| |

|

|

During the 11th Five-Year Plan period (2006-2010), China will continue to put more efforts to increase its investment in environmental protection and its total investment is expected to reach CNY1.375 trillion, up 64% compared to the 10th Five-Year Plan period (2001-2005). The investment in environmental protection will take up at least 1.5% of China's GDP in the same period.

According to the forecast and the analysis made by ERM, China will be one of the countries with the fastest growth in environment protection industry. The primary estimation of China's Ministry of Environmental Protection shows that China's environment protection industry is expected to have an average annual growth rate of 15% to 17% in the five years and its output value is forecast to total CNY880 billion to CNY1 trillion in 2010.

China's solid waste treatment industry originated in early 1980s. At present, its proportion amounts to less than 10% of the total output value of China's entire environmental protection industry. As China attaches more and more attention to the solid waste control, development potential in China solid waste treatment industry will be gradually released. In the period 2006-2010, China's solid waste treatment industry is forecast to have an average annual growth rate of more than 15%.

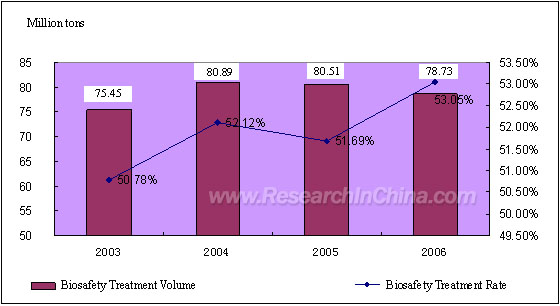

In 2006, China's urban refuse treated by biosafety disposal, mainly including landfill, composting and incineration, reached 78.73 million tons, less than that in 2005. China's biosafety treatment rate of living refuse stood at 53.05%, higher than that in 2005. The biosafety treatment rate of urban refuse in China is expected to exceed 60% in 2010, when the market size of China urban refuse treatment industry is forecast to reach around CNY200 billion.

Urban Living Refuse Treatment Volume and Biosafety Treatment Rate in China, 2003-2006

Source: ResearchInChina

In 2006, China's comprehensive utilization, storage and disposal of industrial solid waste were 926 million tons, 224 million tons and 429 million tons respectively. China's utilization rate of industrial solid waste reached 61%, indicating a continuous growth year by year. On the other hand, China's storage volume of industrial solid waste exceeds 200 million tons each year, implying that China is still under great pressure in storage of industrial solid waste.

Since 2004, China's production of equipment to dispose industrial solid waste has generally maintained a momentum of rapid growth. In the first two months of 2008, China's production of solid waste treatment equipment was 357 units, up 30.8% year on year. In 2007, China's production of solid waste treatment equipment reached 4,707 sets, up 83.4% year on year. The rapid growth in production shows that China's demand for solid waste treatment equipment is quite strong.

By the end of 2006, China has had 60 refuse-fired power plants and another 50 refuse-fired power plants either under construction or in the pipeline. According to the National Eleventh Five-Year Plan for Environmental Protection, refuse-fired power plant is one of the sectors with key support from the central government.

In 2006, China's Volume of urban refuse treatment through incineration took up only 15% of the total disposal volume and China's urban refuse treatment volume by refuse-fired power plants accounted for 8% of the total disposal volume, a low proportion, showing a bright future for the development of refuse-incinerated power generating industry.

The report is based on the authoritative statistics from the Ministry of Environmental Protection, the National Bureau of Statistics, the National Development and Reform Commission, the Ministry of Housing and Urban-Rural Development, the China Machinery Industry Federation and the China Association of Environmental Protection Industry, and some research findings publicized by some research institutes as well as some information from websites and financial reports of several key listed companies.

|

|

|

|

|

If this report could not still meet your requirement, or

you have any comments or suggestions on it, please leave a

message to us.

|

2005-2007 www.researchinchina.com All Rights Reserved

| |

|

|

| |

|

During the 11th Five-Year Plan period (2006-2010), China will continue to put more efforts to increase its investment in environmental protection and its total investment is expected to reach CNY1.375 trillion, up 64% compared to the 10th Five-Year Plan period (2001-2005). The investment in environmental protection will take up at least 1.5% of China's GDP in the same period.

According to the forecast and the analysis made by ERM, China will be one of the countries with the fastest growth in environment protection industry. The primary estimation of China's Ministry of Environmental Protection shows that China's environment protection industry is expected to have an average annual growth rate of 15% to 17% in the five years and its output value is forecast to total CNY880 billion to CNY1 trillion in 2010.

