China Passenger Car Highway & Urban NOA (Navigate on Autopilot) Research Report, 2024

NOA industry research: seven trends in the development of passenger car NOA

In recent years, the development path of autonomous driving technology has gradually become clear, and the industry is accelerating from L2 to L2.5/L2.9 and even L3. In this process, promoting popularization of Highway NOA and rapid development of Urban NOA has become a consensus of entire industry. Since 2023H2, the market competition for Urban NOA has become increasingly fierce. Major OEMs have accelerated the implementation of Urban NOA technology and gradually disclosed their development plans. Since 2023Q3, the development of passenger car NOA has entered the second half stage. Many automakers have actively deployed and used end-to-end foundation models and map-free solutions to promote the development of national intelligent driving into a new stage.

Currently, passenger car NOA faces the following evolution trends:

Trend 1: Highway NOA and Urban NOA penetration rates continue to increase

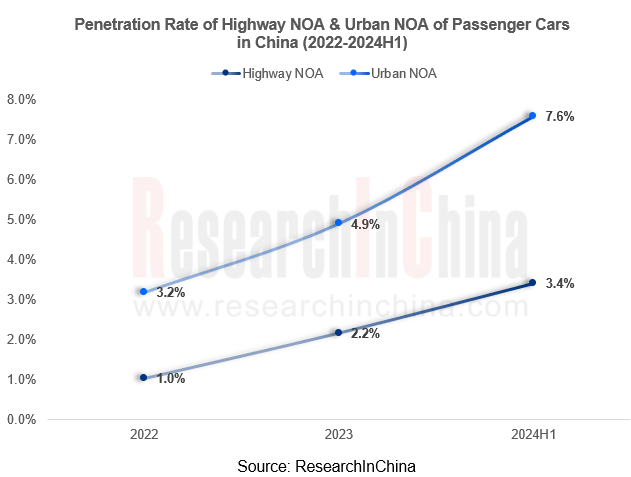

Since Tesla first introduced Highway NOA to China in 2019, it has been rapidly implemented in 2022 and has now covered many domestic independent and joint venture brands. By the end of 2023, sales volume of domestic ADAS passenger cars with L2.5 and above reached 1.484 million, with a penetration rate of 7.1%, of which sales increased by 78.3% year-on-year.

By the end of 2024H1, sales volume of domestic new passenger cars with L2.5 and above ADAS models was 1.06 million, with a penetration rate of 11%; among them, sales volume of Highway NOA models was 328,000, with a penetration rate of 3.4% (excluding models with both Highway NOA and Urban NOA functions). Sales volume of Urban NOA models was 732,000, with a penetration rate of 7.6%.

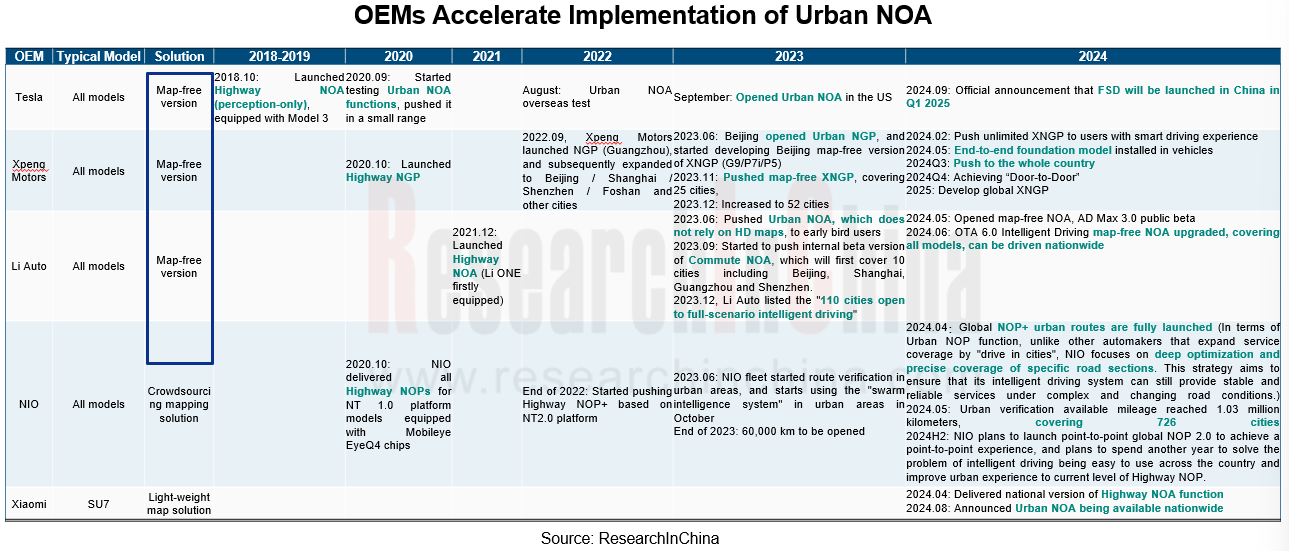

Trend 2: Urban NOA entering an arms race in 2023~2024

Led by OEMs such as Tesla, NIO/Xpeng Motors/Li Auto, and Huawei System, major domestic OEMs and solution providers have all moved towards Urban NOA, some of which have begun to installed in vehicles in 2023. From 2023 to 2024, Urban NOA enters an arms race, and many OEMs have successfully mass-produced L2.9.

