Passenger Car Intelligent Chassis Controller and Chassis Domain Controller Research Report, 2024

Chassis controller research: More advanced chassis functions are available in cars, dozens of financing cases occur in one year, and chassis intelligence has a bright future.

The report combs through the development and application of passenger car chassis controllers and chassis domain controllers, and interprets the status quo of the industry from three perspectives: suppliers, OEMs, and capital.

1. From the perspective of the capital market, intelligent chassis has an eye-catching ability to attract capital.

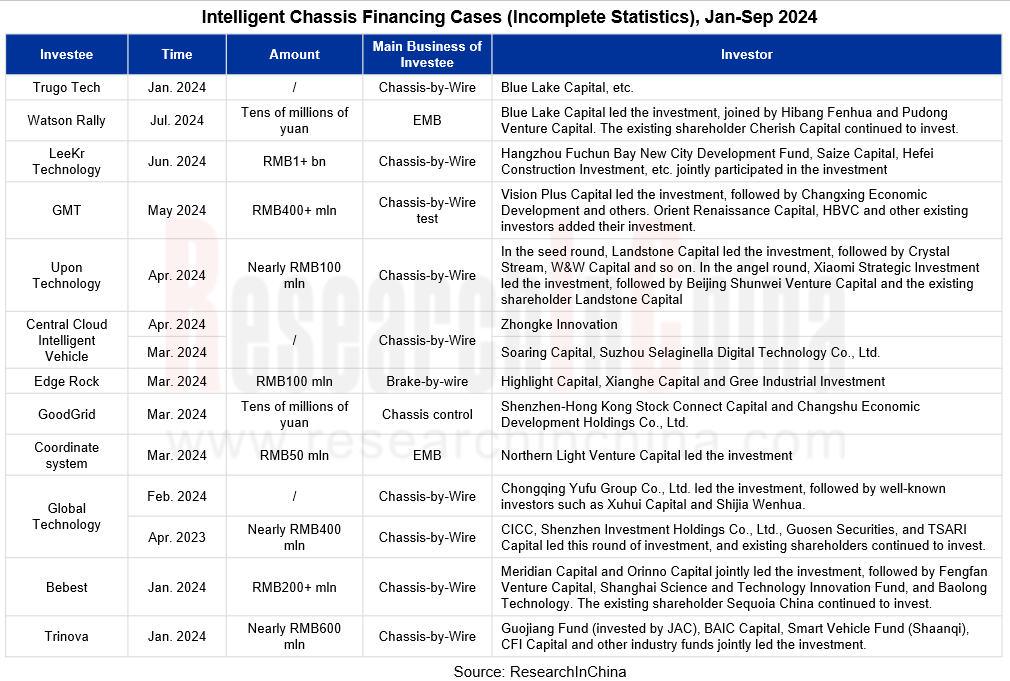

According to incomplete statistics from ResearchInChina, dozens of financing cases have been completed in the field of intelligent chassis in 2024, with the financing amount exceeding RMB3 billion.

For example, Trugo Tech closed a Series B funding round in January 2024, only 6 months away from its A++ funding round, thanks to the capital market's sustained attention to intelligent chassis and Trugo Tech's own technical strength.

It is known that Trugo Tech has supplied over 80,000 ESC products monthly. Based on the mature development experience of ESC, Trugo Tech has deployed EHB and EMB products.

EHB. The product adopts the One-Box technology route and can be matched with <3.2t vehicle models. It integrates more than 30 intelligent functions such as power assist control, coordinated braking energy recovery, wheel anti-lock control and body stability control, and supports multi-sensor fusion. It features pressure build-up in less than 150ms, and the maximum pressure build-up greater than 180bar, and can recover over 90% of energy.

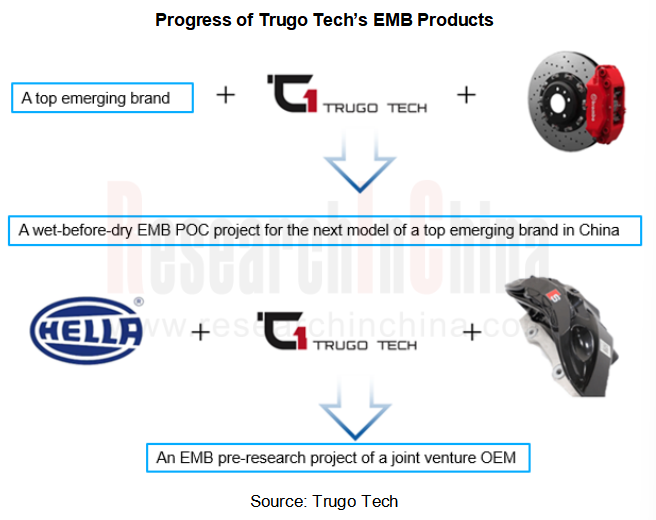

EMB. Starting from actuators and core algorithms, Trugo Tech has started pre-research on dry EMB products and related solutions, providing full dry EMB POC projects for the models to be released by domestic leading emerging OEMs. The EMB products are expected to land on vehicles for testing in 2024, and come into small volume production in 2026.

2. From the perspective of OEMs, some have expanded multiple chassis functions.

NIO 4D Comfort Pilot + Adaptive Suspension Predictive Control Solution

As the first OEM in the industry to install chassis domain controllers on cars, NIO released the Banyan 2.4.0 via OTA in January 2024, adding 4D Comfort Pilot (the horizontal, vertical and longitudinal axes of the body and the time dimension). NIO claims that it is "the industry's first intelligent chassis system powered by AI technology". Enabling the functions is inseparable from NIO's intelligent chassis hardware system composed of intelligent chassis controller (ICC), air spring and continuous damping control system (CDC).

