Global and China Automotive Wireless Communication Module Market Report, 2024

Communication module and 5G research: 5G module installation rate reaches new high, 5G-A promotes vehicle application acceleration

5G automotive communication market has exploded, and 5G FWA is evolving towards 5G-A

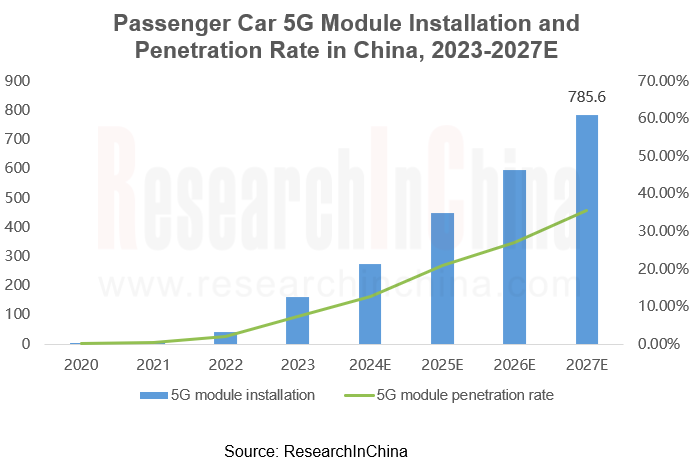

In 2023, 5G vehicle module installation ushered in a surge. According to statistics, China passenger car 5G module installation hits 1.633 million units in 2023, the installation rate is about 7.5%, and it is expected that the installation in 2027 will rise to 7.856 million with installation rate of 35.6%.

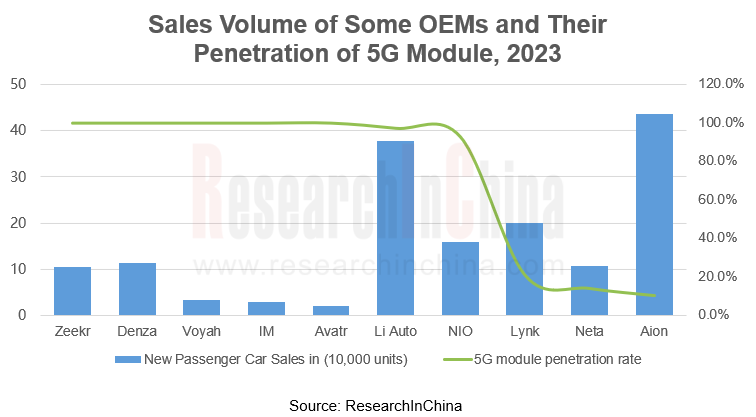

From the perspective of major models, the 5G installation rate of new energy models of emerging OEMs? is higher, such as Zeekr, Denza, Avatr, Voyah, IM, Li Auto and NIO, which have all achieved standard configuration of 5G module.

Factors driving 5G installation for OEMs

5G infrastructure is gradually improving: According to MIIT statistics, as of February 2024, the total number of 5G base stations in China reached 3.509 million, accounting for 29.8% of the total number of mobile base stations. And China is the country with the largest number of 5G base stations in the world, accounting for more than 65%;

5G policy standards are gradually improved: In August 2023, Shanghai Mobile and China Academy of Information and Communications Technology took the lead in organizing more than 20 standard drafting units to participate in preparation of "5G Network Planning, Construction and Acceptance Requirements for Supporting High-level Autonomous Driving" and "5G Network Performance Requirements for Supporting High-level Autonomous Driving" and other two group standards were officially released and implemented, filling the gap of corresponding standards at home and abroad; in December 2023, Huawei and China Mobile, Unicom, Quectel, Fuzhou Internet of Things Open Laboratory, Fudan University School of Microelectronics, etc. jointly developed and released 5G automotive-grade module Uu port communication certification standard 1.0;

5G is more suitable for development of autonomous driving: The development of autonomous driving requires high speed and low latency, which is difficult to meet with 4G modules. The three major characteristics of 5G network are fast transmission speed, low latency, and D2D device transmission technology, which realizes ultra-low latency of 1 ms, high peak rate of 20 Gbps, and extremely high density of up to 1,000,000 vehicles and devices, making it ideal for the development of autonomous driving.

5G is evolving towards 5G-A: 2024 is the first year of 5G-A. The new capabilities brought by 5G-A can effectively meet applications such as in-vehicle software OTA, in-car large-screen entertainment and smart driving training, and 5G-A can be combined with AI to better meet the network needs of AI era. At present, Beijing, Shanghai, Hangzhou and other places have landed 5G-A-based telematics demonstration lines.

