Automotive Software Business Models and Suppliers’ Layout Research Report, 2024

Software business model research: from "custom development" to "IP/platformization", software enters the cost reduction cycle

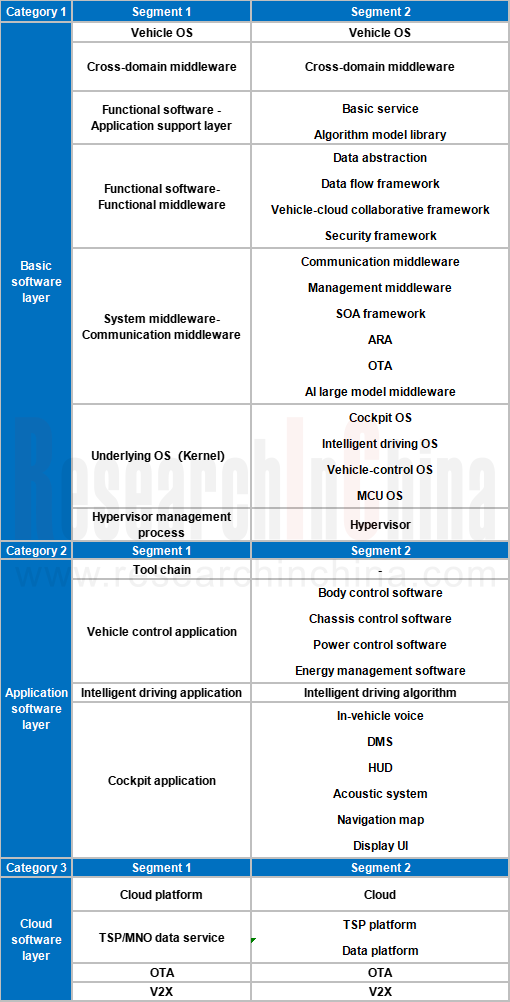

According to the vehicle software system architecture, this report classifies smart car software into three categories: basic software layer, application software layer, and cloud software layer, as well as several sub-categories.

The software development of OEMs is developing towards "platformization" to achieve cost reduction at the source

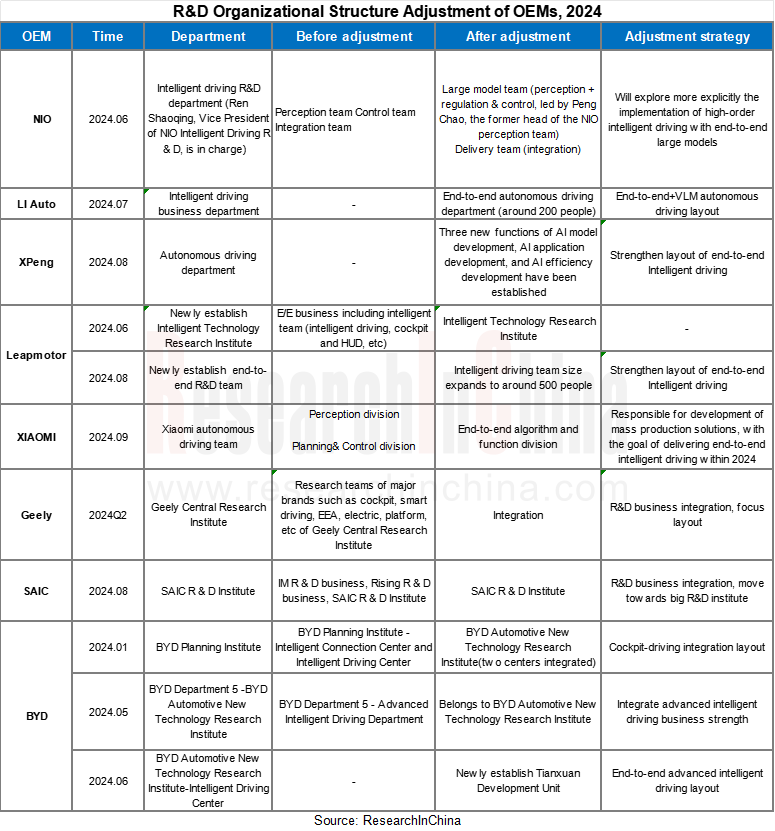

In 2024, the organizational structure of OEMs are adjusted more and more frequently, and strategies need to be adjusted in real time to cope with the fiercely competitive automotive market. Some OEMs adjust their organizational structure in order to stabilize the company's sales and other status quo, and some adjust their organizational structure, especially R & D business team, to promote the company's software and new business focus.

