HUD research: AR-HUD accounted for 21.1%; LBS and optical waveguide solutions are about to be mass-produced.

?

The automotive head-up display system (HUD) uses the principle of optics to display such information as vehicle speed, navigation and ADAS in front of the vehicle in real time. By display screen, HUD can be divided into three types: C-HUD, W-HUD, and AR-HUD. Among them, AR-HUD (augmented reality head-up display) has TFT, DLP, LCoS and LBS technology routes.???

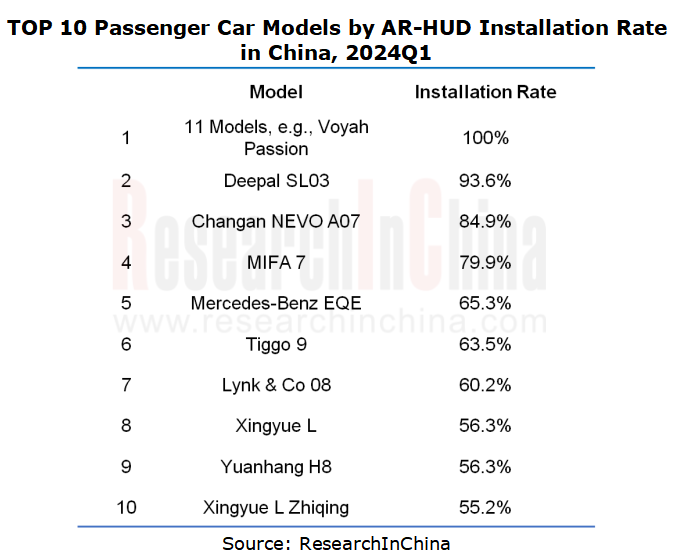

1. A total of 38 car models were equipped with AR-HUD, of which the full range of 11 models like Voyah Passion came standard with it.???

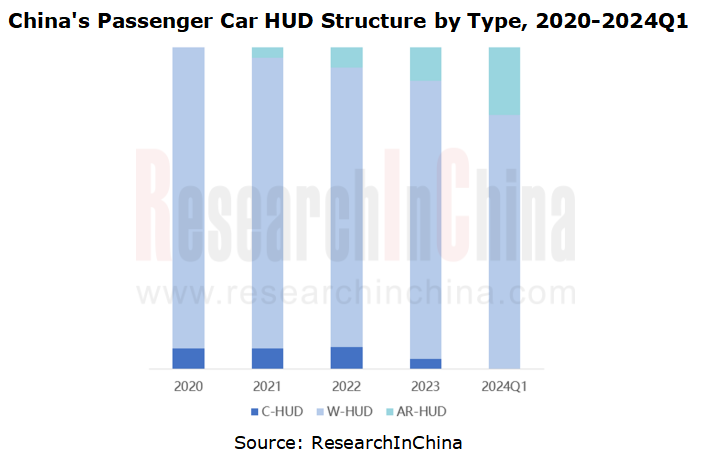

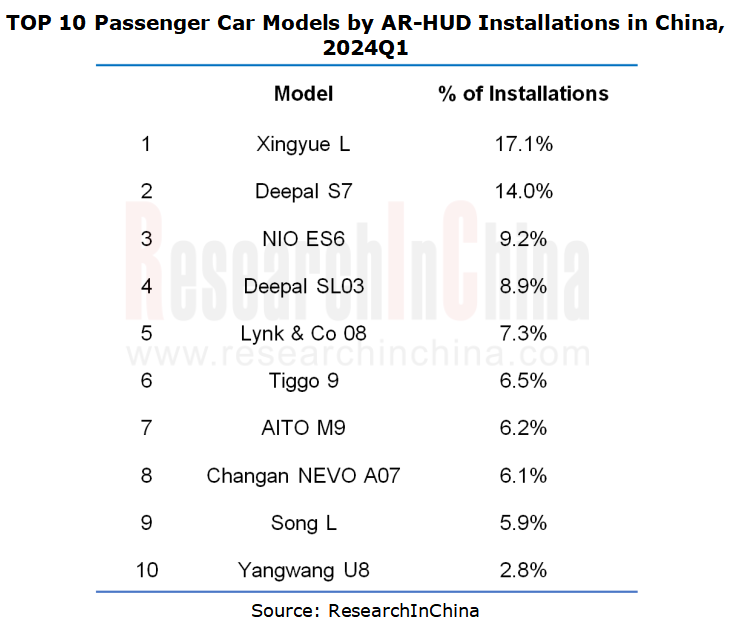

In 2023, AR-HUD was installed in over 230,000 passenger cars, making up 10.6% of the overall HUD market. In the first quarter of 2024, the share of AR-HUD in the overall HUD market surged to 21.1%, mainly driven by the sales of Xingyue L, Deepal S7, Deepal SL03 and Lynk & Co 08.?

