China Passenger Car Mobile Phone Wireless Charging Research Report, 2024

China Passenger Car Mobile Phone Wireless Charging Research Report, 2024 highlights the following:

Passenger car wireless charging (principle, standards, and Qi2.0 protocol);

Passenger car wireless charging (principle, standards, and Qi2.0 protocol);

Passenger car mobile phone wireless charging module (sales volume and standard-configured vehicle model data, industry chain, and competitive landscape);

Passenger car mobile phone wireless charging module (sales volume and standard-configured vehicle model data, industry chain, and competitive landscape);

Product solutions of core components suppliers such as NXP, MPS, and Southchip; module solutions and composition of module suppliers such as Foryou Multimedia, InvisPower, and Laird Novero; automotive mobile phone wireless charging cases of OEMs such as Tesla, AITO, and BYD.

Product solutions of core components suppliers such as NXP, MPS, and Southchip; module solutions and composition of module suppliers such as Foryou Multimedia, InvisPower, and Laird Novero; automotive mobile phone wireless charging cases of OEMs such as Tesla, AITO, and BYD.

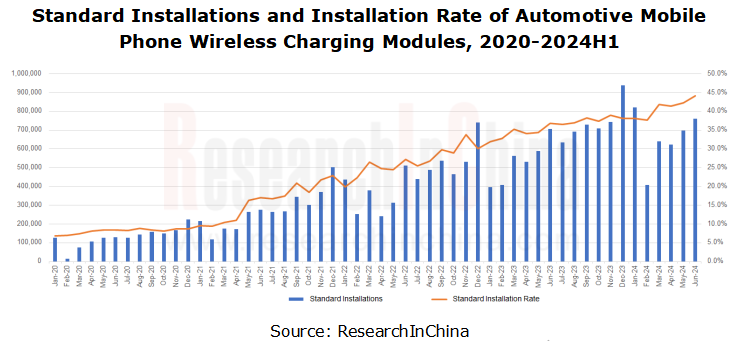

In June 2024, the standard installation rate of passenger car mobile phone wireless charging reached 44%.

When many people still discuss whether there are application scenarios for automotive mobile phone wireless charging and whether it is necessary to install mobile phone wireless charging modules as standard, OEMs and suppliers have made a quiet response.

Between 2020 and 2024, the standard installation rate of automotive mobile phone wireless charging modules in new cars increased from 6.9% in January 2020 to 44.1% in June 2024.

If optional models and post-installed mobile phone holders with wireless charging modules are considered, the actual installation rate of automotive mobile phone wireless charging modules exceeded 50%.

It is estimated that the installation is expected to exceed 10 million sets in 2024 and exceed 18 million sets in 2027.

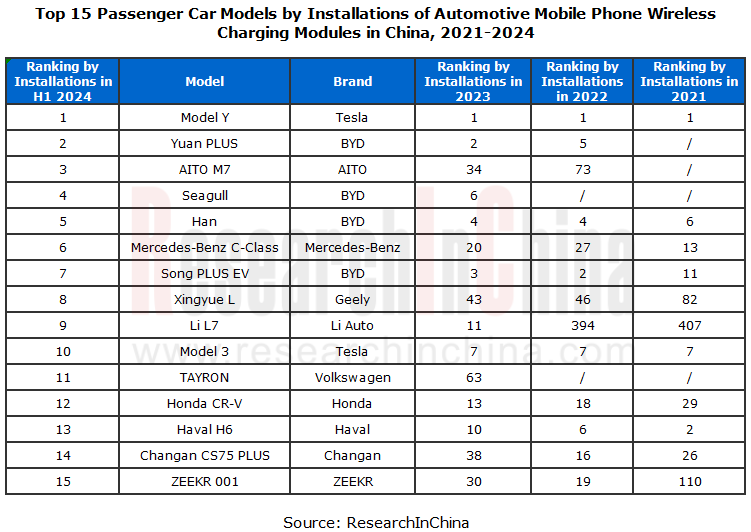

In terms of installed models, Tesla Model Y, BYD Yuan Plus, and AITO M7 were the top three models with automotive mobile phone wireless charging modules in H1 2024, all with a standard configuration rate of 100%. Among the top 15 models by installation of mobile phone wireless charging modules, 7 models boasted the standard installation rate of 100%; the average standard configuration rate of the other 8 models was 70.5%.

