Research Report on Intelligent Vehicle E/E Architectures (EEA) and Their Impact on Supply Chain in 2024

E/E Architecture (EEA) research: Advanced EEAs have become a cost-reducing tool and brought about deep reconstruction of the supply chain

The central/quasi-central + zonal architecture has become a way for OEMs to reduce costs

In this report, ResearchInChina divides the EEAs of OEMs into five types:

Distributed ECU

Distributed ECU

Domain centralized architecture: The multi-domain architecture spreads to fuel vehicles, A-class and below battery-electric passenger cars;

Domain centralized architecture: The multi-domain architecture spreads to fuel vehicles, A-class and below battery-electric passenger cars;

Domain fusion architecture: Usually equipped with the vehicle central domain controller, it can support cross-domain communication, such as cockpit-driving integration, integration of intelligent driving and chassis, cockpit-body-gateway integration, camera sharing, etc.

Domain fusion architecture: Usually equipped with the vehicle central domain controller, it can support cross-domain communication, such as cockpit-driving integration, integration of intelligent driving and chassis, cockpit-body-gateway integration, camera sharing, etc.

Quasi-central computing + zonal architecture: With ZCUs (intelligent power distribution, zonal servitization), there are still multiple computing centers with multiple boxes and chips;

Quasi-central computing + zonal architecture: With ZCUs (intelligent power distribution, zonal servitization), there are still multiple computing centers with multiple boxes and chips;

Central computing + zonal architecture: With vehicle-level OS and ZCUs (intelligent power distribution, zonal servitization), it can support a computing center with multiple chips or a single chip in a single box to realize the integration of cockpit domain, intelligent driving domain, vehicle control domain, etc..

Central computing + zonal architecture: With vehicle-level OS and ZCUs (intelligent power distribution, zonal servitization), it can support a computing center with multiple chips or a single chip in a single box to realize the integration of cockpit domain, intelligent driving domain, vehicle control domain, etc..

According to statistics from ResearchInChina, 779,000 passenger cars with domain fusion architectures were sold in 2024H1, accounting for 7.9%, followed by 336,000 passenger cars with quasi-central + zonal architectures with a share of 3.4% and 67,000 passenger cars with central + zonal architectures with a share of 0.7%.

Due to the obvious cost advantages incurred by zonal architectures and the superior vehicle space design, the penetration rate of "quasi-central + zonal" architectures and “central + zonal” architectures will reach 16.3% and 14.3% by 2027 respectively.

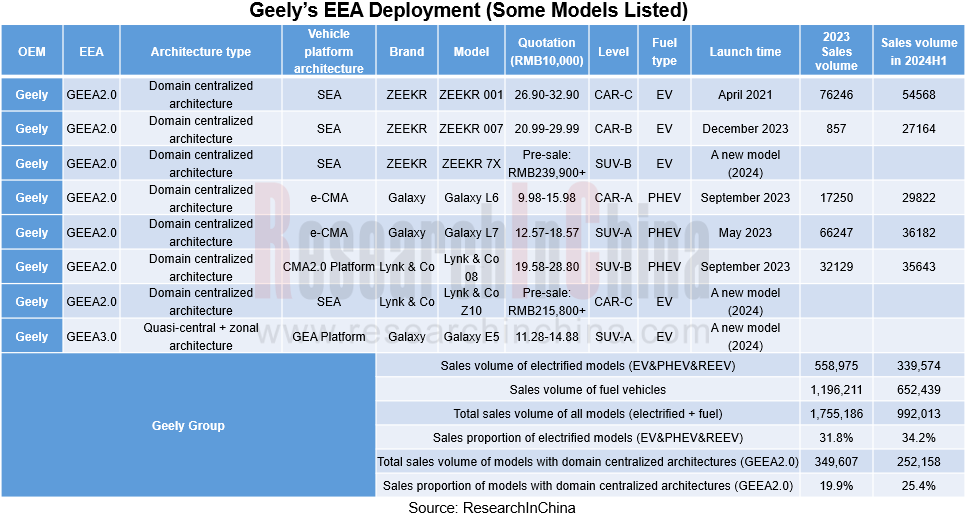

For example, Geely secured an electrification rate of 34.2% and a domain fusion architecture penetration rate of 25.4% in 2024H1.

