Automotive audio systems in 2024: intensified stacking, and involution on number of hardware and software tuning

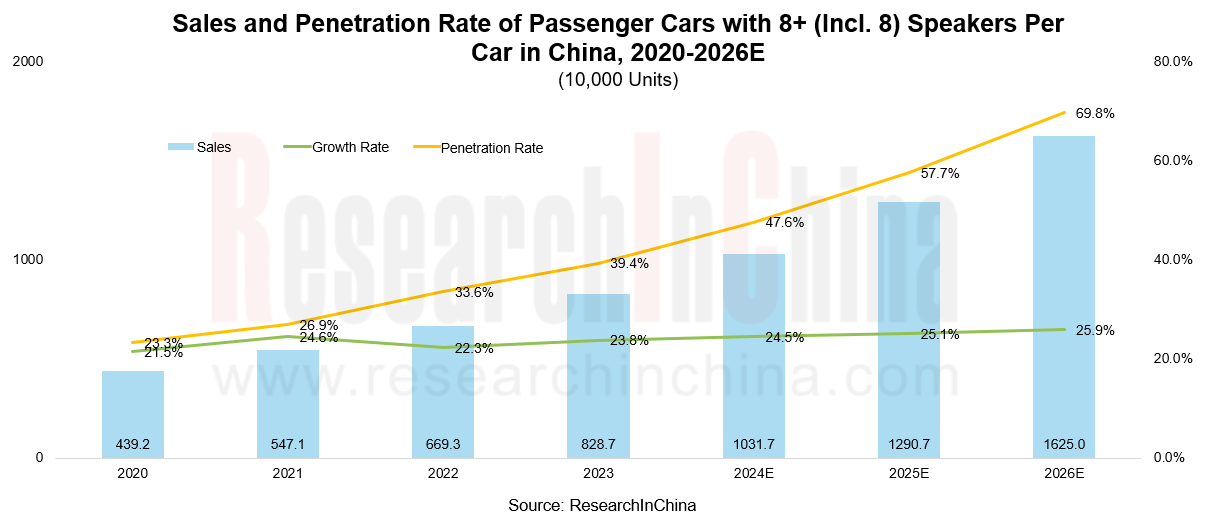

Sales of vehicle models equipped with more than 8 speakers have made steady growth.

In 2024, the automotive audio market makes steady growth. In the case of models equipped with at least 8 speakers, the annual sales of such models in 2023 were 8.287 million units, with a penetration rate of 39.4%; the sales from January to July 2024 reached 5.419 million units, with a penetration rate of 47.5%. It is expected to sustain growth rate of about 24% in the next two years, and will be up to about 16.25 million units in 2026.

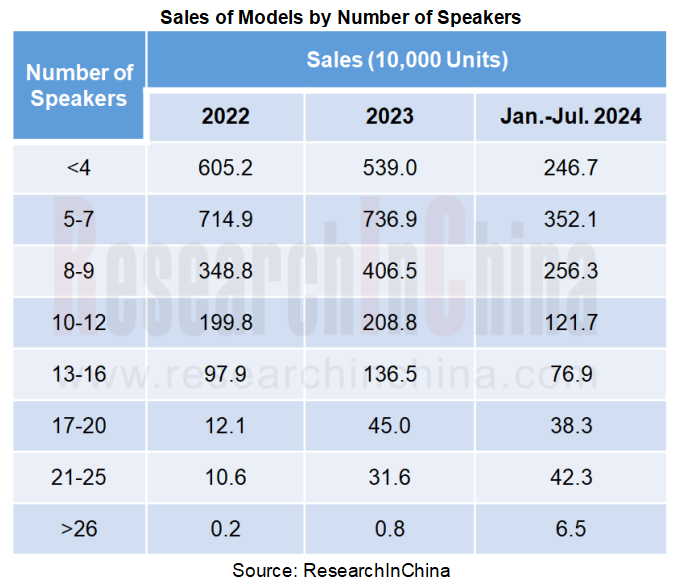

From 2022 to July 2024 the sales of models by number of speakers are shown below. Overall, the sales of models with more speakers were on the rise year on year.