In terms of the number of models equipped with AR-HUD, a total of 38 models were equipped with AR-HUD in the first quarter of 2024, compared with only 17 in 2022. As for installations, in the first quarter of 2024, the top ten models by AR-HUD installations were all from Chinese independent brands, among which the top three models Xingyue L, Deepal S7, and NIO ES6 accounted for a combined more than 40% of the total.?

In terms of installation rate, there were 11 models equipped with AR-HUD as a standard configuration in the first quarter of 2024, including Voyah Passion, Deepal S7, AITO M9 and Zeekr X.

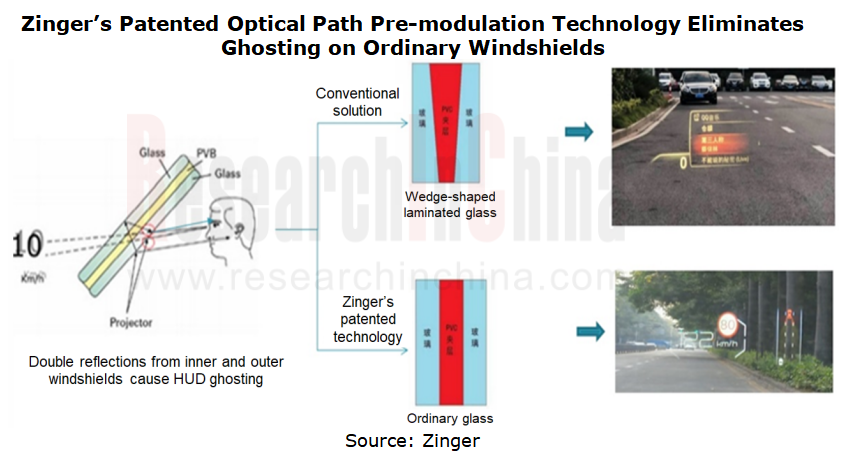

The AR-HUD carried by Voyah Passion is exclusively supplied by ShenZhen QianHai Zinger Technology. The product adopts TFT technology, offering an up to 60-inch display, a FOV of 10°*3°, and an imaging distance of 7.5 meters. The product can display more than 30 types of driving information, including complex intersection guidance and entry into the auxiliary road, and can also fuse ADAS information such as FCW.???

The AR-HUD supplied by Zinger for Voyah Passion can be used with ordinary windshields, with no ghosting. Zinger has devoted itself to developing core HUD technologies for ten years and has applied for a patent for optical path pre-modulation technology. With a range of optical technologies and structural designs, it helps OEMs remove the "wedge film" and eliminate ghosting by imaging with ordinary windshields, thus reducing the vehicle cost (compared with conventional wedge film solutions, cut down the glass cost by 25%~30%). Also it brings convenient optional configurations and after-sales maintenance to 4S stores, and enables the aftermarket installation, facilitating the popularization of aftermarket HUD and bringing new business opportunities.?????

?

?

Zinger was founded in 2014 and is headquartered in Shenzhen. In 2022, it successfully secured the exclusive AR-HUD supply project for Voyah Passion. In 2023, its AR-HUD was designated by a leading emerging carmaker, a high-end new energy brand and a new energy vehicle company in China. It is expected that it will take a bigger market share in 2024.??

?

2. AR engine is the key factor to improving AR-HUD user experience.

AR-HUD integrates information from multiple ends such as cameras, radars, and maps, and uses rendering to present images in front of the driver with low latency, no distortion, and high accuracy. Its product features require AR-HUD software to ensure the stability of image rendering in any vehicle conditions, and have high requirements for the software's optical algorithms such as anti-shake, distortion correction, and spatial coordinate display.???

