Automotive gateway research: 10BASE-T1S and CAN-XL will bring more flexible gateway deployment solutions

ResearchInChina released "Automotive Gateway Industry Report, 2024", analyzing and researching impact of E/E architecture evolution on gateways, new gateways for passenger cars and commercial vehicles, gateway supplier analysis, gateway chip and gateway security software enterprise analysis.

1. Gateway presents different deployment strategies in the three stages of E/E architecture

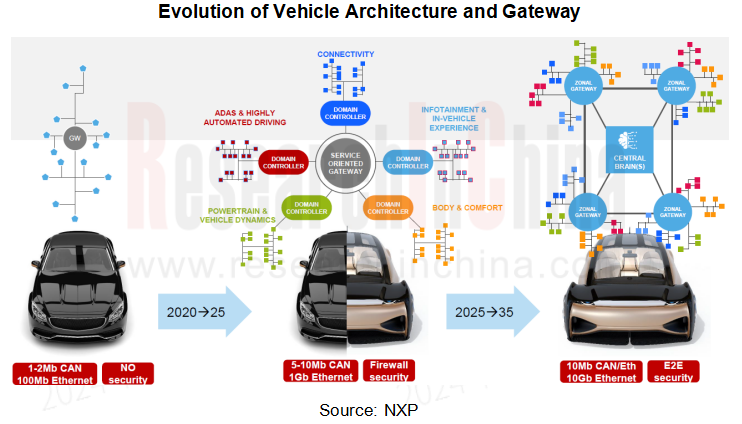

As the hub of in-vehicle network, the deployment strategy of automotive gateway changes with evolution of E/E architecture.

In a distributed architecture, there is a traditional CAN gateway in the vehicle to connect electronic Control Units (ECUs) with different functions in the vehicle.

Under the domain control architecture, the gateway has two forms. One is to use a non-integrated central gateway to securely and reliably transfer data between multiple domains such as Telematics Control Unit (T-BOX), powertrain, body, infotainment system, digital cockpit and ADAS applications. The other is to use an integrated gateway, which integrates the central gateway into a domain controller. It can be divided into several forms, including integrated in central control domain, integrated in body domain, integrated in cockpit domain, integrated in communication domain, and integrated in intelligent computing domain. At this stage, the central gateway is usually a hybrid gateway of CAN + Ethernet.

Under Zonal architecture, the on-board computing platform is at the core of the computing, and Zonal controller mainly acts as a gateway, not only as a data processing center, but also as a power distribution module. Under this architecture, the zonal controller is more divided by physical location, which can further reduce ECU in the car, simplify cable layout and reduce cable length.

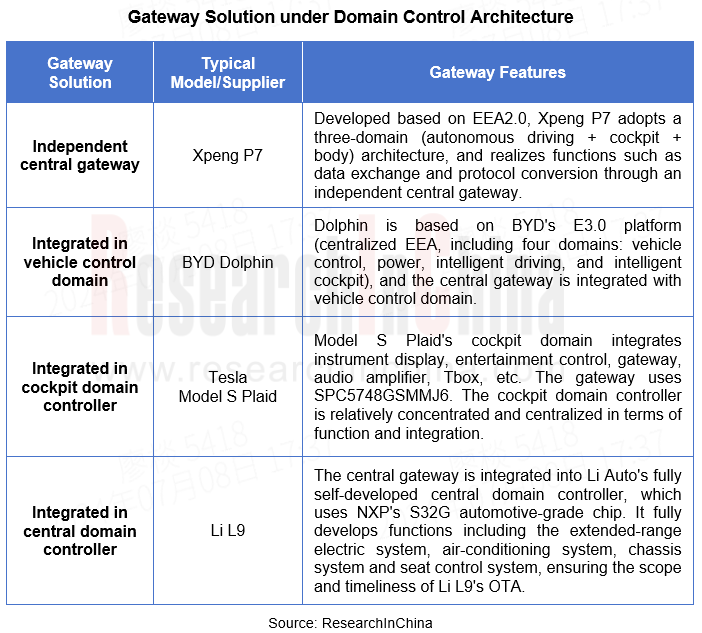

2. Deployment method of gateway under domain control architecture

In the domain control stage, there are four main deployment methods of? gateway, namely: an independent central gateway, a gateway integrated in vehicle control domain, a gateway integrated in cockpit domain, and a gateway centralized in central domain.

The independent central gateway is mainly responsible for communication between different domains, and Ethernet is used as backbone network to undertake information exchange tasks; the system interconnection within each domain still uses CAN and FlexRay communication buses. At this stage, the central gateway is usually a hybrid gateway of CAN + Ethernet.

The gateway integrated in vehicle control domain realizes integration of? central gateway with body control, chassis and even power.