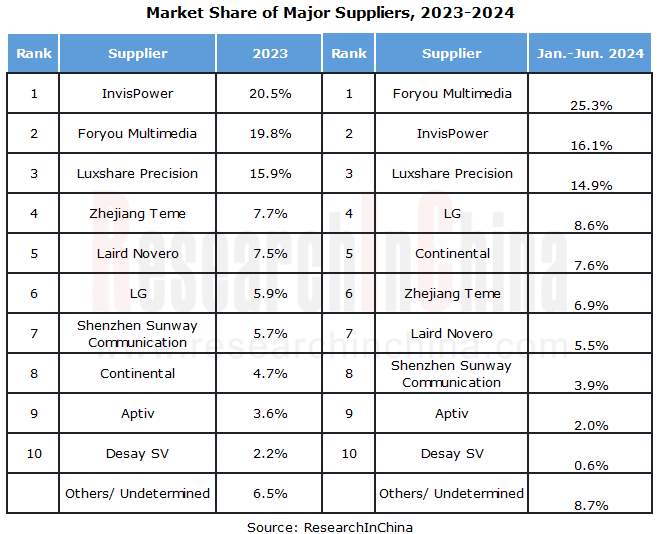

Passenger car mobile phone wireless charging module suppliers are led by Chinese companies, and bellwethers include Foryou Multimedia, InvisPower, Luxshare Precision and Zhejiang Teme. In the field of traditional components, although solutions of international suppliers are still mainly adopted, such as NXP's master chip, TI's voltage regulator chip, and AOS’ MOS tube, ever more solutions of Chinese companies such as ConvenientPower Semiconductor, NuVolta, Maxic and Southchip also find application in automotive mobile phone wireless charging modules.

???

???

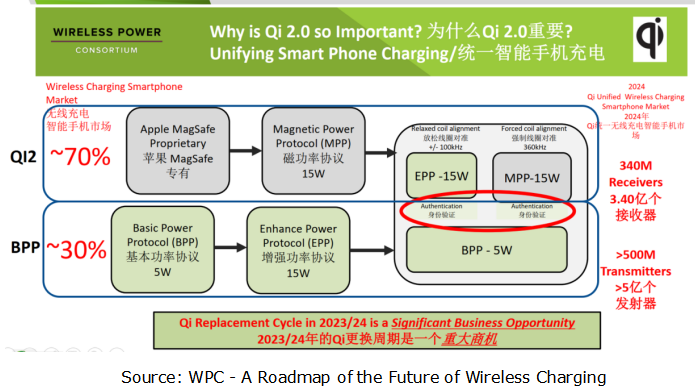

In 2024, over 80% of automotive mobile phone wireless charging modules have obtained Qi 2.0 certification

There are Qi-certified wireless charging products of varying prices and designs on the market, enough to meet diverse requirements of users. But for OEMs and Tier1s, a unified Qi standard can create more ideal automotive wireless charging solutions. Qi 2.0 undertakes the functions of a unified mobile phone wireless charging protocol, especially the introduction of MPP (Magnetic Power Profile) based on Apple's MagSafe magnetic charging technology. By optimizing magnetic field distribution and software correction, MPP can improve charging efficiency, making devices more stable and reliable during wireless charging. Qi2.0's MPP technology has greatly improved user experience of wireless charging.

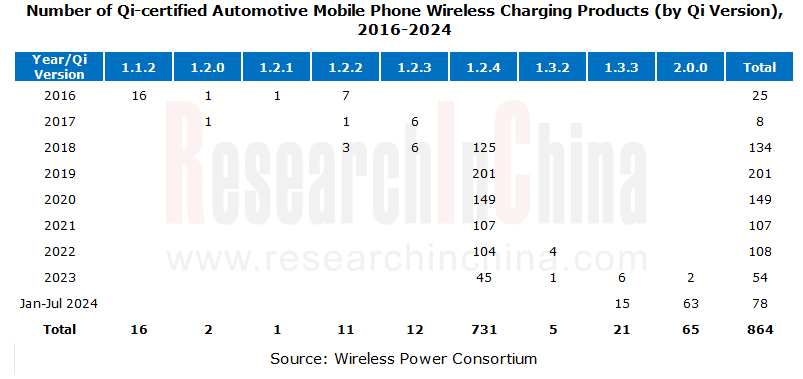

The test standard of Qi2.0 was released in October 2023, and the soft certification started on October 30, 2023, and the certification was fully opened on December 7, 2023. As of July 2024, 78 automotive wireless charging products have passed Qi certification, compared with 54 in the full year of 2023. It is expected that 130-150 automotive products will be Qi-certified in 2024.

Qi 1.2.4 is the version certifying the most automotive products, sweeping nearly 85%, but since 2024, suppliers have fully turned to Qi 2.0.

Of the 78 products that passed Qi certification in 2024, 63 are Qi 2.0 certified, or more than 80% of the total.