?

At present, the AR-HUD industry generally adopts software-hardware integrated solutions, bundling optical device hardware with software. Yet the trend towards the separation of software and hardware is inevitable amid the demand for rapid iteration of intelligent vehicles. OEMs' needs for HMI self-development and rapid iteration stimulate the birth of professional AR engines.???

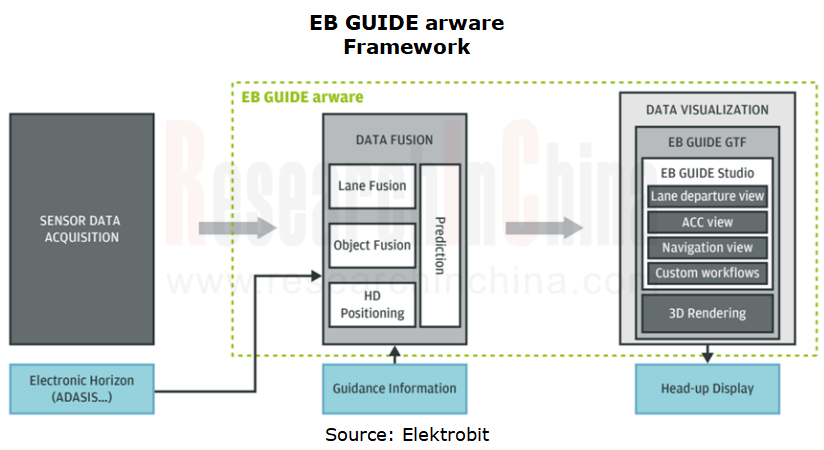

The foreign company Continental first used the AR-Creator software developed by its subsidiary Elektrobit. Later, Elektrobit launched the AR engine for EB GUIDE arware. Using EB GUIDE arware, HMI developers can quickly add AR information to a HUD solution.???

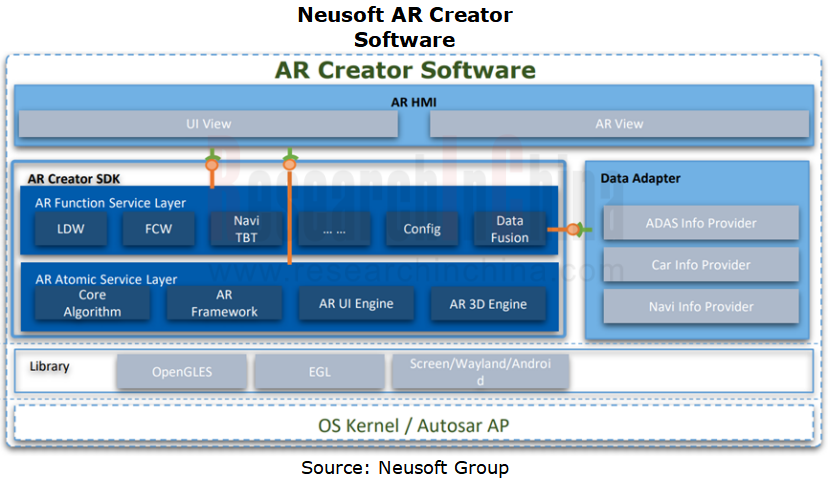

As for Chinese companies, Neusoft Group has introduced AR For Car solutions, including AR SDK and AR Studio. AR SDK has cross-platform flexible deployment capabilities, allowing for deployment in the optical device, cockpit domain controller, or intelligent driving domain controller. It can also span multiple OSs like Linux and Android, and also supports deployment of Autosar and QNX.????

??

AR Studio, the first designer platform launched in China, provides product functions including visual AR scene editor, real-time preview of user experience design, import of UX design resources, import or simulation of sensor data, and rapid generation of AR applications, improving the development efficiency of vehicle AR applications and simplifying the cooperation between product designers and developers.

