| |

|

|

China external logistics reached a total value of RMB 48 trillion in 2005 with a yr-on-yr growth of 25.2%, which was a little lower than the previous year but still remained a rapid increase. Structurally, as the industrial product logistics developed fastest, naturally it took the largest proportion in total value of the external logistics; whereas the agricultural product logistics increased slowest, and its proportion was rather small.

The total value of China external logistics amounted to RMB 26.8 trillion in the first half of 2006, rising 15.3% compared to the 1st half of 2005 (calculated at comparable price, hereafter the same in this paragraph) , but its growth rate declined by 1%, which was mainly caused by decreasing growth rate of industrial product logistics; The total value of industrial product logistics was RMB 23.4 trillion, up 15.6% compared to the 1st half of 2005, but its growth rate declined by 1.2%; the total value of import logistics was RMB 2.95 trillion, up 14.2% compared to the 1st half of 2005, and its growth rate increased by 0.2%; The total value of agricultural product logistics reached RMB 461.5 billion, growing 5.1% compared to the 1st half of 2005, its growth arte remained almost the same as the 1st half of 2005.

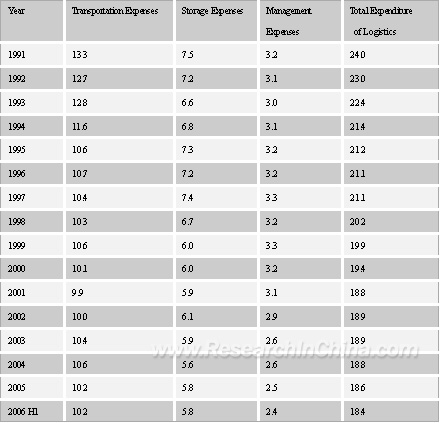

The total expense of China external logistics was RMB 1678.6 billion in the first half of 2006, rising 14.7% compared to the 1st half of 2005 (calculated at current price, hereafter the same in this paragraph), and its growth rate increased by 1.2%. It was mainly because of the sharp rise of energy cost that caused the common rise of transportation fee. However, the ratio of the total expense of external logistics to GDP continued to drop from 18.6% in 2005 to 18.4% in the first half of 2006, down by 0.2%.

From the view of total logistics expense structure, in the first half of 2006, transport cost was RMB 932.9 billion, rising 12.9% compared to the 1st half of 2005, and its growth rate up 0.8 by 0.8%, which maintained almost the same as compared to the 1st half of 2005 with a proportion of 55.6% to the total expense. The storage cost was RMB 531.4 billion, rising 18.6% compared to the 1st half of 2005, and its growth rate ascending by 2.4%, the storage cost shared 31.7% of the total expense, ascending by 1.2% compared to the 1st half of 2005. Management cost RMB 214.4 billion, rising 13.2% compared to the 1st half of 2005, and its groth rate increased by 0.2%, moreover, it shared 12.8% of the total expense, but the proportion declined by 0.1% compare to the 1st half of 2005.

Ratio of Total Logistics Expenditure to GDP since 1991 (%)

The market scale of China third-party logistics in 2005 exceeded RMB 100 billion, rising about 30% compared to the previous year. More and more global logistics corporations began to establish bases or distribution centers in Asia Pacific, such as UPS, FedEx, DHL, TNT, Exel, APL, BAX, Maersk, and SchenKer etc. As for the total revenue of Asia Pacific's third-party logistics market in 2003, China accounted for 40%, Japan and Australia accounted for 18% respectively, India accounted for 9% and the other countries accounted for 15%. It is forecasted by the end of 2006, China will account for 38%, Japan and Australia for 14% respectively, India for 12% and the other countries for 22%.

Meanwhile, due to the rising price of petroleum and the increasing investment in facility and technology, the operation cost of logistics enterprises will increase dramatically; on the other hand, the intensive competition led to the common decrease of logistics service charges(price war), therefore, the profit margin of the TPL market decreased universally in 2005. The services of the logistics enterprises become more and more professional in order to improve their profitability and competitiveness. Therefore the TPL market is segmented continuously according to industries, regions and products.

By 2006, about 12% of logistics and storage & transport companies in China have a storage area of 10,000 m2 or less; 40% have a storage area between 10,000 to 50,000 m2, 22% have a storage area between 50,000 and 100,000 m2 and 26% have a storage area of 100,000 m2 or more.

