Analysis on Xiaomi Auto's Electrification, Connectivity, Intelligence and Sharing, 2024

Research on Xiaomi Auto: Xiaomi Auto's strengths and weaknesses

Since the release of SU7, Xiaomi delivered 7,058 units and 8,630 units in April and May, respectively, and more than 10,000 units in both June and July. Xiaomi officially expects to fulfill 110,000 orders in November, which means it needs to achieve the average monthly delivery of 16,000 units in the next four months from August to November.

Xiaomi Auto’s first car was a success thanks to its advantages in many aspects, but there are also some shortcomings in its development.

Strength 1: Sufficient funds, ten times more investment to polish hot-selling products

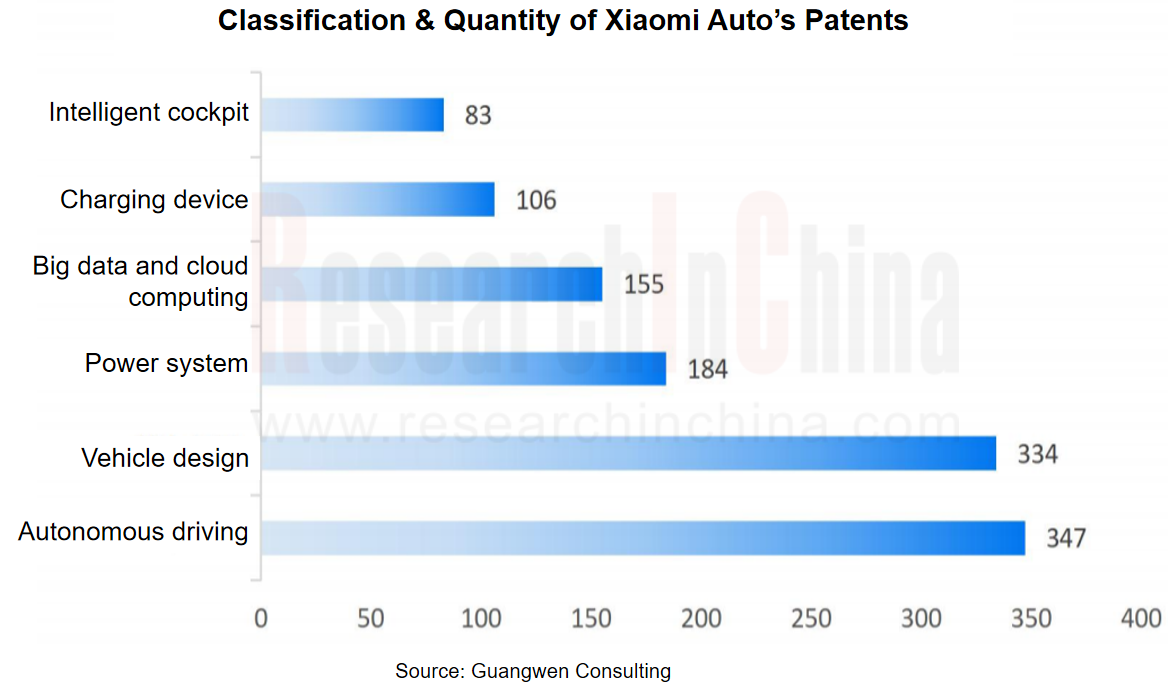

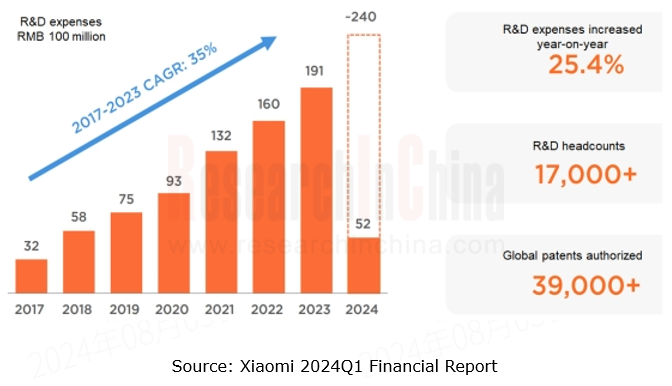

Compared with other emerging auto brands that need to keep raising funds, Xiaomi Group itself is a listed company with about RMB100 billion in cash. Traditional OEMs generally input 300 to 400 people and RMB1-2 billion in R&D funds to develop a vehicle. Xiaomi put 3,400 engineers and a total R&D funds of RMB10 billion to develop its first car, of which the investment in the key technology intelligent driving was as high as RMB4.7 billion, with the dedicated team size exceeding 1,000 people. By H1 2024, Xiaomi Auto has published about 1,200 Chinese patents/patent fillings, most of which are autonomous driving and vehicle design patents.

