Improved technologies and increased output results in wind power cost to continuously drop, to a nickel/kilowatt-hour. Wind power cost is expected to further reduce by 30% by 2010, which has been close to the regular energy cost.

In 2006, newly-increased installed capacity of wind power in China was 1337 MW, accounting for 8.9% of world's total newly-increased, up by 165.83% year on year. The installed capacity of wind power in China by 2006 accumulated to 2604 MW, accounting for 3.5% of global total, up by 105.29%.

Overseas manufacturers have great advantages in China's wind turbine market, and they shared 55.10% of newly-increased installed capacity and 65.92% of total installed capacity of China in 2006. Vestas, Gamesa and GEWind are the top three, respectively responsible for 18.73%, 18.63% and 10.74% of total installed capacity of China.

Currently, China's domestic-funded wind turbine manufacturers include mainly Goldwind, Sinovel, Windey, Dongfang Steam Turbine and HEC, of which, Goldwind is dominant with market share in 2006 reaching 80.81% among China's domestic-funded wind turbine manufactures and newly-increased installed capacity accounting for 33.29% of total newly-increased. By the end of 2006, the market share of Goldwind accumulated to 83.36% among China's domestic-funded wind turbine manufacturers and installed capacity accounted for 25.68% of total.

Global Top 10 Countries by Wind Power Installed Capacity by Dec 2006

Source: GWEC

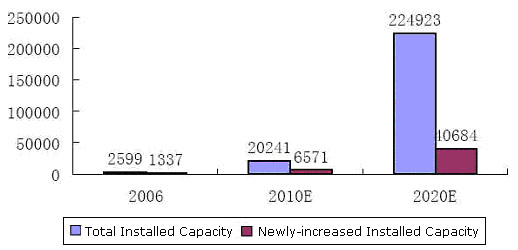

Forecast of Installed Capacity of Wind Power in China

(Unit: MW)

Source: ResearchInChina

Market Share of Wind Power Equipment Manufacturers in China 2006

(By newly-increased installed capacity)

Source: China Wind Power Association

Market Share of Wind Power Equipment Manufacturers in China

(By accumulated installed capacity)

Source: China Wind Energy Association

|