There are about 16,000 logistics companies with an industrial output value of more than RMB 39 billion in China. It is forecasted that the output value will reach RMB 1.2 trillion by 2010. The huge market has attracted many freight transportation giants to join in. China logistics industry will maintain the rapid growth in the following several years. The promising logistics market in China will provide the investors with great opportunities.

|

|

|

|

|

If this report could not still meet your requirement, or

you have any comments or suggestions on it, please leave a

message to us.

|

2005-2007 www.researchinchina.com All Rights Reserved

| |

|

|

| |

|

China external logistics reached a total value of RMB 48 trillion in 2005 with a yr-on-yr growth of 25.2%, which was a little lower than the previous year but still remained a rapid increase. Structurally, as the industrial product logistics developed fastest, naturally it took the largest proportion in total value of the external logistics; whereas the agricultural product logistics increased slowest, and its proportion was rather small.

The total value of China external logistics amounted to RMB 26.8 trillion in the first half of 2006, rising 15.3% compared to the 1st half of 2005 (calculated at comparable price, hereafter the same in this paragraph) , but its growth rate declined by 1%, which was mainly caused by decreasing growth rate of industrial product logistics; The total value of industrial product logistics was RMB 23.4 trillion, up 15.6% compared to the 1st half of 2005, but its growth rate declined by 1.2%; the total value of import logistics was RMB 2.95 trillion, up 14.2% compared to the 1st half of 2005, and its growth rate increased by 0.2%; The total value of agricultural product logistics reached RMB 461.5 billion, growing 5.1% compared to the 1st half of 2005, its growth arte remained almost the same as the 1st half of 2005.

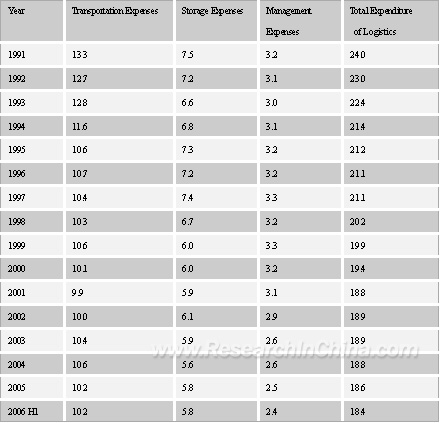

The total expense of China external logistics was RMB 1678.6 billion in the first half of 2006, rising 14.7% compared to the 1st half of 2005 (calculated at current price, hereafter the same in this paragraph), and its growth rate increased by 1.2%. It was mainly because of the sharp rise of energy cost that caused the common rise of transportation fee. However, the ratio of the total expense of external logistics to GDP continued to drop from 18.6% in 2005 to 18.4% in the first half of 2006, down by 0.2%.

From the view of total logistics expense structure, in the first half of 2006, transport cost was RMB 932.9 billion, rising 12.9% compared to the 1st half of 2005, and its growth rate up 0.8 by 0.8%, which maintained almost the same as compared to the 1st half of 2005 with a proportion of 55.6% to the total expense. The storage cost was RMB 531.4 billion, rising 18.6% compared to the 1st half of 2005, and its growth rate ascending by 2.4%, the storage cost shared 31.7% of the total expense, ascending by 1.2% compared to the 1st half of 2005. Management cost RMB 214.4 billion, rising 13.2% compared to the 1st half of 2005, and its groth rate increased by 0.2%, moreover, it shared 12.8% of the total expense, but the proportion declined by 0.1% compare to the 1st half of 2005.

Ratio of Total Logistics Expenditure to GDP since 1991 (%)

The market scale of China third-party logistics in 2005 exceeded RMB 100 billion, rising about 30% compared to the previous year. More and more global logistics corporations began to establish bases or distribution centers in Asia Pacific, such as UPS, FedEx, DHL, TNT, Exel, APL, BAX, Maersk, and SchenKer etc. As for the total revenue of Asia Pacific's third-party logistics market in 2003, China accounted for 40%, Japan and Australia accounted for 18% respectively, India accounted for 9% and the other countries accounted for 15%. It is forecasted by the end of 2006, China will account for 38%, Japan and Australia for 14% respectively, India for 12% and the other countries for 22%.

Meanwhile, due to the rising price of petroleum and the increasing investment in facility and technology, the operation cost of logistics enterprises will increase dramatically; on the other hand, the intensive competition led to the common decrease of logistics service charges(price war), therefore, the profit margin of the TPL market decreased universally in 2005. The services of the logistics enterprises become more and more professional in order to improve their profitability and competitiveness. Therefore the TPL market is segmented continuously according to industries, regions and products.

By 2006, about 12% of logistics and storage & transport companies in China have a storage area of 10,000 m2 or less; 40% have a storage area between 10,000 to 50,000 m2, 22% have a storage area between 50,000 and 100,000 m2 and 26% have a storage area of 100,000 m2 or more.

