| |

|

|

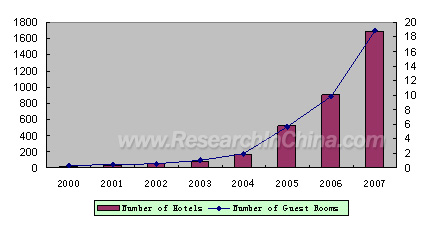

By the end of 2007, China has had 1,689 budget hotels and meanwhile, the number of guest rooms has reached 180,000. The main budget hotel chain brands are as the followings, Star of Jinjiang, Home Inn, Motel, Super 8, Sunny Youth Hotel, GreenTree Inn, 7 Days, Vienna, and Joy Inn. Among which, Home Inn went public in NASDAQ in Oct., 2006.

In 2007, the domestic brands still dominated the market. The top three not only further strengthened their leading positions, but also showed their good potential for further development. China's budget hotels have a short history and the average age had only five years and two months at the end of 2007.

Growth of China Budget Hotels, 2000-2007 (Unit: 10,000 rooms)

Source: ResearchInChina

Among the large cities in China, Shanghai has 286 hotels, ranking the first in terms of the number of budget hotels. Jiangsu Province, close to Shanghai, has 182 budget hotels, making it the second place by surpassing Beijing that has 156 hotels. Guangdong Province and Zhejiang Province ranks the fourth and fifth places respectively with 146 hotels and 126 hotels.

According to the statistics, Beijing, capital of China, has had 156 budget hotels by the end of 2007 with the average price standing at about CNY249.53.

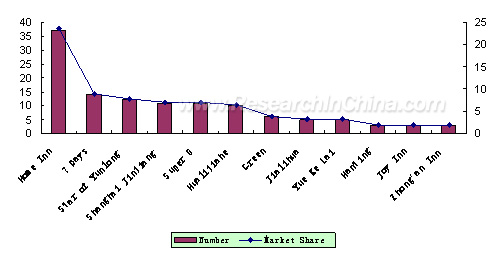

Structure of Budget Hotel Market in Beijing, 2007

Source: ResearchInChina

Among the budget hotels in Beijing, Home Inn with 37 chain hotels ranks the first place in terms of the number of hotel, accounting for 23.72% of the total market, followed by 7 Days with 14 chain hotels, amounting to 8.97%. Star of Yunlong, a regional brand, ranks the third place by 12 chain hotels, accounting for 7.69% of the total market, followed by Star of Shanghai, Super 8 and Hualijiahe, accounting for 7.05%, 7.05% and 6.41% respectively.

China had only 23 budget hotels with a total of 3,236 guest rooms in 200 and had 1,698 hotels with a total of 88,788 guest rooms in 2007, representing an average annual growth rate of 84.88% in budget hotel. In the period 2008-2010, the growth of China's budget hotels will slow down to 41.99% compared with 87.42% posted in 2007. The following three years will witness the consolidation of budget hotels in China. The increasingly fierce market competition will raise service quality and management level, and meanwhile the market will be consolidated widely by mergers and acquisitions.

|

|

|

|

|

If this report could not still meet your requirement, or

you have any comments or suggestions on it, please leave a

message to us.

|

2005-2008 www.researchinchina.com All Rights Reserved

| |

|

|

| |

|

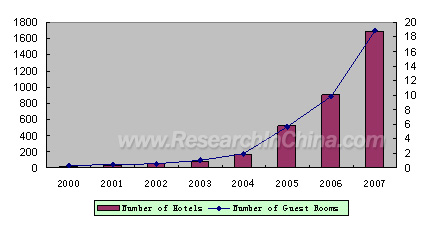

By the end of 2007, China has had 1,689 budget hotels and meanwhile, the number of guest rooms has reached 180,000. The main budget hotel chain brands are as the followings, Star of Jinjiang, Home Inn, Motel, Super 8, Sunny Youth Hotel, GreenTree Inn, 7 Days, Vienna, and Joy Inn. Among which, Home Inn went public in NASDAQ in Oct., 2006.

In 2007, the domestic brands still dominated the market. The top three not only further strengthened their leading positions, but also showed their good potential for further development. China's budget hotels have a short history and the average age had only five years and two months at the end of 2007.

Growth of China Budget Hotels, 2000-2007 (Unit: 10,000 rooms)

Source: ResearchInChina

Among the large cities in China, Shanghai has 286 hotels, ranking the first in terms of the number of budget hotels. Jiangsu Province, close to Shanghai, has 182 budget hotels, making it the second place by surpassing Beijing that has 156 hotels. Guangdong Province and Zhejiang Province ranks the fourth and fifth places respectively with 146 hotels and 126 hotels.

