ltd.

7.2.2 HuiCong Technology Ltd.

7.2.3 Laiwu Jiexun Electronics Co., Ltd.

7.2.4 Fizi RFID Laboratory

7.2.5 Shanghai Refine Technologies Co., Ltd.

7.2.6 Shenzhen TFRD Industry Co., Ltd.

7.2.7 Shenzhen GoldU Tech Co., Ltd.

7.2.8 Sense Controlling System Group

7.2.9 Champtek Electronics Co., Ltd.

7.3 Enterprises in manufacturing MWF products

7.3.1 Guangzhou LongSun Network Technology Development Co., Ltd.

7.3.2 Shanghai Super Ele&Tec Co., Ltd. 8. Study on RFID system integration enterprises in Mainland China

8.1 Beijing Acctrue Centrury Tech Co., Ltd.

8.2 Lynko Technologies Inc.

8.3 Beijing GTV Technology Development Co., Ltd.

8.4 Beijing Jiudingantong Technology Co., Ltd.

8.5 Beijing Nankai Guard Information Technology Co., Ltd.

8.6 Beijing Yatai Grand Software Technology Co., Ltd.

8.7 Beijing Yushi Technology Co., Ltd.

8.8 Beijing CIIT Application Science & Technology Co., Ltd.

8.9 VAS Technology Co., Ltd.

8.10 Guangzhou Hengchuang Smartcard Co., Ltd.

8.11 Guangzhou Tianqi Intelligence Technology Co., Ltd.

8.12 Hangzhou Sendinfo Electronic Information Technology Co., Ltd./Suzhou New Sendinfo Intelligence Technology Co., Ltd.

8.13 Nanjing Lead Industrial Co., Ltd.

8.14 Shanxi Xun Wei Technology Co., Ltd.

8.15 Shanghai Hsic Application System Co., Ltd.

8.16 Shanghai Keentop Electronic Technology Co., Ltd.

8.17 Shanghai RFID System Technology Co., Ltd.

8.18 AIOI Systems (Shanghai) Co., Ltd.

8.19 Shanghai CityID Co., Ltd.

8.20 Shanghai Huayuan Electronics Co., Ltd.

8.21 Shanghai MagCard Information Technology Co., Ltd.

8.22 Shanghai Hopela Information Technology Co., Ltd.

8.23 Ubhitech Asia Ltd.

8.24 Shanghai Zeyu Smartcard Equipment Co., Ltd.

8.25 IDICore Technologies, Inc.

8.26 Shenzhen Huiqitong Xing Electronic Co., Ltd.

8.27 Shenzhen Jiayi Technology Co., Ltd.

8.28 Shenzhen JSTAR Technology Development Co., Ltd.

8.29 Shenzhen HQS Intelligence & Technology Co., Ltd.

8.30 Shenzhen Seatech Smart Technology Co., Ltd.

8.31 Shenzhen Eway Technology Co., Ltd.

8.32 Shenzhen Yuanwanggu Information Technology Co., Ltd.

8.33 Thinker information Technology Co., Ltd.

8.34 Tangshan Xuanshi Technology Co., Ltd.

8.35 Wuhan IDtech Development Co., Ltd.

8.36 Feitian Intelligent Engineering Co., Ltd.

8.37 Wuhan Shangji Electronics Research Institute

8.38 Xi’an Guowei Electronics Co., Ltd. 9. Study on product agencies in Mainland China

9.1 Bejing Futianda Technology Co., Ltd.

9.2 Shengtianhe Technology (Beijing) Co., Ltd.

9.3 Beijing Systron Technologies Co., Ltd.

9.4 Cixi Xinyang Electronics Co., Ltd.

9.5 Shanghai Point Science & Trade Co., Ltd.

9.6 Shanghai Sunion Electronics Co., Ltd.

9.7 Sigma Electronics

9.8 Brief introduction to other relevant enterprises in Mainland China 10. Brief introduction to RFID relevant organizations and institutions in Mainland China

10.1. EPC Global China

10.2. Auto-ID China Lab

10.3. UID China Centre

|

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

Working flow of RFID system (Passive)

RFID market size and forecast worldwide in 2002-2008

Income forecast of integration services and products, 2003-2008

Global distribution of active RFID in 2005

Gross sales revenue of RFID systems and tags worldwide, 2005-2015

Forecast of active RFID in 2015

Forecast value of active RFID tags in 2015

The application of industrial chains drive RFID development

Sales volume of RFID handsets and forecast worldwide in 2005-2015

RFID application fields in China in 2005

RFID applications by different frequencies in China in 2005

Distribution of Chinese RFID enterprises by industrial chains

Distribution of Chinese RFID enterprises by hardware's frequencies

Distribution of Chinese RFID enterprises by regions

Size and forecast of Chinese RFID industry, 2004-2010

Forecast distribution of RFID markets in Mainland China in 2010

Aggregate demand and forecast of RFID tags in Mainland China, 2004-2010

Development history of Datang Microelectronics Technology Co., Ltd.

Internal structure of contactless IC chip of China Huada IC Design (Group) Co., Ltd

Systemic structure of contactless IC chip

Contactless IC card module series of Shandong Shanlv Electronics

Dual-interface module of Shandong Shanlv Electronic Technology Co., Ltd.

Internal structure of contactless IC chip product SHC1102 of Shanghai Hua Hong

Prime operating revenue of Shanghai Belling, 2002-2004

Statistics on sales revenue and operational profits of Atmel, 2000-2005

Statistics on sales revenue from Atmel's four business departments, 2000-2004

Income structure of STMicroelectronics by products in 2005

Total solutions of Infineon's contactless IC cards

Distribution of contactless storage-type IC cards of Infineon

Internal framework of Infineon's contactless IC chip SLE66CLxxxP series

Contactless IC card attendance machines of Beijing Lanyarfid Technology

Attendance machine series of Fangtong Technology Co., Ltd.

Electronic tags of Keentop Technology

Automatic identification warehouse management systems of Beijing CIIT Application Science & Technology Co., Ltd.

Comparison of RFID frequency bands

Historic development of RFID technology

Comparison of EPC standards and Ucode

Typical RFID applications

Analysis of RFID applications by different frequencies

The buildup of a tag

Classification of tags

Comparison between active tag and passive tag

Comparison between tags of various frequency bands

The buildup of a reader

Classification of antennas

Gross RFID tags, 1944-2005

Main RFID application events of Wal-Mart

Big events of RFID development in America in 2005

Big events of RFID development in U.K in 2005

Big events of RFID development in China in 2005

Standards for LF/HF RFID application in Mainland China

Overview of Datang Microelectronics Technology Co., Ltd

Contactless chip products of Datang Microelectronics Technology Co., Ltd.

Contactless products of Tongfang Microelectronics

Basic features of contactless IC chip

Basic features of dual-interface IC chip

Development history of Hangzhou Silan Microelectronics Co., Ltd.

Contactless chip products of Fudan Microelectronics

Performance indicators of FM11RF08 of Fudan Microelectronics

Performance indicators of FM11RF005 of Fudan Microelectronics

CryptoRF series of Atmel

RFID products of Atmel

RFID products of STMicroelectronics

TI's chip products

TI's inlay products

TI's antenna products

|

2005-2008 www.researchinchina.com All Rights Reserved

|