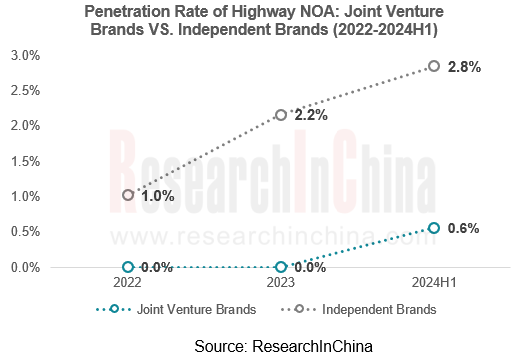

Trend 3: Since 2023, joint venture OEMs have accelerated their follow-up of Highway NOA

From the perspective of OEM type, in 2022, Highway NOA enterprises concentrated in local market, and no foreign capital has entered. Since 2023, joint venture OEMs have begun to accelerate their follow-up of Highway NOA. As of 2024H1, sales of joint venture OEM Highway NOA models in China reached 54,000 units, with a penetration rate of 0.6%. From 2022 to 2024H1, the sales and penetration rate of independent OEM Highway NOA models continued to rise. By the end of 2023, its sales had reached 454,000 units, a year-on-year increase of 124.5%; the penetration rate reached 2.2%, an increase of 1.2 percentage points year-on-year. In 2024H1, its sales reached 275,000 units, with a penetration rate of 2.8%.

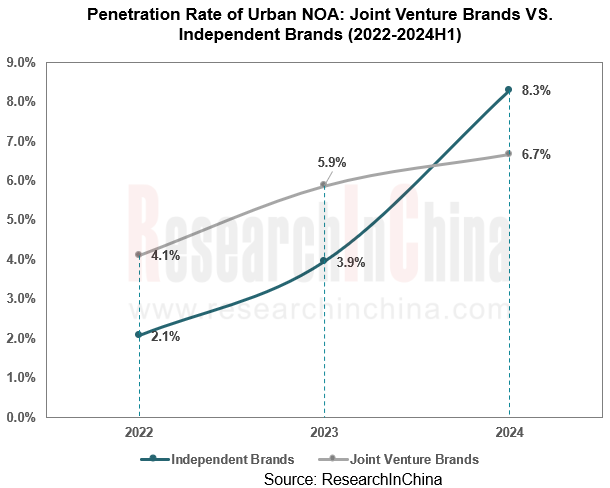

In 2023, sales volume of joint venture brand Urban NOA was 604,000 units, with a penetration rate of 5.9%, up 1.8 percentage points year-on-year; sales volume of independent brand models was 423,000 units, with a penetration rate of 3.9%, up 1.8 percentage points year-on-year. From 2023 to 2024H1, the penetration rate of independent brand Urban NOA models further accelerated. As of 2024H1, the sales penetration rate of independent brand Urban NOA increased from 3.9% at the end of 2023 to 8.3%. This trend shows the rapid layout of many independent brands in intelligent driving field and the increasing acceptance of domestic consumers for L2.9 ADAS products.

Trend 4: L2.9 and L2.5 are accelerating their penetration into the mid- and low-end markets, and the era of technological equality is quietly approaching.

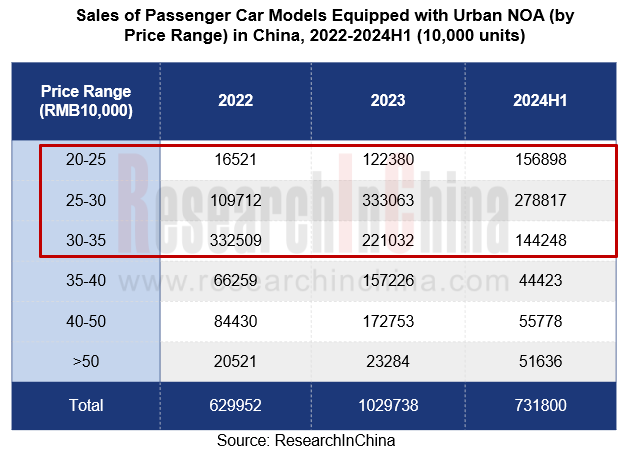

From the perspective of price, Urban NOA functions have grown most significantly in models priced at 200,000-300,000 yuan. In 2024H1, especially in the "200,000-250,000 yuan" market segment, Urban NOA's installation volume grew fastest, and the era of technological equality has quietly arrived. This trend shows that in 2024, ADAS technology is accelerating its penetration into mid- and low-end markets, gradually becoming popular, and becoming a standard configuration for future daily family cars.