In March 2024, Shanghai Mobile and Huawei completed the construction of the first smart parking underground parking network in Shanghai Pudong, providing 5G-A network coverage for more than 70,000 square meters of underground space. The 5G-A parking lot can provide an uplink capacity of over 500Mbps, claiming to be able to meet parking and driving functions of hundreds of cars at the same time; the 5G-A network can also achieve a downlink super gigabit rate, and the vehicle OTA version upgrade can be completed in as little as 30 seconds.

In comparison, the traditional 4G FWA average rate is about 20Mbps, and the 5G FWA average rate is about 100Mbps. 5G-A network will bring a better user experience and promote the acceleration of 5G modules.

In satellite broadband technology, MediaTek showcased a new generation of 5G-Advanced satellite test chips at MWC2024, which can provide more than 100Mbps of data throughput for automobiles and a variety of other termnal devices.

5G-Advanced (5G-A) standards are frozen, and the tide of commercialization is launched

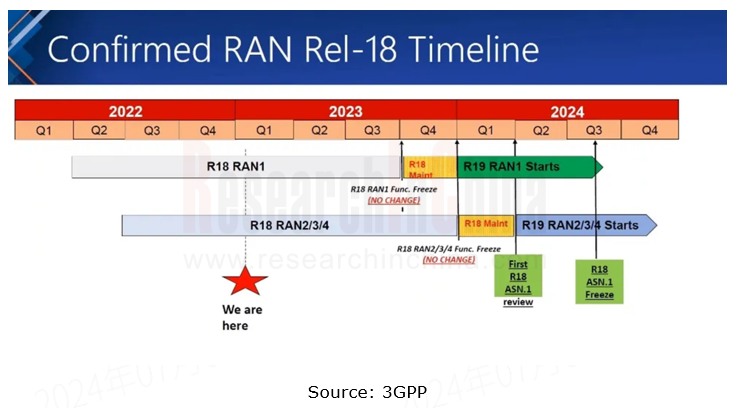

R18 is the first 5G-A version. In February 2024, Huawei promoted 3GPP R18 standard base station energy-saving core part to reach an agreement and freeze at the 102nd meeting of RAN. The freezing of this part marks the concept of "0 Bit 0 Watt" and "Double Excellence of Experience and Energy Saving" advocated by Huawei, was officially accepted by 3GPP International Standards Organization. On June 18, 2024, 3GPP Release 18 was officially frozen, meeting the conditions for commercialization.

The milestone of 6G standardization process has arrived

In December 2023, 3GPP held RAN #102 meeting and identified the first batch of 16 RAN projects in the Rel-19 field, marking a new stage in the development of 5G-Advanced international standards. Looking to the future, 3GPP's 6G work began in 2024 during Release 19, which marked the official start of work related to "requirements" (i.e. 6G SA1 business requirements). This is an important milestone in the 6G standardization process and lays the foundation for subsequent work.

In addition, 3GPP expects the first 6G specification to be completed in Release 21 by the end of 2028. This means that in about four years, 3GPP will complete the core specification of 6G, paving the way for commercialization of 6G technology.

5G module development platform: Qualcomm dominates, and domestic platforms such as ZTE, Huawei, and MediaTek are developing rapidly

Mainstream 5G module development platforms include ZTE, Huawei, Qualcomm, MediaTek, etc. Module supplierrs such as Quectel, Fibocom, MeiG Smart Technology, ZTE Communication, Huawei, and LG provide 5G module products for OEMs based on the development platform.

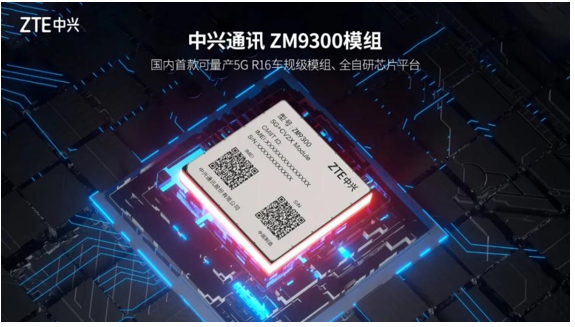

ZTE 5G Development Platform

5G module ZM9300: Using 3GPP Rel-16 technology, based on self-developed car-grade 5G Modem chip platform, supports optional configuration R16 NR & LTE-V2X PC5 direct communication; built-in computing power exceeds 18K + DMIPS CPU, which can support C-V2X ITS protocol stack and applications, without external AP processor. The ZM9300 module will be mass-produced and loaded on GAC in 2024.

