| |

|

|

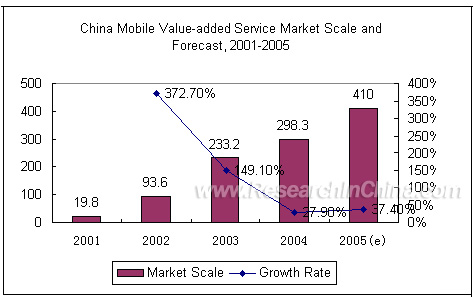

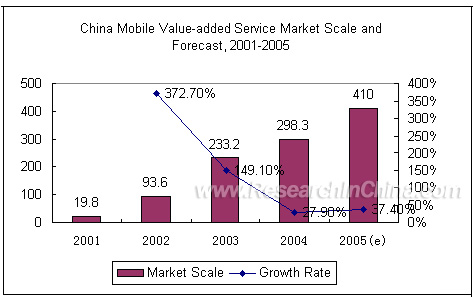

China's mobile value-added market began rapid development in 2002. In 2004 the total market scale reached 29.83 billion Yuan, which is predicted to reach 41 billion by the end of 2005.

As communication fees are charged solely by mobile operators, who also occupy 15 percent of the information fees, most of the revenues from mobile value-added business go to mobile operators. SPs only have a small share of the cake. Fortunately, this cake is huge. Even for the small share of the SPs, the income is considerably big. In 2004, the market scale further increased to 8.4 billion yuan. By the end of 2005, the SP value-added services are predicted to reach a total market scale of 12.35 billion. To SPs, year 2006 will enter the 3G era.

Year 2005 witnessed the decline in SMS revenues for most SPs, while operators' revenues are increasing steadily. According to data released by MII, in the first five months of 2005, SMS traffic was 114.78 billion messages, up 39.6 percent from the previous year. During this period, mobile phone subscribers in China reached 358 million. Per capita message per month is 64. SMS business will reach the development peak in 2006, after when the development focus will be industrial applications.

In the past three years, MMS grew rapidly. However, due to influence of seasonal factors and the adjustment of operators’ policies, it appears a wave-like growth curve. But the market scale is continuously increasing. By the end of 2005, MMS business is predicted to reach a market scale of over 2 billion.

IVR business will not be greatly influenced in the initial development stage of 3G. As 3G progresses, some data business will attract IVR users, which will result in market decline of IVR in 2006 to 2007. However, as IVR has strong business innovation capability, the decline trend will be moderate.

WAP business is currently in a stage of obvious market enlarging and has great growth potential. At present, it is the best time to enter. However, investors should not expect the coming of 3G will bring considerable return of WAP investments very soon. WAP itself is a channel, carrying most of the mobile contents. Its development is based on the development of mobile application contents. For this reason, the development of WAP business will be sustainable and steady growth.

Mobile phone ring tones, color tones and phone music belong to wireless music. They have the inherit relationships. In 2005, the mobile phone ring tone market scale will reach 1.8 billion and enter the market saturation stage. Color tones will exceed ring tones by the end of 2005 and reach 5 billion. In 2007-2008, color tone market will decline. Mobile phone music is likely to be the first fast-growing value-added business in 3G era. From the beginning of 2006, mobile phone music will take on a fast development trend and will exceed color tone with a market scale of 8 billion in 2007.

With the explosive development of music phones, related 3G value-added services will be continuously initiated. In the 3G era, cell phone video will be a 3G service worth attention the most after cell phone music. Market scale of cell phone video in 2006 will reach 1.5 billion yuan. However, phone video will not reach rapid development until after 2007. As video communication through mobile phones is realized, phone video business will expand considerably. But what will attract the most attention in the future will be the multimedia playback function on mobile phones.

Limited by high fees and poor representation form, the development of mobile phone games has been very slow. Considering breaking the limitations of terminals and network, real programmed games such as Java and Brew will not gain rapid development until after 2007.

