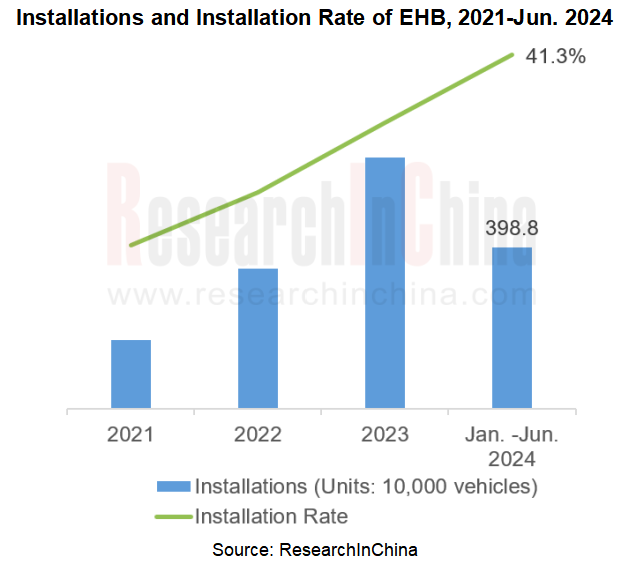

1. EHB penetration rate exceeded 40% in 2024H1 and is expected to overshoot 50% within the year

In 2024H1, the installations of electro-hydraulic brake (EHB) approached 4 million units, a year-on-year increase of 101%; the installation rate exceeded 40%, up 19.9 percentage points compared with the same period last year, the EHB market has kept prosper.

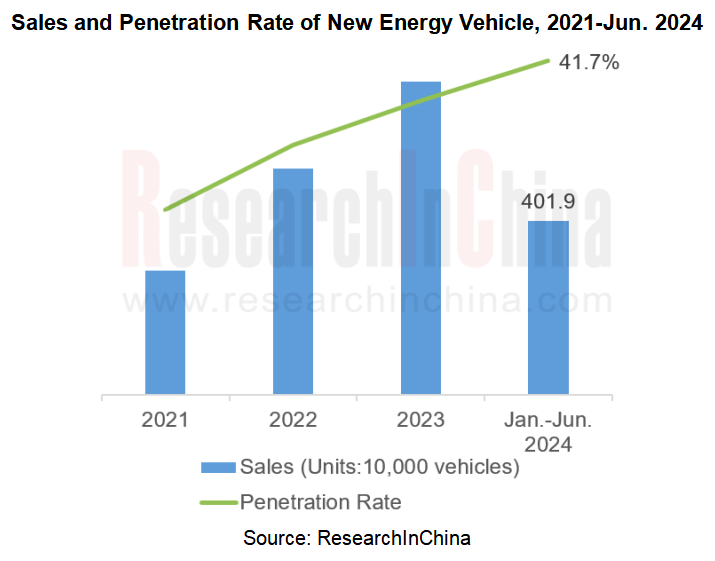

The hot brake-by-wire market is largely driven by the new energy market. Brake-by-wire meets a series of requirements of new energy vehicles, such as no vacuum power source, high requirements for system response speed, and brake energy recovery. The following figure shows the sales and penetration rate of new energy vehicles from 2021 to June 2024. From the data, the growth trend of brake-by-wire installations and installation rate is highly consistent with that of new energy vehicle sales and penetration rate.

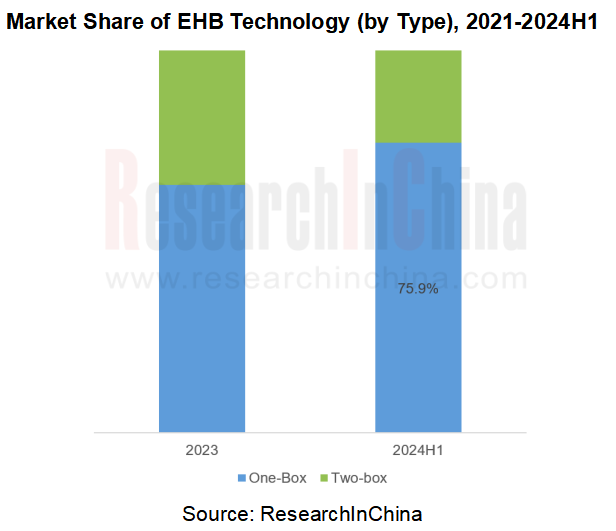

From the perspective of EHB technology classification, the share of One-Box has further expanded. In 2024H1, the share of One-Box increased to 75.9%, an increase of 17.4 percentage points from the same period last year.

