| |

|

|

China is a large medical apparatus and instruments producer in both Asia and the world. China, as one of the top ten emerging markets in the world's medical apparatus and instruments industry, had a market capacity in 2006 exceed CNY60 billion. According to the development plan for the medical apparatus and instruments industry during the period 2006-2010, issued by the former State Economic & Trade Commission, the total output value of China's medical apparatus and instruments industry is expected to reach CNY150 billion in 2010, accounting for 5% of the world total, and China's market share in the world is expected to reach 25% in 2050, making China a world first-class, powerful medical apparatus and instruments producer. In 2007, China initiated the reform on its medical system. According to the reform plan, China will expand its capital expenditure in the infrastructure network of public health, implying a big market space for medical apparatus and instruments producers.

According to the statistics of the General Administration of Customs of China, China's total trade volume of medical apparatus and instruments in 2006 was US$10.55 billion, up 17.57% year-on-year, of which the exports valued at US$6.87 billion, up 28.58% year-on-year and the imports valued at US$3.68 billion, up 1.37% year-on-year. In 2007, China's total trade volume of medical apparatus and instruments reached US$12.7, more than four times US$2.95 billion posted in 2000, of which the imports valued at US$4.28 billion, more than three times US$1.31 billion recorded in 2000, and the exports valued at US$8.42 billion respectively, more than five times US$1.64 billion posted in 2000.

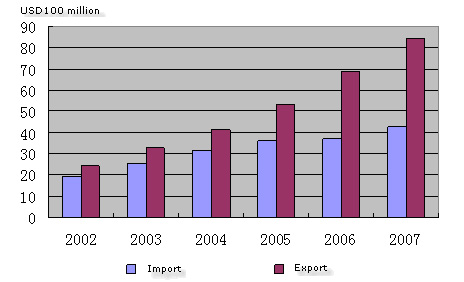

Import and Export of China's Medical Apparatus & Instruments, 2002-2007

At present, about 70% of China's high-end medical apparatus and instruments market is dominated by transnational corporations. Companies like GE, Siemens and Philips have the outstanding competitive advantages in the high-end market. Take radiation diagnosis device as an example, the U.S.'s GE, German's Siemens and the Netherlands' Philips have a higher market shares in CT, MRI device and angiogram device respectively. Manufacturing capability of Chinese companies in software development and precision electronic equipment, which is being increasingly enhanced, is gradually breaking the monopoly of foreign companies and creating a group of excellent companies, engaged in the production of medical apparatus and instruments, including Shenzhen Mindray Bio-medical Electronics Co., Ltd, Jiangsu Yuyue Medical Device Co., Ltd and Shandong Xinhua Medical Instrument Co., Ltd.

|

|

|

|

|

If this report could not still meet your requirement, or

you have any comments or suggestions on it, please leave a

message to us.

|

2005-2007 www.researchinchina.com All Rights Reserved

| |

|

|

| |

|

China is a large medical apparatus and instruments producer in both Asia and the world. China, as one of the top ten emerging markets in the world's medical apparatus and instruments industry, had a market capacity in 2006 exceed CNY60 billion. According to the development plan for the medical apparatus and instruments industry during the period 2006-2010, issued by the former State Economic & Trade Commission, the total output value of China's medical apparatus and instruments industry is expected to reach CNY150 billion in 2010, accounting for 5% of the world total, and China's market share in the world is expected to reach 25% in 2050, making China a world first-class, powerful medical apparatus and instruments producer. In 2007, China initiated the reform on its medical system. According to the reform plan, China will expand its capital expenditure in the infrastructure network of public health, implying a big market space for medical apparatus and instruments producers.

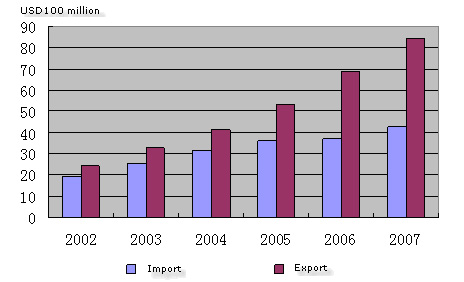

According to the statistics of the General Administration of Customs of China, China's total trade volume of medical apparatus and instruments in 2006 was US$10.55 billion, up 17.57% year-on-year, of which the exports valued at US$6.87 billion, up 28.58% year-on-year and the imports valued at US$3.68 billion, up 1.37% year-on-year. In 2007, China's total trade volume of medical apparatus and instruments reached US$12.7, more than four times US$2.95 billion posted in 2000, of which the imports valued at US$4.28 billion, more than three times US$1.31 billion recorded in 2000, and the exports valued at US$8.42 billion respectively, more than five times US$1.64 billion posted in 2000.