After 2008, the building of 3G networks will enter the optimization and expansion stage. By then, many more new 3G value-added services will emerge, which will in turn stimulate the existing MMS and LBS services.

|

|

|

|

|

If this report could not still meet your requirement, or

you have any comments or suggestions on it, please leave a

message to us.

|

2005-2007 www.researchinchina.com All Rights Reserved

| |

|

|

| |

|

China's mobile value-added market began rapid development in 2002. In 2004 the total market scale reached 29.83 billion Yuan, which is predicted to reach 41 billion by the end of 2005.

As communication fees are charged solely by mobile operators, who also occupy 15 percent of the information fees, most of the revenues from mobile value-added business go to mobile operators. SPs only have a small share of the cake. Fortunately, this cake is huge. Even for the small share of the SPs, the income is considerably big. In 2004, the market scale further increased to 8.4 billion yuan. By the end of 2005, the SP value-added services are predicted to reach a total market scale of 12.35 billion. To SPs, year 2006 will enter the 3G era.

Year 2005 witnessed the decline in SMS revenues for most SPs, while operators' revenues are increasing steadily. According to data released by MII, in the first five months of 2005, SMS traffic was 114.78 billion messages, up 39.6 percent from the previous year. During this period, mobile phone subscribers in China reached 358 million. Per capita message per month is 64. SMS business will reach the development peak in 2006, after when the development focus will be industrial applications.

In the past three years, MMS grew rapidly. However, due to influence of seasonal factors and the adjustment of operators’ policies, it appears a wave-like growth curve. But the market scale is continuously increasing. By the end of 2005, MMS business is predicted to reach a market scale of over 2 billion.

IVR business will not be greatly influenced in the initial development stage of 3G. As 3G progresses, some data business will attract IVR users, which will result in market decline of IVR in 2006 to 2007. However, as IVR has strong business innovation capability, the decline trend will be moderate.

WAP business is currently in a stage of obvious market enlarging and has great growth potential. At present, it is the best time to enter. However, investors should not expect the coming of 3G will bring considerable return of WAP investments very soon. WAP itself is a channel, carrying most of the mobile contents. Its development is based on the development of mobile application contents. For this reason, the development of WAP business will be sustainable and steady growth.

Mobile phone ring tones, color tones and phone music belong to wireless music. They have the inherit relationships. In 2005, the mobile phone ring tone market scale will reach 1.8 billion and enter the market saturation stage. Color tones will exceed ring tones by the end of 2005 and reach 5 billion. In 2007-2008, color tone market will decline. Mobile phone music is likely to be the first fast-growing value-added business in 3G era. From the beginning of 2006, mobile phone music will take on a fast development trend and will exceed color tone with a market scale of 8 billion in 2007.

With the explosive development of music phones, related 3G value-added services will be continuously initiated. In the 3G era, cell phone video will be a 3G service worth attention the most after cell phone music. Market scale of cell phone video in 2006 will reach 1.5 billion yuan. However, phone video will not reach rapid development until after 2007. As video communication through mobile phones is realized, phone video business will expand considerably. But what will attract the most attention in the future will be the multimedia playback function on mobile phones.

Limited by high fees and poor representation form, the development of mobile phone games has been very slow. Considering breaking the limitations of terminals and network, real programmed games such as Java and Brew will not gain rapid development until after 2007.

After 2008, the building of 3G networks will enter the optimization and expansion stage. By then, many more new 3G value-added services will emerge, which will in turn stimulate the existing MMS and LBS services.

