ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2024 – Chinese Companies

ADAS Tier1s Research: Suppliers enter intense competition while exploring new businesses such as robotics

In China's intelligent driving market, L2 era is dominated by foreign suppliers. Entering era of L2 + and above (including L2 +, L2.5 and L2.9), domestic ADAS suppliers have begun to dominate. Therefore, compared with two years ago, the lineup of domestic ADAS Tier1 is expanding year by year. The "Chinese ADAS and Autonomous Driving Tier 1 Suppliers Report, 2021-2022" studied 7 Tier1s,? 2023 version studied 12 Tier1s, and this 2024 version expanded to 20 Tier1s.

1.Tier 1 accelerates the development of advanced intelligent driving functions, and the automotive industry enters "standard configuration era" of intelligent driving

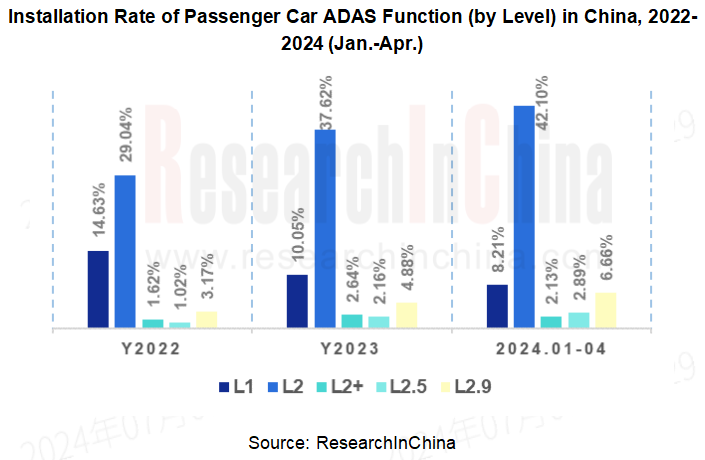

With the continuous iteration of software algorithms and reduction of hardware costs such as large computing power chips and sensors, the landing of intelligent driving has solid software and hardware support. At present, the installation volume and installation rate of domestic passenger car ADAS system functions (L1-L2.9) have been steadily improved, and L2 and L2 ++ autonomous driving are in the stage of rapid improvement in terms of penetration rate. In 2023, the installation volume of L2, L2 +, L2.5, and L2.9 increased by 37.0%, 71.9%, 124.9%, and 63.1% year-on-year compared with 2022. As of January-April 2024, the penetration rate of passenger cars equipped with L2 and above rose from 34.8% in 2022 to 53.8% in 2024 (Jan.-Apr.).

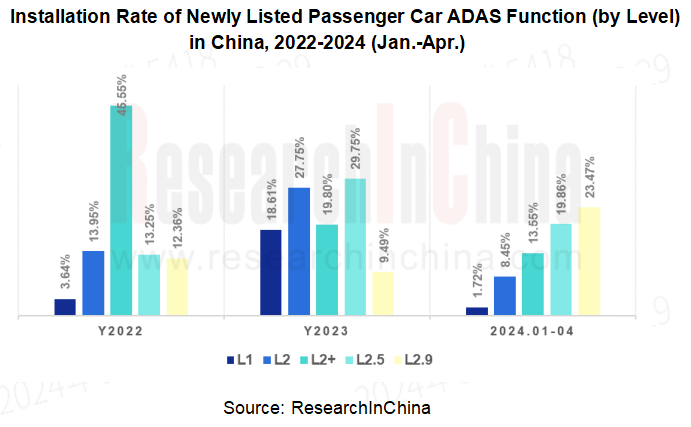

At present, the intelligent driving market is in a window period of accelerated penetration, providing huge development opportunities for major automakers to build "the most powerful intelligent driving". From the perspective of newly listed cars, the installation rate of L2 and above ADAS functions has risen sharply, of which L2.5 and L2.9 have increased significantly. In 2022, the installation rate of L2.5 functions of newly listed passenger cars in China was 13.25%. As of 2024 (Jan.-Apr.), it has increased to 19.86%. The installation rate of L2.9 functions has increased from 12.36% in 2022 to 23.4%. This is consistent with the trend of domestic automakers and Tier 1s focusing on advanced ADAS, large-scale landing of driving-parking integration and NOA solutions.