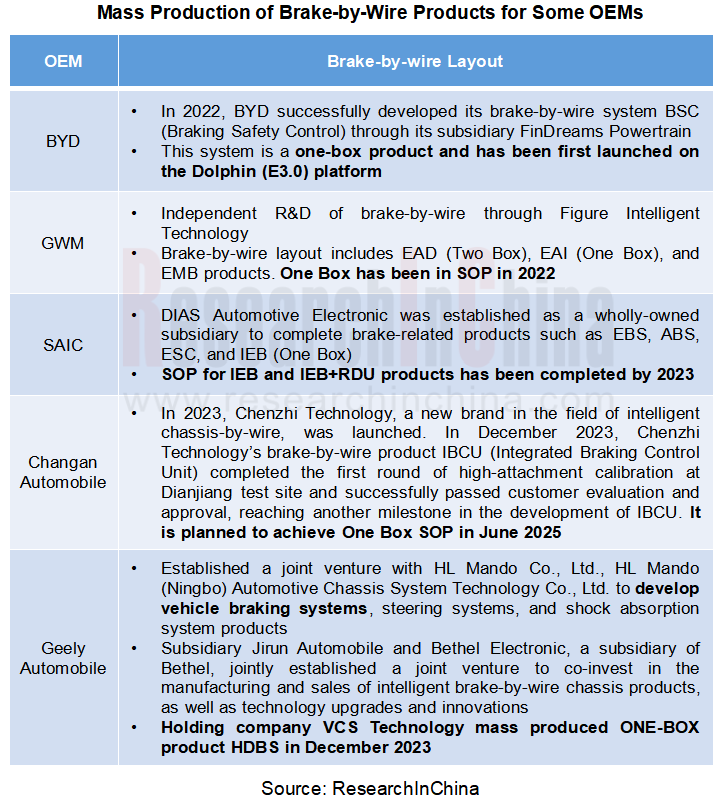

2. Some OEMs have taken the lead in completing the layout of brake-by-wire industry chain

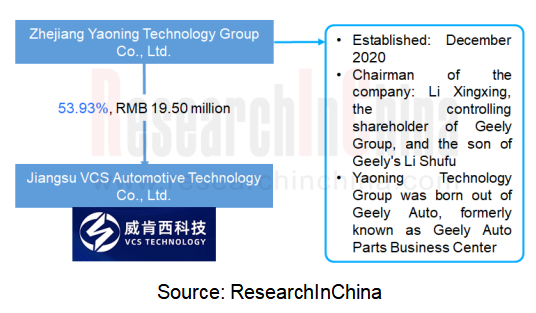

Some OEMs, mainly Chinese independent brands, have entered the brake-by-wire market by setting up subsidiaries or joint ventures with other manufacturers. By 2024, many OEMs have completed mass production of brake-by-wire products.

Geely - VCS Technology

Founded in May 2022, VCS Technology focuses on the R&D and production of 3 core chassis systems, namely brake-by-wire, steer-by-wire and suspension-by-wire, as well as chassis domain controllers.