China's solid waste treatment industry originated in early 1980s. At present, its proportion amounts to less than 10% of the total output value of China's entire environmental protection industry. As China attaches more and more attention to the solid waste control, development potential in China solid waste treatment industry will be gradually released. In the period 2006-2010, China's solid waste treatment industry is forecast to have an average annual growth rate of more than 15%.

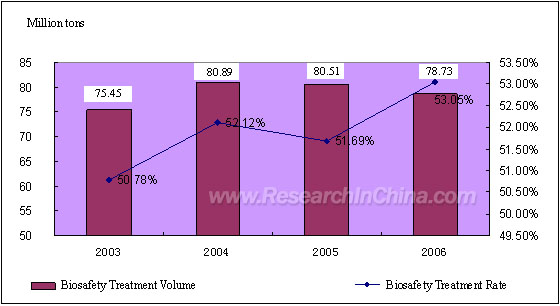

In 2006, China's urban refuse treated by biosafety disposal, mainly including landfill, composting and incineration, reached 78.73 million tons, less than that in 2005. China's biosafety treatment rate of living refuse stood at 53.05%, higher than that in 2005. The biosafety treatment rate of urban refuse in China is expected to exceed 60% in 2010, when the market size of China urban refuse treatment industry is forecast to reach around CNY200 billion.

Urban Living Refuse Treatment Volume and Biosafety Treatment Rate in China, 2003-2006

Source: ResearchInChina

In 2006, China's comprehensive utilization, storage and disposal of industrial solid waste were 926 million tons, 224 million tons and 429 million tons respectively. China's utilization rate of industrial solid waste reached 61%, indicating a continuous growth year by year. On the other hand, China's storage volume of industrial solid waste exceeds 200 million tons each year, implying that China is still under great pressure in storage of industrial solid waste.

Since 2004, China's production of equipment to dispose industrial solid waste has generally maintained a momentum of rapid growth. In the first two months of 2008, China's production of solid waste treatment equipment was 357 units, up 30.8% year on year. In 2007, China's production of solid waste treatment equipment reached 4,707 sets, up 83.4% year on year. The rapid growth in production shows that China's demand for solid waste treatment equipment is quite strong.

By the end of 2006, China has had 60 refuse-fired power plants and another 50 refuse-fired power plants either under construction or in the pipeline. According to the National Eleventh Five-Year Plan for Environmental Protection, refuse-fired power plant is one of the sectors with key support from the central government.

In 2006, China's Volume of urban refuse treatment through incineration took up only 15% of the total disposal volume and China's urban refuse treatment volume by refuse-fired power plants accounted for 8% of the total disposal volume, a low proportion, showing a bright future for the development of refuse-incinerated power generating industry.

The report is based on the authoritative statistics from the Ministry of Environmental Protection, the National Bureau of Statistics, the National Development and Reform Commission, the Ministry of Housing and Urban-Rural Development, the China Machinery Industry Federation and the China Association of Environmental Protection Industry, and some research findings publicized by some research institutes as well as some information from websites and financial reports of several key listed companies.

|

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

1. Overview of Solid Waste Treatment Industry

1.1 Industry Definition

1.2 Main Characteristics

1.3 Segmented Industries

1.4 Industry Chain

1.5 Key Driver for Industry Development 2. Development Environment of China Solid Waste Treatment Industry

2.1 Background

2.2 Policy Environment

2.3 the National Eleventh Five-Year Plan for Environmental Protection 3. Status Quo of China Urban Refuse Treatment

3.1 Plans Related to Urban Refuse Treatment in 11th Five-Year Plan

3.2 General Situation of China's Urban Living Refuse Treatment

3.2.1 Total Volume of Urban Living Refuse Produced in China

3.2.2 Treatment of City Living Refuse in China

3.3 China Urban Refuse Treatment Technology and Its Development

3.3.1 Common Technology

3.3.2 Technical Structure of China Urban Refuse Treatment Volume

3.3.3 Development Trend of China Urban Refuse Landfill Technology

3.3.4 Development Trend of China Urban Refuse Composting Technology

3.3.5 Development Trend of China Refuse Incineration Technology

3.4 China Urban Living Refuse Treatment by Region

3.4.1 Volume of China Urban Living Refuse Produced by Region

3.4.2 Volume of China Urban Living Refuse Treated by Region

3.4.3 Treatment Rates of China Urban Living Refuse by Region 4. Status Quo of China Industrial Solid Waste Treatment

4.1 General Situation of Industrial Solid Waste Treatment

4.1.1 Volume of China Industrial Solid Waste Produced

4.1.2 China Industrial Solid Waste Treatment

4.2 China Industrial Solid Waste Treatment by Region

4.2.1 China Industrial Solid Waste Generated by Region

4.2.2 Comprehensive Utilization of China Industrial Solid Waste by Region

4.2.3 China Storage & Disposal of Industrial Solid Waste by Region

4.3 Downstream Sector of China Industrial Solid Waste Treatment Industry

4.3.1 Main Industries Generating Industrial Solid Waste in China

4.3.2 Main Industries with Comprehensive Utilization of Industrial Solid Waste in China

4.3.3 Main Industries Storing and Disposing Industrial Solid Waste in China

4.4 Generation and Treatment of Hazardous Waste in China 5. Key Segmented Industries of China Solid Waste Treatment Industry

