Commercial vehicle intelligent chassis research: 20+ OEMs deploy chassis-by-wire, and electromechanical brake (EMB) policies are expected to be implemented in 2025-2026

The Commercial Vehicle Intelligent Chassis Industry Report, 2024 released by ResearchInChina combs through and summarizes status quo, installation, product layout of suppliers, and predicts future development trends of commercial vehicle intelligent chassis.

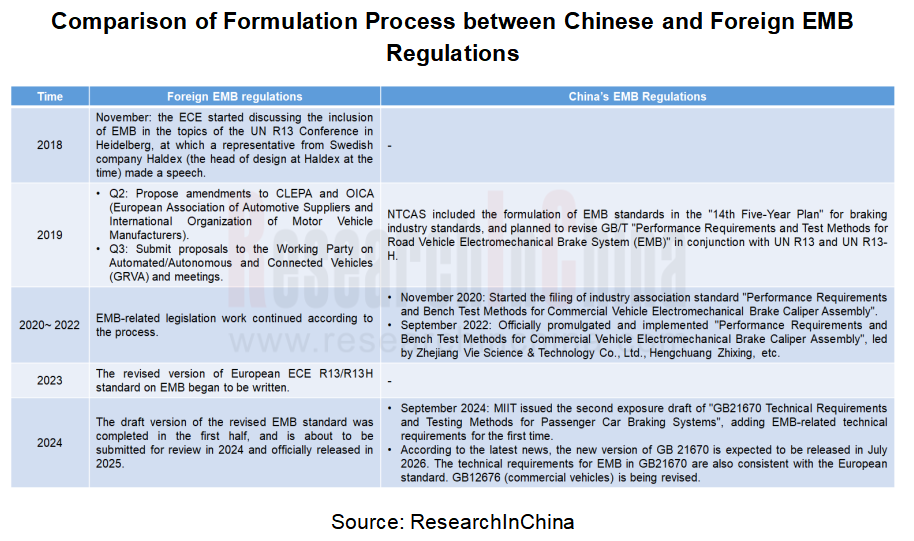

1. Foreign EMB laws and regulations are expected to be introduced in 2025, and China is expected to implement in 2026.

Foreign EMB laws and regulations: Since 2018, the Economic Commission for Europe (ECE) has begun to discuss the inclusion of EMB into the topics of the UN R13 Conference. In the first half of 2024, the ECE completed the draft version of revised EMB standards, which is submitted for review in 2024 and will be officially released in 2025.

China’s EMB laws and regulations: China started revising EMB regulations one year later than foreign countries. In 2019, the National Technical Committee of Auto Standardization (NTCAS) included the formulation of EMB standards in the "14th Five-Year Plan" for braking industry standards. In September 2024, the Ministry of Industry and Information Technology (MIIT) issued the second exposure draft of "GB21670: Technical Requirements and Testing Methods for Passenger Car Braking Systems", adding EMB-related technical requirements for the first time, which marks a significant progress in China's EMB regulations. The new version of GB 21670 is expected to be published in July 2026, and EMB-related technical requirements of new GB21670 are also consistent with European standards. GB12676 (commercial vehicles) is being revised.

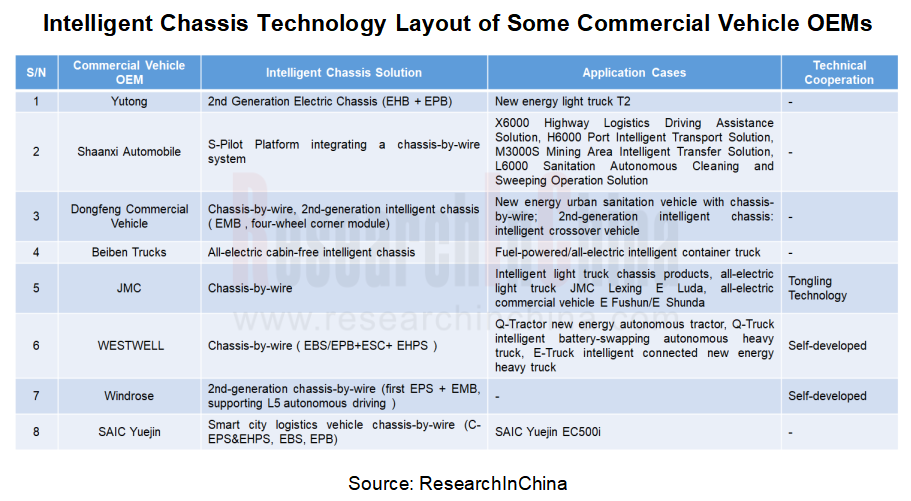

2. 20+ commercial vehicle OEMs deploy chassis-by-wire, accelerating commercial vehicle chassis intelligence.

