Research on in-vehicle payment and ETC: analysis on three major application scenarios of in-vehicle payment

In-vehicle payment refers to users selecting and purchasing goods or services in the car and completing the payment in vehicles. The application scenarios are mainly divided into three categories: function subscription, in-vehicle shopping, and in-vehicle ETC.

Function subscription: Users can purchase function packages such as seat heating, parking assistance, sign recognition, and lane change warning through IVI.

In-vehicle shopping: Users purchase or pay for parking, refueling, charging, car washing, or road/bridge tolls, or purchase items , such as movies, music, games, etc. from the automotive mall via IVI.

Automotive ETC: ETC automatically pays highway tolls, parking fees, etc.

With the diversification of automotive ecological services, the increase of in-vehicle consumption entrances, and the expanding application scenarios of in-vehicle payment, smart cars are expected to become the next generation of "mobile wallets" after mobile phones.

1. OEMs strengthen the layout of on-demand subscription services

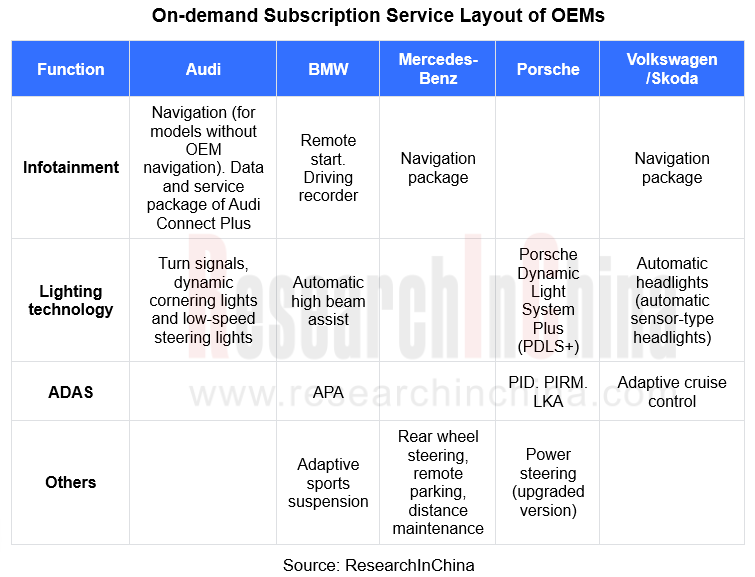

With the improvement of vehicle OTA capabilities, the smart car business model has changed from traditional new car sales to a combination of "hardware + software", and function subscription has become a major part of the layout of OEMs. Audi, BMW, Mercedes-Benz, etc. have launched rich subscription packages to expand functions in infotainment, ADAS, lighting and other scenarios.

Subscription services have become an important way for OEMs to increase service content and revenue:

Audi accelerated the development and launch of "on-demand subscription" services in 2024. In March 2024, the 2025 Audi A3 in Europe introduced a subscription model for features such as high-beam assist, adaptive cruise control, and the much-talked-about dual-zone climate control.

Mazda launched the Mazda Connected Services in September 2024. Car owners can enjoy things like remote keyless entry and vehicle status reports for US$10/month or US$120/year.

Tesla says it will launch its "Full Self Driving" driver assistance product in Europe and China in Q1 2025. The subscription price in China is expected to be US$98/month, or approximately RMB711/month.

General Motors aims to turbocharge its non-vehicle revenue by introducing dozens of new fee-based digital features by 2026, including one enabling a car to predict when it will need maintenance, a top executive said on Thursday.

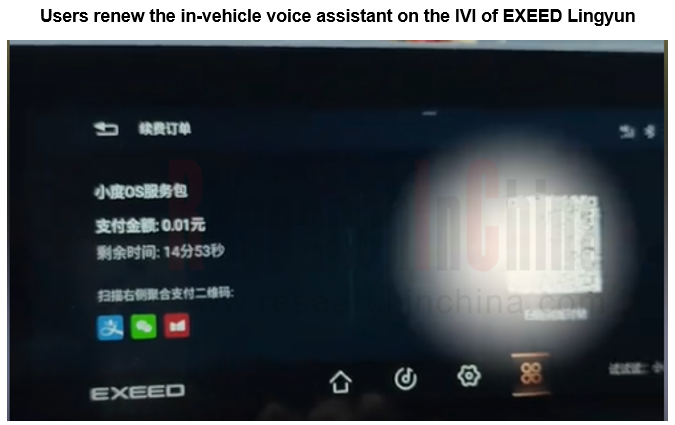

Currently, OEMs’ subscription services can be purchased on IVI, and users can view subscription services on IVI and enter the payment interface. However, in terms of payment methods, payment is mainly made by scanning QR codes with mobile phones, for example, users purchase the high-level function package of ADS on the IVI of AITO M9 or renew the in-vehicle voice assistant on the IVI of EXEED Lingyun.