4G module ZM8201V: equipped with a self-developed 4G communication chip platform. It has been first mass-produced and delivered in SAIC MAXUS Xintu V80, and subsequent SAIC passenger cars will also be equipped with this module product one after another. At the same time,? ZM8201V has passed AEC Q100 vehicle certification, supports overseas eCa11, and has passed network access certification test of operators in more than 70 countries around the world.

MediaTek 5G Development Platform

MediaTek MTK2735: In China, products such as Fibocom AN758 and Mobiletek?Communication T800 are equipped with MediaTek MTK2735. Mobiletek?Communication T800 is the first MTK 5G module in China to obtain European Union ecall certification and Huawei compatibility test certification. As early as 2022, MediaTek's automotive 5G modems have entered the supply chain of Japanese and European OEMs.

MediaTek Dimensity Auto 5G smart cockpit platform: includes four SoC products, CX-1, CY-1, CM-1 and CV-1, using 3nm/4nm advanced manufacturing process. The communication technologies supported by Dimensity Auto include: 5G Sub-6GHz carrier aggregation technology, Wi-Fi 7, GNSS, 5G NTN two-way satellite communication capability, V2X vehicle connection communication, etc.

Qualcomm 5G Development Platform

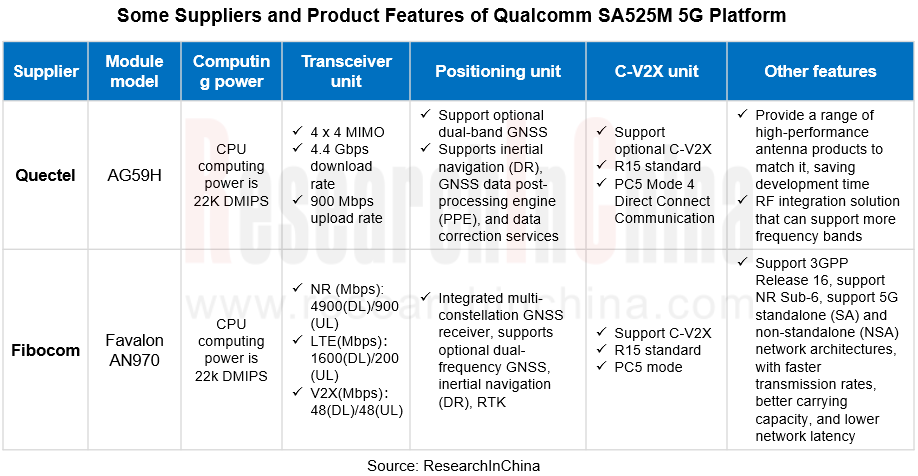

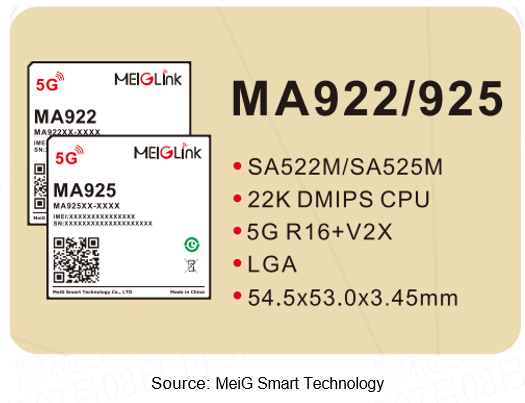

Qualcomm's 5G platform has evolved to the latest generation of SA525M/SM522M platforms, and for the latest generation of 5G platforms launched by Qualcomm, module suppliers such as Quectel, Fibocom, and MeiG Smart Technology have also made arrangements.?

Quectel AG59 series: including AG59xH series based on Qualcomm SA525M platform and AG59xE series based on Qualcomm SA522M platform. At the same time, Quectel also provides a series of high-performance antenna products to match the modules of this series, which can shorten R & D cycle of customer products. Quectel's modules have been mass-produced in nearly 20 mainstream OEMs such as SAIC, Great Wall, FAW Hongqi, NIO, and Li Auto.