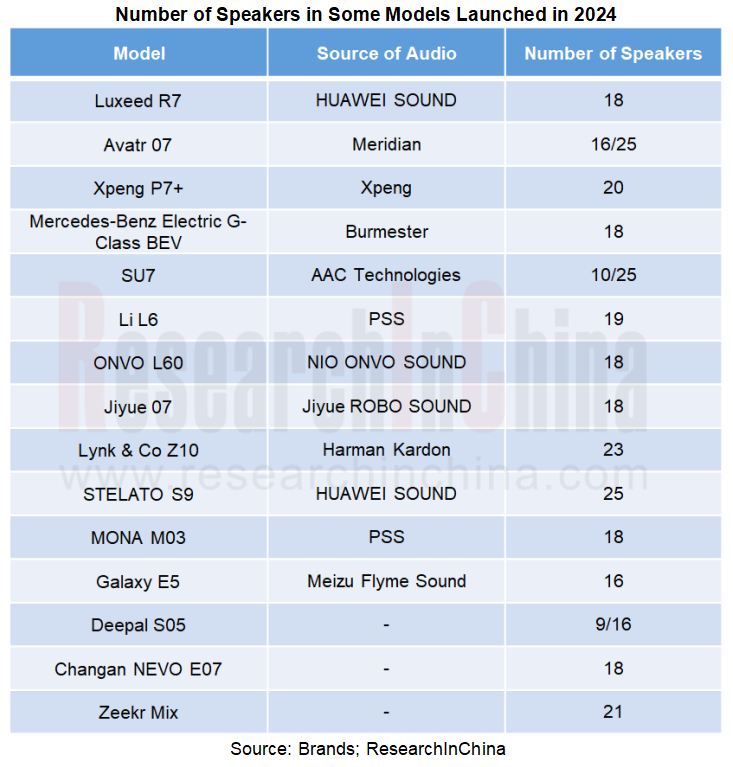

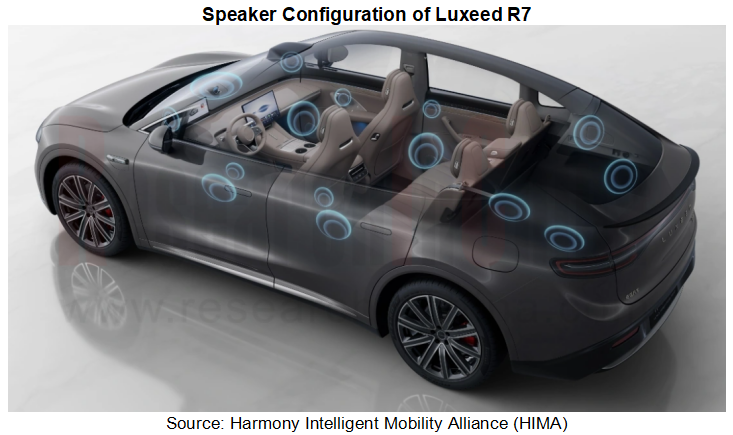

Luxeed R7

Luxeed R7 packs Huawei's HUAWEI SOUND audio system. Of the 17 speakers arranged inside the car, 15 constitute a 7.1 surround sound field, and combined with the star ring diffusor (equipped with Schroeder diffusor technology, achieving 180° full-angle sound diffusion and balanced sound field performance) and the unique turbo subwoofer, enable stronger low-frequency dive in a smaller volume; 1 speaker is deployed outside the car, and used to play specific sound effects.

ONVO L60

ONVO L60's intelligent cockpit is equipped with a 1000W ONVO SOUND audio system with 18 speakers. It supports 7.1.14 Dolby Atmos, can be linked with the 16-million-color ring cabin waterfall ambient lights, and allows for generation of an exclusive tuning equalizer via AI algorithms.

OEMs deeply self-develop audio systems, and the share of audio brands remains unchanged.

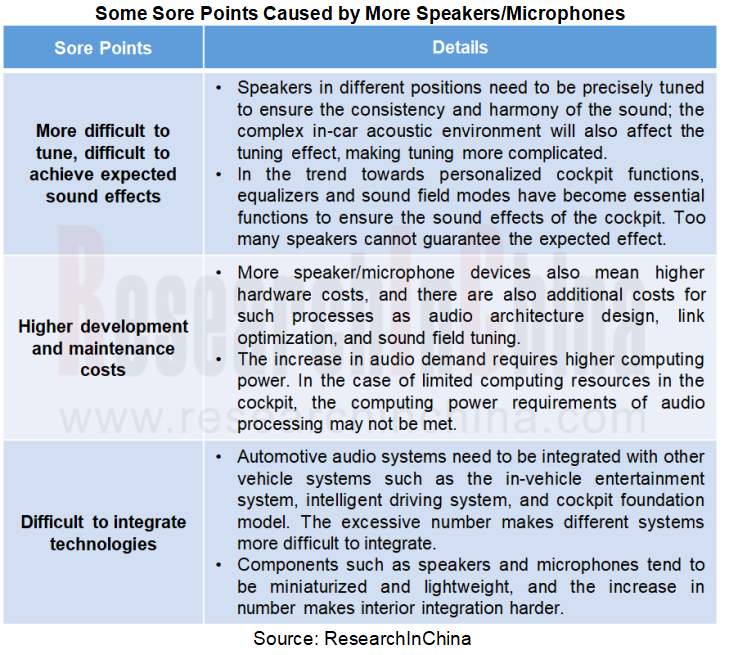

The more speakers and microphones not only means more hardware devices, but also involves a range of tasks such as reconstruction of the sound field, redesign of the audio architecture, and readjustment of the software tuning function. If all of the work is outsourced to suppliers, the total development cost will increase.