Local OEMs conduct R & D organizational structure change, and restructure software development strategy

In recent years, XPeng Motors has continued to adjust its organizational structure on a large scale, and at the same time proposed a number of measures such as cost reduction and efficiency increase, budget reduction, etc., to face the intelligent and highly competitive automotive market. In July 2024, XPeng Motors' autonomous driving department ushered in another organizational restructuring. Xpeng's autonomous driving department established three new segments: AI model development, AI application development, and AI efficiency development. The AI model development department is mainly responsible for end-to-end model development, which is to strengthen the layout of AI end-to-end intelligent driving technology.

In August 2024, SAIC is unifying R & D business of IM and Rising brands into SAIC Group Innovation Research and Development Institute (referred to as SAIC R & D Institute). Among them, the R & D teams of IM and Rising brands, as well as technical projects such as power batteries, intelligent driving, and chassis, will be centrally migrated to SAIC R & D Institute, and unified and coordinated by R & D Institute. This model of centralizing the R & D power of all its sub-brands and developing them uniformly is the "large R & D institute" model commonly used by automobile manufacturing groups. Through this model, the platform and standardized layout of products are carried out to achieve equal sharing of R & D costs and strive to reduce costs at the source.

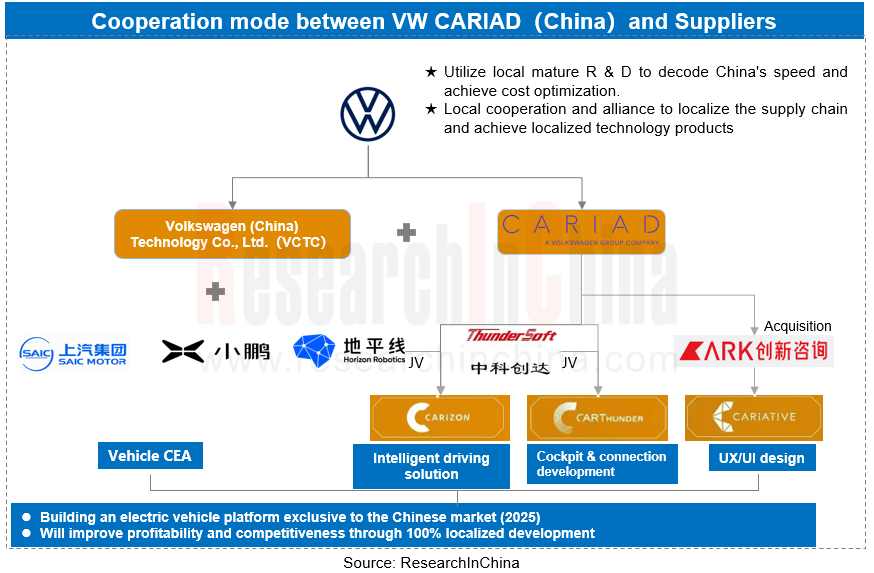

Multinational automakers strengthen cooperation with China's local software supply chain

At present, the localization development of multinational automakers in China has entered a new stage. This is different from the previous "sewing" auxiliary decoration and development, but to fundamentally restructure the system, actively adjust the strategy, and actively layout to cope with the new changes in China's auto market. It can be summarized as follows:

? Increase China's local investment and R & D center layout. For example, in March 2022, Mercedes-Benz announced the establishment of a R & D center in Shanghai to further expand its R & D layout in China. The Shanghai R & D center will focus on intelligent interconnection, autonomous driving, software and hardware development and big data. In April 2023, Volkswagen Group announced that it will invest about 1 billion euros to establish a R & D, innovation and procurement center focusing on intelligent connected electric vehicles.