|

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

1.Overview

1.1 Research background and definitions

1.1.1 Research background

1.1.2 Definitions of mobile value-added business and research scope

1.2 Development environment of mobile value-added business

1.2.1 Macro policies

1.2.2 Change of management mode of value-added business by mobile operators

1.3 Market status and forecast

1.3.1 Analysis of subscriber scale of mobile value-added business

1.3.2 Market status and forecast

1.4 Competition analysis

1.4.1 Analysis of operator competition

1.4.2 Analysis of SP competition

1.5 User analysis

1.5.1 User category

1.5.2 User requirement analysis

1.6 Analysis of terminal support

1.6.1 Analysis of terminal sales

1.6.2 Users' terminal usage 2.SMS

2.1 SMS business introduction

2.2 SMS business category

2.2.1 Overview

2.2.2 Entertainment SMS

2.2.3 Education SMS

2.2.4 Finance SMS

2.2.5 Medical care and beauty SMS

2.2.6 News SMS

2.3 Characteristics of SMS

2.4 SMS market scale and development trend

2.4.1 Market scale

2.4.2 Factors affecting SMS development

2.5 Payment methods of Network SMS users

2.6 Performance analysis of leading SPs

2.6.1 SMS revenue comparison between TOM and Sina

2.6.2 SMS service types provided by SPs

2.6.3 SMS service charging methods by SP

2.6.4 SP marketing strategy

2.7 Operator's SMS business management analysis

2.8 Conclusions and suggestions 3.MMS

3.1 Introduction

3.1.1 Definitions

3.1.2 Characteristics of MMS

3.1.3 Platform requirement

3.1.4 MMS industry chain

3.2 MMS market status and trend

3.2.1 MMS market scale and development trend, 2004-2005

3.2.2 MMS subscribers, 2002-2005

3.2.3 Factors affecting MMS development

3.3 User analysis

3.3.1 Analysis of user recognition

3.3.2 Users' intention to use MMS and analysis of reasons for not using

3.3.3 Users' response to MMS price (0.6-0.9 yuan)

3.4 SP analysis

3.4.1 SP market share ranking

3.4.2 Analysis of MMS revenues of top 3 SPs concerning market share

3.4.3 MMS products of TOM, Sina and KongZhong

3.5 Operator's MMS business

3.5.1 China Unicom's ‘Color-e’ service

3.5.2 China Mobile' MMS marketing mode

3.6 Conclusions and suggestions 4.IVR service

4.1 Introduction

4.1.1 History of IVR

4.1.2 Characteristics of IVR

4.1.3 IVR business category

4.1.4 Platform requirement

4.1.5 IVR industry chain

4.2 IVR market status and trend

4.2.1 IVR market scale and trend

4.2.2 IVR marketing mode

4.2.3 Factors affecting IVR development

4.3 User analysis

4.3.1 Age and gender analysis of IVR users

4.4 SP analysis

4.4.1 SP market share in Q4 04 and Q1 05

4.4.2 Product type analysis of leading SPs

4.4.3 Product price analysis of leading SPs

4.4.4 China Unicom SPs' IVR revenue

4.4.5 China Mobile SPs' IVR revenue

4.5 Conclusions and suggestions 5.WAP

5.1 Introduction

5.1.1 History of WAP business in China

5.1.2 Classification and innovation of WAP business

5.1.3 Characteristics of WAP business

5.1.4 WAP industry chain

5.1.4.1 Structure of the industry chain

5.1.4.2 Fee structure and allocation

5.2 Market status and forecast

5.2.1 WAP market scale, 2003-2005

5.2.2 WAP subscribers, 2003-2005

5.2.3 Factors affecting WAP market development

5.3 User analysis

5.4 SP analysis

5.4.1 China Mobile SPs' revenue ranking and market share

5.4.2 China Unicom SPs' revenue ranking and market share

5.4.3 Product type and price analysis of leading SPs

5.5 Operator's operating analysis

5.5.1 Operating characteristics of WAP websites

5.5.2 China Mobile's WAP business

5.5.3 China Unicom's WAP business

5.5.4 Competition comparison of the two operators

5.6 Conclusions and suggestions 6.Ring Tones

6.1 Ring tone business

6.1.1 Definitions

6.1.2 Market overview

6.1.3 Ring tone formats and classification