To control costs, OEMs have further deepened independent R&D of audio systems. Some of them directly purchase key components, leverage the advantages of the supply chain, and independently design and manufacture speakers, achieving self-development of audio systems, involving audio architecture design, solution integration, device manufacturing, and sound effect adjustment.

Xpeng

In Xpeng’s case, the audio systems of both X9 and P7+ are self-developed. Wherein, Xpeng X9 carries 23 self-developed Xopera speakers, providing key sound source locations in four sound fields (front, center front, center, and rear) for selection in the sound field mode, and different riding modes support dynamic adjustment.

For P7+, Xpeng uses speaker diaphragms imported from Germany and independently designs the 20-speaker solution. In the development process, it completed a range of tasks, for example, 1,500+ user listening preference surveys, 100+ speaker diaphragm modulations, 40+ rounds of audio tuning optimization, and 20+ rounds of blind listening tests with cross-level luxury models. The audio solution supports 7.1.4 Dolby Atmos and provides 3 tuning styles and 9-band equalizers for car owners to choose from.

Jiyue

Jiyue 01 and 07 are both equipped with the self-developed Robo Sound audio system. Jiyue 01 bears 16 speakers, supports 7.1.2 Dolby Atmos decoding, and the peak power of amplifiers is 1000W. Jiyue 07 is equipped with 18 speakers, and 16-channel independent amplifiers, and adopts 7.1.2 speaker layout with sky channels, which can bring 360-degree surround effects.

BYD

BYD adopts different speaker configuration strategies according to vehicle orientation:

Low-to-mid-end models such as Qin Series pack self-developed speakers;

High-end models (including some mid-end models) use branded speakers, for example, Dynaudio (supply to Han, Song L, Seal, Yangwang U8, etc.), Devialet (supply to Bao 5), and Infinity (supply to Song PLUS NEV).

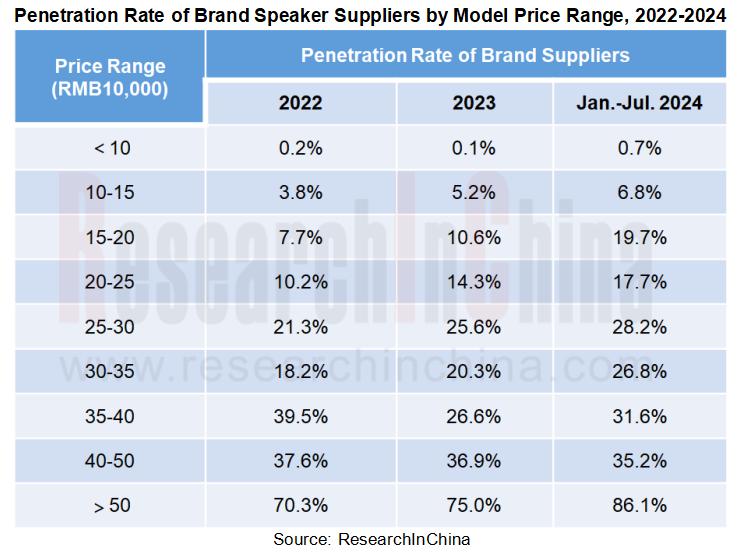

How much impact do OEMs’ self-developed audio solutions have on the market share of audio brands?

According to the data from ResearchInChina, from 2022 to July 2024, except for the model price range of RMB350,000-500,000, the penetration rate of brand suppliers in other price ranges didn’t decrease, but rose steadily. It can be seen that brand suppliers still firmly dominate the market of audio systems for mid-to-high-end models, and are not affected by the model of "some OEMs self-developing audio systems".

While OEMs are working on in-depth self-development of audio systems, brand speaker suppliers are also optimizing automotive acoustic technology.