? Further open up the authority of China's local teams and strengthen China's local customization strategy. At present, Mercedes-Benz, BMW, Volkswagen and other foreign automakers have proposed China's local customized development model to further open up the authority of China's local teams.

? Actively cooperate with local Chinese suppliers. For example, Mercedes-Benz has in-depth cooperation with Momenta, Tencent, AISpeech, etc.; Volkswagen has in-depth cooperation with ThunderSoft, Horizon, XPeng Motors, etc.

In recent years, Volkswagen Group has actively promoted the layout of intelligent software. In Chinese market, Volkswagen Group has completely delegated the R & D decision-making power to the team in the Chinese market. From hardware platform of the model to electronic and electrical architecture to intelligent driving, cockpit, and even design, the local team makes independent decisions and makes local solutions. Volkswagen is responding to the challenges of its development in China and reshaping its software business by strengthening partnerships and leveraging external expertise.

In May 2023, Volkswagen Group announced the establishment of the largest R & D center in Hefei besides the German headquarters, investing about 1 billion euros, namely Volkswagen (China) Technology Co., Ltd., to systematically strengthen R & D strength "in China, for China". On April 11, 2024, Volkswagen Group (China) announced that it would invest 2.50 billion euros to further expand production and innovation center in Hefei, Anhui.

At the same time, starting from 2023, Volkswagen will cooperate with Horizon, ThunderSoft, XPeng Motors, SAIC and other local Chinese companies in the fields of E/E architecture, cockpit, intelligent driving, UI/UX and so on.

Software suppliers promote "customized development" to "IP/platformization" layout, the software R&D cycle is greatly compressed, and the cost reduction cycle is started

The IP/platformization layout of the software supplier's products helps OEM reduce costs and increase efficiency

At present, the automotive software business mainly includes customized software development and design, technical services, software IP authorization/licensing, and system integration, and the fees mainly include one-time fee NRE, software authorization/licensing, and royalty paid per piece.

In recent years, software suppliers in China's automotive market have mainly focused on software customized development or technical service business. Especially in the field of intelligent cockpit and intelligent driving. As to customized supply model,? suppliers need to improve their company's reputation and expand market demand by developing new technologies and solutions through customized development with OEMs at the early stage.

With the emergence of mass production effect, in order to further improve efficiency and achieve large-scale product production at the same time, the software supplier business has gradually developed from "customization" to "IP/platformization". On the one hand, through IP or platformization product layout, OEMs can reduce costs and increase efficiency at a greater level, shorten the development cycle; on the other hand, it is more conducive to the large-scale replication of supplier business and the polishing and optimization of smart vehicle products, expanding the company's profit margins.

Taking cockpit platform products as an example, many suppliers offer cockpit platform products, which not only ensure high performance, but also achieve performance such as shortening development cycles and reducing costs through platform to meet the needs of highly competitive OEMs.

Cloud-native, AI large models help explore new models of software development and shorten development cycles

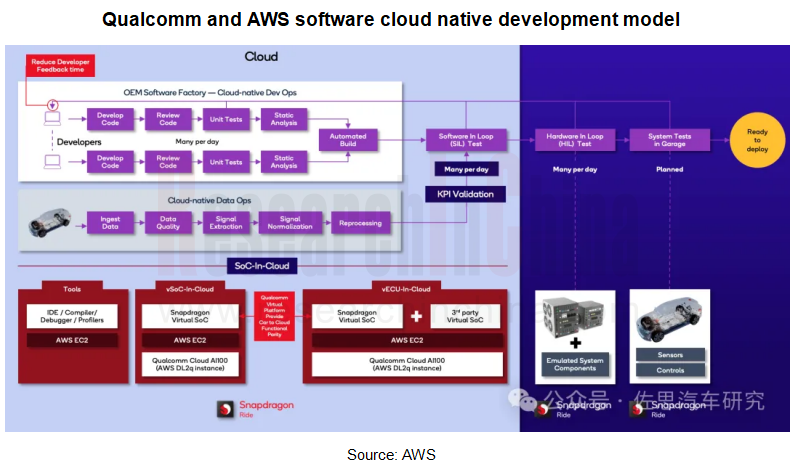

With the increasing complexity of automotive system software, especially the birth of new applications such as central computing and autonomous driving, application code has become more and more abundant, resulting in new ways of software development, deployment, and management to quickly meet a variety of changing consumer needs.

