China Automotive Multimodal Interaction Development Research Report, 2024

Multimodal interaction research: AI foundation models deeply integrate into the cockpit, helping perceptual intelligence evolve into cognitive intelligence

China Automotive Multimodal Interaction Development Research Report, 2024 released by ResearchInChina combs through the interaction modes of mainstream cockpits, the application of interaction modes in key vehicle models launched in 2024, and the cockpit interaction solutions of OEMs/suppliers, and summarizes the development trends of cockpit multimodal interaction fusion.

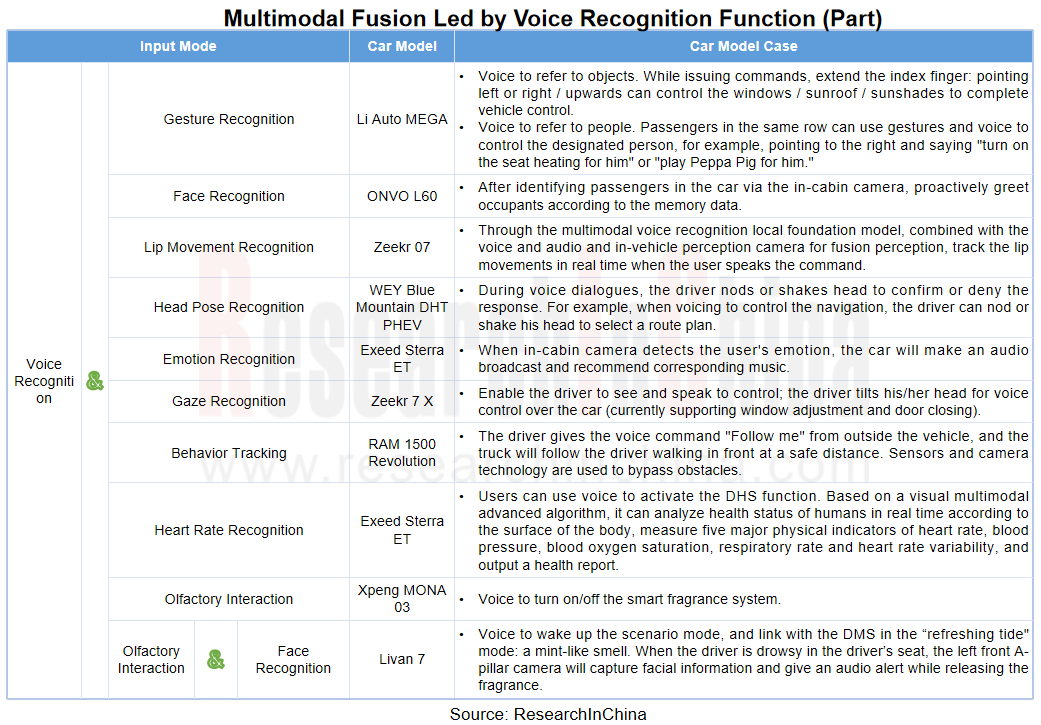

1. Voice recognition dominates cockpit interaction, and integrates with multiple modes to create a new interaction experience.

Among current cockpit interaction applications, voice interaction is used most widely and most frequently in intelligent cockpits. According to the latest statistics from ResearchInChina, from January to August 2024, the automate voice systems were installed in about 11 million vehicles, a year-on-year increase of 10.9%, with an installation rate of 83%. Li Tao, General Manager of Baidu Apollo's intelligent cockpit business, pointed out that "the frequency of people using cockpits has increased from 3-5 times a day at the beginning to double digits today, and has even reached nearly three digits on some models with leading voice interaction technology."

The frequent use of voice recognition function not only greatly optimizes user interactive experience, but also promotes the development trend of fusing with other interactive modes such as touch and face recognition. For example, the full-cabin memory function of NIO Banyan 2.4.0 is based on face recognition, and NOMI actively greets occupants who have recorded information (e.g., "Good morning, Doudou"); Zeekr 7X integrates voice recognition with eye contact to enable the driver to see and speak to control, and tilt his/her head to control the car via voice.