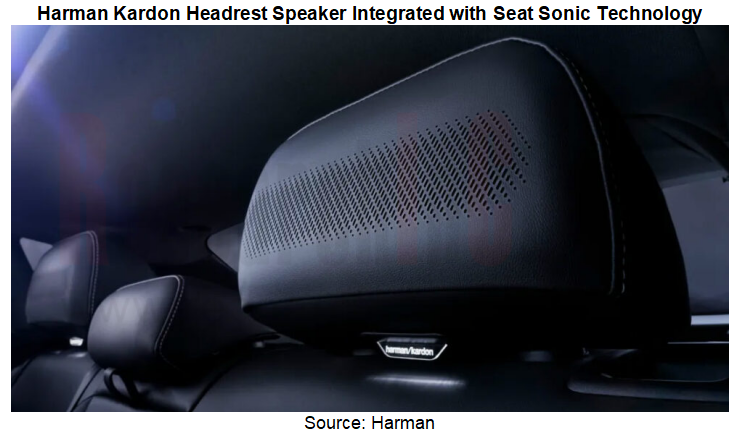

Harman

In 2024, Harman announced Seat Sonic, a technology which aims to enhance in-car entertainment by integrating sound into seats. The technology moves hardware components from the doors to the seats, reducing design complexity, and uses vibration sensors embedded in the seats to convert audio signals into vibrations, thereby improving the sound field effect in the cabin.

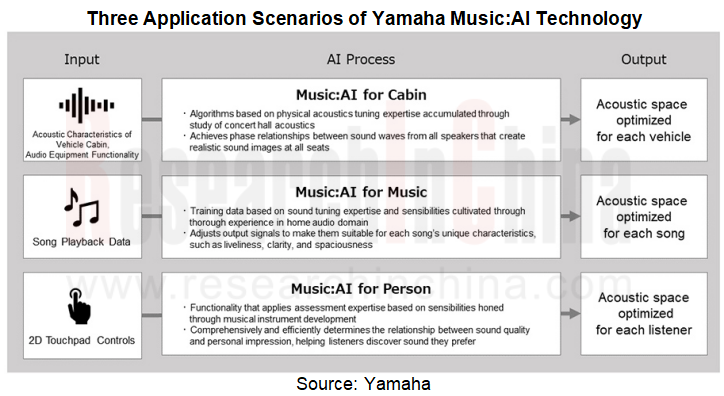

Yamaha

In 2024, Yamaha unveiled Music:AI, a technology which uses AI algorithms to automatically optimize acoustic parameters such as dynamic effect, transparency and volume. The technology is scheduled to come into mass production in 2025 and be promoted globally.

More speakers are not always better, and tuning technology is a way to improve sound effects.

In 2024, the audio system has begun to be deeply integrated with various functions of intelligent cockpits, such as music recommendation and audio-visual linkage. AI algorithms and models allow the sound effect mode to be automatically adjusted according to the user's preferences and the current environment, providing users with more intimate and personalized services. Multi-channel audio systems find broader application, including more ceiling speakers and subwoofer configurations, to achieve better 3D sound effects. To ensure user experience, more speakers in an automotive audio system are inevitable, so are the more speakers and microphones in a car audio system, the better?

ResearchInChina’s research shows that after speakers in a car reach a number, blindly adding speakers will not only increase hardware costs, but will also have a very limited effect in improving in-car sound effect. It will also have some impact on audio architecture design and sound field layout.

In involution on increasing the number of hardware, in 2024 OEMs pay ever more attention to tuning technologies that can optimize acoustic effects, and cooperate with established tuning suppliers or use AI technologies (such as foundation models) for tuning.

Great Wall

In April 2024, Great Wall Motor cooperated with Dirac, a Swedish digital audio tuning supplier, to equip WEY Blue Mountain Intelligent Driving Edition with "Dirac Virtuo Professional". Based on sound separation technology, this technology decodes the spatial information contained in ordinary stereo music, re-positions the spatial dynamics and remixes it, and then allows the more than 20 speakers in the car to play it in the corresponding locations according to the spatial layout. This technology lets the narrow sound movement trajectory originally limited by dual channels extend to the entire cabin space, thereby achieving 100% conversion of audio contents, and enabling all types of sound sources to have a three-dimensional sense of space.

Geely

In May 2024, Geely and Flyme Sound Inside jointly released the AI-powered intelligent audio system - "Flyme Sound". The system supports 9.1.6 channels and panoramic surround sound. The entire architecture design can accommodate up to 27 speakers, and uses AI algorithms to enable the audio system with intelligent optimization capabilities. It can automatically optimize the sound field distribution, intelligently match the sound effects, and automatically switch virtual venues according to the in-car space, the number of passengers, what to play, etc., in a bid to ensure that every location is the best for listening.

This technology is first installed on Galaxy E5. It is equipped with a total of 16 speakers, including 2 headrest speakers with 4 modes, and can simulate 4 mixing effects and support WANOS panoramic sound.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...