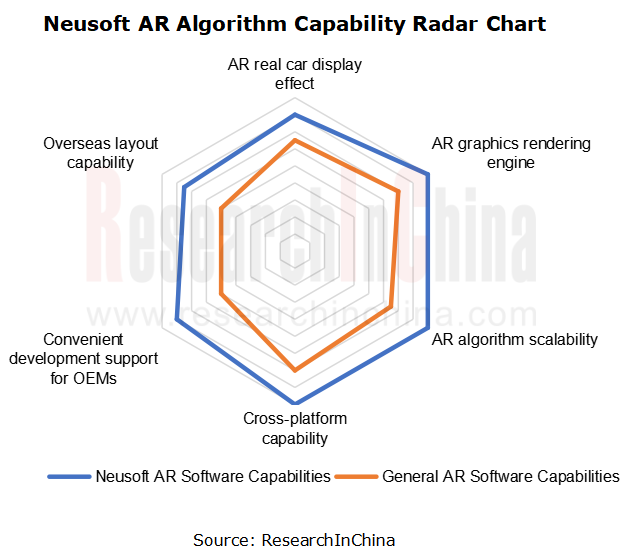

Note: indicator explanation:

?AR real car display effect: AR-HUD accuracy, real-time performance, stability, etc.????

?AR graphics rendering engine: AR real-time rendering effect

?AR algorithm scalability: support expansion to other intelligent cockpit displays such as cluster, center console and electronic rearview mirrors

?Cross-platform capability: adaptability to multiple chips, operating systems, and various optical device hardware???

?Convenient development support for OEMs: OEMs can use this tool to quickly build HMI and rapidly iterate

?Overseas layout capability: manufacturers have overseas layout experience??

??

Neusoft AR SDK+AR Studio helps OEMs quickly build AR algorithm capabilities. This tool kit can not only be used for AR-HUD, but also allows for application on other cockpit screens such as cluster, center console and electronic rearview mirrors. Neusoft AR For Car solution is developed to help OEMs create a consistent AR experience on cockpit screens.????

?

At present, Neusoft's AR software has supported multiple models of multiple OEMs. The statistics show that in 2023, models with AR-HUD accounted for about 30% of the total sales of related models.

3. AR-HUD blooms, and LBS and optical waveguide technologies are production-ready.???

In 2023, under the leadership of Huawei, LCoS AR-HUD found mature application in Rising R7 and AITO M9. In addition to TFT, DLP, and LCoS solutions, LBS and optical waveguide solutions have also been production-ready.???

?

Raythink and FICG cooperated to promote mass production of LBS.

In January 2024, Raythink and FIC Global (FICG) formed a strategic partnership on mass production of LBS technology. Based on their respective resource advantages, both parties will jointly commit to the R&D, manufacturing and mass production of LBS.??

?

Raythink’s light source module based on LBS technology (Opticalcore) has now iterated to the fourth generation. Its unique multi-light source micro-combination is the first solution to successfully solve the speckle problem of LBS through diffuser imaging, providing the HUD market with a PGU technology route that can be truly applied on a large scale.?

FICG started developing LBS AR-HUD in 2019, and now has deployed single-focal-plane and dual-focal-plane LBS AR-HUDs, with FOV range of 6-42 degrees, VID range of 3-50 meters, and product volume of 4-20 L.???

?

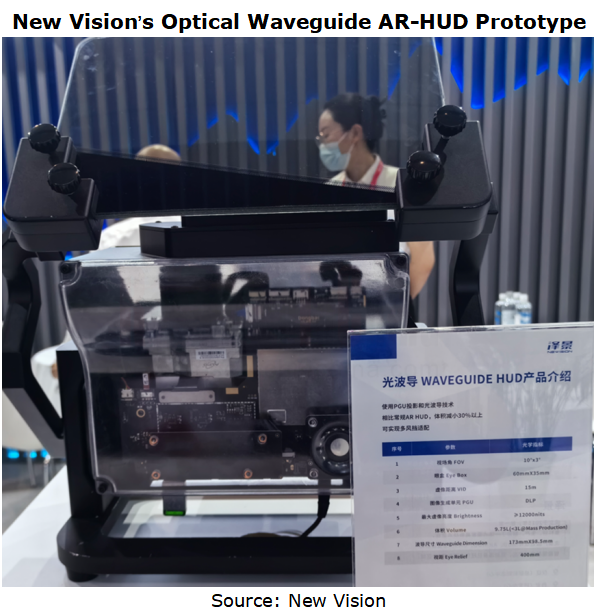

Jiangsu New Vision Automotive Electronics’ Optical Waveguide AR-HUD Prototype

In April 2024, New Vision showcased its optical waveguide HUD at the Beijing International Automotive Exhibition. Compared with conventional AR HUD, this product is more than 30% smaller and can be matched with multiple windshields.???

