Research on automotive smart exteriors: in the trend towards electrification and intelligence, which exteriors will be replaced by intelligence

The Automotive Smart Exteriors Research Report, 2024 released by ResearchInChina analyzes and studies the installation, market size, content-per-car value, competitive pattern, suppliers’ strategy, OEMs’ strategy, and development trends of various automotive smart exteriors.

The research covers the following:

Digital grille: digital grille (application scenarios and development history); active grille shutter (installations and installation rate, distribution by price range, and competitive pattern); luminous interactive grille (installations and installation rate, market size, supplier pattern, etc.).

Digital grille: digital grille (application scenarios and development history); active grille shutter (installations and installation rate, distribution by price range, and competitive pattern); luminous interactive grille (installations and installation rate, market size, supplier pattern, etc.).

Smart charging gate: features, installation, vehicle model cases, suppliers, development trends, etc.

Smart charging gate: features, installation, vehicle model cases, suppliers, development trends, etc.

Hidden door handle: categories, system costs, installation, market size, vehicle model cases, suppliers and competitive pattern, development trends, etc.

Hidden door handle: categories, system costs, installation, market size, vehicle model cases, suppliers and competitive pattern, development trends, etc.

Intelligent headlight: development history, main technology routes, installations, penetration rate, vehicle model cases, suppliers, etc.

Intelligent headlight: development history, main technology routes, installations, penetration rate, vehicle model cases, suppliers, etc.

Body ambient lighting: various body ambient lights, luminous LOGO, application scenarios of projector lamp, installation rate, application cases, etc.

Body ambient lighting: various body ambient lights, luminous LOGO, application scenarios of projector lamp, installation rate, application cases, etc.

Smart B-pillar: features, vehicle model cases, etc.

Smart B-pillar: features, vehicle model cases, etc.

Smart glass: features, new applications and trends, etc.

Smart glass: features, new applications and trends, etc.

Electronic exterior rearview mirror: features, vehicle model cases, development trends, etc.

Electronic exterior rearview mirror: features, vehicle model cases, development trends, etc.

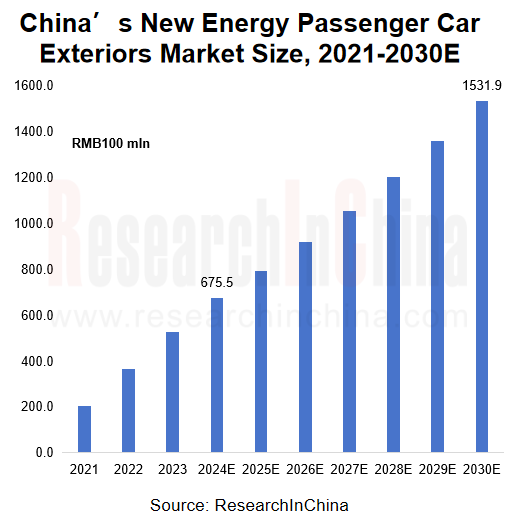

1. In 2030, China’s new energy passenger car exteriors market will be valued at more than RMB150 billion.

In the trend towards electrification and intelligence, the penetration rate of smart exteriors in passenger cars in China is on the rise. By one estimate, the penetration rate was 10.4% in 2023 and is expected to reach 20.8% in 2030.

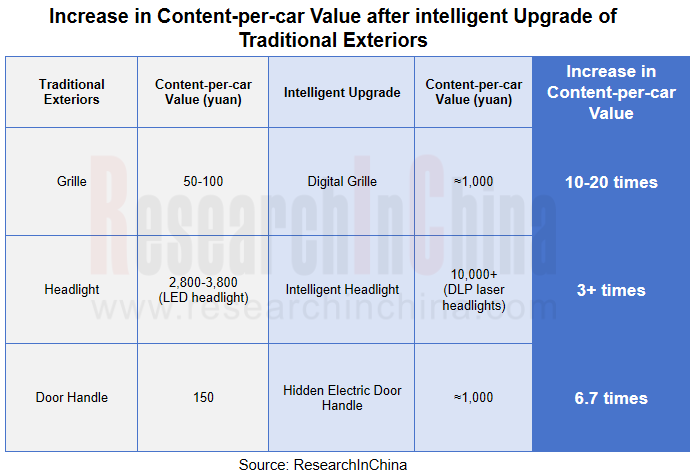

Compared with traditional exteriors, smart exteriors boast higher content-per-car value.