In-vehicle payment with mobile phones does not truly realize the closed loop of payment in vehicles. To break this deadlock, OEMs have launched IVI-native payment systems. With "Mercedes pay+", Mercedes-Benz customers do not need a mobile phone or even a password. They can purchase subscription services, such as ordering a rear-wheel steering system with a larger steering angle, simply through fingerprint recognition.

2. IVI application stores will expand in-vehicle purchase scenarios

Through rich ecological applications, IVI application stores can not only enhance the personalized and entertaining experience of users, but also attain the scalability of the application ecology and expand in-vehicle purchase and payment scenarios.

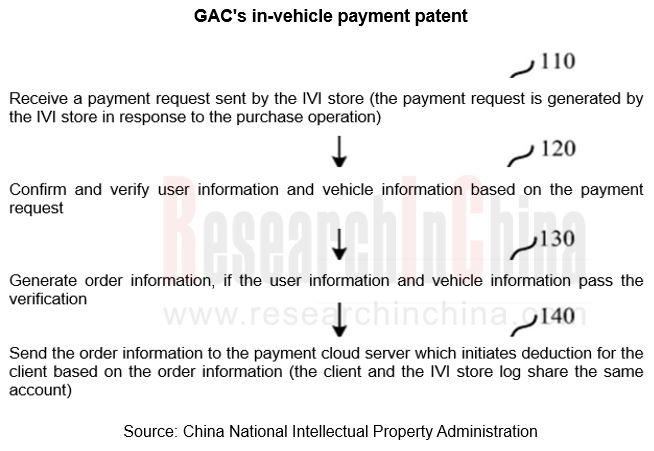

GAC announced a patent for in-vehicle payment based on the App store

In April 2024, GAC announced an in-vehicle App store payment patent - "Method, device, electronic equipment and storage medium for purchasing in-vehicle goods". This patent confirms user information and vehicle information, sends the order to the payment cloud server, and completes the deduction without the user having to scan the QR code on IVI to pay.

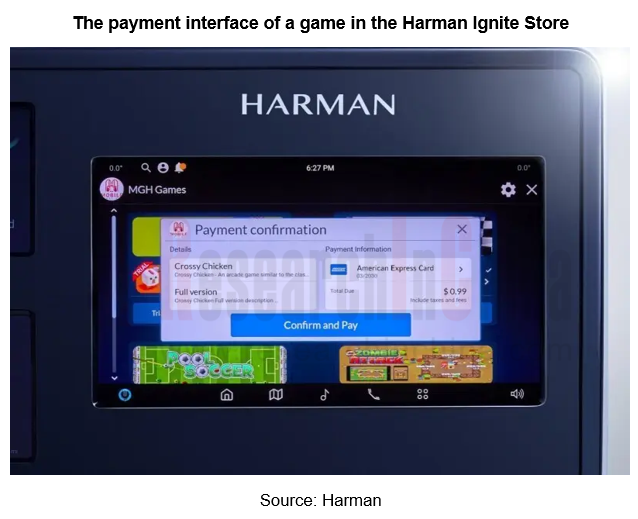

Multiple Apps in the HARMAN Ignite Store support in-vehicle payment

In January 2024, Harman added Harman Ignite Store Payments solution to Harman Ignite Store. The product backed by Samsung Checkout integrates with OEM wallets and supports multiple payment service providers. The Harman Ignite Store allows OEMs to access more than 70 Apps, including:

ChargePoint provides services like searching charging stations, charging and payment while driving.

Vector Unit offers In-vehicle games, so that users can play games such as "Beach Buggy Racing" directly on the automotive display.

Mavi: “Mavi OnMyWay” solution is designed to bring safe, easy, curated shopping to the dashboard of consumers’ favorite connected cars. The solution is available via the Harman Ignite Store connected vehicle platform in vehicles that are equipped with Harman Ignite. It offers a seamless, cross-platform (from home to car) retail experience.

3. The expanded capabilities of AI assistants broaden in-vehicle payment scenarios.

With the combination of AI assistants and foundation models, active interaction capabilities and perception of vehicle sensors are enhanced, giving rise to a large number of in-vehicle payment scenarios. The vehicle can take action in advance before the user makes a request. Especially in some shopping scenes, the vehicle can provide users with full-process services such as demand perception, product selection and payment.

Alipay uses foundation models to provide in-vehicle payment in a pure voice mode

In September 2024, Alipay launched an automotive assistant named "Zhi Xiao Bao" based on the Ant Bailing foundation model. By connecting to the Alipay ecosystem, "Zhi Xiao Bao" can quickly book tickets, order food, hail taxis and the like through a pure voice mode, and can also give personalized advices according to the users' living habits, time and location, for example, it can automatically remind users that their vehicles are running low on power and help them find nearby parking lots and charging stations. In addition, voice-only smart ordering and express delivery are also being planned.

