Research on electronic rearview mirrors: electronic internal rearview mirrors are growing rapidly, and electronic external rearview mirrors are facing growing pains

ResearchInChina released "Global and China Electronic Rearview Mirror Industry Report, 2024", which summarizes the development status, loading situation, supplier product layout, and supply chain layout of global and Chinese electronic rearview mirrors, and forecasts the future development trend of electronic rearview mirrors.

1. Streaming media rearview mirror: assembly volume is growing rapidly, and market landscape of TOP 5 has changed

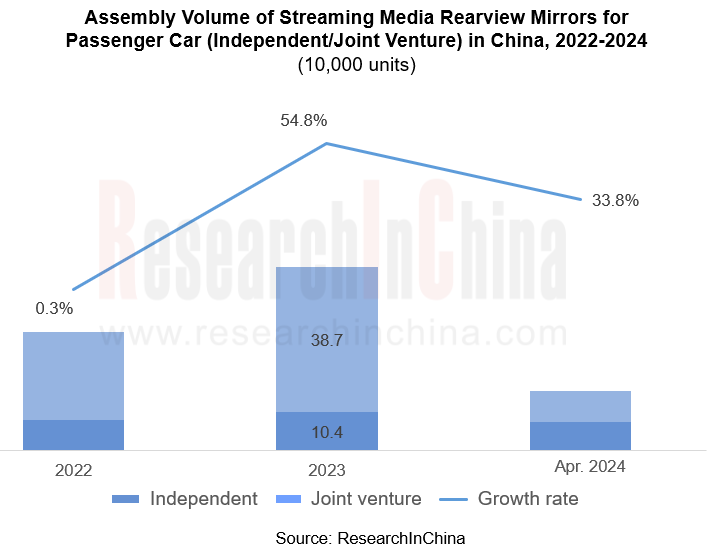

In 2023, the assembly volume of new passenger car electronic rearview mirrors hit 491,000 units, an increase of 54.8% year-on-year. From January to April 2024, the assembly volume of streaming media rearview mirrors was 159,000 units, an increase of 33.8% year-on-year.

?

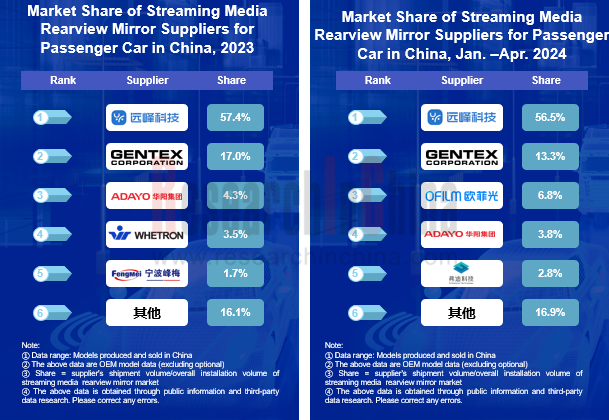

From the perspective of suppliers, Yuanfeng Technology is still in the leading position in the industry, but CR5 decreases from January to April 2024, and market competition intensifies.

From January to April 2024, compared with 2023, the TOP 5 market pattern of electronic internal rearview mirrors changed, with Yuanfeng and Gentex still ranking among the top two. OFILM replaced Huayang in the third place, and FinDreams Technology entered the top five.

Source: ResearchInChina

?

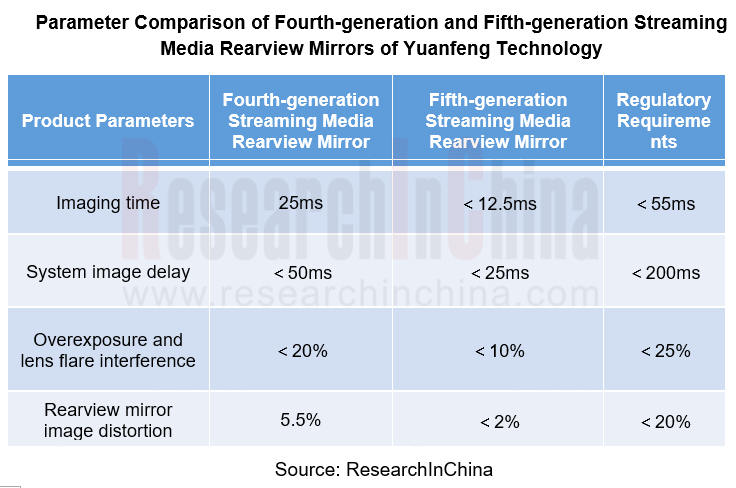

Yuanfeng Technology's fifth-generation streaming media rearview mirror products have improved in imaging time, image delay, overexposure, lens halo interference, and rearview mirror image distortion compared with the fourth-generation streaming media rearview mirror products. The specific comparison is as follows:

2. Installation of CMS is less than expected, facing growth troubles

At present, users encounter the following problems when using electronic exterior mirrors:

Screen position needs to be adapted: The position of electronic external rearview mirror screen setting is lower than that of the physical rearview mirror. Users need to adjust the habit of looking at rearview mirror, and the field of vision needs to be lowered, which takes some time to adapt;

Focusing the screen back and forth can cause eye discomfort: the electronic rearview mirror screen is closer to the eye and is an optical screen. When the user reflexively looks at the physical external rearview mirror, the angle of head and the focus position of the eye need to be readjusted.