2. BYD launched palm vein recognition, and Sterra in-cabin health monitoring debuted

Compared with the mature interaction modes such as voice and face recognition, biometric technologies such as fingerprint, vein, and heart rate are still in the early stage of exploration and development, but they are gradually being mass-produced and applied. For example, BYD launched a palm vein recognition function in 2024, which can realize convenient vehicle unlocking; Genesis and Mercedes-Benz introduced fingerprint recognition systems in the 2025 Genesis GV70 and 2025 Mercedes-Benz EQE BEV respectively, allowing users to complete a range of operations such as identification, vehicle start and payment only with fingerprints; in addition, Exeed Sterra still uses visual perception technology provided by ArcSoft in new ET model, realizing in-cabin intelligent health monitoring function, and outputting health reports for users including five major physical indicators, i.e., heart rate, blood pressure, blood oxygen saturation, respiratory rate and heart rate variability.

Introduction of biometric technology not only improves driving convenience, but also significantly enhances the safety protection performance of vehicles, effectively preventing potential safety hazards such as tired driving and car theft. In the future, these biometric technologies will be more widely integrated into the development of intelligent and connected vehicles, providing drivers with a safer and more personalized mobility experience.

Case 1: Fingerprint recognition system of Genesis 2025 GV70 allows users to quickly apply personalized settings (seats, positions, etc.) through fingerprint authentication, and also supports vehicle start/drive. In addition, there are personalized linkage functions such as easy to use, fingerprint payment, and valet mode.

Case 2: BYD's palm vein recognition system uses a camera to read palm vein data for recognition at a distance of 8-20cm, 360 degrees horizontally and 15 degrees vertically. It uses professional image acquisition module to obtain images of vein patterns, extracts characteristics through algorithms and stores them, and finally realizes identification and recognition. In the future, it may be first installed in high-end brand Yangwang models.

Case 3: Exeed Sterra ET model is equipped with DHS intelligent health monitoring function. Based on advanced visual multimodal algorithm, it can analyze health status in real time according to the surface of the human body, measure the five major physical indicators of heart rate, blood pressure, blood oxygen saturation, respiratory rate and heart rate variability, and output a health report.

3. AI foundation models lead cockpit interaction innovation, and perceptual intelligence evolves into cognitive intelligence