According to enterprise type, joint venture brand is the main force of L2 ADAS currently. 47.48% of joint venture models in 2023 are equipped with L2; the installation rate reached 55.05% in 2024(Jan.-Apr.). Mid-end and high-end models are important target markets for L2.9 functions. The installation rate of models priced at 250-300,000 yuan and more than 300,000 yuan is higher. Among them, the installation rate of 250-300,000 yuan price range is the highest. As of 2024(Jan.-Apr.), the installation rate of passenger cars in this price range has increased from 23.34% in 2023 to 40.89%; the installation rate of high-end models priced over 500,000 yuan has the fastest growth rate, increasing from 6.73% in 2023 to 24.39% in 2024(Jan.-Apr.).

In addition, as the intelligent driving technology route becomes clearer, many OEMs are making intensive efforts in urban NOA in terms of technical path, city scale, landing speed and cost, and the competition has entered a white-hot stage. L2.9 installation has begun to show a downward trend, and L2.9 installation rate in the price range of 200-250,000 yuan has risen from 5.15% in 2023 to 9.32%; indicating that users' recognition and acceptance of high-level autonomous driving are gradually increasing, and high-level autonomous driving also reflects the core competitiveness of many OEMs.

As ADAS level increases, the number of sensors increases and variety becomes richer. At the hardware level, the mainstream solutions are summarized as follows:

L1 ADAS solution: mainly realized through 1V or 1R, and the functions are mainly ACC/AEB, etc.

L2 ADAS solution: 1R1V and 3R1V are the mainstream, accounting for about 80%.

L2 + ADAS solution: 5R1V is the mainstream, and the proportion is increasing year by year, reaching 69.51% in 2023.

L2.5 ADAS solution: 6V1R and 1V5R are the mainstream, accounting for more than 50%. The number of cameras has been significantly improved.

L2.9 ADAS solution: Most solutions introduce LiDAR based on L2.5.

2. Domestic Tier 1s have launched cost-effective lightweight ADAS solutions targeted mass production

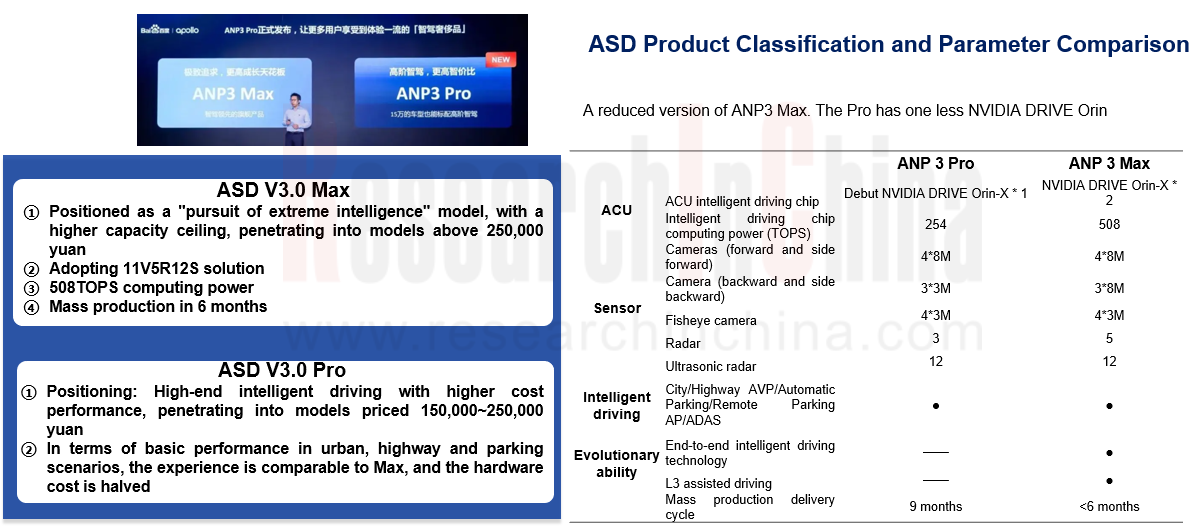

1) In April 2024, Baidu officially released ANP3 Pro, another product of pure visual urban NOA, which reduces one NVIDIA DRIVE Orin compared with the ANP3 Max version; the Max series is aimed at segmented users that "pursuit extreme intelligent driving products, and the car price is over 250,000 yuan", the Pro series is aimed at "150-250,000 yuan "market segment, with more cost-effective high-end intelligent driving (" reduced configuration version ") solution.