The gateway integrated into cockpit domain supports wireless connection of the vehicle, provides remote interconnection functions, such as remote diagnosis, OTA updates, etc., and provides security services (intrusion detection, firewall, etc.). The intelligent gateway is one of the four key modules of the intelligent cockpit of the car.

In addition, the gateway also appears in the form of integration with the central domain control, such as Li L9.

3. Zonal gateway under Zonal architecture will be gradually mass-produced from 2024 to 2025

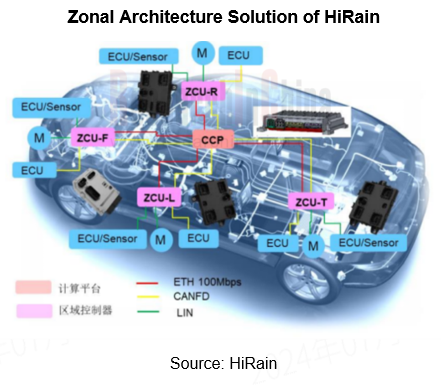

Zonal architecture consists of a central brain and several zonal controllers, among which the central brain is mainly responsible for the complex data processing and calculation of the upper layer, and several zonal controllers are mainly responsible for functions of gateways, power distribution, data collection, and load control. Under Zonal architecture, there are mainly two kinds of gateways, one is integrated in central computing platform, and the other is integrated in zonal controller.

Under the general trend of software-defined vehicles, automotive E/E architectures require more flexible, personalized, and scalable network architectures, and the need for zonal control has become increasingly prominent. In 2024, a number of Zonal architecture models have been launched or will be launched soon, such as Chery STERRA ET, Changan Qiyuan E07, Neta Shanhai 2.0 models, etc.

?

Changan Qiyuan E07 is expected to be launched in October 2024. It adopts a "central + zonal" ring network architecture, composed of C2 (central computer) + EDC (experience computer) to form a central computing platform, plus three VIU (zonal controllers). It adopts ring network communication technology. The backbone is mainly 100-megabit Ethernet, and the core controllers are equipped with Gigabit network. The three VIU are responsible for network management and power distribution and control of nearby devices, and have realized cross-domain integration of 15 controllers for power, chassis, air conditioning thermal management, and body.?

In 2025, Neta Shanhai 2.0 platform model will be mass-produced and launched, which adopts the central controller and zonal controller solutions of HiRain, among which the central computing platform integrates the central gateway, body and comfort control, new energy vehicle power control, air conditioning and thermal management, vehicle management, full data collection, OTA upgrade, SOA services and many other functions; Zonal Control Unit has zonal gateway routing function, 100MB Ethernet, CAN-FD, LIN, etc.

4 Ethernet 10BASE-T1S and CAN-XL will provide more flexible gateway deployment options

With faster transmission speeds and more stable communication connections, Ethernet is gradually becoming the backbone of in-car transmission. Xpeng G9, Voyah Zhuiguang, Lynk & Co 08, EXEED Yaoguang, IM LS7, Li L9, etc. are all equipped with Gigabit Ethernet, and GAC Aion's Xingling architecture even claims to use 10 Gigabit Ethernet data transmission.

In March 2024, BMW and ADI announced that they would be the first to adopt ADI's 10BASE-T1S E 2 B ? (Ethernet-Edge Bus) technology. Using ADI's 10BASE-T1S E 2 B technology, BMW eliminates microcontrollers and moves software from edge nodes to central processing units, thus enabling full hardware edge nodes and reducing software development and authentication tasks. That is to say, based on 10BASE-T1S E 2 B technology, traditional gateways will no longer be a required option.

?

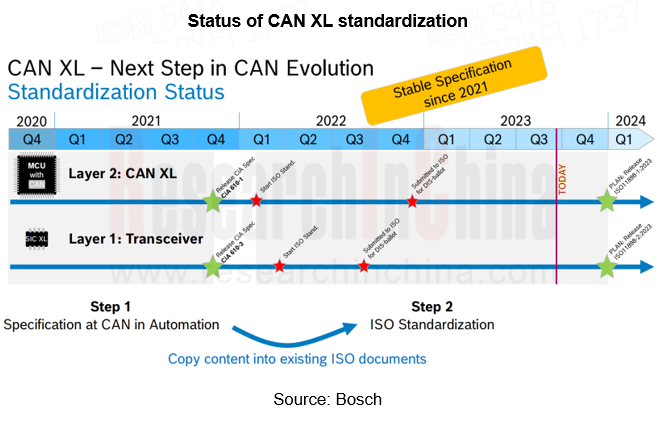

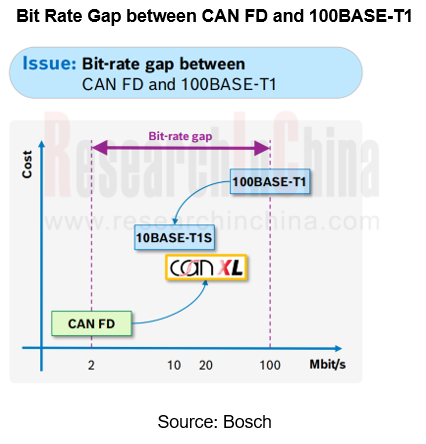

While Ethernet quickly grabbed the market, CAN family welcomed the third generation member - CAN XL, and the performance was upgraded. The main advantages of CAN XL are:

1. High speed: CAN XL communication rate up to 20 Mbit/s, payload size increased to 2048 bytes, providing greater data throughput

2. Compatibility: On the one hand, it inherits the characteristics of CAN FD; and on the other hand, it has greatly expanded its protocol, allowing TCP/IP to run on CAN XL. It is expected to achieve good compatibility with Ethernet upper-layer protocols (especially service-oriented communication methods).

3. Cost-effective: Combining CAN and Ethernet functions while maintaining the low price of CAN.

?

In terms of standardization, ISO standardization work has begun to incorporate CAN XL into ISO standards ISO 11898-1 and ISO 11898-2, and CAN XL has also obtained AUTOSAR support. In terms of productization, Bosch and Daimler trucks use CAN XL networks instead of FD networks in the car for performance verification, and Infineon, NXP, STMicroelectronics, Renesas, etc. are also deploying CAN XL.

In short, 10BASE-T1S, which sank from high-speed communication technology, and CAN XL, which was upgraded from low-rate bus upgrades, are expected to "divide the world" in the 10 Mbit/s communication range, providing a more flexible solution for the future deployment of automotive communication networks, and will also have a practical impact on gateway requirements. After all, pure Ethernet architectures do not require gateways, while CAN-XL requires gateways to achieve protocol conversion.

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...

China Passenger Car HUD Industry Report, 2024

ResearchInChina released the "China Passenger Car HUD Industry Report, 2025", which sorts out the HUD installation situation, the dynamics of upstream, midstream and downstream manufacturers in the HU...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2025 – Chinese Companies

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2025 – Chinese Companies

Research on Domestic ADAS Tier 1 Suppliers: Seven Development Trends in the Era of Assisted Driving 2.0

In the ...

Automotive ADAS Camera Report, 2025

①In terms of the amount of installed data, installations of side-view cameras maintain a growth rate of over 90%From January to May 2025, ADAS cameras (statistical scope: front-view, side-view, surrou...

Body (Zone) Domain Controller and Chip Industry Research Report,2025

Body (Zone) Domain Research: ZCU Installation Exceeds 2 Million Units, Evolving Towards a "Plug-and-Play" Modular Platform

The body (zone) domain covers BCM (Body Control Module), BDC (Body Dom...

Automotive Cockpit Domain Controller Research Report, 2025

Cockpit domain controller research: three cockpit domain controller architectures for AI Three layout solutions for cockpit domain controllers for deep AI empowerment

As intelligent cockpit tran...

China Passenger Car Electronic Control Suspension Industry Research Report, 2025

Electronic control suspension research: air springs evolve from single chamber to dual chambers, CDC evolves from single valve to dual valves

ResearchInChina released "China Passenger Car Elect...

Automotive XR Industry Report, 2025

Automotive XR industry research: automotive XR application is still in its infancy, and some OEMs have already made forward-looking layout

The Automotive XR Industry Report, 2025, re...

Intelligent Driving Simulation and World Model Research Report, 2025

1. The world model brings innovation to intelligent driving simulation

In the advancement towards L3 and higher-level autonomous driving, the development of end-to-end technology has raised higher re...

Autonomous Driving Map (HD/LD/SD MAP, Online Reconstruction, Real-time Generative Map) Industry Report 2025

Research on Autonomous Driving Maps: Evolve from Recording the Past to Previewing the Future with "Real-time Generative Maps"

"Mapless NOA" has become the mainstream solution for autonomous driving s...

End-to-End Autonomous Driving Research Report, 2025

End-to-End Autonomous Driving Research: E2E Evolution towards the VLA Paradigm via Synergy of Reinforcement Learning and World Models??The essence of end-to-end autonomous driving lies in mimicking dr...

Research Report on OEMs and Tier1s’ Intelligent Cockpit Platforms (Hardware & Software) and Supply Chain Construction Strategies, 2025

Research on intelligent cockpit platforms: in the first year of mass production of L3 AI cockpits, the supply chain accelerates deployment of new products

An intelligent cockpit platform primarily r...

Automotive EMS and ECU Industry Report, 2025

Research on automotive EMS: Analysis on the incremental logic of more than 40 types of automotive ECUs and EMS market segments

In this report, we divide automotive ECUs into five major categories (in...