Strength 2: High brand awareness and a huge fan base

Xiaomi has built a fan base by marketing means such as community marketing. As of Q4 2023, the global monthly active users of MIUI have numbered 641 million. Lei Jun's personal Weibo has 24 million fans, far more than other emerging auto brand leaders. Traditional OEM bosses lack influence on Internet.

Xiaomi Group's new retail system enables vehicle sales services. Xiaomi has created a new online and offline integrated retail model. Major online channels are Xiaomi Mall, Xiaomi Youpin (e-commerce platform), Xiaomi Tmall Flagship Store, Xiaomi JD Flagship Store, and offline channels are mainly Xiaomi Home (including direct-sale and franchised) in the core business districts of cities, authorized experience stores/special areas in suburbs and towns, and service outlets. As of April 2024, Xiaomi Group has boasted a total of 12,060 offline stores, including 5,993 Xiaomi Home stores/franchised stores/exclusive stores + 281 Xiaomi Home direct-sale stores + 1,595 service outlets + 4,472 authorized experience stores/special areas.

By the end of July 2024, Xiaomi Auto has opened across China: 30 delivery centers, 102 sales stores, and 58 service outlets.

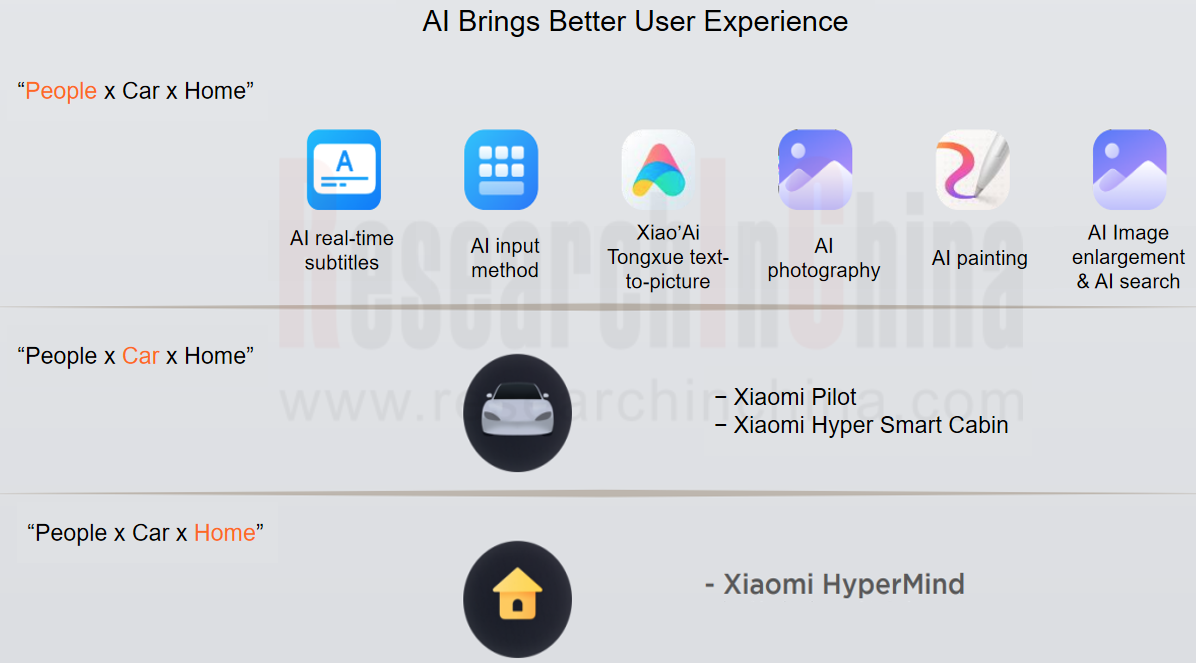

Strength 3: The people-car-home ecosystem brings convenience to Xiaomi Auto users through integration of information and intelligent applications

In 2022, Xiaomi decided to unify the OS of various devices, involving the software architecture of MIUI, Vela, Mina, and IVI OS. In October 2023, Xiaomi announced HyperOS, a system which is based on the fusion of Android in deep evolution and the self-developed Vela system, rewrites the underlying architecture, and enables dynamic real-time networking of all devices, bringing a new terminal interconnection experience.