The screen field of view is slightly narrow: the screen of electronic rearview mirror is too small, the field of view of rearview mirror is a little narrow, and the electronic rearview mirror cannot change the angle at any time and cannot change with the field of view;

It is difficult to accurately determine the distance of the rear car in electronic rearview mirror: Looking at electronic rearview mirror, the rear vehicle looks obviously far away, but when actually looking back, the vehicle is close to the side of the body, the distance is inaccurate, and the user will have uncertainty when changing lanes.

There will be a little delay in the screen, and users are also worried about blue screen, black screen, stuck and other problems;

The control authority of head unit is not enough: for example, the heating function of electronic rearview mirror of a certain model needs to be found on the secondary interface. The voice control authority of head unit is too low. When the rearview mirror fogs on highway, the user can only operate blindly.

In addition, the high price of electronic external rearview mirror itself is also an important factor affecting its development. At present, existing models have HUD with digital rearview mirror image function, which can project the blind spot image on both sides of the body on HUD, realizing low-cost function of CMS. Users do not need to pay any fees to use? "similar electronic rearview mirror" function. If CMS supplier cannot solve the above problems when using, and the CMS is not recognized by users, the electronic rearview mirror may be replaced by display terminal of this "similar electronic rearview mirror" function.

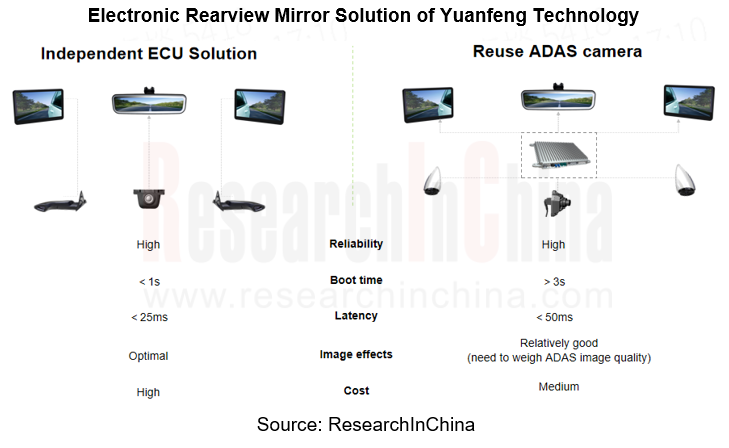

Faced with this situation, CMS suppliers need to improve user experience of CMS products and reduce CMS costs. In terms of cost reduction, Yuanfeng Technology has launched CMS products that support independent ECUs and reused ADAS architectures, which can be more easily adapted to vehicle development, and?? ADAS cameras reuse can also reduce CMS costs.

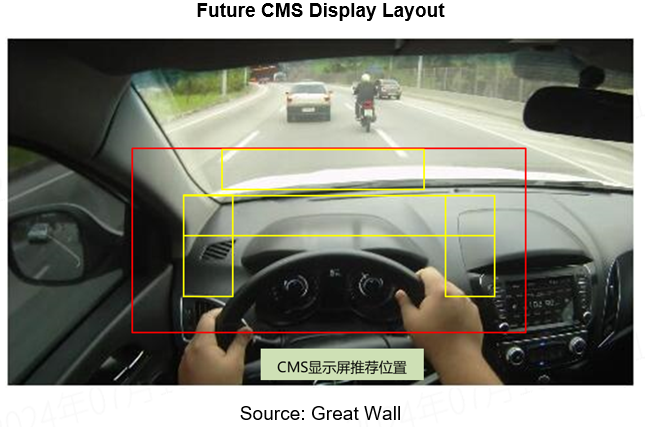

From the user experience of product, the placement of CMS display is an important part that affects user's driving experience. Common installation positions of CMS display are both sides of instrument,? both sides of joint screen,? left and right A pillars, and left and right door panels. From the perspective of product layout, the installation position of? CMS display should comprehensively consider the integration of cockpit shape and convenience of driver's observation. The best position should be to allow driver to complete the field of vision observation without turning his head as much as possible.

