Research on automotive smart surface: "Plastic material + touch solution" has become mainstream, and sales of smart surface models soared by 105.1% year on year

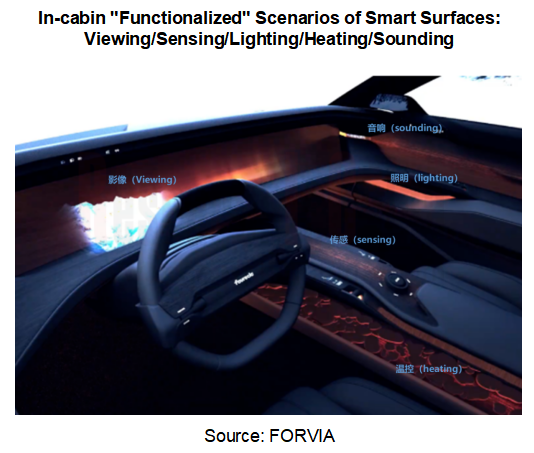

In this report, smart surface refers to an interior technology that is used outside the vehicle or inside the cabin and is integrated with various interior materials (including but not limited to leather, fabric, wood, glass, plastic, natural fiber, metal, etc.) through electronic sensors. It can be "functionalized" (for decoration or issuing commands) and can generate light and heat, or issue commands, sounds, etc. when activated.

Sales of smart surface models surged by 105.1% year on year

In 2024, automotive smart surfaces find very rapid adoption, with a rising penetration rate:

From January to September 2023, sales of models equipped with smart surfaces reached 256,000 units.

From January to September 2024, sales of models equipped with smart surfaces climbed to 525,000 units, soaring by 105.1% on a like-on-lie basis, with a penetration rate of 3.4%.

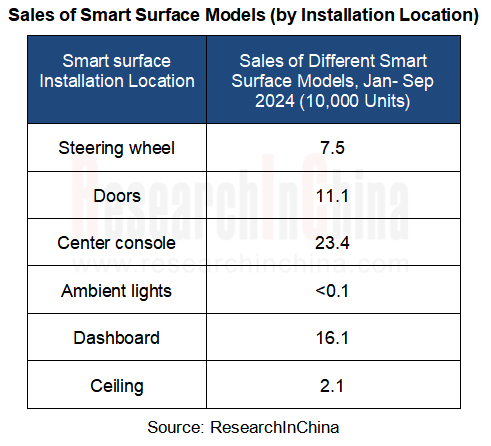

From the perspective of installation locations, smart surfaces are mainly concentrated in steering wheel, center console, doors, dashboard functional zone, etc., providing sensing/temperature control/lighting functions.

From January to September 2024, among the smart surface models, most applied smart surfaces to the center console, with sales up to 234,000 units; those that applied smart surfaces to doors, ceiling, and steering wheel grew rapidly year on year, with sales reaching 111,000 units, 21,000 units, and 75,000 units, respectively.

Wherein:

The center console adopts smart surface interior trims, integrating multiple functions such as information display and air conditioning, and transforming the originally cumbersome buttons into a simple touch control interface, thus making the center console look more simple, elegant and modern in appearance;

On the door interior panel, the smart surface design enables integrated operation of door lock control, window control and other functions through touch, and supports hiding related functions when not activated, enhancing the ornamental value of door interiors;

The smart surface on the steering wheel allows for control over multiple functions, for example, volume adjustment and driving mode switching, making it easier for the driver to operate.

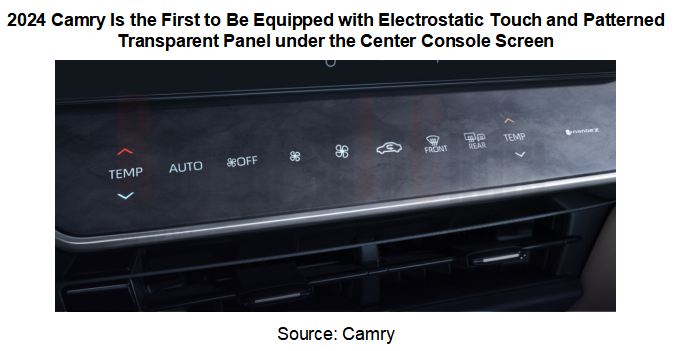

Camry

The 2024 Camry uses electrostatic touch and patterned transparent panel at the center console, supporting touch control on air-conditioner temperature, wind direction, glass heating and other functions.

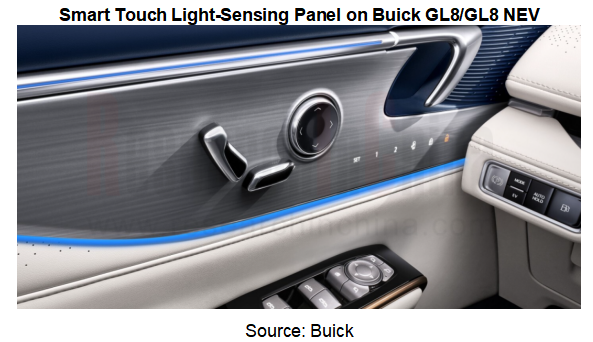

Buick

Buick GL8/GL8 NEV’s front doors are equipped with a Smart Touch light-sensing panel using a new fusion process. When not activated, it blends into the interior style. When activated, it allows seat position adjustment and door locking/unlocking.