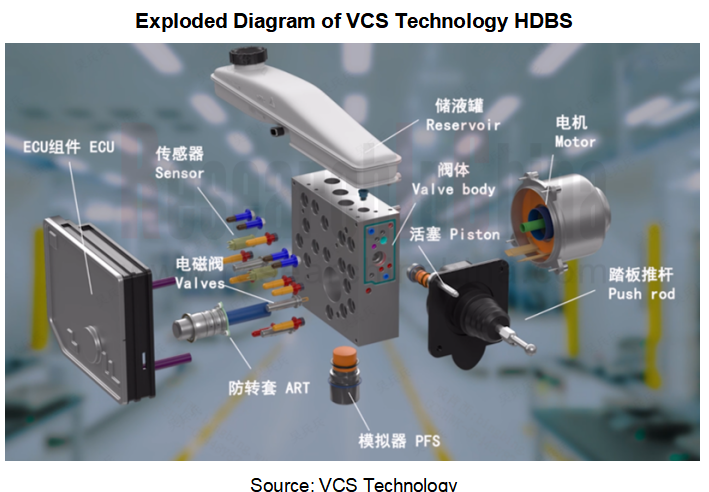

In December 2023, VCS Technology's One-Box product HDBS was mass-produced and rolled off the production line, with an expected annual output of 600,000 sets. The system can realize brake assist, conventional ESC functions and intelligent driver assist functions, and the response time can reach within 150ms. Its application range can cover fuel, all-electric and hybrid models, and can also be applied to some light commercial vehicles. It is reported that VCS Technology HDBS will be the first to be equipped on Geely brands after mass production.

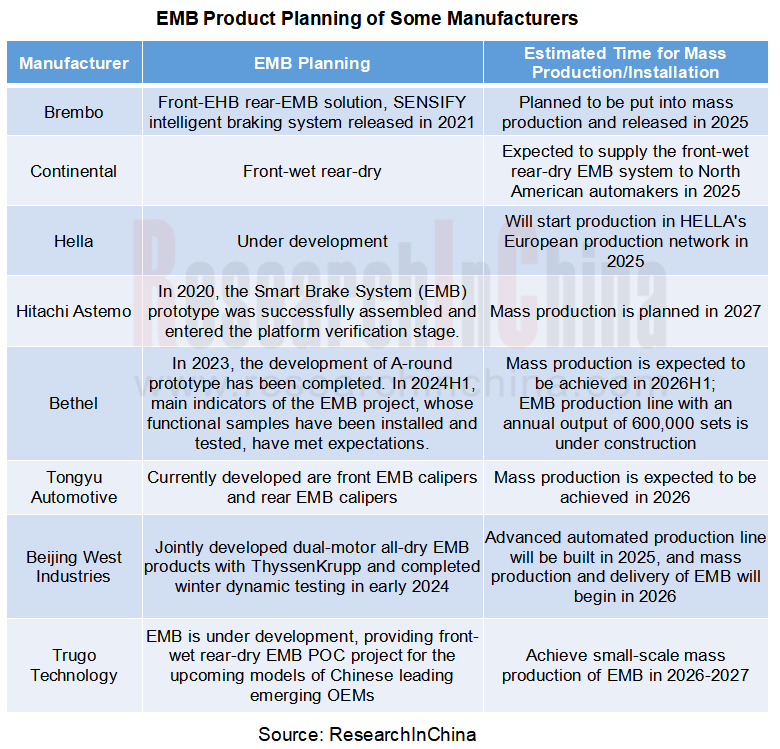

3. EMB expects to achieve small-scale mass production by 2026 at the latest

It is an industry consensus that EMB is truly brake-by-wire. Although the research history of EMB system has been more than 20 years, it is difficult to overcome a series of technical problems such as "high requirements for motors, no fail-safe backup braking function, and high cost", and EMB system has not been applied in large quantities so far. However, in recent years, Chinese and foreign manufacturers have made great progress in EMB research and development. According to the plans of various manufacturers, it is expected that EMB will be able to achieve small-scale mass production by 2026 at the latest.

Beijing West Industries (BWI)'S EMB will be mass-produced in 2026, with the first batch to be launched in Kaiyi Auto and U POWER

In July 2024, BWI released the "2035 Full X-by-wire" global technology strategy, which mentioned that BWI's electronic mechanical braking system (EMB) has obtained strategic cooperation with Kaiyi Automobile and U POWER, and will be mass-produced for customers in 2026. Its product features include:

BWI's EMB system integrates ABS, ESC, TCS, ACC, etc. The self-developed dual-motor EMB system dramatically accelerates the response speed, and the wheel locking time is as short as 75ms. Four-wheel independent control maximizes braking stability.

Without servo mechanism or ESC module, BWI EMB realizes truly x-by-wire. The system is completely free of braking pipe, while left and right rudder structures are unified, reducing space requirements and enhancing the possibility of lightweight and compactness.

Utilizes plug-in electronic structural interfaces, eliminating the need for filling or discharge brake fluid and simplifying the assembly process.

Once finished braking, the BWI EMB system releases calipers instantly, achieving true zero drag, effectively lowering energy consumption and reducing CO2 & particulate matter emissions.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...