6.2 Ring tone market status and trend

6.2.1 World ring tone market analysis

6.2.2 China ring tone market analysis

6.2.3 China ring tone copyright analysis

6.3 Ring tone industry chain structure

6.3.1 Operators

6.3.2 Ring tone SPs

6.3.3 Sound source chip makers

6.4 Analysis of SP competition

6.4.1 Ring tone SPs profit earning mode

6.4.2 Analysis and comparison of leading ring tone SPs

6.4.2.1 Sina

6.4.2.2 TOM Online

6.4.2.3 Any8.com

6.5 Conclusions and suggestions 7.Color Tones

7.1 Color tone business

7.1.1 Definitions

7.1.2 Color tone service overview

7.1.3 Main types of color tone business

7.1.4 Life cycle of color tone business

7.1.5 Survey of color tone subscribers

7.2 Color tone market status and trend

7.2.1 World color tone market analysis

7.2.2 China color tone market analysis

7.2.3 Development barriers of China's color tone business

7.2.4 Color tone industry dynamics in China 2005

7.3 Color tone industry chain

7.3.1 Color tone SPs operating pattern

7.3.2 Color tone CPs operating pattern

7.3.3 Record companies' color tone operating pattern

7.3.4 Operators' color tone policies and operating pattern

7.4 China's mobile operators' color tone business

7.4.1 China Mobile's color tone business

7.4.2 China Unicom's color tone business

7.5 Leading color tone SPs

7.5.1 Tencent

7.5.2 Sina

7.5.3 Linktone

7.5.4 Colorme

7.5.5 Rockmobile

7.5.6 TOM

7.5.7 KongZhong

7.6 Mobile phone music downloads

7.7 Conclusions and suggestions 8.Phone Video

8.1 Overview of phone video business

8.2 Phone video market status and trend

8.2.1 World phone video market analysis

8.2.2 China phone video market analysis

8.2.3 Forecast of phone stream media business

8.3 Analysis of phone video business

8.3.1 Factors affecting phone video business development

8.3.2 Six development problems of China's phone video industry

8.3.3 Opportunities provided to SPs by wireless video business

8.3.4 Introduction of main phone video applications

8.4 Phone video industry chain structure

8.4.1 Operators

8.4.2 Phone video service providers

8.4.3 Video phone makers

8.5 Phone video SPs

8.5.1 100tv.cn

8.5.2 eechu.com

8.5.3 15651.com

8.6 Conclusions and suggestions 9.Mobile phone TV

9.1 Phone TV business

9.1.1 Definitions

9.1.2 Overview of phone TV business

9.1.3 Implementation method of mobile phone TV

9.1.4 Characteristics of phone TV users

9.2 Phone TV market status and trend

9.2.1 World phone TV market analysis

9.2.2 China phone TV market overview

9.2.3 China phone TV business development trend

9.3 Analysis of phone TV business

9.3.1 Phone TV business development opportunities

9.3.2 Phone TV business development opportunities

9.3.3 Introduction of main phone TV applications

9.3.4 Analysis of related national broadcasting, television and film policies

9.4 Phone TV industry chain structure

9.4.1 Operators

9.4.2 Television stations (CPs)

9.4.3 Technical platform providers (content access providers)

9.4.4 Mobile/phone TV makers

9.5 Operator development strategy and dynamics of related players

9.5.1 China Mobile's phone TV development strategy

9.5.2 China Unicom's phone TV development strategy

9.6 Conclusions and suggestions 10.Mobile phone games

10.1 Overview

10.1.1 Definitions

10.1.2 Mobile phone game classification

10.1.3 Characteristics of mobile phone games

10.2 Mobile phone game market status and trend

10.2.1 China mobile phone game market scale

10.2.2 Current development stage and trend of China mobile phone game industry

10.2.3 Factors affecting development of mobile phone game industry

10.2.4 Mobile phone game development trend in 2005

10.3 Analysis of mobile phone embedded game products

10.3.1 Survey and analysis of the amount of mobile phone embedded games (Q3 02-Q3 04)