Among them, cloud-native software development, as a new development model, means moving to a cloud-based development model for automotive application development, enabling software development in the cloud and deployment directly on the edge of the car. Developers deploy and test automotive software applications anytime, anywhere, greatly shortening the development and deployment cycle of in-vehicle system applications.

In September 2023, AWS and Qualcomm announced a collaboration. One of the core of the collaboration is a power builder and infrastructure based on cloud-native technologies to help automakers develop, test and deploy software in the cloud. The partnership project showcases a cloud-based development environment and virtualized Snapdragon SoC platform for testing and validating automotive software in the cloud. The entire architecture design takes full advantage of the flexibility and scalability of cloud computing, enabling developers to carry out efficient development work anywhere in the world.

Based on the open-source community, ETAS builds SDV. OS cloud-native solutions, provides SDV power builder chains, and provides customers with cloud-native development, deployment, and management and analysis solutions.

In addition, as technologies such as AI large models continue to mature, AI large models will lead a new model of automotive software development. More than 60% of automotive software code work will be replaced by large models, and basic application software and other products will continue to develop on a platform. At that time, the concentration of automotive software industry will further increase, and the industry's leadership will become inevitable. The upstream and downstream will enter the "flywheel acceleration" rally.

Vehicle-level OS platform, OEMs and suppliers coordinate layout

At present, vehicle OS products are mainly composed of standardized middleware such as Hypervisor, underlying OS, AUTOSAR, other core middleware and tool chains, etc., to realize the operating system of the central computing unit software system function.

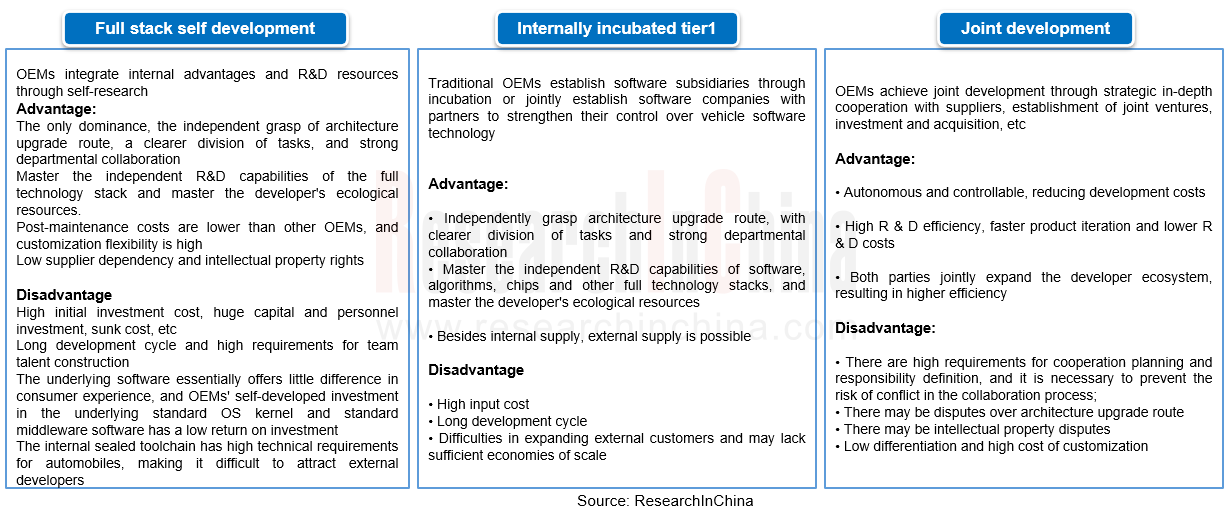

At present, there are three main paths for OEMs in China to deploy vehicle OS: full-stack self-development, internal incubation of Tier1, and joint development.

