| |

|

|

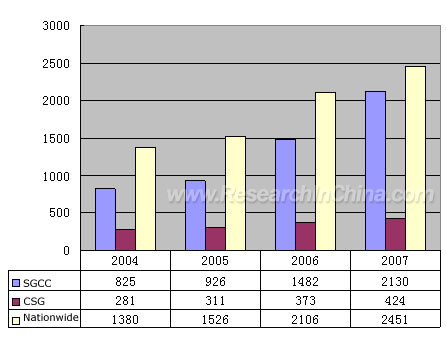

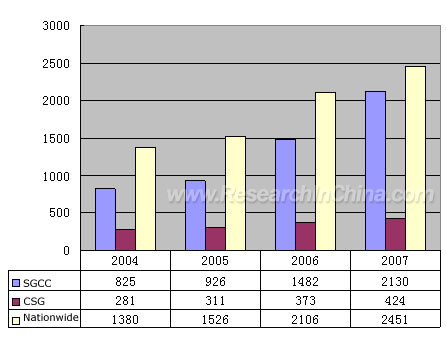

Power industry is the mainstay of the national economy. The scale of China's grid construction has been expanding continuously.

China Total Investment in Grid, 2004-2007

(Unit: CNY100 million)

Source: State Grid Corporation of China (SGCC) & China Southern Power Grid Co., Ltd. (CSG)

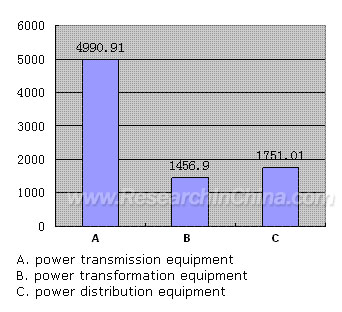

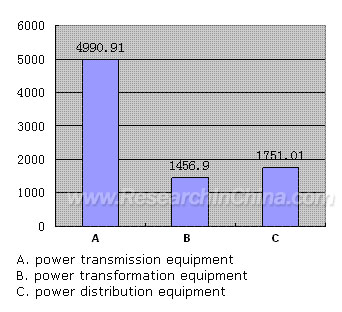

Driven by power grid construction, China's power transmission & distribution equipment industry is developing rapidly and its market size and sales revenue are both increasing continuously. As for power transmission & distribution sub-industries, the growth rate of revenue and profit in the sub-industries both remained above 30% in 2007.

Sales Revenue of Power Transmission & Distribution Equipment Sub-industries, 2007

(Unit: CNY100 million)

Source: State Electricity Regulatory Commission (SERC)

According to the characteristics of power construction, power plants should be built in advance of power grid. In the Tenth Five-Year Plan period (2001-2005), China's investment in power industry focused on the construction of power plants, while China is to focus its investment on the construction of power grid during the Eleventh Five-Year Plan period (2006-2010). The ratio of power transmission & distribution assets to power generation assets is 6:4 in the developed countries, but the ratio in China is still smaller than 4:6. China will increase its investment in the power transmission & distribution field to raise the proportion of power grid assets in the future. The power transmission & distribution industry will keep a momentum of steady growth.

|

|

|

|

|

If this report could not still meet your requirement, or

you have any comments or suggestions on it, please leave a

message to us.

|

2005-2007 www.researchinchina.com All Rights Reserved

| |

|

|

| |

|

Power industry is the mainstay of the national economy. The scale of China's grid construction has been expanding continuously.

China Total Investment in Grid, 2004-2007

(Unit: CNY100 million)

Source: State Grid Corporation of China (SGCC) & China Southern Power Grid Co., Ltd. (CSG)

Driven by power grid construction, China's power transmission & distribution equipment industry is developing rapidly and its market size and sales revenue are both increasing continuously. As for power transmission & distribution sub-industries, the growth rate of revenue and profit in the sub-industries both remained above 30% in 2007.

Sales Revenue of Power Transmission & Distribution Equipment Sub-industries, 2007

(Unit: CNY100 million)

Source: State Electricity Regulatory Commission (SERC)

According to the characteristics of power construction, power plants should be built in advance of power grid. In the Tenth Five-Year Plan period (2001-2005), China's investment in power industry focused on the construction of power plants, while China is to focus its investment on the construction of power grid during the Eleventh Five-Year Plan period (2006-2010). The ratio of power transmission & distribution assets to power generation assets is 6:4 in the developed countries, but the ratio in China is still smaller than 4:6. China will increase its investment in the power transmission & distribution field to raise the proportion of power grid assets in the future. The power transmission & distribution industry will keep a momentum of steady growth.