According to the statistics, Beijing, capital of China, has had 156 budget hotels by the end of 2007 with the average price standing at about CNY249.53.

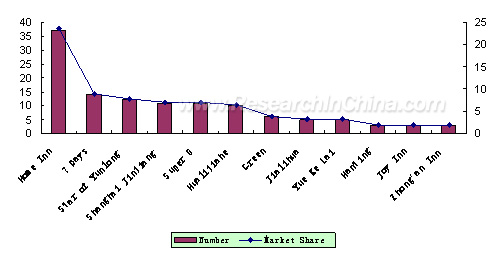

Structure of Budget Hotel Market in Beijing, 2007

Source: ResearchInChina

Among the budget hotels in Beijing, Home Inn with 37 chain hotels ranks the first place in terms of the number of hotel, accounting for 23.72% of the total market, followed by 7 Days with 14 chain hotels, amounting to 8.97%. Star of Yunlong, a regional brand, ranks the third place by 12 chain hotels, accounting for 7.69% of the total market, followed by Star of Shanghai, Super 8 and Hualijiahe, accounting for 7.05%, 7.05% and 6.41% respectively.

China had only 23 budget hotels with a total of 3,236 guest rooms in 200 and had 1,698 hotels with a total of 88,788 guest rooms in 2007, representing an average annual growth rate of 84.88% in budget hotel. In the period 2008-2010, the growth of China's budget hotels will slow down to 41.99% compared with 87.42% posted in 2007. The following three years will witness the consolidation of budget hotels in China. The increasingly fierce market competition will raise service quality and management level, and meanwhile the market will be consolidated widely by mergers and acquisitions.