The cost of traditional exteriors is about RMB2,000 per car (excluding headlights), largely for bumpers, exterior rearview mirrors, sealing strips, and wheel trims. If the cost of headlights is added (by RMB2,800-3,800 for LED headlights per car), the cost of exteriors per car will be around RMB5,000.

In the intelligent upgrade process, the value of exteriors has surged. For example, the digital grille is more than 10 times the ordinary grille, the laser headlight is more than 3 times the LED headlight, and the hidden electric door handle is 6.7 times the ordinary door handle. Overall, the content value of smart exteriors per car will be more than 5 times traditional exteriors, that is, the cost per car is RMB10,000 (excluding headlights), and plus headlights, the content-per-car value is higher than RMB20,000.

New energy passenger cars pioneer smart exteriors. On ResearchInChina’s estimate, China’s new energy passenger car exteriors market will be worth RMB67.55 billion in 2024, of which smart exteriors will be valued at RMB25.05 billion, accounting for 37.1%. It is predicted that China’s new energy passenger car exteriors market will be valued at RMB153.19 billion in 2030, of which smart exteriors will take an over 50% share.

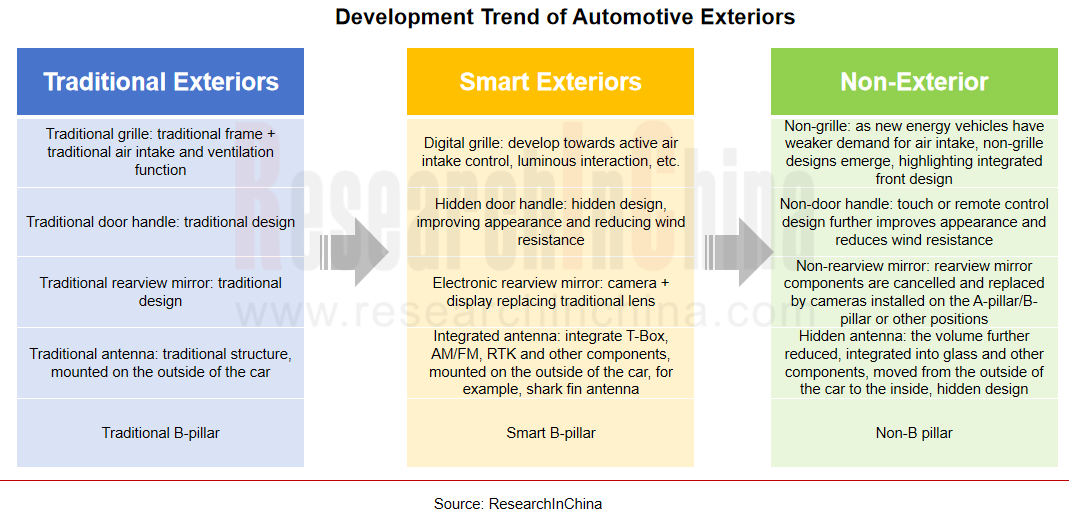

2. In the trend towards intelligence, some traditional exteriors are being replaced by intelligence.

As exteriors tend to be smart, some traditional components will gradually be replaced by intelligence, and even non-exterior designs will appear.

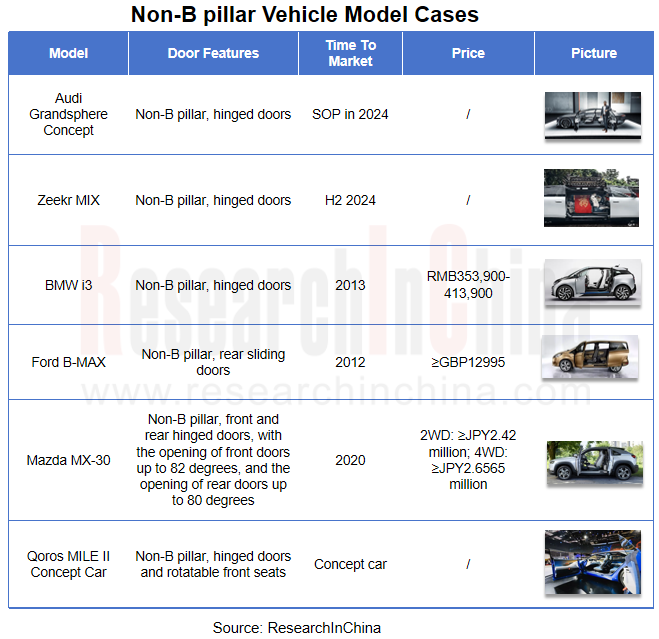

1) Non-B pillar design

The non-B pillar design is usually a non-B pillar + hinged door design. Not only is the door opening full of sense of ritual, but the extra-wide door opening (maximum opening of more than 1m) makes it more convenient for users to get on and off the car. The non-B pillar design has received much attention in the market, especially from household and business users who appreciate the convenience and space utilization of this design.