Waveguide size: 173mm*98.5mm

Viewing distance: 400mm

Virtual image distance: 15mm

After mass production, the volume of this product can be less than 3L

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...

China Passenger Car HUD Industry Report, 2024

ResearchInChina released the "China Passenger Car HUD Industry Report, 2025", which sorts out the HUD installation situation, the dynamics of upstream, midstream and downstream manufacturers in the HU...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2025 – Chinese Companies

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2025 – Chinese Companies

Research on Domestic ADAS Tier 1 Suppliers: Seven Development Trends in the Era of Assisted Driving 2.0

In the ...

Automotive ADAS Camera Report, 2025

①In terms of the amount of installed data, installations of side-view cameras maintain a growth rate of over 90%From January to May 2025, ADAS cameras (statistical scope: front-view, side-view, surrou...

Body (Zone) Domain Controller and Chip Industry Research Report,2025

Body (Zone) Domain Research: ZCU Installation Exceeds 2 Million Units, Evolving Towards a "Plug-and-Play" Modular Platform

The body (zone) domain covers BCM (Body Control Module), BDC (Body Dom...

Automotive Cockpit Domain Controller Research Report, 2025

Cockpit domain controller research: three cockpit domain controller architectures for AI Three layout solutions for cockpit domain controllers for deep AI empowerment

As intelligent cockpit tran...

China Passenger Car Electronic Control Suspension Industry Research Report, 2025

Electronic control suspension research: air springs evolve from single chamber to dual chambers, CDC evolves from single valve to dual valves

ResearchInChina released "China Passenger Car Elect...

Automotive XR Industry Report, 2025

Automotive XR industry research: automotive XR application is still in its infancy, and some OEMs have already made forward-looking layout

The Automotive XR Industry Report, 2025, re...

Intelligent Driving Simulation and World Model Research Report, 2025

1. The world model brings innovation to intelligent driving simulation

In the advancement towards L3 and higher-level autonomous driving, the development of end-to-end technology has raised higher re...

Autonomous Driving Map (HD/LD/SD MAP, Online Reconstruction, Real-time Generative Map) Industry Report 2025

Research on Autonomous Driving Maps: Evolve from Recording the Past to Previewing the Future with "Real-time Generative Maps"

"Mapless NOA" has become the mainstream solution for autonomous driving s...

End-to-End Autonomous Driving Research Report, 2025

End-to-End Autonomous Driving Research: E2E Evolution towards the VLA Paradigm via Synergy of Reinforcement Learning and World Models??The essence of end-to-end autonomous driving lies in mimicking dr...

Research Report on OEMs and Tier1s’ Intelligent Cockpit Platforms (Hardware & Software) and Supply Chain Construction Strategies, 2025

Research on intelligent cockpit platforms: in the first year of mass production of L3 AI cockpits, the supply chain accelerates deployment of new products

An intelligent cockpit platform primarily r...

Automotive EMS and ECU Industry Report, 2025

Research on automotive EMS: Analysis on the incremental logic of more than 40 types of automotive ECUs and EMS market segments

In this report, we divide automotive ECUs into five major categories (in...

Automotive Intelligent Cockpit SoC Research Report, 2025

Cockpit SoC research: The localization rate exceeds 10%, and AI-oriented cockpit SoC will become the mainstream in the next 2-3 years

In the Chinese automotive intelligent cockpit SoC market, althoug...

Auto Shanghai 2025 Summary Report

The post-show summary report of 2025 Shanghai Auto Show, which mainly includes three parts: the exhibition introduction, OEM, and suppliers. Among them, OEM includes the introduction of models a...

Automotive Operating System and AIOS Integration Research Report, 2025

Research on automotive AI operating system (AIOS): from AI application and AI-driven to AI-native

Automotive Operating System and AIOS Integration Research Report, 2025, released by ResearchInChina, ...

Software-Defined Vehicles in 2025: OEM Software Development and Supply Chain Deployment Strategy Research Report

SDV Research: OEM software development and supply chain deployment strategies from 48 dimensions

The overall framework of software-defined vehicles: (1) Application software layer: cockpit software, ...