Import and Export of China's Medical Apparatus & Instruments, 2002-2007

At present, about 70% of China's high-end medical apparatus and instruments market is dominated by transnational corporations. Companies like GE, Siemens and Philips have the outstanding competitive advantages in the high-end market. Take radiation diagnosis device as an example, the U.S.'s GE, German's Siemens and the Netherlands' Philips have a higher market shares in CT, MRI device and angiogram device respectively. Manufacturing capability of Chinese companies in software development and precision electronic equipment, which is being increasingly enhanced, is gradually breaking the monopoly of foreign companies and creating a group of excellent companies, engaged in the production of medical apparatus and instruments, including Shenzhen Mindray Bio-medical Electronics Co., Ltd, Jiangsu Yuyue Medical Device Co., Ltd and Shandong Xinhua Medical Instrument Co., Ltd. |

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

1. China Medical Apparatus & Instruments Industry

1.1 Overview

1.2 Market

1.3 Import and Export 2. China Medical Apparatus & Instruments Market Segments

2.1 Medical Dressing

2.2 Diagnosis and Therapy Devices

2.3 Health Care Products

2.4 Disposal Medical Consumables

2.5 Dental Equipment and Material Commodities

2.6 Medical, Surgical and Veterinary Machine Manufacturing Industry 3 Key Manufacturers

3.1 Key Import and Export Companies

3.2 Hangwei GE Medical System Co., Ltd

3.2.1 Company Profile

3.2.2 Domestic Market

3.3 Shenzhen Mindray Bio-medical Electronics Co., Ltd

3.3.1 Company Profile

3.3.2 Domestic Market

3.4 Jiangsu Yuyue Medical Device Co., Ltd

3.4.1 Company Profile

3.4.2 Domestic Market

3.5 Shenyang Neusoft Digital Medical Device Co., Ltd

3.5.1 Company Profile

3.5.2 Domestic Market

3.6 Siemens Shanghai Medical Equipment Co., Ltd

3.7 Shandong Xinhua Medical Instrument Co., Ltd

3.8 Beijing Wandong Medical Equipment Co., Ltd

3.9 Omron Dalian Co., Ltd

3.10 Rexton (Suzhou) Hearing Systems Co. Ltd

3.11 Knowles Electronics (Suzhou) Co., Ltd

3.12 Double-Dove Group Co., Ltd

3.13 Shandong Zibo Shanchuan Medical Instrument Co. , Ltd

3.14 Tai'erMao Medical Products (Hangzhou) Co., Ltd 4 Conclusions and Viewpoints

|

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

Classification of Medical Device

Import and Export of China's Medical Machine, 2002-2007

China's Medical Machine Export, 2006

China's Medical Machine Import, 2006

Medical Device Processing Trade Trend in China

Export of Five Kinds of Medical Machines in China, Jan-Oct, 2007

Top Five Dental Equipment Manufacturers by Sales Revenue, 2005

Top Five Medical, Surgery and Veterinary Manufacturers by Sales Revenue, 2005

Top Ten Medical Device Companies by Import, 2007

Top Ten Medical Device Companies by Export, 2007

Sales of Core Products of Jiangsu Yuyue Medical Device Co., Ltd

Sales of Key Products of Jiangsu Yuyue Medical Device Co., Ltd, 2005-2007

Change of Main Business Revenue Structure of Jiangsu Yuyue Medical Device Co., Ltd, 2005-2007

Medical Machine Manufacturing Patents of Jiangsu Yuyue Medical Device Co., Ltd

Operation of Siemens Shanghai Medical Equipment Co., Ltd, 2005

Financial Evaluation of Shandong Xinhua Medical Instrument Co., Ltd

Main Financial Index of Shandong Xinhua Medical Instrument Co., Ltd, 2007

Financial Evaluation of Beijing Wandong Medical Equipment Co., Ltd

Main Financial Index of Beijing Wandong Medical Equipment Co., Ltd, 2007

|

2005-2008 www.researchinchina.com All Rights Reserved

|