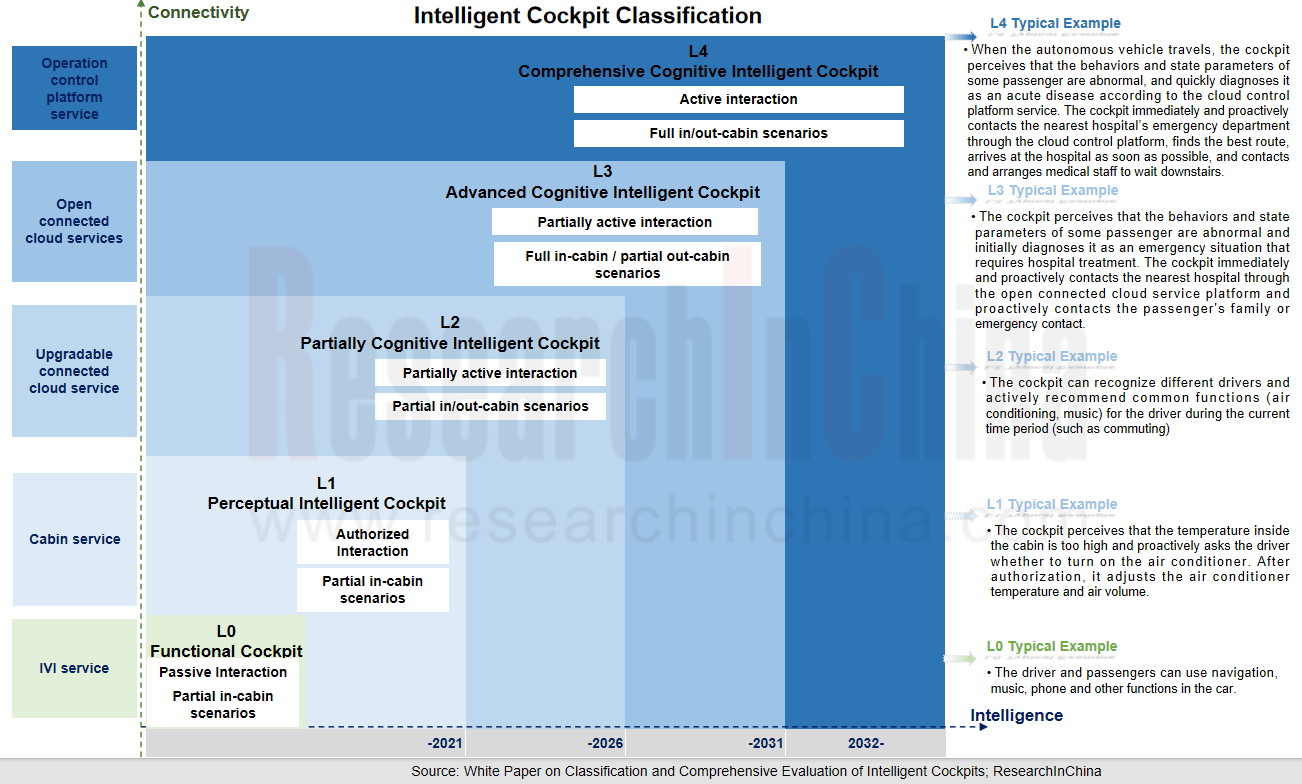

China Society of Automotive Engineers clearly defines and classifies intelligent cockpits in its jointly released white paper. The classification system is based on capabilities achieved by intelligent cockpits, comprehensively considers the three dimensions of human-machine interaction capabilities, scenario expansion capabilities, and connected service capabilities, and subdivides intelligent cockpits into five levels from L0 to L4.

With the wide adoption of AI foundation models in intelligent cockpits, HMI capabilities have crossed the boundary of L1 perceptual intelligence and entered a new stage of L2 cognitive intelligence.

Specifically, in the stage of perceptual intelligence, intelligent cockpit mainly relies on the in-cabin sensor system, such as cameras, microphones and touch screens, to capture and identify the behavior, voice and gesture information of driver and passengers, and then convert the information into machine-recognizable data. However, limited by established rules and algorithm framework, the cockpit interaction system in this stage still lacks the capability of independent decision and self-optimization, which is mainly reflected in the passive response to input information.

After entering the cognitive intelligence stage, intelligent cockpits can comprehensively analyze multiple data types such as voice, vision and touch by virtue of powerful multimodal processing capabilities of foundation model technology. This feature makes intelligent cockpits highly intelligent and humanized, able to actively think and serve, as well as keenly perceive actual needs of the driver and passengers, providing users with personalized HMI services. perceives

Case 1: SenseAuto introduced an intelligent cockpit AI foundation model product, A New Member For U, at the 2024 SenseAuto AI DAY. It can be regarded as the "Jarvis" on the vehicle, which can weigh up occupants’ words and observe their expressions, actively think, serve, and plan. For example, on the road, it can actively turn up the air conditioner temperature and lower music volume for the sleeping children in the rear seat, and adjust the chassis and driving mode to the comfort mode to create a more comfortable sleeping environment. In addition, it can actively detect the physical condition of occupants, find the nearest hospital for the sick ones, and plan the route.

Case 2: NOMI Agents, NIO's multi-agent framework, uses AI foundation models to reconstruct NOMI's cognition and complex task processing capabilities, allowing it to learn to use tools, for example, calling search, navigation, and reservation services. Meanwhile, according to complexity and time span of the task, NOMI is able to perform complex planning and scheduling. For example, among NOMI's six core multi-agent functions, "NOMI DJ" recommends a playlist that suits the context to users based on their needs, and actively creates an atmosphere; "NOMI Exploration" understands based on spatial orientation, matches map data and world knowledge, and answers children's questions, for example, "what is the tower on the side?".

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...