Strength 4: Excellent marketing and pre-sale activities

Xiaomi is good at using social media and online and offline channels for all-round marketing and promotion. The Xiaomi Auto Launch in December last year and the Xiaomi SU7 Launch in March this year were particularly eye-catching. In these two launches, Xiaomi Auto easily dominated the top trending searches on major social media platforms. According to the statistical report of Zhiwei Data, on the Launch day in December, Xiaomi Auto had more than 350,000 posts and more than 200 hot searches/hashtags on the entire Internet. This launch event had an influence index of up to 80.6, higher than 97% of events and higher than 98% of corporate events. It was really the king of traffic, and even the king of Weibo, Li Auto, could not catch up with it.

Through well-planned launch and online live broadcast, it attracted a mass of viewers. Meanwhile, Xiaomi introduced limited-time offers such as generous gifts for first-day car purchase and exclusive rights for limited-time car ordering, which stimulated consumers' enthusiasm for ordering.

Strength 5: Supply chain integration and manufacturing capabilities

Although Xiaomi is a fresh entrant in the automobile manufacturing industry, it has been able to quickly build a high-quality automobile production system relying on its strong supply chain management and resource integration capabilities, ensuring the timely delivery and stable production supply, thus eliminating consumers' concerns about insufficient supply in the early stages of new product launch.

Despite multiple advantages, Xiaomi Auto also has some obvious shortcomings:

Shortcoming 1: Insufficient manufacturing experience

Xiaomi has always adopted an asset-light business model, and often relies on external partners in product manufacturing. Yet the manufacturing process of automobiles is far more complicated than consumer electronics, which is a big challenge to Xiaomi. Since its birth, Xiaomi has entrusted mobile phone production to ODMs. Xiaomi is responsible for design and sales, while ODMs take charge of production.??????

Among emerging carmakers, Li Auto, Xpeng Motors and NIO all chose the OEM/ODM mode to enter the market at the beginning. Under the premise that mobile phones are all produced by ODMs/OEMs, it is undoubtedly a huge challenge for Xiaomi to directly skip to building its own car factory and manufacturing cars.

Shortcoming 2: The threshold for core automotive technology is high, and Xiaomi’s automotive R&D expertise is insufficient.

Although Xiaomi has gathered rich experience in intelligent hardware and electronics, automobile manufacturing is a complex system engineering that requires higher technical thresholds and longer technology accumulation. Xiaomi's technical expertise in battery management, vehicle systems, power batteries, and autonomous driving development is relatively insufficient.

Compared with Huawei, Li Auto, NIO, and Tesla, Xiaomi makes underinvestment in EE architecture, automotive basic software, and charging/swapping facilities. Compared with traditional OEMs such as Geely, BYD, and Changan, Xiaomi has insufficient expertise in batteries, hybrids, chassis, and production & manufacturing.

Shortcoming 3: BEV market growth slows down, and need to start from scratch in extended-range models.

Sales data from 2023 to 2024 show that the BEV market has reached a growth bottleneck, and hybrid electric vehicles (especially the extended-range) grew much faster. Xiaomi plans to launch an extended-range SUV in 2026. It has started R&D of extended-range vehicles. After all, it needs to start from scratch and lags behind Li Auto and Huawei for several years. It is not easy to catch up with the two tough rivals.

Shortcoming 4: There are many faults in new cars. Xiaomi still needs to polish software and manufacturing and improve after-sales services.

According to feedback from some we-media (like Leyuan Wangchuang), Xiaomi Auto mainly has following problems since car release:

1. Battery: Many users said that the cruising mileage of cars is quite different from the officially announced, and even some cars had battery failures, thus failing to start normally.

2. Software failures: Problems such as vehicle system halt, inaccurate navigation system, and slow response of voice control affect user experience.

3. Manufacturing quality: Some car owners reported that there are defects in the vehicle assembly process, such as uneven door gaps, loose interior trims, and abnormal body noise.

4. After-sales services: Faced with frequent quality problems, Xiaomi Auto seems to be overstretched in after-sales services, for example, long time to wait for repair and insufficient supply of accessories.

Xiaomi Auto's long-term goal is to "become one of the top five global automakers with 15-20 years of efforts and create a mobile smart space that looks good and is easy to drive, comfortable and safe." Relying on the strengths of Xiaomi Group, Xiaomi Auto has made an initial success in SU7. However, to achieve its long-term goal, Xiaomi Auto still has many problems to overcome.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...