Source: Baidu

2) In April 2024, Momenta announced that it will launch a variety of scalable automotive intelligent driving solutions in conjunction with Qualcomm. By leveraging Momenta's "one flywheel" core technology and Snapdragon Ride's SA8620P and SA8650P platforms, a complete set of functions can be reused. Adopting flexible sensor configuration solutions brings users more cost-effective solutions and a wider range of smart driving applications.

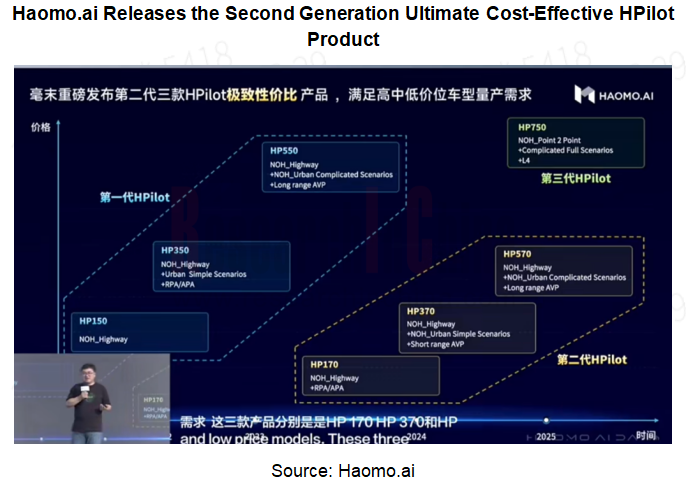

3) Zhang Kai, chairperson of Haomo.ai, believes that China's intelligent assisted driving is in a big market explosion, and the more cost-effective driving-parking integrated domain control solution will become the mainstream. In October 2023, Haomo.ai launched the "three ultimate cost-effective" intelligent assisted driving product HPilot 2.0, seizing the smart driving market.

4) In 2024, PhiGent Robotics launched the ultimate cost-effective "PhiGo Pro" (for 100-200,000 yuan market segments) and "PhiGo Pro Plus" (for 200-300,000 market segments) smart driving solutions, and controlled the cost within 4,000 yuan and 5,500 yuan respectively.

3. Tier 1 Reform: Subverting the traditional supply chain and reshaping the new ecosystem of intelligent connected vehicles

With the acceleration of? automotive intelligent connection wave, the automotive industry chain, technology chain, and value chain are accelerating deconstruction and reshaping. In terms of industrial chain, the original industrial boundaries are expanding, and more specialized new industrial entities are emerging. At the same time, the vertical chain industrial structure is shifting to a horizontal mesh structure, and new local industrial chains will be derived. The role positioning and development model of OEMs and Tier1 will undergo major changes. First, the automotive industry will further evolve into a multi-party ecosystem, with participants including OEMs, Internet companies, ICT companies, artificial intelligence companies, cloud computing service providers, big data companies, Tier2/Tier1/Tier0.5 suppliers, and governments. This multi-party model will promote the collaborative development and innovation of the entire industrial chain.

Secondly, the past vertical supply model will be broken, and the automotive supply chain will begin to develop into a mesh. In the past, automotive OEMs mainly defined functional architectures and participated in system integration work, and supply chain implemented the vertical supply model of Tier3 → Tier2 → Tier1. OEMs mainly cooperated directly with Tier1 suppliers. Under the trend of the overall change of "software-defined vehicles", in order to achieve more functional differentiation features, improve development efficiency, and realize code reuse, OEMs will also participate in the development of applications, and the automotive supply chain will begin to develop into a mesh.

At present, some automakers purchase software and hardware separately, and the procurement method has become very flexible. A set of integrated driving-parking system can be divided into sensors, controllers, system integration, application software development and other components. For the necessary and capable parts, automakers will choose to develop their own, while other parts will be purchased through suppliers.

At present, Tier1 is mainly provided to OEMs through gray-box or white-box mode.

White-box mode: Tier1 is responsible for hardware production, middle layer and chip solution integration, OEM is responsible for software part of? application layer of autonomous driving, or Tier1 is only responsible for hardware production, OEM or its designated software supplier is responsible for the system architecture and application layer development of domain controllers. Typical cases: Desay SV + NVIDIA + Xiaopeng/Li Auto/IM, Zeekr + Mobileye + iMotion, etc.