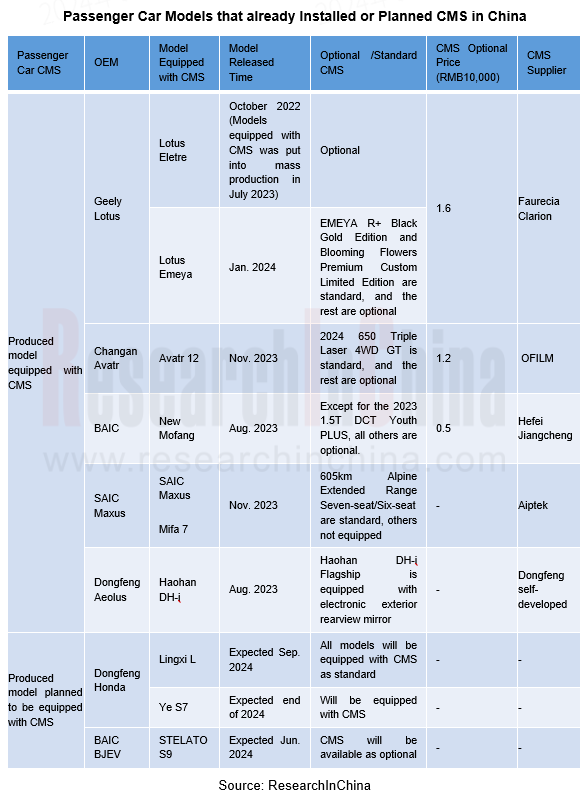

Since China began allowing CMS on the road on July 1, 2023, there have been only 6 mass-produced models equipped with CMS in passenger cars, far below market expectations. At present, some OEMs are also planning CMS models, which are expected to usher in significant growth from 2025 to 2026.

3. There will be an intermediate transition product form of electronic exterior rearview mirrors in the future

Under the situation that CMS has not yet installed in volume, the appearance of CMS intermediate transition product form may be a new trend. It is undeniable that CMS has great advantages over traditional rearview mirrors in scenarios such as rain and fog, and the impact of bad road lighting environments. But for the current users who dare not rely solely on electronic rearview mirrors, can there be a form in which CMS coexists with traditional rearview mirrors, or can traditional rearview mirrors be retained and existing products be used to achieve CMS functions? At present, Li Auto and IM have realized the form of "similar electronic exterior rearview mirror" function by using existing products.

Taking Li Auto as an example, in May 2024, Li Auto's latest OTA 5.2 added HUD digital rearview mirror imaging function. This system directly calls the surround/side view camera, projects the blind spot images on both sides of car on HUD while the driver toggles steering lever, and can issue a blind spot alarm in time through HUD blind spot image. Although there is a large gap in image display clarity compared to CMS, the low-cost function of CMS is realized.

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...

China Passenger Car HUD Industry Report, 2024

ResearchInChina released the "China Passenger Car HUD Industry Report, 2025", which sorts out the HUD installation situation, the dynamics of upstream, midstream and downstream manufacturers in the HU...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2025 – Chinese Companies

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2025 – Chinese Companies

Research on Domestic ADAS Tier 1 Suppliers: Seven Development Trends in the Era of Assisted Driving 2.0

In the ...

Automotive ADAS Camera Report, 2025

①In terms of the amount of installed data, installations of side-view cameras maintain a growth rate of over 90%From January to May 2025, ADAS cameras (statistical scope: front-view, side-view, surrou...

Body (Zone) Domain Controller and Chip Industry Research Report,2025

Body (Zone) Domain Research: ZCU Installation Exceeds 2 Million Units, Evolving Towards a "Plug-and-Play" Modular Platform

The body (zone) domain covers BCM (Body Control Module), BDC (Body Dom...

Automotive Cockpit Domain Controller Research Report, 2025

Cockpit domain controller research: three cockpit domain controller architectures for AI Three layout solutions for cockpit domain controllers for deep AI empowerment

As intelligent cockpit tran...

China Passenger Car Electronic Control Suspension Industry Research Report, 2025

Electronic control suspension research: air springs evolve from single chamber to dual chambers, CDC evolves from single valve to dual valves

ResearchInChina released "China Passenger Car Elect...

Automotive XR Industry Report, 2025

Automotive XR industry research: automotive XR application is still in its infancy, and some OEMs have already made forward-looking layout

The Automotive XR Industry Report, 2025, re...

Intelligent Driving Simulation and World Model Research Report, 2025

1. The world model brings innovation to intelligent driving simulation

In the advancement towards L3 and higher-level autonomous driving, the development of end-to-end technology has raised higher re...

Autonomous Driving Map (HD/LD/SD MAP, Online Reconstruction, Real-time Generative Map) Industry Report 2025

Research on Autonomous Driving Maps: Evolve from Recording the Past to Previewing the Future with "Real-time Generative Maps"

"Mapless NOA" has become the mainstream solution for autonomous driving s...

End-to-End Autonomous Driving Research Report, 2025

End-to-End Autonomous Driving Research: E2E Evolution towards the VLA Paradigm via Synergy of Reinforcement Learning and World Models??The essence of end-to-end autonomous driving lies in mimicking dr...

Research Report on OEMs and Tier1s’ Intelligent Cockpit Platforms (Hardware & Software) and Supply Chain Construction Strategies, 2025

Research on intelligent cockpit platforms: in the first year of mass production of L3 AI cockpits, the supply chain accelerates deployment of new products

An intelligent cockpit platform primarily r...

Automotive EMS and ECU Industry Report, 2025

Research on automotive EMS: Analysis on the incremental logic of more than 40 types of automotive ECUs and EMS market segments

In this report, we divide automotive ECUs into five major categories (in...

Automotive Intelligent Cockpit SoC Research Report, 2025

Cockpit SoC research: The localization rate exceeds 10%, and AI-oriented cockpit SoC will become the mainstream in the next 2-3 years

In the Chinese automotive intelligent cockpit SoC market, althoug...