5.1 China Solid Waste Treatment Equipment Industry and Its Forecast

5.2 Output of China Solid Waste Treatment Equipment Industry

5.1.2 Production of Solid Waste Treatment Facility Industry in China by Region

5.1.3 Competition Status

5.1.4 Development Trend of China Solid Waste Treatment Equipment Industry

5.2 China Refuse-fired Power Generation Industry

5.2.1 Status Quo of the Industry and Development Trend

5.2.2 Revenue of China Refuse-fired Power Generation Industry

5.2.3 Competition Status 6. Investment and Risk in China Solid Waste Treatment Industry

6.1 Investment Opportunities

6.2 Risks 7. Key Companies

7.1 Eguard Resources Development Co., Ltd.

7.1.1 Company Profile

7.1.2 Main Business Structure

7.1.3 Business on Solid Waste Treatment Project

7.1.4 Business on Solid Waste Treatment Facility

7.1.5 Key Financial Indicators

7.1.6 Development Forecast

7.2 Shanghai Environment Group Co., Ltd

7.2.1 Company Profile

7.2.2 Assets of the Company

7.2.3 Profitability Status

7.2.4 Competition Strength

7.3 Nanhai Development Co., Ltd

7.3.1 Company Profile

7.3.2 Solid Waste Treatment Business and Its Forecast

7.4 Tianjin Teda Co., Ltd

7.4.1 Company Profile

7.4.2 Solid Waste Treatment Business

7.4.3 Competition Strength

7.5 Wuxi Huaguang Boiler Co., Ltd

7.5.1 Company Profile

7.5.2 Solid Waste Treatment Business

7.5.3 Competition Strength

7.6 Jinzhou Environment Co., Ltd

7.6.1 Company Profile

7.6.2 Solid Waste Treatment Business

7.6.3 Competition Strength

7.7 China Ecological Technology Co., Ltd

7.7.1 Company Profile

7.7.2 Solid Waste Treatment Business

7.7.3 Competition Strength

7.8 Everbright Environment

7.8.1 Company Profile

7.8.2 Solid Waste Treatment Business

7.9 Hangzhou Jinjiang Group

7.9.1 Company Profile

7.9.2 Solid Waste Treatment Business

7.10 Zhejiang Weiming Group

7.10.1 Company Profile

7.10.2 Solid Waste Treatment Business 8. Summarization

8.1 Policy Background

8.2 China Urban Living Refuse Treatment

8.2.1 General Situation

8.2.2 Landfill Treatment and Its Development Trend

8.2.3 Composting Treatment and Its Development Trend

8.2.4 Incineration Treatment and Its Development Trend

8.3 Summarization of China Industrial Solid Waste

8.3.1 General Situation of Industrial Solid Waste Treatment

8.3.2 General Situation of Hazardous Waste Treatment

8.4 Summarization of China Solid Waste Treatment Equipment Industry

8.5 Summarization of China Refuse-fired Power Generation Industry

8.6 Summarization of Key Companies

8.6.1 Eguard Recourses Development Co., Ltd

8.6.2 Nanhai Development Co., Ltd

8.6.3 Tianjin Teda Co., Ltd |

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

Classification of Solid Wastes by Sources

Solid Waste Treatment Industry Chain

Development Phase of China Environmental Protection

Position of Solid Waste in Global Environmental Protection

Target of Solid Waste Treatment Policy

Investment Growth in China Environmental Protection Industry in 2006-2010

China Investment in Solid Waste Treatment in 2006-2010

Distribution of China Investment in Solid Waste Treatment in 2006-2010

China Investment in Urban Refuse Biosafety Treatment Facilities in 2006-2010

Volume of China Urban Living Refuse Removed in 2003-2006

Volume of China Urban Living Refuse Removed and Its Changes in 2003-2006

Volume of China Urban Living Refuse Disposed and Its Disposal Capacity in 2003-2006

Disposal Volume and Disposal Rate of China Urban Living Refuse by Biosafety Treatment, 2003-2006