At present, except for some OEMs with strong R & D strength, most OEMs tend to implement the layout of the whole vehicle OS through the model of joint development with suppliers. In the face of the customized needs of OEMs, the supplier's software development team is an ideal partner for OEMs, which can cooperate in R & D and help customers quickly develop products, shortening product launch time.

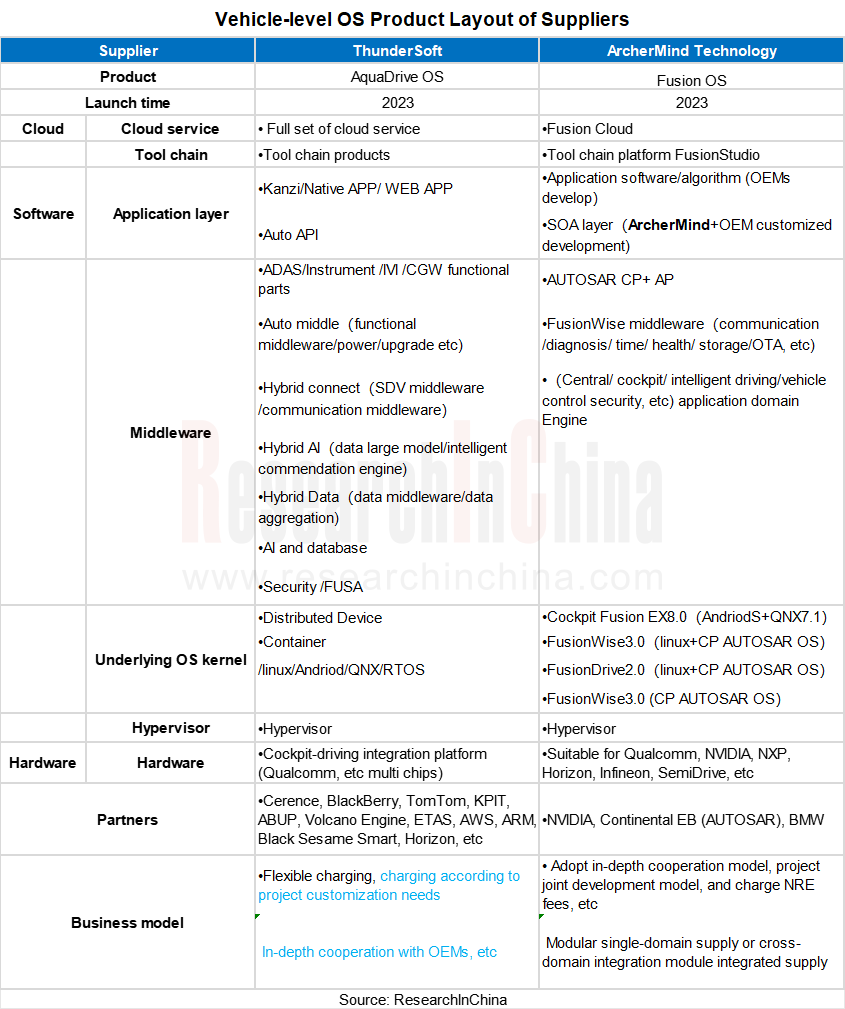

In the face of the vehicle-level OS market, software suppliers have launched platform-based vehicle OS solutions and flexible supply methods to help OEMs quickly create suitable software platform products for central computing. For example, ThunderSoft launched the vehicle AquaDrive OS system, ArcherMind Technology's cross-domain vehicle Fusion OS, Kotei KCar-OS, ETAS's end-to-end vehicle OS solution, Huawei iDVP intelligent digital base, etc.

In addition, under the trend of SOA software frameworks, cooperation models such as OEMs, Tier1, and software developers are no longer chimney-like, but in-depth strategic cooperation models. Through partnerships and ecological integration, the entire OS can be more open and serve the development of the entire industry.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...