Gray-box mode: OEMs put forward customized requirements, and Tier1 provides R & D services, which are finally presented in the form of independent R&D by OEMs. At the same time, OEMs may also develop their own domain controller system architecture and autonomous driving application layer algorithm software development. The final product logo is designated by OEM.

Black box mode: Tier1 cooperates with chipmakers to achieve solution integration, develop a central domain controller, and sell it to OEMs.

4. Suppliers enter intense competition, and ADAS Tier1s explores new businesses such as robots

In the past year, ADAS market has entered a stage of intense competition, and most suppliers are facing losses. At present, only the top Tier 1 can achieve profitability. Second-tier Tier 1 is striving to expand market share and achieve profitability in the next few years by expanding mass production.

In addition to competing for more ADAS production orders, many Tier1s are also entering the fields of AI robots, flying cars, and more.

In early 2024, Zongmu Technology announced that its new subsidiary Cancong Robot officially launched a new product - FlashBot Lightning Treasure. According to reports, this product is not only an energy robot, but also can be used as a "mobile power bank" for new energy vehicles. Equipped with L4 intelligent driving capability and 104KWh capacity, it can provide intelligent charging services for new energy vehicles in parks, parking lots and other scenarios.

In April 2024, iMotion Technology announced that the company had become the autonomous driving solution provider of "a well-known domestic flying car company" and would provide it with an integrated software and hardware autonomous driving solution with the core of autonomous driving domain controller iDC High.

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...

China Passenger Car HUD Industry Report, 2024

ResearchInChina released the "China Passenger Car HUD Industry Report, 2025", which sorts out the HUD installation situation, the dynamics of upstream, midstream and downstream manufacturers in the HU...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2025 – Chinese Companies

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2025 – Chinese Companies

Research on Domestic ADAS Tier 1 Suppliers: Seven Development Trends in the Era of Assisted Driving 2.0

In the ...

Automotive ADAS Camera Report, 2025

①In terms of the amount of installed data, installations of side-view cameras maintain a growth rate of over 90%From January to May 2025, ADAS cameras (statistical scope: front-view, side-view, surrou...

Body (Zone) Domain Controller and Chip Industry Research Report,2025

Body (Zone) Domain Research: ZCU Installation Exceeds 2 Million Units, Evolving Towards a "Plug-and-Play" Modular Platform

The body (zone) domain covers BCM (Body Control Module), BDC (Body Dom...

Automotive Cockpit Domain Controller Research Report, 2025

Cockpit domain controller research: three cockpit domain controller architectures for AI Three layout solutions for cockpit domain controllers for deep AI empowerment

As intelligent cockpit tran...

China Passenger Car Electronic Control Suspension Industry Research Report, 2025

Electronic control suspension research: air springs evolve from single chamber to dual chambers, CDC evolves from single valve to dual valves

ResearchInChina released "China Passenger Car Elect...

Automotive XR Industry Report, 2025

Automotive XR industry research: automotive XR application is still in its infancy, and some OEMs have already made forward-looking layout

The Automotive XR Industry Report, 2025, re...

Intelligent Driving Simulation and World Model Research Report, 2025

1. The world model brings innovation to intelligent driving simulation

In the advancement towards L3 and higher-level autonomous driving, the development of end-to-end technology has raised higher re...

Autonomous Driving Map (HD/LD/SD MAP, Online Reconstruction, Real-time Generative Map) Industry Report 2025

Research on Autonomous Driving Maps: Evolve from Recording the Past to Previewing the Future with "Real-time Generative Maps"

"Mapless NOA" has become the mainstream solution for autonomous driving s...

End-to-End Autonomous Driving Research Report, 2025

End-to-End Autonomous Driving Research: E2E Evolution towards the VLA Paradigm via Synergy of Reinforcement Learning and World Models??The essence of end-to-end autonomous driving lies in mimicking dr...

Research Report on OEMs and Tier1s’ Intelligent Cockpit Platforms (Hardware & Software) and Supply Chain Construction Strategies, 2025

Research on intelligent cockpit platforms: in the first year of mass production of L3 AI cockpits, the supply chain accelerates deployment of new products

An intelligent cockpit platform primarily r...

Automotive EMS and ECU Industry Report, 2025

Research on automotive EMS: Analysis on the incremental logic of more than 40 types of automotive ECUs and EMS market segments

In this report, we divide automotive ECUs into five major categories (in...