Cost control is the key to mass production of smart surfaces

In 2024, the penetration rate of automotive smart surfaces is still lower than 5%. The key to further expanding mass production is to solve the process and cost issues. Wherein, the cost of smart surfaces is mainly composed of materials, process and maintenance.

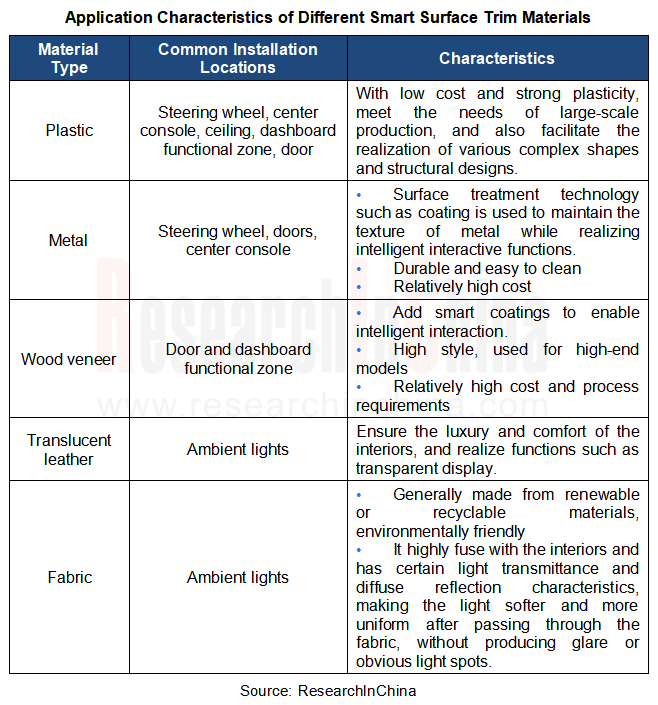

Materials cost

In addition to electronic components, smart surface trim materials mainly include plastic, metal, wood veneer, translucent leather and fabric. The most common material in 2024 is plastic. Related smart surface models prefer to use the combination of "plastic material" and "touch solution". It is expected that this solution will still prevail during 2024-2025.

Process cost

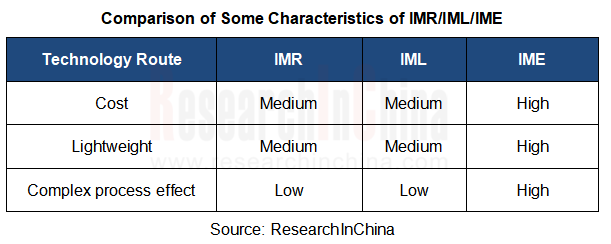

There are multiple smart surface production process routes, including IMD (including IML/IMR), IME and OMD. In actual applications, manufacturers will choose the process route according to cost and effect. Compared with 2023, the number of smart surface supply chain manufacturers in 2024 further increases, and the IME process is used on a larger scale. Compared with routes such as IML/IMR, IME can achieve lighter weight and more complex processes despite high cost.

For suppliers, it is more difficult to develop new smart surface materials than change the structural design scheme, so suppliers tend to change the structure of smart surface accessories and optimize the design scheme, for example:

Through modular design, smart surface components can be integrated into different interior modules within a limited space, reducing installation and maintenance costs;

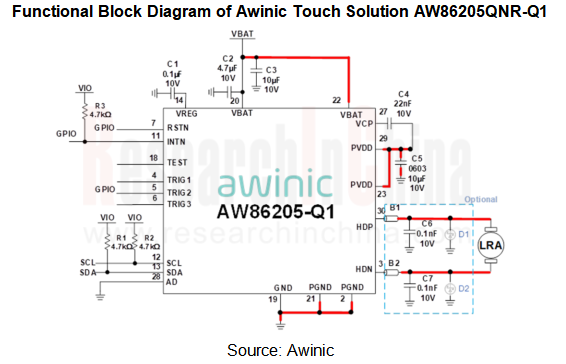

In terms of the selection of touch chips, a more integrated chip design is adopted to reduce circuit volume and energy consumption;

In terms of latency, capacitive touch sensor with higher sensitivity is used to improve the response speed and accuracy of smart surfaces to user operation;

In terms of communication, to achieve seamless connection with the overall electronic system of vehicles, the faster and more stable CAN - FD protocol is adopted.

How smart surface design improves customer experience?