There are about 16,000 logistics companies with an industrial output value of more than RMB 39 billion in China. It is forecasted that the output value will reach RMB 1.2 trillion by 2010. The huge market has attracted many freight transportation giants to join in. China logistics industry will maintain the rapid growth in the following several years. The promising logistics market in China will provide the investors with great opportunities.

|

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

1 Development of Global Third-party Logistics

1.1 American Third-party Logistics

1.2 Asian Third-party Logistics

1.3 European Third-party Logistics

1.4 Forecast of Global Third-party Logistics Development

1.5 Foreign key Third-party Logistics Enterprises 2 Analysis of China Third-party Logistics Development

2.1 Market Environment of China Third-party Logistics

2.1.1 Economy Hotspots that Promote Market Demands

2.1.2 Market Competition Environment

2.1.3 Supply and Demand

2.2 Background of China Third-party Logistics

2.3 Retrospect of Third-party Logistics Development in 2005

2.4 Analysis of Third-party Logistics Market in 2006

2.5 Current Status of China Third-party Logistics

2.5.1 China Third-party Logistics still in the initial phase

2.5.2 System Barriers

2.5.3 Current Status

2.5.4 Prosperity of China Third-party Logistics

2.5.5 Development Strategies of China Third-party Logistics 3 Supply and Demand of China Third-party Logistics Market

3.1 Supply & Demand and Development Trend of Third-party Logistics Market

3.1.1 Market Capacity

3.1.2 Market Segmentation

3.1.3 Development Trend

3.2 Supply

3.3 Demand

3.4 Countermeasures on Supply 4 Development of E-Business and Third-party Logistics

4.1 Requirement of E-business development against Third-party Logistics

4.2 Third-party Logistics in E-Business Era

4.3 Third-party Logistics and Mobile E-Business

4.4 Prospect and Strategy for logistics Enterprises under E-Business Circumstance

4.5 Development Strategies of China Third-party Logistics and E-Business 5 Development of Transportation and Third-party Logistics

5.1 Development of Third-party Logistics and Transportation

5.2 Third-party Logistics and Railway Transportation Development

5.3 Transfer of Medium-small Highway Transportation Enterprises to Third-party Logistics

5.4 Economy Globalization and Port Third-party Logistics Development Strategy

5.5 Air Express and Third-party Logistics Development 6 Developments of Related Industries

6.1 Postal Service

6.2 Chain Retail

6.3 Medicine

6.4 Household Electric Appliance 7 Development of Third-party Logistics Information System

7.1 Current Status of Informationization in Third-party Logistics

7.2 Network-based Information System

7.3 Designs of Third-party Logistics Information System

7.4 Design of Information Management System for Third-party Logistics

7.5 Current Development, Problems and Countermeasures 8 Competition Analyses

8.1 Evaluation of Competitiveness

8.2 Cooperation and Competition for Third-party Logistics Enterprises

8.3 Third-party Logistics Regains Competitiveness

8.4 Survival and Competitive Strategy of Medium-small Companies 9 Development of Third-party Logistics Enterprises

9.1 Merger and Integration

9.2 Resource Integration

9.3 Maturity

9.4 Operation

9.5 Environment and Strategy Selection

9.6 Operation Strategy Classifications

9.6.1 Strategy of Comprehensive Logistics

9.6.2 Strategy of Systematic Logistics

9.6.3 Strategy of Integrated Logistics

9.6.4 Strategy of Soft Logistics

9.7 Marketing Strategies 10 Development Trend and Countermeasures of Third-party Logistics

10.1 Development Trend

10.2 Development Status

10.3 Government Measures for the Development of Third-party Logistics Market

10.4 Cooperation Trap and Countermeasures

10.5 Strategies for Enterprises to Enter Third-party Logistics

|

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

Third-party Logistics can choose Different Market Orientation Strategies

Different Third-party Logistics Enterprises Have Various Advantages and Disadvantages

Services Items of Third-party Logistics

Factors Affecting Success of Third-party Logistics Enterprise

Steps of Market Orientation of Logistics Enterprise

Comparison of Market Orientation Strategies among Logistics Enterprises

Logistics Expenditure Settlement Methods of Enterprise

Change Approach of Traditional Storage & Transport Enterprises

Information Construction Course of P.G. Logistics

Change of Third-party Logistics

Management Form Evolution of Third-party Logistics

How to Build the Effective Customer Relation

Improvement Brought by Logistics Suppliers

Logistics Service Items inclined to Inner Solution

Logistics Service Items inclined to Outsourcing

Brief System Network

Third-party Logistics Mode of Postal Service

Flow chart of Third-party Logistics Distribution Center of

Information System Network Structure of Third-party Logistics

Information Process of Third-party Logistics

Management System Plan of Logistics Information

Logistics Demand of Industrial Enterprises

Logistics Demand of Commercial Enterprises

Development Course of Third-party Logistics

Development Trend and Possible Ways of Third-party Logistics Services

Five Development Stages of TPL

|

2005-2008 www.researchinchina.com All Rights Reserved

|