In August 2024, Geely Galaxy E5 debuted with GEEA 3.0:

In the body domain, there are a driver-side ZCU (ZCUDM) and a front-passenger-side ZCU (ZCUP)

Flyme Auto is deeply customized based on Android

The single-chip "cockpit-parking integration solution is based on "Longying No.1" of SiEngine Technology

The electric drive system realizes "eleven-in-one": VCU, MCU, HBMS, LBMS, OBC, DCDC, PDU, Motor, Reducer, GWRC and TMS?

As the quasi-central + zonal control architecture brings advantages like better vehicle wiring harness layout, weight reduction, and cost reduction, the usable area in the Galaxy E5 car accounts for 67.2% of the total cockpit space, which is outstanding among battery-electric A-class SUVs of the same level. It is priced at RMB109,800-145,800 after being subsidized and discounted. It is expected to have a huge impact on the A-class battery-electric SUV market.

Geely will promote GEEA 3.0 among more models, and further install vehicle-level OS in vehicles to form a true central computing + zonal architecture platform.

In addition, Leapmotor’s vehicles equipped with central + zonal architectures have experienced a surge in sales volume. Leapmotor's main models currently on sale, namely C16, C10, C11 and C01, carry the latest LEAP 3.0 (“Four-leaf Clover” central + zonal architecture). In August 2024, Leapmotor sold 30,305 vehicles, a year-on-year spike of more than 113%.

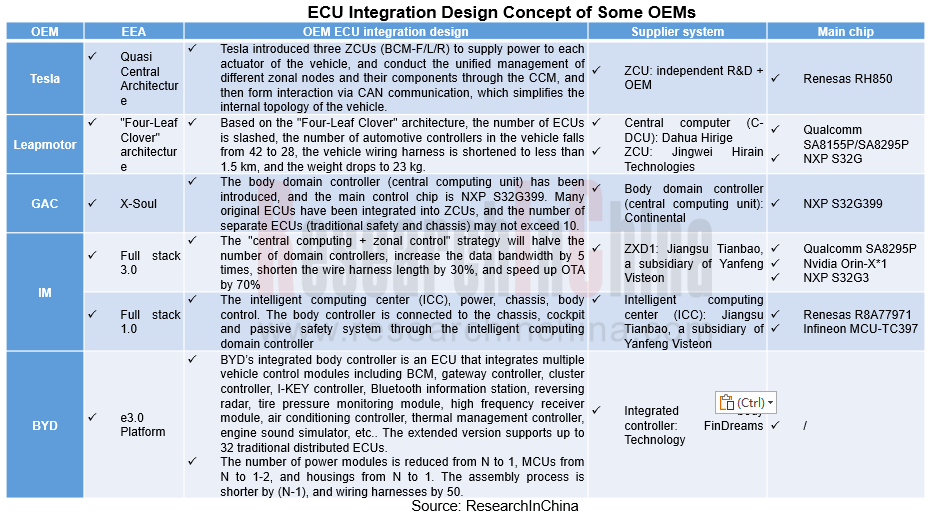

Based on LEAP 3.0, four domains are integrated into one, and the number of ECUs is slashed. Compared with LEAP 2.0 (domain centralized architecture), LEAP 3.0 makes the number of automotive controllers in the vehicle fall from 42 to 28, the vehicle wiring harness to less than 1.5 km, and the weight to 23 kg. While reducing costs and increasing space, it improves functional configuration and lower the price.

The central/quasi-central + zonal architecture has become a way for OEMs to reduce costs, such as Leapmotor C series, Geely Galaxy E5, IM L6, and the soon-to-be-delivered Voyah Courage.

EEA innovation: In addition to SoCs, ECU integrated design and central cross-domain SoCs (MCUs) will be introduced to accelerate supply chain integration and reduce costs.

A vehicle equipped with a traditional distributed architecture has more than 100 ECUs. The functional domain architecture has achieved partial ECU integration. Under the final central computing + zonal architecture, ZCUs and HPCs will integrate most of the ECUs in the vehicle.

The hardware design concept of ZCUs is to standardize controllers by board-level integration, and integrate all control modules with similar properties in a zone. The MCU integrates ECUs into a super large controller, so that one PCBA controls the functions of different zones. Therefore, under the zonal architecture, the number of ECUs is slashed, and the reduced ECUs are incorporated into ZCUs. Alternatively, they can be uploaded to the HPC, and transformed into smart sensors or actuators.

ZCUs can reduce the number of ECUs and communication interfaces, wiring harness costs and weight while saving space and achieving higher computing power utilization. Currently, most OEMs have planned to use 2 to 4 ZCUs in their next-generation multi-domain computing architectures each to integrate most ECU functions and cut down the number of ECUs.