Overall, Zhi Xiao Bao will rely on Alipay's digital cockpit capabilities to complete in-vehicle payment. In terms of the payment process, Zhi Xiao Bao will be connected with the IVI system based on the Alipay account system. Regarding payment scenarios, it will use Alipay's powerful service system to cover more than 8,000 life services. As for payment methods, Zhi Xiao Bao will leverage Alipay’s technology to enable various authentication methods such as password-free payment, face scanning payment, and voiceprint payment.

As of September 2024, Alipay had seen more than 1 billion users registered with real names and more than 300 million car owners, and had certified more than 100 million vehicles. Alipay has carried out in-depth cooperation with BYD, NIO, FAW Toyota, FAW Hongqi, FAW Audi, Xpeng, GAC Honda, FAW Volkswagen, Volvo and other brands. In mid-October, the executive in charge of Alipay stated that a large number of OEMs had expressed interest in Zhi Xiao Bao after its debut in early September.

Huawei Celia actively perceives data such as the fuel level and completes the closed loop payment

The smart refueling function of the in-vehicle smart assistant “Celia” can not only provide car owners with a one-stop refueling service without having to get off cars or queuing, but can also actively perceive data such as the fuel level and vehicle location, and provide a closed-loop payment system of refueling reminders → online payment → one-click issuance of electronic invoices.

During driving, Celia will actively perceive the fuel level and user's refueling habits. When the fuel level is low, it will inform the user of the remaining mileage and remind the user to refuel in time. When the user arrives at the gas station, Celia will ask whether to activate the smart refueling service based on the user's geographic location, allowing the user to quickly find the smart refueling application. During the refueling payment process, the user can select the fuel gun number and fuel number on the IVI screen, enter the refueling amount and pay online, and get an electronic invoice with one click. The user does not need to get off the vehicle during the entire refueling process, which is more convenient and efficient. At the same time, the refueling service under the same Huawei account will be actively pushed to the user's mobile phone under Celia’s suggestion, so that the service can be accessed through multiple entrances. This function is currently available on AITO M7.

4. ETC charging scenarios continue to expand, and ETC-based smart parking, smart refueling, smart charging and other services are launched.

ETC is the earliest in-vehicle payment scenario. The vehicle information recognition and automatic deduction allow car owners to pay easily without any feeling. Driven by ETC-related policies, the number of ETC users has grown rapidly. In 2023, the penetration rate of ETC hit more than 85% in China. It is expected to exceed 90% in 2024.

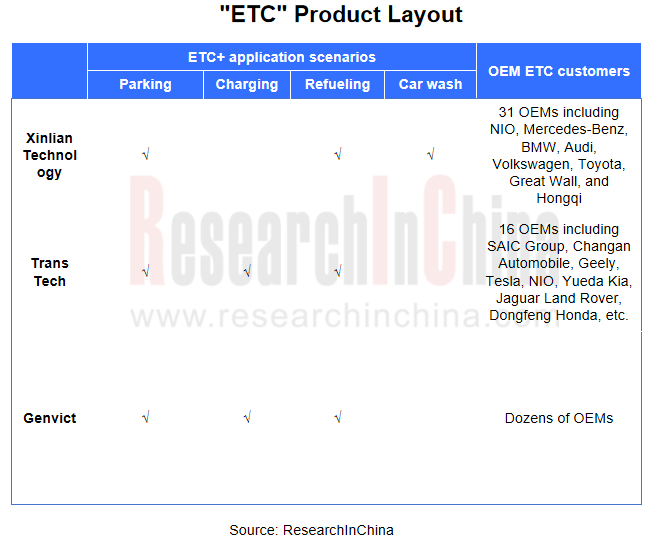

ETC is mainly used in three major scenarios: highways, multi-lane traffic flow (mainly toll stations for urban roads, bridges and tunnels with concentrated traffic flow), and smart parking lots. At the same time, ETC further spreads to scenarios such as refueling, charging, and car washing. The following companies have deployed the ETC business.

Xinlian Technology provides comprehensive automotive services such as Internet refueling, smart parking, and smart car washing based on ETC.

Trans Tech has launched smart transportation derivative businesses with "ETC+" as the core, like ETC+charging+parking, ETC+smart parking, ETC+refueling.

Genvict applies ETC to smart transportation fields such as smart parking and frictionless payment for refueling and charging.

Since 2020, the Ministry of Industry and Information Technology of the People's Republic of China (MIIT) has successively issued several policies requiring OEMs to provide optional ETC solutions.

In 2020, the Ministry of Industry and Information Technology proposed the concept of "ETC OEM" for the first time, allowing cars to have ETC equipment installed in advance before leaving the factory, and car owners can directly activate it when purchasing cars.

In April 2020, the Ministry of Industry and Information Technology announced that starting from January 1, 2021, new vehicle models applying for approval should be equipped with ETC equipment that uses direct power supply.

Subsequently, OEMs such as NIO and BYD began to launch OEM ETC equipment. OEM ETC equipment is not only more concise and beautiful in terms of wiring, but can also be deeply integrated with IVI, empowering more ETC application scenarios.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...