10.3.2 Survey and analysis of mobile phone game names (Q3 02-Q3 04)

10.3.3 Mobile phone game technical platform and development trend

10.3.4 Best 10 mobile phone games of 2004

10.4 Mobile phone game industry chain structure

10.4.1 Mobile operators

10.4.2 Mobile phone game service providers

10.4.3 Mobile phone game developers

10.4.4 Mobile phone game players

10.4.5 Mobile phone makers

10.4.6 Distribution channel

10.4.7 Mobile phone game related technologies providers

10.5 Analysis of leading SPs

10.5.1 Tencent

10.5.2 Sina

10.5.3 TOM

10.5.4 Netease

10.5.5 KongZhong

10.5.6 Mig

10.5.7 Digital-Red Mobile Software

10.5.8 DigiFUN

10.6 Analysis of mobile operators' mobile phone games

10.6.1 Analysis of Montnet mobile phone games

10.6.2 Analysis of China Unicom's Ufun mobile phone games

10.7 Conclusions and suggestions

10.7.1 General trend

10.7.2 Marketing

10.7.3 Products and players

10.7.4 Suggestions 11.Mobile Commerce

11.1 Mobile commerce business

11.1.1 Definitions

11.1.2 Overview

11.1.3 Characteristics of mobile commerce

11.1.4 Mobile commerce mode

11.2 Mobile commerce market status and trend

11.2.1 World mobile commerce market analysis

11.2.2 China mobile commerce development background

11.2.3 China mobile commerce market analysis

11.2.4 China mobile commerce development forecast

11.3 Mobile commerce business analysis

11.3.1 Mobile commerce development opportunities

11.3.2 Development bottlenecks of Mobile commerce

11.4 Mobile commerce industry chain structure

11.4.1 Operators

11.4.2 SPs

11.4.3 Mobile commerce platform suppliers

11.4.4 Distribution channel

11.5 Operator development strategy

11.5.1 Foreign operator development strategy

11.5.2 Domestic operator development strategy

11.6 Dynamics of Mobile commerce SPs

11.7 Analysis of SP competition

11.8 Main mobile commerce services

11.8.1 SMS domain name registration

11.8.2 Mobile phone ticket booking

11.8.3 Mobile phone search

11.8.4 Mobile phone advertising

11.8.5 Mobile phone purse

11.8.6 Mobile phone lottery

11.9 Conclusions and suggestions 12.Mobile Phone Payment

12.1 Mobile phone payment business

12.1.1 Definitions

12.1.2 Mobile phone payment overview

12.1.3 Mobile phone payment model

12.2 Characteristics of mobile phone payment

12.2.1 Business characteristics of mobile phone payment

12.2.2 Flow characteristics of mobile phone payment

12.2.3 Fee charging of mobile phone payment

12.3 Mobile phone payment market status and trend

12.3.1 Development status of world mobile phone payment business

12.3.2 Development trend of world mobile phone payment business

12.3.3 Development status of China mobile phone payment business

12.3.4 Environmental factors of China mobile phone payment development

12.3.5 Barriers facing China mobile phone payment business

12.3.6 Solutions to mobile phone payment business barriers

12.3.7 Development prospects of China mobile phone payment business

12.4 Mobile phone payment business mode

12.5 Analysis of mobile phone payment business

12.5.1 Mobile phone fee-charging service

12.5.2 Mobile phone purse business

12.5.3 Mobile phone bank business

12.5.4 Mobile phone credit platform business

12.5.5 Analysis of mobile phone payment business development

12.6 Mobile phone payment industry chain structure

12.6.1 Operators

12.6.2 Banks (service providers)

12.6.3 Mobile pone payment platform operators

12.7 Development trend of mobile phone payment industry chain

12.7.1 China Mobile's mobile phone payment development strategy

12.7.2 China Unicom's mobile phone payment development strategy

12.7.3 Banks' mobile phone payment development strategy

12.7.4 Development of payment platform operators

12.8 Factors affecting mobile phone payment development

12.9 Conclusions and suggestions

12.9.1 Market development conclusions