4D Comfort Pilot means that the vehicle generates road surface features in advance according to the intelligent driving hardware on the body, and then through real-time or offline big data processing, the features are finally fed back to the chassis domain to adjust the suspension height and damping control strategy in real time to improve driving comfort. The navigation layer of 4D Comfort Pilot can be generated as long as four NIO cars (equipped with air springs + CDC) pass by on a road section. Subsequent NIO cars passing through this road section can confirm the bumpy layer and achieve real-time updates.

Geely's AI digital chassis supports such functions as crab walk mode, tank turn and super magic carpet.

In April 2024, Geely released an AI digital chassis based on the GEA. The self-developed chassis integrates domain controllers and is equipped with steer-by-wire, brake-by-wire, active suspension and four-wheel motor system, supporting three-way (XYZ), six-degree-of-freedom intelligent decision. Supported by the above hardware and Geely's AI algorithm control system, the AI ??digital chassis can enable the following intelligent chassis functions:

Crab walk mode (front and rear wheels roll in the same direction)

Tank turn

Super magic carpet (active suspension adjustment)

"Zero" impact when passing over bumps (real-time perception of road information; tire height adjusted by the suspension actively)

Automatic adjustment for wading (the front suspension is automatically lifted before wading, and the suspension height is adjusted in real time during wading)

Side active defense (when there is a risk of a side collision, one side of the body will quickly rise to reduce the damage caused by the collision)

Geely's AI digital chassis makes a reaction in just 4 milliseconds (25 times faster than the human extreme reaction), enabling "automatic vehicle control for risk avoidance" in extreme conditions. It is known that Geely's AI digital chassis will be mass-produced and installed in Geely Galaxy, Lynk & Co and other products by 2025 at the latest.

3. From the prospective of suppliers, some OEMs in China have made significant progress in chassis domain controllers in 2024.

In research and development of cooperative intelligent chassis controllers, foreign players benefit from their technical expertise and first-mover advantages in traditional automobiles. Some foreign suppliers already have some mature products, such as Bosch's integrated vehicle dynamic control system and ZF's cubiX chassis integrated controller. Chinese parts suppliers have started R&D of cooperative intelligent chassis controllers since 2000, and quickened their pace in recent years, gradually narrowing the gap with international giants.

Currently, there are three main types of players in China that are developing chassis domain controllers:

First, companies that focus on chassis domain controllers, such as MXD. They can provide full-stack services from hardware platforms to application layer, but they have a short history and limited development capital reserve.

Second, Chinese chassis suppliers that deploy one or more components for brake-by-wire, steer-by-wire or suspension-by-wire. They have mature chassis development experience and have initially achieved mass production of actuators. Representatives including Global Technology, Tongyu Automobile and Trinova often have profound technical expertise in a single actuator, but still face obstacles in horizontal expansion for domain control solutions.

Third, traditional automotive electronics companies represented by Jingwei Hirain. They often have mature development experience in domain controllers. For example, Jingwei Hirain has deployed products in the body domain, driving domain, and chassis domain, and participated in the R&D and supply of chassis domain controllers for NIO, with certain mass production experience.

MXD

In April 2024, MXD debuted at the Auto China with VCC 1.0, its first-generation Lingkong Series chassis domain controller which integrates CDC, ECAS, EPB and onboard IMU and realizes the function of dual-control EPB through the EPB module. It is known that VCC 1.0 has been designated by JAC.

In July 2024, MXD announced that it would integrate its self-developed rear wheel steering control on the first-generation chassis domain controller, providing the market with VCC 1.5, a new chassis controller with software and hardware decoupled.

Tongyu Automotive

In July 2024, Mr. Shu Qiang, founder, chairman and general manager, said that Tongyu Automotive had released its first-generation chassis domain controller which can enable integrate control of braking, steering, suspension, parking, driving and other systems, and decouple the high-level functional algorithms related to vehicle dynamic performance in the original components (VDC, TCS, etc.) from the braking system and place them in the chassis domain controller instead. In addition, the solution supports dual MCU redundancy and integrates a combined positioning module. The two MCUs and CAN form vehicle architecture ring network redundancy. In terms of hardware redundancy, key power supplies, sensors, actuators, and communications are redundant.

As early as March 2024, Tongyu Automotive formed a partnership with C*Core Technology. They will create a localized automotive electronic chassis-by-wire controller solution.

Jingwei Hirain

In June 2022, NIO announced China's first full-stack self-developed suspension control system equipped with a full-stack self-developed intelligent chassis controller (ICC). It was first available to the production vehicle ET7. Jingwei Hirain participated in the R&D and production of this domain controller.

In February 2024, Jingwei Hirain started mass production of its full-stack self-developed chassis domain controller. So far, it has mass-produced controllers, underlying software, air springs, suspension algorithm modules, and realized functions such as welcoming and seeing off, active prediction, and magic carpet suspension. Jingwei Hirain’s full-stack self-developed chassis domain controller has the following features:

It integrates damping control, air spring height control and other functions, and simplifies the chassis control system

It can also integrate rear wheel steering, electronic stabilizer bars, steering column position control, engine mounting, etc.

In the combination with intelligent actuators, the chassis domain controller with enough computing power reserved can integrate longitudinal, lateral and vertical control functions of vehicles, such as steering, braking and suspension to perform high-level cooperative chassis control and vehicle motion trajectory control.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...