Undoubtedly Qi 2.0 is born to meet consumers' demand for medium- and high-power wireless charging. It operates at a frequency of 360kHz and adds 55 data packets based on Qi 1.3. It can support foreign object detection before power transmission, and also additionally supports reverse charging. Qi 2.0 technology and standards will head in the direction of higher power in the future. It is expected that a 25W wireless fast charging standard will be launched in 2025, and a 50W wireless fast charging standard with wide compatibility and strong applicability will be launched in 2026.

Seen from current products on the market, the 15W Qi 2.0 has fallen behind 50W private protocols. As the demand for charging mobile phones in the cockpit increases, higher-power charging solutions are needed. For example, Luxeed M7 supports charging 9 devices simultaneously, including 2 50W private protocol wireless fast charging and 2 66W wired super charging devices. The Qi 2.x fast charging protocol needs to be accelerated.

Precision, efficiency, and heat dissipation: Solutions to three major enduring problems in automotive mobile phone wireless charging

Problem 1: Precision: use magnetic attraction to ensure device alignment

Wireless charging relies on electromagnetic coils. In the charger, one or more induction coils create a magnetic field and transfer energy, and smaller coils in mobile phone or other devices collect the energy. The coils must be aligned to transfer energy between them.

The biggest upgrade of Qi 2.0 is adding the same magnetic function as Apple MagSafe. As the chairman member of WPC, Apple has contributed its MagSafe technology to WPC, which has over 370 members. The magnetic solution of Qi 2.0 guarantees perfect alignment, thereby reducing energy loss and ensuring charging efficiency.

The automotive mobile phone wireless charging module is mainly installed in central storage box or armrest box. Its position is fixed according to the space shape. The pattern and material increase its friction and can also improve localization accuracy of devices. However considering that devices may shift when the vehicle encounters complex road conditions such as bumps and turns during driving, magnetic attraction can better improve device stability. If bracket-type wireless charging devices in the aftermarket are taken into account, the role of magnetic attraction becomes even more important.

Problem 2: Efficiency: private protocols and new policies accelerate the launch of fast charging devices

The Qi standard initially featured charging power of 5W, which was later increased to 7.5W and 10W, while Qi 2.0 increases charging power to 15W. During 2025-2026, 25W and 50W versions with faster charging efficiency are scheduled to be released.

Yet currently many vehicle models already offer 50W wireless charging mainly through private protocols. For example, private protocols of Android phones such as Huawei, Xiaomi, and OPPO can enable automotive wireless charging power to reach 40-50W. For Apple phones, these models can only provide 15W charging solutions that support the MagSafe protocol.

In 2021, AITO M5 increased the power of automotive wireless charging to 40W for the first time. At that time, the Qi protocol could no longer meet this standard, so private protocols were also adopted for automotive wireless charging. New models in 2024, such as IM L6, Lynk & Co 07, New AITO M5, Xiaomi SU7, Zeekr 001, Luxeed S7 and Li L6, have generally supported 50W mobile phone wireless charging, but private protocols of each company are also easy to connect. At present, most 50W automotive wireless charging private protocol solutions can already support mainstream Android mobile phone brands.

The Interim Provisions on Administration of Radio of Wireless Charging (Power Transmission) Devices" the Ministry of Industry and Information Technology will begin to implement on September 1, 2024, indicates that mobile and portable wireless charging devices shall operate in the frequency ranges of 100-148.5kHz, 6765-6795kHz, and 13553-13567kHz, and the rated transmission power shall not exceed 80W. Earlier in February 2021, the Interim Provisions on Administration of Radio of Wireless Charging (Power Transmission) Devices (Draft for Comments) drafted by the Radio Administration Bureau of the Ministry of Industry and Information Technology emphasized that the rated transmission power of wireless charging shall not exceed 50W, which is why the maximum power of current wireless charging products does not exceed 50W, in spite of relevant suppliers pushing up the technology to more than 100W. Perhaps after September 2024, 80W private protocol wireless charging products will be available on market soon.

Problem 3: Heat dissipation: it is a long-lasting problem, and physical cooling is still the mainstream strategy

Most automotive mobile phone wireless charging solutions use a full-bridge SOC solution with built-in MCU and built-in power tube. This solution will easily cause heating problems.