|

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

1. Concept and Characteristics of Budget Hotels

1.1 Definition of Hotel

1.2 Classification of Hotel

1.3 Conception of Budget Hotel

1.4 Characteristics of Budget Hotel2. Overview of Global Budget Hotel Development

2.1 Overview of International Budget Hotel Development

2.2 International Budget Hotel Management 3. Overview of China Budget Hotel Development

3.1 Overview of China Hotel Industry

3.1.1 Overview of China Tourism Industry Development

3.1.2 China Hotel Market

3.2 Development Course of China Budget Hotels

3.3 China Budget Hotel Development

3.4 Market Demand of China Budget Hotels

3.4.1 Budget Hotels Driven by China Mass Tourism

3.4.2 Budget Hotels Stimulated by Economic Development

3.4.3 International Tourist Demand for Budget Hotels

3.4.4 Influences of Real Estate Industry on Hotel Industry

3.5 Main Problems in China Budget Hotel Industry

3.5.1 Divergences Incurred by Foreign Management System

3.5.2 Influences of Star-rating Standard for Hotel on Budget Hotels

3.5.3 Market Irregularities Caused by Unclear Property Rights of Budget Hotels

4. China Budget Hotel Development in Some Cities

4.1 Shanghai Budget Hotel Development

4.1.1 Tourism and Hotel Industry

4.1.2 Overview of Budget Hotel

4.1.3 Prospect of Budget Hotel

4.2 Beijing Budget Hotel Development

4.2.1 Tourism and Hotel Industry

4.2.2 Overview of Budget Hotel

4.2.3 Forecast of Budget Hotel

4.3 Guangzhou

4.3.1 Tourism and Hotel Industry

4.3.2 Overview of Budget Hotels

4.4 Shenzhen

4.4.1 Tourism and Hotel Industry

4.4.2 Overview of Budget Hotels

4.5 Hangzhou

4.5.1 Tourism and Hotel Industry

4.5.2 Overview of Budget Hotels

4.6 Chengdu

4.6.1 Tourism and Hotel Industry

4.6.2 Overview of Budget Hotels

4.7 Nanjing

4.7.1 Tourism and Hotel Industry

4.7.2 Overview of Budget Hotels

4.8 Qingdao

4.8.1 Tourism and Hotel Industry

4.8.2 Overview of Budget Hotels 5. Analyses and Evaluation on Major Budget Hotels in China, 2007

5.1 Home Inns

5.1.1 Overview

5.1.2 Layout

5.1.3 Core Competitiveness

5.1.4 Development Strategy and Development Models

5.1.5 Consolidation Trend through Mergers & Acquisitions

5.2 JinJiang Inn

5.2.1 Overview

5.2.2 Layout

5.2.3 Core Competitiveness

5.2.4 Development Strategy and Development Models

5.2.5 Consolidation Trend through Mergers & Acquisitions

5.3 GDH Inn

5.3.1 Overview

5.3.2 Layout

5.3.3 Core Competitiveness

5.3.4 Development Strategy and Development Models

5.3.5 Consolidation Trend through Mergers & Acquisitions

5.4 Motel 168 Chain Hotel

5.4.1 Overview

5.4.2 Layout

5.4.3 Core Competitiveness

5.4.4 Development Strategy and Development Models

5.4.5 Consolidation Trend through Mergers & Acquisitions

5.5 UTELS

5.5.1 Overview

5.5.2 Layout

5.5.3 Core Competitiveness

5.5.4 Development Strategy and Development Models

5.5.5 Consolidation Trend through Mergers & Acquisitions

5. 6 Super 8 Hotel

5.6.1 Overview

5.6.2 Layout

5.6.3 Core Competitiveness

5.6.4 Development Strategy and Development Models

5.6.5 Consolidation Trend through Mergers & Acquisitions

5.7 7 Days Inn Group

5.7.1 Overview

5.7.2 Layout

5.7.3 Core Competitiveness

5.7.4 Development Strategy and Development Models

5.7.5 Consolidation Trend through Mergers & Acquisitions

5.8 Zhongzhou Express Hotel

5.8.1 Overview

5.8.2 Layout

5.8.3 Core Competitiveness

5.8.4 Development Strategy and Development Models

5.8.5 Consolidation Trend through Mergers & Acquisitions

5.9 Hanting Hotel

5.9.1 Overview

5.9.2 Layout

5.9.3 Core Competitiveness

5.9.4 Development Strategy and Development Models

5.9.5 Consolidation Trend through Mergers & Acquisitions

5.10 Xinyu Inn 6. Clients' Demands of Budget Hotels

6.1 Clients

6.2 Demands

6.3 Brand Awareness of Budget Hotels 7. Suggestions on China Budget Hotels Development, 2008-2010

7.1 Forecast of Development Trend

7.1.1 Chain Operations - Main Development Model

7.1.2 Differentiated Operation and Brand Building

7.1.3 Professional Management and Technical Advancement

7.2 Suggestions on Management

7.2.1 Cost control

7.2.2 Location

7.2.3 Matching Capacity

7.2.4 Brands and Network

7.25 Marketing Concept |

|

|

|

|

2005-2008 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

Number of China star-level hotels, 2001-2006

Opening results of star-level hotels in big cities of China, 2006

Number of China star-level hotels by star, 2006

Growth of main budget hotels in China, 2006

Number of budget hotels and room growth rate in China, 2001-2007

Distribution rate of budget hotels in China by region

Distribution rate of room of budget hotels in China by region

Distribution of budget hotels in China by region, 2007

Number of inbound tourism receipts in Shanghai, 2007

Foreign tourists in Shanghai by country, Dec, 2007

Average room rent and price in Shanghai tourism hotels, Dec. 2007

Market share of main budget hotels in Shanghai, 2007

Beijing tourism market in 2007

Market constitutes of Beijing budget hotel market, 2007

Market structure of Guangzhou budget hotels

Shenzhen tourism market in 2007

Market constitutes of Shenzhen budget hotel market, 2007

Tourism revenue in Hangzhou, 2000-2007

Top five budget hotels and their market shares in Hangzhou

Market structure of Chengdu budget hotels, 2007

Star-level hotel receipts and operation in Nanjing, 2007

Market share of budget hotels in Qingdao

Distribution of Home Inn by region

Market segmented structure of Home Inn

Distribution of Jinjiang Inn by region

Market segmented structure of Jinjiang Inn

Network distribution of Motel 168 Chain Hotel

Network distribution of Super 8 Hotel

Network distribution of 7 Days Inn Group

Network distribution of Zhongzhou Express Hotel Home

Age of clients in budget hotels

Gender of clients in budget hotels

Marital status of clients in budget hotels

Incomes of clients of budget hotels

Industry of clients of budget hotels

Occupation of clients of budget hotels

Education of clients of budget hotels

Hobbies of clients of budget hotels

Most focused characteristics of budget hotels

Most focused room facilities in budget hotels

Area requirements of budget hotels

Ideal price of budget hotels

Most focused free services of budget hotels

Most focused promotion of budget hotels

Most common reserving forms of clients of budget hotels

Information sources of clients in budget hotels

Brand awareness of budget hotels

Preferred brand of budget hotels

Demand forecast of China budget hotels, 2008-2010

|

2005-2008 www.researchinchina.com All Rights Reserved

|