As most of ECU functions are integrated into the HPC and ZCUs, MCUs (SoCs) have been? upgraded, and high-performance MCUs (SoCs) have been widely used.

In addition to the widely used NXP S32G2/G3 series, Renesas R-CarS3/S4 series, TI DRA series, SemiDrive G9H and other chips, NXP's powerful 5nm MCUs (SoCs), SemiDrive E3650, etc. also attract much attention.

NXP’s first 5nm automotive MCU (SoC)

At the end of March 2024, NXP officially launched the world's first 5-nanometer automotive MCU. However, NXP did not call it an MCU, but dubbed it the S32N55 processor, the first device in the new S32N family of vehicle super-integration processors. It is actually a SoC with the following features:

It has highly efficient computing cores that emphasize real-time performance;

It has highly efficient computing cores that emphasize real-time performance;

The cores can operate in split or lockstep mode to support different functional safety levels up to ISO 26262 ASIL D;

The cores can operate in split or lockstep mode to support different functional safety levels up to ISO 26262 ASIL D;

It has a variety of network interfaces, including CAN, LIN, FlexRay, automotive Ethernet, CAN-FD, CAN-XL and PCIe, with at least 15 CAN network interfaces;

It has a variety of network interfaces, including CAN, LIN, FlexRay, automotive Ethernet, CAN-FD, CAN-XL and PCIe, with at least 15 CAN network interfaces;

Multiple ECU functions are integrated, including vehicle dynamic control, body, comfort, and central gateway. For example, S32N55 boasts the Automotive Math and Motor Control Library (AMMCLib) which supports AUTOSAR and small real-time operating systems (such as Zephyr), Real-Time Drivers (RTD), Type1 hypervisors, Inter-Platform Communication Framework (IPCF), Safety Software Framework (SAF) and Structural Core Self-Test (SCST).

Multiple ECU functions are integrated, including vehicle dynamic control, body, comfort, and central gateway. For example, S32N55 boasts the Automotive Math and Motor Control Library (AMMCLib) which supports AUTOSAR and small real-time operating systems (such as Zephyr), Real-Time Drivers (RTD), Type1 hypervisors, Inter-Platform Communication Framework (IPCF), Safety Software Framework (SAF) and Structural Core Self-Test (SCST).

SemiDrive E3650

This product uses the latest ARM Cortex R52+ high-performance lock-step multi-core cluster, supports virtualization, has a non-volatile memory (NVM) up to 16MB, large-capacity SRAM and rich available peripheral resources to enable EEAs with higher integration and wider configurations.

EEA innovation: from decentralized operating system to vehicle-level OS which is the key to central computing

The vehicle OS is oriented towards the central computing platform and is based on SOA. It can integrate the functions of different domains in the vehicle (cockpit, intelligent driving, vehicle control, etc.) into one platform system, thereby providing a vehicle-level platform with the same set of programming interfaces. It is a development and operation platform for all vehicle domain software and services.

Leapmotor vehicle OS: software and hardware decoupling, SOA, and multi-system software integration.

Leapmotor OS IVI system: QNX (cluster) + Android (IVI system) based on QNX Hypervisor;

Leapmotor OS IVI system: QNX (cluster) + Android (IVI system) based on QNX Hypervisor;

Gateway, etc.: Linux;

Gateway, etc.: Linux;

ADAS, vehicle control, CAN bus system: based on RTOS;

ADAS, vehicle control, CAN bus system: based on RTOS;

Communication middleware: DDS distributed communication middleware + Mailbox communication bus;

Communication middleware: DDS distributed communication middleware + Mailbox communication bus;

SOA: “Four-Leaf Clover” SOA software design architecture. 200+ interfaces are open for custom scenario applications, 500+ interfaces are reserved, scenario codes can be shared. Super senseless OTA: cockpit upgrade completed within 8 seconds (detection environment in 7 seconds, system switching in one second).

SOA: “Four-Leaf Clover” SOA software design architecture. 200+ interfaces are open for custom scenario applications, 500+ interfaces are reserved, scenario codes can be shared. Super senseless OTA: cockpit upgrade completed within 8 seconds (detection environment in 7 seconds, system switching in one second).