Zeekr MIX, to be launched in the second half of 2024, adopts a non-B pillar design. The removal of B-pillar can further expand the opening area of ??Zeekr MIX’s doors, enhance the airy and open feel and flexibility of the car’s interior space, and make the car’s interior layout more flexible.

2) Non-door handle design

Hidden door handles are quite controversial, and non-door handle solutions then come out.

In the keyless entry trend, non-door handle design becomes possible. Non-door handle design is a new solution developed for users to unlock and get in and off cars. It often applies wireless inductive unlocking technology and power door system. When the user carries the smart key or authorizes the car via the mobile phone APP to unlock, the control unit triggers the operation of the built-in electric actuator of the door after receiving the command, so that the door automatically pops out or slides at a preset angle, so as to facilitate the user's entry.

In April 2024, Jiyue 07 was unveiled at the Auto China. It adopts a non-door handle design. In addition, Jiyue 07 is also equipped with intelligent inductive power doors, allowing the user to open the door with one button and enabling more intelligent door opening.

3) Non-grille design

The original intention of grille design was to meet the engine's need for air intake and heat dissipation. As new energy vehicles develop, this demand has become much weaker. Non-grille design will become a trend in the future.

At the Tokyo Motor Show in November 2023, Nissan's first all-electric crossover concept car Hyper Urban removed its typical V-Motion grille. This means that in the wave of electrification transformation, Nissan begins to use a non-grille design.

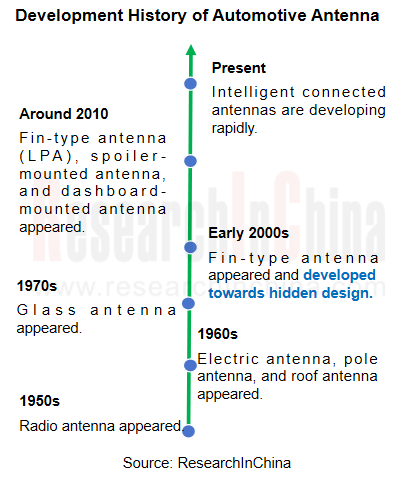

4) Hidden antenna design

Automotive antennas tend to be miniaturized and integrated, and hidden design is one of its future development directions.

The significance of hidden antennas is that the introduction of antennas does not affect the appearance of the vehicle body, that is, they are hidden somewhere on the body. Hidden design requires overall consideration of what types of antennas are used and how to simplify antenna deployment on the vehicle body.

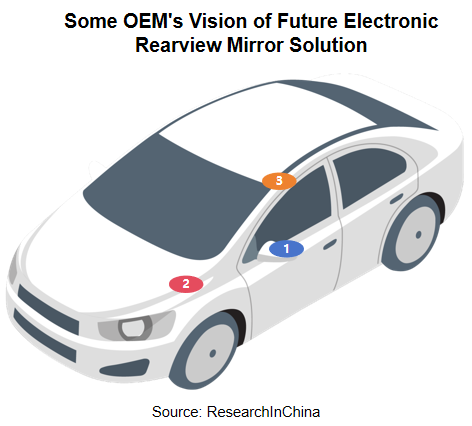

5) Non-rearview mirror design

In current stage, the camera of the electronic exterior rearview mirror is installed in the positions similar to ADAS, mainly on the traditional exterior rearview mirror or at the rear of the vehicle. There is also overlap between the functions of the two, such as blind spot detection and lane change assist based on side cameras. At present, one direction of OEMs to achieve overall cost reduction is reuse of ADAS cameras. From the perspective of field of view, the two have the possibility of reuse. In this period, the camera of the electronic exterior rearview mirror still lies in the traditional positions.

In the future, as traditional rearview mirrors disappear, electronic exterior rearview mirrors will only exist for the purpose of installing cameras, and become much less necessary. Some OEM once mentioned its vision of the future electronic rearview mirror solution in which the camera is expected to be moved to the side of the front hood (position ② in the figure below) or the top corner of the window (position ③ in the figure below). By then, the "non-rearview mirror" design will be realized.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...