12.9.2 Market development suggestions 13.Mobile Location Positioning Service (LBS)

13.1 Introduction of positioning service

13.2 System composition of positioning service

13.2.1 Space position obtaining (positioning platform)

13.2.2 LBS management system

13.2.3 Information transmission system

13.2.4 Geographic information system (GIS)

13.2.5 Service providing system

13.2.6 Mobile terminals

13.3 Wireless positioning technology

13.4 Business classification and main applications of positioning service

13.4.1 Burst service

13.4.2 Tracking and monitoring

13.4.3 Location based information

13.4.4 Getting-help service

13.5 Precision requirement of positioning service

13.6 Global LBS operating market development

13.6.1 Europe and US

13.6.2 Japan and South Korea

13.6.3 Global LBS market development forecast

13.7 China LBS operating market development

13.7.1 Overview

13.7.2 Operator development

13.7.3 Development of the industry chain

13.7.4 LBS user amount in China

13.7.5 LBS operating revenue in China

13.7.6 Positioning terminal market scale in China

13.7.7 E-map market scale in China

13.7.8 China car navigation market scale

13.8 Prospects of China's positioning service

13.8.1 LBS applications of handheld terminals

13.8.2 LBS applications of private cars

13.8.3 Safety rescue applications

13.8.4 Position tracking applications

13.8.5 Mobile advertising

13.9 Positioning service development trend

13.9.1 Positioning service market development scale in the coming few years

13.9.2 Advantageous conditions of positioning service development

13.9.3 Adverse factors of positioning service development

13.9.4 Application development trend

13.9.5 Technology development trend

13.10 Private market consumer survey of China's positioning service

13.10.1 Consumer recognition

13.10.2 Consumers' concerns

13.10.3 Consumer usage

13.10.4 Consumer's purpose of using

13.10.5 Consumer's price acceptance degree

13.10.6 Factors affecting consumer's using

13.10.7 Problems existed in positioning service

13.10.8 Consumer viewpoints about prospects of positioning service

13.11 Analysis of positioning service industry chain

13.11.1 Composition of positioning service industry chain

13.11.2 Income and expenditure mode of positioning platform operators

13.11.3 Income and expenditure mode of application platform operators

13.11.4 Income and expenditure mode of service providers

13.11.5 Cooperative mode of links in the industry chain

13.12 Positioning service SPs

13.12.1 Guodu Group

13.12.2 GCI Science & Technology Co., Ltd

13.12.3 Guangdong Iscreate Communication Co., Ltd

13.12.4 ChinaOk.com CBI Group

13.12.5 Hangzhou Red Rain Technology

13.12.6 Beijing Antong Vehicle Satellite Positioning & Communication Co., Ltd

13.12.7 Aircom

13.12.8 Beijing Huayu Network Technology

13.12.9 Sichuan Great Wall Soft Technology Co., Ltd

13.12.10 Unicom Guomai Co., Ltd

13.12.11 Airversal Technology

13.12.12 Orient Star

13.12.13 Go2Map

13.12.14 Beijing Lingtu Software

13.12.15 China Quest

13.12.16 Beijing Zhixiang Communication Co., Ltd

13.12.17 Hunan Global Village Communication Co., Ltd

13.13 Sum-up of market development analysis

13.13.1 China LBS market competition

13.13.2 Analysis of market development space

13.13.3 Analysis of positioning service SPs

13.13.4 Analysis of market development mode

13.14 Suggestions to China's positioning service SPs

13.14.1 Market needs a cultivation period

13.14.2 Precision has influence on service development

13.14.3 Providing contents needed by users

13.14.4 Consider related problems while developing business 14.China Mobile's Wireless Data Business in 2005

14.1 Status quo

14.2 Development strategy

14.2.1 Development strategy

14.2.2 Development mode

14.3 Regulation on Montnet