NIO's full-stack self-developed vehicle OS - SkyOS

SkyOS-L: The first real-time operating system that realizes localization of AutoSAR and large-scale commercialization. Compared with AUTOSAR, SkyOS-L has a 30-40% higher real-time periodic signal delivery rate;

SkyOS-L: The first real-time operating system that realizes localization of AutoSAR and large-scale commercialization. Compared with AUTOSAR, SkyOS-L has a 30-40% higher real-time periodic signal delivery rate;

SkyOS-M: The microkernel architecture runs in the central brain and mainly controls the body, chassis, suspension, etc. The kernel is more stable than traditional Linux with better service isolation. On the basis of safety isolation, there is a four-layer monitoring and three-layer recovery security mechanism;

SkyOS-M: The microkernel architecture runs in the central brain and mainly controls the body, chassis, suspension, etc. The kernel is more stable than traditional Linux with better service isolation. On the basis of safety isolation, there is a four-layer monitoring and three-layer recovery security mechanism;

SkyOS-C: The deeply customized operating system based on Android carries the functions of the smart cockpit, with the self-developed TOX protocol stack, more stable data transmission, and AI smart experience including NOMI;

SkyOS-C: The deeply customized operating system based on Android carries the functions of the smart cockpit, with the self-developed TOX protocol stack, more stable data transmission, and AI smart experience including NOMI;

SkyOS-R: It improves the load capacity of the system;

SkyOS-R: It improves the load capacity of the system;

SOA framework: NIO defines a high-performance cross-domain communication protocol named TOX, which means Talks Over X. It can be applied to all network types and all communication terminals;

SOA framework: NIO defines a high-performance cross-domain communication protocol named TOX, which means Talks Over X. It can be applied to all network types and all communication terminals;

The cross-domain communication protocol TOX can provide high-bandwidth, high-capacity, low-latency, and high-reliability communication. It can be 30-50 times faster than the traditional CAN bus. Compared with the traditional automotive communication protocol SOME/IP, the end-to-end delay is reduced by 40%, and the zero packet loss threshold is increased by 109%. The reliability of TOX transmission is higher than SOME/IP.

The cross-domain communication protocol TOX can provide high-bandwidth, high-capacity, low-latency, and high-reliability communication. It can be 30-50 times faster than the traditional CAN bus. Compared with the traditional automotive communication protocol SOME/IP, the end-to-end delay is reduced by 40%, and the zero packet loss threshold is increased by 109%. The reliability of TOX transmission is higher than SOME/IP.

?

Xpeng’s unified cross-domain middleware (UCM) for vehicles:

Vehicle communication middleware includes system security middleware, data security middleware, functional safety, vehicle OTA, vehicle SOA, etc. Cockpit applications and autonomous driving applications are immune to differences or changes in hardware platforms, thus greatly improving research and development efficiency and speed.

Vehicle communication middleware includes system security middleware, data security middleware, functional safety, vehicle OTA, vehicle SOA, etc. Cockpit applications and autonomous driving applications are immune to differences or changes in hardware platforms, thus greatly improving research and development efficiency and speed.

To optimally allocate hardware resources, Xpeng adopts the "building blocks" approach to arrange and combine resources according to actual needs, so as to make products with optimal utilization, best performance and best experience.

To optimally allocate hardware resources, Xpeng adopts the "building blocks" approach to arrange and combine resources according to actual needs, so as to make products with optimal utilization, best performance and best experience.

?

EEA innovation: Cockpit-driving integration and integration of cockpit + driving + vehicle control are gradually becoming the mainstream, and the PCIe communication framework will be built

Under the quasi-central/central architecture, all systems that require computing resources, such as intelligent driving, cockpit, parking, power, chassis, body, and seating systems, may be concentrated in a central computing unit. Therefore, a severe challenge for automotive networks is the high-performance computing interconnection of the central computing platform itself.

According to the degree of concentration of the "central computing platform", there are "Multi-Box", "One-Box", "One-Board" and "One-SoC". In addition to breakthroughs in integrated design technology at the chip hardware level, this centralized process also relies on advances in communication technologies such as inter-board interconnection, inter-chip interconnection, and on-chip interconnection.

As shown in the figure below, 4 Ethernets are connected to the PCIe bridge. The bandwidth of these 4 ECUs is about 50Gbps, so a bridge chip or switch should be used to convert Ethernet to PCIe.

Architecture centralization has promoted the development of data storage technology from traditional eMMC and UFS to more powerful PCIe 3.0 and PCIe 4.0 SSD. Large-capacity SSDs with PCIe bus will be the main form of automotive storage under zonal architectures in the future.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...