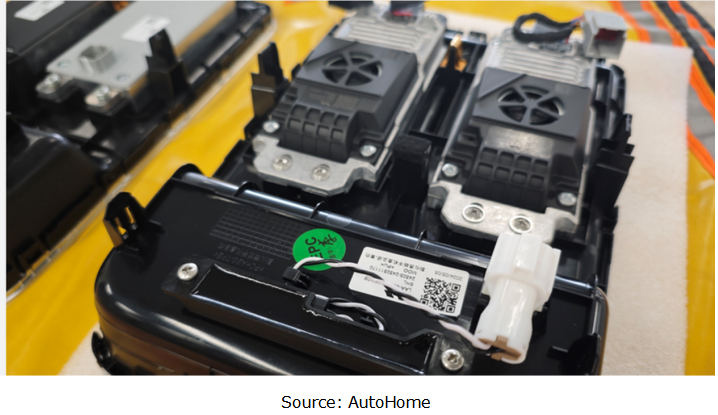

Thermally conductive silicone sheets, thermally conductive gels, heat dissipation holes, and air cooling devices are currently major heat dissipation strategies for automotive wireless charging modules. The wireless charging compartment of AITO series is set in the concave space of the center console (one/both sides), with heat dissipation holes to actively cool the mobile phone and wireless charging module. The wireless charging board (50W) for Li Auto’s 2024 models has more metal materials inside and uses an electric cooling fan for better heat dissipation.

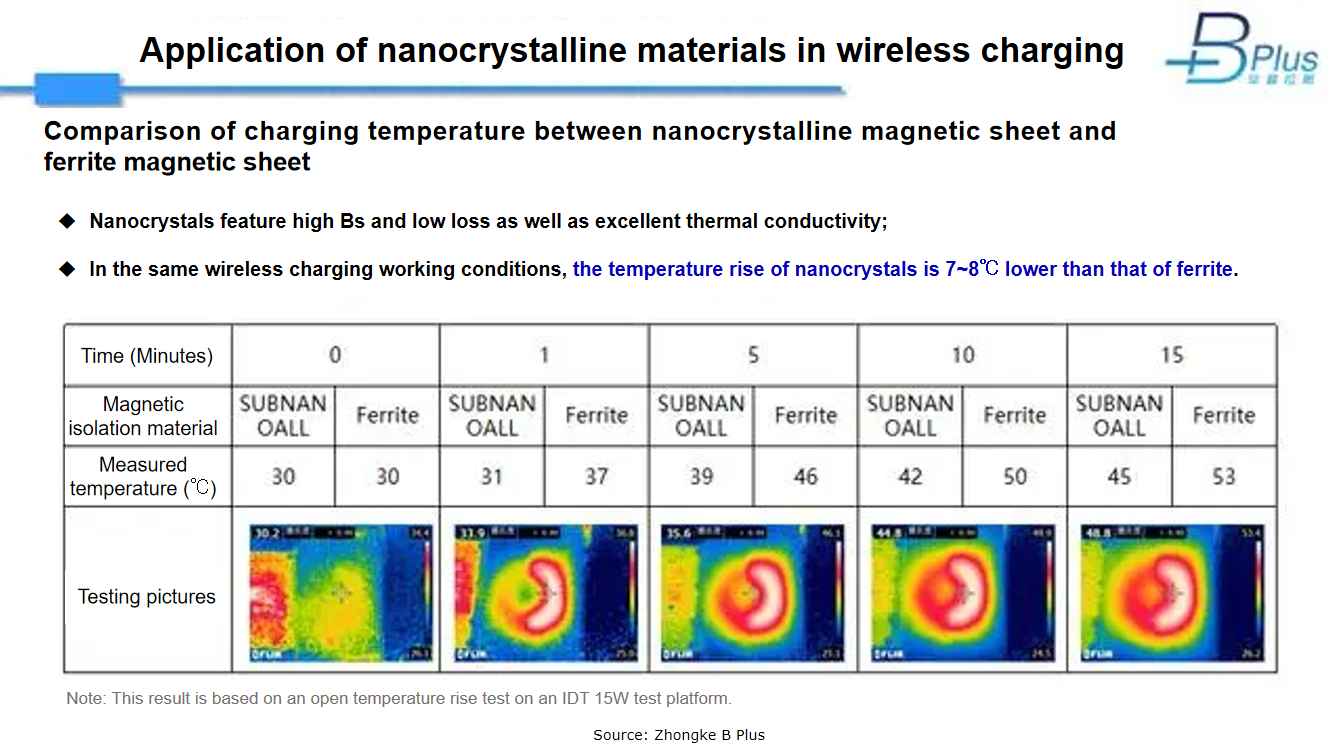

Some suppliers are also trying to use new materials to deal with heat dissipation. Zhongke B Plus's research shows that in the same wireless charging working conditions, the temperature rise of nanocrystals is 7~8℃ lower than that of ferrites. Of course, the nanocrystalline material is also a major wave-absorbing material. As a major supplier of nanocrystalline materials in China, Yunlu AMT provides nanocrystalline materials for the receiving terminals of some wireless charging products of Apple, Xiaomi and Huawei.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...