14.4 Montnet SMS business

14.4.1 Overview

14.4.2 Fees & fares

14.4.3 Problem solving solutions

14.5 MMS business

14.5.1 Definitions

14.5.2 Development overview

14.5.3 Development strategy

14.5.4 Problems

14.6 Color tone business in 2004

14.6.1 Development overview

14.6.2 Business introduction

14.6.3 Fees & fares

14.6.4 Characteristics of color tone business

14.6.5 Business promotion

14.7 IVR business in 2004

14.7.1 Definitions

14.7.2 Development overview

14.8 WAP business in 2004

14.8.1 Definitions

14.8.2 Development overview

14.8.3 WAP-supporting terminals

14.8.4 Fees & fares

14.8.5 Development trend

14.9 Sui-e-xing business in 2004

14.9.1 Introduction

14.9.2 Definitions

14.9.3 Business classification

14.9.4 Business characteristics

14.9.5 Fees & fares

14.9.6 Business development overview

14.9.7 Supporting terminals

14.9.8 Business promotion strategy

14.10 Baibaoxiang business in 2004

14.10.1 Definitions

14.10.2 Business characteristics

14.10.3 Business development overview

14.10.4 Supporting terminals

14.10.5 Fees & fares 15.China Unicom's Wireless Data Business in 2004

15.1 Development strategy in 2005

15.2 Business promotion, 2003-2004

15.3 Analysis of UNI platform development in 2005

15.3.1 Development focus of value-added business in 2005

15.3.2 Problems existing in the value-added business value chain

15.3.3 UNI strategic cooperation

15.3.4 UNI development overview

15.4 U-sms business in 2004

15.4.1 Introduction

15.4.2 Development overview

15.4.3 Fees & fares

15.4.4 Promotion strategy

15.4.5 Introduction of U-sms SPs

15.5 Color-E business in 2005

15.5.1 Definitions

15.5.2 Business overview

15.5.3 Business development

15.5.4 Supporting terminals

15.5.5 Fees & fares

15.6 IVR business in 2004

15.6.1 Definitions

15.6.2 IVR development in 2004

15.6.3 New IVR business—Li Yin Jie

15.7 U-info business in 2003-2004

15.7.1 Definitions

15.7.2 Business introduction

15.7.3 Development overview

15.7.4 Supporting terminals

15.7.5 Fees & fares

15.7.6 Promotion strategy

15.8 U-power business in 2005

15.9 Unet business in 2003-2004

15.10 Ufun business in 2003-2004 16.Wireless Data Business Comparison between China Mobile and China Unicom in 2005

16.1 3G development strategies of China Mobile and China Unicom in 2005

16.1.1 Mobile operators exploring 3G operating strategies in 2005

16.1.2 Mobile operators exploring 3G industry pattern in 2005

16.2 China Mobile's wireless data business development in 2005

16.2.1 Adjusting revenue dividing mode

16.2.2 Speeding up building of MISC platform

16.2.3 Establish different management mode

16.3 China Unicom's wireless data business development in 2005

16.3.1 Brand adjusting

16.3.2 Cultivate value-added business market

16.3.3 Speed up industry chain adjustment

16.3.4 Strengthen cooperation with CPs and SPs

16.4 Montnet SMS v.s. U-sms

16.5 MMS v.s. Color-e

16.5.1 Position

16.5.2 Terminals

16.5.3 Service price

16.5.4 Content providing

16.5.5 Sum-up

16.6 WAP v.s. U-info

16.6.1 China Mobile and China Unicom's differences on WAP business

16.6.2 China Mobile and China Unicom's commonness on WAP business

16.7 Sui-e-Xing v.s. U-net

16.7.1 Sui-e-Xing

16.7.2 U-net

16.8 Baibaoxiang v.s. U-fun

16.8.1 U-fun

16.8.2 China Unicom's reasons of choosing BREW

16.8.3 Baibaoxiang

16.8.4 Problems facing Baibaoxiang service

16.8.5 Solutions to problems facing Baibaoxiang service

16.8.6 Development of mobile phone games in Baibaoxiang and U-fun

16.9 Positioning service v.s. U-map

16.9.1 Development overview of positioning services

16.9.2 Comparison of positioning services

16.9.3 Necessary factors for positioning services 17.Mobile Value-added Services in 3G Era |

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