Common Technology Adopted by China

2006 China Urban Living Refuse Treatment Volume by Different Technologies

Number of Refuse Landfill Yards, Disposing Capacity and Disposal Volume in 2003-2006

Number of Refuse Landfill Yards in China in 2003-2006

Disposing Capacity of Refuse Landfill Yards in China, 2003-2006

Disposal Volume of Refuse Landfill Yards in China, 2003-2006

Number of Compost Plants, Disposing Capacity and Disposal Volume in 2003-2006

Number of Refuse Compost Plants in China, 2003-2006

Disposing Capacity of Refuse Compost Plants in China, 2003-2006

Disposal Volume of Refuse Compost Plants in China, 2003-2006

Number of Refuse Incineration Plants, Disposing Capacity and Disposal Volume, 2003-2006

Disposing Capacity of Refuse Incineration Plants in China, 2003-2006

Disposal Volume of Refuse Incineration Plants in China, 2003-2006

China Top Ten Provinces/Cities in Volume of Urban Refuse Removed in 2006

China Top Ten Provinces/Cities in Volume of Urban Refuse Disposed in 2006

China Top Ten Provinces/Cities in Disposal Rate of Urban Refuse in 2006

Volume of Industrial Solid Waste Produced in China, 2003-2006

Volume of Industrial Solid Waste Produced in China and Its Changes, 2003-2006

Disposal Volume of Industrial Solid Waste in China, 2003-2006

China Industrial Solid Waste Disposal in 2003-2006

China Top Ten Provinces/Cities in Volume of Industrial Solid Waste Produced in 2006

China Top Ten Provinces/Cities in Volume of Industrial Solid Waste Stored & Treated in 2006

China Top Ten Industries in Comprehensive Utilization of Industrial Solid Waste in 2006

China Top Ten Industries in Volume of Industrial Solid Waste Stored & Treated in 2006

Hazardous Waste Generation and Treatment in China, 2001-2006

Hazardous Waste Generation and Treatment in China and Its Changes, 2001-2006

First Batch of Hazardous Waste Disposal Projects under Construction

First Batch of Medical Waste Disposal Projects under Construction

Production Trend of Solid Waste Treatment Facility in China, 2004-2008

China Top Ten Provinces/Cities in Production of Solid Waste Disposal Equipment in 2007

Some Solid Waste Disposal Equipment Producers in China

China's Key Development Field of Environmental Protection Equipment

Output Value of China Environmental Protection Equipment Industry through 2020

Contrast of Output Value of China Environmental Protection Industry in 2000-2010

Refuse-fired Power Plants in Operation or under Construction in Key Regions, 2008

Installed Capacity of China's Refuse-fired Power Plants in 2001-2010

Feed-in Tariffs of China Refuse-fired Power Plants in Each Regions in 2007

Eguard Main Business Revenue by Industry

Eguard Gross Profit by Industry

Eguard Main Business Revenue by Region

Eguard Gross Profit by Region

Revenue & Gross Profit of Eguard Solid Waste Disposal Projects, 2004-2007

Revenue Changes of Eguard Solid Waste Disposal Projects, 2004-2007

Gross Profit Changes of Eguard Solid Waste Disposal Projects, 2004-2007

Revenue & Gross Profit of Eguard Solid Waste Disposal Equipment Business, 2004-2007

Gross Profit Changes of Eguard Solid Waste Disposal Equipment Business, 2004-2007

Eguard Key Financial Indicators, 2004-2007

Changes of Eguard Revenue and Profit, 2004-2007

Eguard Growing Ability and Its Changing Trend, 2004-2007

Eguard Profitability and Its Changing Trend, 2004-2007

Eguard Solid Waste Disposal Projects

Main Refuse Disposal Operation Centers of Shanghai Environment Group

Revenue and Operation Profit of Nanhai Refuse-fired Power Generation Business, 2006-2007

Nanhai Refuse Disposing Capacity and Its Growth Trend, 2006-2010

Forecast of Revenue Growth of Nanhai Refuse-fired Power Generation Business, 2006-2009

Main Solid Waste Treatment Projects of Tianjin Teda Co., Ltd.

Sales Revenue Structure of Utility Boilers of Wuxi Huaguang Boiler Co.

Forecast of Revenue and Profit of Huilian Refuse-fired Power Generation Projects

Main Solid Waste Disposal Projects of Golden State Environment Group Corp.

Solid Waste Disposal Projects Invested by Everbright Environmental Protection Engineering and Technology (Shenzhen) Co., Ltd.

Revenue and Profit of Tianjin Teda Refuse-fired Power Generation Business, 2005-2007

|

2005-2008 www.researchinchina.com All Rights Reserved

|