Fibocom AN970T: AN970 series based on Qualcomm SA525M and AN960 series based on SA522M, two series of modules P2P, support customers to switch quickly.

Among them, the AN970 series module has a CPU computing power of up to 22k DMIPS, integrates multi-constellation GNSS receivers, supports optional dual-frequency GNSS, inertial navigation (DR), RTK, C-V2X units, 3GPP Release 16, NR Sub-6, 5G independent networking (SA) and non-independent networking (NSA) architectures, with faster transmission rates, better carrying capacity, and lower network latency.

Innovative in-vehicle communication module products emerge in an endless stream, bringing a diverse experience

1) Intelligent modules: communication modules are moving towards a high degree of integration with cockpit

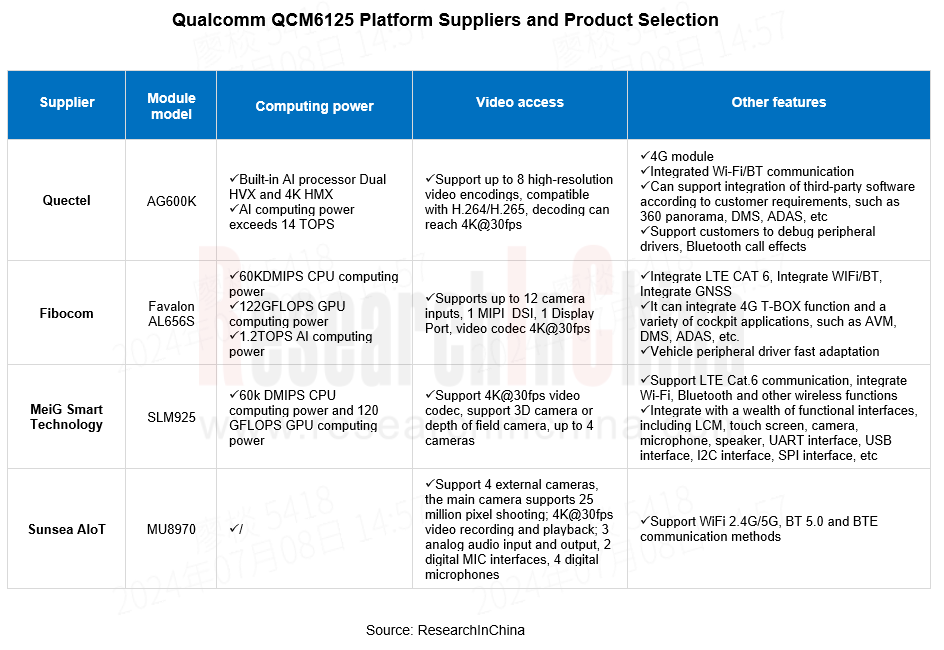

In the development environment of automotive domain control architecture, automotive wireless communication solutions have entered a stage of cost-effectiveness improvement, driving vehicle modules to evolve towards integrated intelligent modules. Compared with traditional communication modules, intelligent modules will further integrate operating systems, CPUs/GPUs, etc.

The current intelligent modules on the market are mainly developed based on Qualcomm platform. The newly released MediaTek Dimensity Auto 5G smart cockpit platform has received great attention from the market and will help MediaTek achieve high-end market breakthroughs.

MeiG Smart Technology: Intelligent module SLM925 supports LTE Cat.6 communication, integrates Wi-Fi, Bluetooth, GNSS and other wireless functions, supports Android 10 operating system, supports 4K@30fps video codec, supports 3D camera or depth of field photography, supports dual-screen display, can support 8-way camera, supports 8-channel TDM, meets the requirements of vehicle temperature and width, and has obtained designation from a number of OEMs.

2) NearFlash module

NearFlash technology, as a new generation of wireless short-range communication technology, is applied in smart cars including digital car keys, head unit projection, intelligent terminal display, and wireless audio & video application solutions around the smart cockpit.

At present, based on NearFlash technology, Huawei, PATEO, Lilda, etc. have launched vehicle products.

PATEO: In April 2024, the demo product showing NearFlash smart key has characteristics of sensing the owner within 80 meters, automatically opening the lights and reflectors in 9-meter welcome area, and unlocking the vehicle within 3 meters.

3)WIFI7 Module

As the WiFi 7 standard continues to improve, chip vendors and module suppliers have deployed WiFi 7 technology, and the world's first automotive Wi-Fi 7 solution was launched by Qualcomm in early 2024, namely Qualcomm QCA6797AQ.