In the field of Highway NOA, L2.5 has been extended to models in two price ranges of "100,000-150,000 yuan" and "150,000-200,000 yuan". According to ResearchInChina data, penetration rate of domestic passenger car Highway NOA models priced at "100,000-150,000 yuan" and "150,000-200,000 yuan" increased from 0.02% and 0.29% at the end of 2023 to 0.08% and 1.39% in 2024H1, respectively. Taking the iCAR03 Family, a new energy electric brand under Chery Group, as an example, on June 12, 2024, iCAR 03 launched two new intelligent driving versions with an official price of 149,800 yuan and 159,800 yuan. iCAR 03 Intelligent Driving belongs to the L2.5 and has Highway NOA functions.

Trend 5: The first year of map-free Urban NOA has arrived, and many OEMs have launched national intelligent driving solutions without HD maps

At present, the debate around "map-free" technology route has also risen to an unprecedented height, and getting rid of HD maps has begun to become a key R&D direction of more and more Chinese companies. Among many domestic OEMs, OEMs that have adopted map-free NOA solutions include but are not limited to: Li Auto, Xpeng Motors, Huawei System, GAC, Great Wall Motor, Zeekr, etc., and Xiaomi adopts the low-weight map solution. Taking Huawei as an example, the NCA (Navigation Cruise Assist) system launched by Huawei in December last year does not require HD maps and covers all types of public roads across China. Based on ADS2.0 platform, the system integrates BEV and GOD networks to improve road analysis capabilities. In 2024, Huawei released Qiankun ADS3.0 system, which makes driving behavior more humanized through bionic neural networks and AI algorithms. In May 2024, Xpeng Motors announced that XNGP has achieved 100% map-free, and in cities and counties, core sections will be opened first to ensure the continuity of user experience. Even in areas without HD maps, through the combination of "navigation map + XNet perception capability + driving strategy", XNGP's functional performance is close to that in areas with HD maps.

Trend 6: End-to-end foundation models are being adopted in vehicles to help upgrade intelligent driving

In 2024, emerging OEMs announced that their self-developed foundation model would be applied to vehicles. Introduction of foundation model made the system more accurate and efficient in dealing with complex environments and dynamic changes. Through deep learning and real-time data processing, the foundation model can analyze road conditions in real time, make intelligent decisions, and provide drivers with a safer and more reliable driving experience. With the promotion of this solution, autonomous driving systems can be more widely used nationwide, improving driving flexibility and adaptability.

Li Auto believes that it is not possible to achieve autonomous driving above L4 by relying solely on One Model end-to-end. It proposed a new solution: "System 1 + System 2", namely, E2E (end-to-end foundation model) + VLM (visual language model). Currently, System 1 is in the "second generation: map-free, segmented end-to-end", which consists of two models, namely perception and planning. The biggest change is the removal of NPN, which does not rely on prior information. This generation of technology allows Li Auto to truly be able to drive across the country and can be driven with navigation only.

Trend 7: Vision-only perception route is regarded as one of new directions of technological development by more Chinese OEMs

In the evolution of Chinese intelligent driving technology, core technology architecture of the first half is highly dependent on LiDAR and HD map. This mode ensures the stability and safety of autonomous driving functions through complex sensor fusion technology and support of geographic information systems, especially in real-time updating and precise matching of HD maps.

As the second half of intelligent driving competition begins, the technical routes are showing a diversified development trend, which can be mainly divided into two categories:

The first technical route, represented by Huawei, adopts the strategy of "LiDAR multi-fusion perception + map-free solution/lightweight map solution + end-to-end foundation model". Under this framework, LiDAR provides high-precision perception data, combined with map-free or lightweight map solutions, reducing the system's dependence on HD maps. Meanwhile, the application of end-to-end foundation model further enhances system's autonomous learning and decision capabilities, making the autonomous driving system more flexible and reliable in complex environments.

The second technical route, represented by Tesla, Xpeng Motors, Jiyue, etc., mainly adopts the technical combination of "vision-only + map-free solution / HD map + end-to-end foundation model". In August 2024 , Xpeng Motors officially launched the AI Eagle Eye Vision Solution, which is a high-level intelligent driving solution with light radar (LiDAR has changed from mandatory to optional in L3). The first model equipped with AI Eagle Eye Vision Solution is the P7+, which will be officially launched in Q4.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...