|

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

1. Overview of China's Power Industry

1.1 Macro Analysis of China's Power Industry

1.2 China's Grid Construction

1.2.1 China's Grid Size

1.2.2 Introduction of China's Key Grid Companies

1.2.2.1 State Grid Corporation of China

1.2.2.2 China Southern Power Grid Co., Ltd.2. Status Quo of China's Power Transmission & Distribution Industry

2.1 Overview of China's Power Transmission & Distribution Industry

2.1.1 Power Transmission Equipment

2.1.2 Power Transformation Equipment

2.1.3 Power Distribution Equipment

2.1.4 Electric Power Automation Equipment

2.2 Wire and Cable

2.2.1 Cable Market Size

2.2.2 Competition in Cable Sector

2.3 Transformer

2.3.1 Transformer Market Size

2.3.2 Competition in Transformer Sector

2.4 Switch Equipment

2.4.1 Market Size of Switch Equipment

2.4.2 Competition in Switch Equipment Sector

2.5 Power Capacitor

2.5.1 Power Capacitor Market Size

2.5.2 Competition in Power Capacitor Sector

2.6 Electric Power Automation Equipment

2.6.1 Market Size of Electric Power Automation Equipment

2.6.2 Competition in Electric Power Automation Equipment Sector 3. Forecast of China's Power Transmission & Distribution Equipment Industry

3.1 Forecast of China's Power Transmission & Distribution Industry Development

3.1.1 Forecast of China's Development of Power Construction

3.1.2 Overall Forecast of China's Power Transmission & Distribution Industry

3.2 Forecast of Sub-industries' Development

3.2.1 Wire and Cable

3.2.2 Transformer

3.2.3 Switch Equipment

3.2.3 Power Capacitor

3.2.4 Electric Power Automation Equipment 4. Key Companies in Power Transmission & Distribution Equipment Industry

4.1 Key Wire and Cable Producers

4.1.1 Far East Holding Group Co., Ltd.

4.1.2 Jiangsu Shangshang Cable Group

4.1.3 Jiangsu Baosheng Group

4.2 Key Transformer Producers

4.2.1 Xi'an XD Transformer Co., Ltd.

4.2.2 Baoding Tianwei Baobian Electric Co., Ltd.

4.2.3 Tebian Electric Apparatus Stock Co., Ltd.

4.3 Key Switchgear Producers

4.3.1 New Northeast Electric (Shenyang) High Voltage Switchgear Co., Ltd.

4.3.2 Xi'an Xikai High Voltage Electric Co., Ltd.

4.3.3 Pinggao Group Co., Ltd.

4.4 Key Power Capacitor Producers

4.4.1 Xi'an XD Power Capacitor Co., Ltd.

4.4.2 Guilin Power Capacitor Co., Ltd.

4.4.3 New Northeast Electric (Jinzhou) Power Capacitor Co., Ltd.

4.5 Key Electric Power Automation Companies

4.5.1 NARI Technology Development Co., Ltd.

4.5.2 Guodian Nanjing Automation Co., Ltd.

|

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

Structure of Power Industrial System

Total Output Value of China's Power Industry, 1985-2006

Layout of National Grid Distribution

Investment in Grid, 2004-2007

Market Structure of Distribution Network

Scale of Power Transmission of Two Big Grid Companies, 2007

Staff Structure of SGCC

Main Business Revenue and Net Profit of SGCC, 2004-2007

Power Companies of SGCC

Business Revenue of China Southern Power Grid Co., Ltd., 2004-2007

Sales Revenue of Power Transmission & Distribution Equipment Sub-industries, 2007

YOY Growth of Revenue and Profit of Sub-industries, Jan.-Aug. 2007 (%)

Distribution of China Top 100 Companies in Electric Industry, 2007

Sales of Wire and Cable Manufacturing Sector, 2005-2007

Growth Rates of Sales Revenue in Wire and Cable Sector, 2001-2007

Operation of Transformer, Rectifier and Inductor Manufacturing Sector, 2005-2007

Operation of Switch Control Equipment Manufacturing Sector, 2005-2007

Market Demand for Electric Power Automation Products in 2001-2005

Sales Revenue of Wire and Cable Sector, 2001-2006

Power Cable Output, 2004-2007

Sales Revenue and Profit of Wire and Cable Sector, 2004-2006

China Top Ten Wire and Cable Producers in2006

China's Transformer Output, 2001-2007

Financial Statements of Power Capacitor Sector, 2002-2006

Quantity Ratio of Transformers with Different Voltage Classes (above 110KV), 1995-2005

Capacity Ratio of Transformers with Different Voltage Classes (above 110KV), 1995-2005

Market Shares of 500KV Transformer in 2007

China Top Ten Transformer Companies in 2006

Revenue and Profit of High-voltage Switch Equipment Sector, 2003-2005

Market Shares of 500KV Isolating Switches in 2007

Market Shares of 220KV Isolating Switches in 2007

Regional Distribution of China's High-voltage Switch Companies in 2007

Market Shares of Different Types of Power Capacitors, 2004-2020

Market Size of China's Electric Power Automation and Relay Protection Sector, 2005-2007

|

2005-2008 www.researchinchina.com All Rights Reserved

|