Qualcomm QCA6797AQ supports 320MHz channel bandwidth, 4K QAM technology enables peak throughput up to 5.8Gbps, and also introduces innovative technologies such as high-frequency concurrency and multi-link multi-radio frequency.

Global and China Automotive Wireless Communication Module Market Report, 2024 includes following contents:

Research on development policies, industry standards, market size, competition landscape, etc. of automotive wireless communication module industry;

Research on development policies, industry standards, market size, competition landscape, etc. of automotive wireless communication module industry;

Application of automotive 5G modules, including 5G platform selection, 5G loading applications, 5G standard vehicles, 5G technology trends, etc.

Application of automotive 5G modules, including 5G platform selection, 5G loading applications, 5G standard vehicles, 5G technology trends, etc.

The application prospect of automotive intelligent modules, including research on development platform selection, production process, development status and trends, etc.

The application prospect of automotive intelligent modules, including research on development platform selection, production process, development status and trends, etc.

Research on the latest developments and manufacturer layouts of innovative modules, such as NearFlash modules, WiFi 7 modules, C-V2X modules, etc.;

Research on the latest developments and manufacturer layouts of innovative modules, such as NearFlash modules, WiFi 7 modules, C-V2X modules, etc.;

Research on the product lines of major suppliers of automotive communication chips and communication modules, technology trends, and vehicle loading and mass production trends.

Research on the product lines of major suppliers of automotive communication chips and communication modules, technology trends, and vehicle loading and mass production trends.

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...

China Passenger Car HUD Industry Report, 2024

ResearchInChina released the "China Passenger Car HUD Industry Report, 2025", which sorts out the HUD installation situation, the dynamics of upstream, midstream and downstream manufacturers in the HU...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2025 – Chinese Companies

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2025 – Chinese Companies

Research on Domestic ADAS Tier 1 Suppliers: Seven Development Trends in the Era of Assisted Driving 2.0

In the ...

Automotive ADAS Camera Report, 2025

①In terms of the amount of installed data, installations of side-view cameras maintain a growth rate of over 90%From January to May 2025, ADAS cameras (statistical scope: front-view, side-view, surrou...

Body (Zone) Domain Controller and Chip Industry Research Report,2025

Body (Zone) Domain Research: ZCU Installation Exceeds 2 Million Units, Evolving Towards a "Plug-and-Play" Modular Platform

The body (zone) domain covers BCM (Body Control Module), BDC (Body Dom...

Automotive Cockpit Domain Controller Research Report, 2025

Cockpit domain controller research: three cockpit domain controller architectures for AI Three layout solutions for cockpit domain controllers for deep AI empowerment

As intelligent cockpit tran...

China Passenger Car Electronic Control Suspension Industry Research Report, 2025

Electronic control suspension research: air springs evolve from single chamber to dual chambers, CDC evolves from single valve to dual valves

ResearchInChina released "China Passenger Car Elect...

Automotive XR Industry Report, 2025

Automotive XR industry research: automotive XR application is still in its infancy, and some OEMs have already made forward-looking layout

The Automotive XR Industry Report, 2025, re...

Intelligent Driving Simulation and World Model Research Report, 2025

1. The world model brings innovation to intelligent driving simulation

In the advancement towards L3 and higher-level autonomous driving, the development of end-to-end technology has raised higher re...

Autonomous Driving Map (HD/LD/SD MAP, Online Reconstruction, Real-time Generative Map) Industry Report 2025

Research on Autonomous Driving Maps: Evolve from Recording the Past to Previewing the Future with "Real-time Generative Maps"

"Mapless NOA" has become the mainstream solution for autonomous driving s...

End-to-End Autonomous Driving Research Report, 2025

End-to-End Autonomous Driving Research: E2E Evolution towards the VLA Paradigm via Synergy of Reinforcement Learning and World Models??The essence of end-to-end autonomous driving lies in mimicking dr...

Research Report on OEMs and Tier1s’ Intelligent Cockpit Platforms (Hardware & Software) and Supply Chain Construction Strategies, 2025

Research on intelligent cockpit platforms: in the first year of mass production of L3 AI cockpits, the supply chain accelerates deployment of new products

An intelligent cockpit platform primarily r...

Automotive EMS and ECU Industry Report, 2025

Research on automotive EMS: Analysis on the incremental logic of more than 40 types of automotive ECUs and EMS market segments

In this report, we divide automotive ECUs into five major categories (in...