Value-added Service Industry Chain Structure Chart

Evolvement of Mobile Network Technology and Mobile Value-added Service

Mobile Subscriber Scale in China, 2001-2005

Mobile Market Scale and Forecast in China, 2001-2005

History and Trend of Value-added Service Revenue

SWOT Analysis of China Mobile's Value-added Services

SWOT Analysis of China Unicom's Value-added Services

China Mobile's Brand Development Strategy

China Unicom's Brand Development Strategy

SP Market Position Distribution Chart

Value Representation of Different Market Segmentations

Student Market Chart

Young White-collar Market Chart

30-year-above White-collar Market Chart

Young Blue-collar Market Chart

30-year-above Blue-collar Market Chart

User Requirement Analysis of Value-added Services

Value-added Service Products Requirements and Market Maturity Level

Sales of Domestically Made Handsets, 2002-2005

Price Levels of Interviewees' Handsets

Proportion of Handset Type used by Interviewees

Whether to Update to Handsets with More Functions

Category Proportion of China's 2008 SMS Services in 2004

Proportion of Sub-class SMS Types in Entertainment Category

Proportion of Sub-class SMS Types in Education Category

Proportion of Sub-class SMS Types in Finance Category

Proportion of Sub-class SMS Types in Medical Car and Beauty Category

Proportion of Sub-class SMS Types in News Category

SMS Traffic in China, 2000-2004

Payment methods of Network SMS Users

SMS Revenue Comparison between TOM and Sina, 2004-2005

SMS Service Types Provided by Main SPs in China

SMS Service Proportion by Types Provided by Main SPs in China

Proportion of Different SMS Fee-charging Methods

MMS Market Scale, 2004-2005

MMS Subscriber Statistics and Forecast, 2002-2005

Consumers' Recognition Degree of MMS Service

Consumers' Using Intention of MMS Service

Main Factors Affecting Consumer's Usage of MMS

Users' Response to MMS Price (0.6-0.9 yuan)

SP Market Share Rank in MMS Business Q4 04

SP Market Share Rank in MMS Business Q1 05

Analysis of MMS revenues of Top 3 SPs in Market Share

MMS Service Types Provided by TOM

MMS Product Types Provided by Sina

MMS Product Types Provided by KongZhong.com

Analysis of MMS Service Fees of TOM

Analysis of MMS Service Fees of Sina

Analysis of MMS Service Fees of Kongzhong.com

Network Structure of ‘Color-e’

China Unicom's ‘Color-e’ Income Trend

China Unicom's ‘Color-e’ Subscriber Growth

IVR Industry Chain Structure

IVR Market Scale, 2003-2005

IVR Users Age Distribution

IVR Users Gender Proportion

SP Market Share Q4 04

SP Market Share Q1 05

TOM's IVR Income, 2004-2005

IVR Product Category Proportion Provided by Leading SPs

WAP Industry Chain

Fee Distribution Mode of WAP

WAP Market Scale, 2003-2005

WAP User Amount, 2003-2005

Proportion of Entertainment WAP Services Provided by Leading SPs

Fees of Entertainment WAP Services Provided by Leading SPs

China Mobile's WAP Business Market Scale Change in 2004

World Mobile Phone Ring Tone Market Scale, 2003-2008

Mobile Phone Ring Tone Market Scale in Different Countries and Regions in 2004

China Mobile Phone Ring Tone Market Scale, 2003-2004

Ring Tone Industry Chain

Ring Tone Profit Allocation

Ring Tone Download Price Comparison between China Mobile and China Unicom

Ring Tone Amount Owned by Major Ring Tone SPs

Sina's Revenue of Mobile Value-added Services Q1 04-Q2 05

Category Proportion of Sina's Ring Tones

Category Proportion of TOM's Ring Tones

Category Proportion of Any8.com's Ring Tones

Market Share of Different Color Tone Categories

Life Cycle of Color Tone Business in China

Color Tone Usage of China Mobile's Subscribers

Proportion of Different Ages Using Color Tones

Reasons of Using Color Tones

|

2005-2008 www.researchinchina.com All Rights Reserved

|