In 2024, the most common interaction mode of smart surfaces is touch, which is easier to operate than traditional buttons and can effectively avoid mis-operation. In the case of Awinic's smart surface solution, its touch-superimposed pressure-sensitive button design can effectively reduce false triggers, and the haptic feedback effect can also restore the touch of traditional micro switches, allowing users to obtain clear feedback during operation, improving the accuracy and comfort of operation.

For smart surface design, consumers pay more attention to the three aspects: enhancing the sense of technology, optimizing space utilization and aesthetics, and personalized customization.

Enhance the sense of technology

Automotive smart surface fully meets customers' pursuit of a sense of technology, with the cool touch interaction mode and futuristic display effects:

In terms of touch sensing, capacitive touch technology is used to build a highly sensitive touch sensing matrix. Whether it is a light touch, a slide or a multi-touch gesture, it can achieve accurate and rapid response. The response time can be as low as a few milliseconds, effectively avoiding the adverse experience caused by operation delays.

In terms of touch feedback, the built-in precision haptic feedback device, such as linear resonant brake or eccentric rotating mass motor, can generate suitable vibration feedback according to touch operation. For example, when selecting a menu, a gentle and short vibration will be generated; when confirming an important operation, a slightly stronger and longer-lasting vibration prompt will be given, thus simulating the real touch of buttons and enhancing the intuitiveness and confirmability of the operation.

In terms of display, Micro LED or OLED technology is used to present functional logos in an intuitive graphical interface.

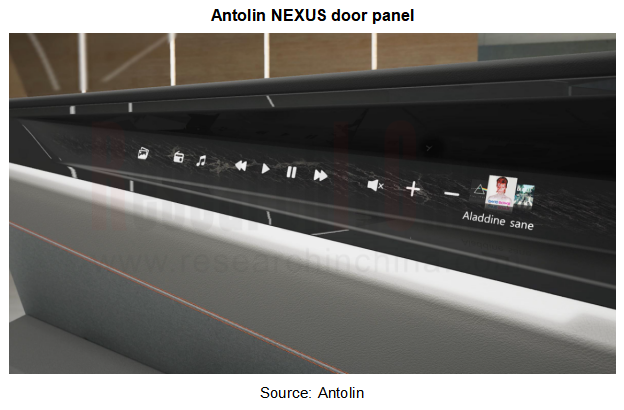

In March 2024, Antolin unveiled NEXUS, a door panel concept which is equipped with a touch smart surface. In addition to vision lighting, it also provides heating function using the interior adaptive thermal surface technology. Meanwhile, it supports electronic rearview mirror function for the 3D hologram driving assistance system, providing different information about the road outside the vehicle when needed.

Optimize space utilization and aesthetics

The complex layout of traditional buttons is easy to make the cockpit look cluttered, while smart surfaces can reduce the number of physical buttons through integrated design, for example, use electronic integration technologies such as system-in-package (SiP) and multi-chip module (MCM) to highly integrate such electronic components as originally scattered microcontroller unit (MCU), touch chip, display driver IC and various sensors into a compact module, effectively reducing the physical space occupied by electronic components and creating favorable conditions for optimizing the layout of other cockpit components.

The smart surfaces of relevant models in 2024 all support invisible touch function when not activated, making the overall cockpit more concise and elegant, creating a spacious, comfortable and beautiful visual experience in a limited space. For example, on the smart surface center console, multiple physical buttons originally used to control the air conditioning system, audio system, window lifting and driving mode switching are integrated into one or several simple touch zones. By presenting intuitive function icons and operation prompts on the display interface, it will make it easier for occupants to complete various complex operations.

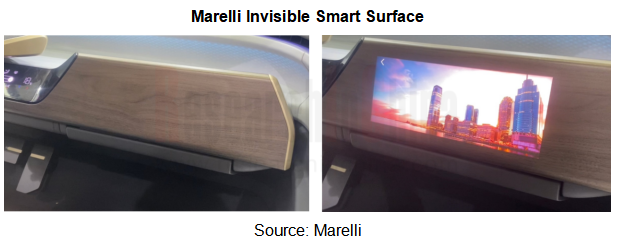

In April 2024, Marelli launched a new invisible smart surface product, which adopts the design concept of "screen-free cockpit". The product is designed at the co-pilot seat, and installs a screen under the translucent surface trim with a thin film material covered with tiny holes on the surface. When activated, lights or LED/OLED in it will light up, and the light will pass through the tiny holes to display the control interface; when not wakened up, it will blend into the interior surface.

Personalization

Different consumers have different preferences for car interiors. Smart surfaces can be designed through process schemes to achieve different function layouts and display effects to meet personalized needs of consumers. For example, consumers can set theme color, display content, etc. of the center console smart surface as they like.

In April 2024, Changshu Automotive Trim launched a door ambient light, which is composed of wood grain LED, translucent PU leather and translucent fabric from top to bottom. All the three allows users to customize lighting later. Wherein, the wood grain LED enables occupants to customize the virtual touch function via the embedded inductive vibration mechanism.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...