According to incomplete statistics, more than 20 commercial vehicle OEMs have deployed chassis-by-wire by way of self-development or technical cooperation. For example, JMC depends on Tongling Technology to develop intelligent chassis, a company which established in April 2022 and was incubated by JMC and Tongji University. It concentrates on R&D of commercial vehicle intelligent chassis products and provides intelligent chassis solutions for intelligent driving companies.

Commercial vehicle steering: As the demand for intelligent driving of commercial vehicles expands, electro-hydraulic coupling power steering system comes into being

In the past few decades, commercial vehicles have widely adopted hydraulic power steering systems (HPS). For the oil pump of HPS is driven by the engine, with the increasing proportion of new energy commercial vehicles in sales, electrohydraulic power steering systems (EHPS) that use electric pumps to replace engines have also increased accordingly. Yet as commercial vehicles have increasing demand for intelligent driving steering functions, EHPS is unable to actively intervene in steering control and cannot meet the demand. At present, a great deal of researches have been conducted at home and abroad on commercial vehicle electric steering systems that can implement active steering intervention control, including electro-hydraulic coupling power steering (EHCPS) systems.

EHCPS essentially integrates an EPS motor system at the steering input end of the HPS system, including the sensor unit, motor, control unit and worm gear reducer. It is a new steering system with both electric and hydraulic power. In terms of intelligence, EHCPS provides a higher degree of freedom through the design of motor control algorithms to improve driver's steering feel on roads, and enables intelligent steering functions by controlling motor active intervention, for example:

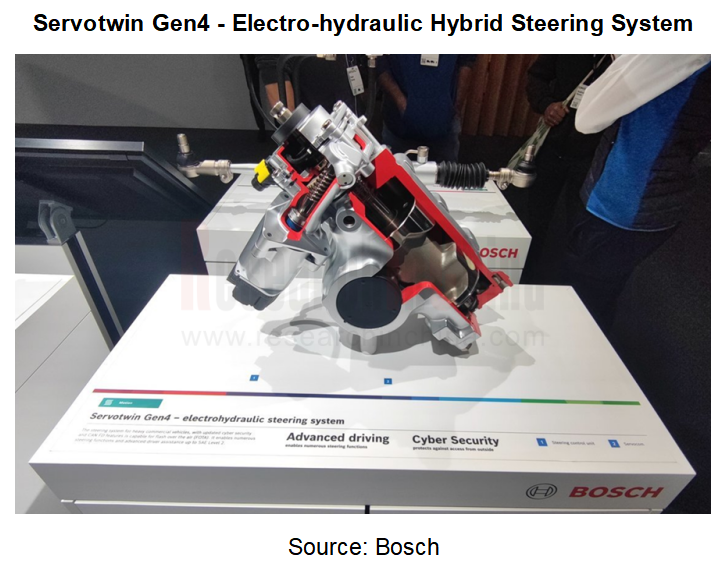

Since Bosch completed the acquisition of ZF Steering Systems in 2015, and Servotwin was included in Bosch's commercial vehicle steering product line. Its electro-hydraulic hybrid power steering system - Servotwin Gen3 - can achieve such functions as active return and speed-dependent power steering. In April 2024, Bosch introduced Servotwin Gen4, the fourth-generation electro-hydraulic hybrid power steering system;

Yutong Bus cooperated with Zhengzhou University of Light Industry and Zhejiang University of Technology on the “R&D and Application of Key Technologies of High-performance Electro-hydraulic Coupling Steering System for Buses" in 2023;

In 2023, Shi Guobiao and others from Beijing Institute of Technology studied a new method for emergency steering using a new type of Integrated Electro-Hydraulic Steering System (IEHS);

In August 2024, Xiamen King Long United Automotive Industry Co., Ltd. released "A Collaborative Control Method for A Vehicle Electro-hydraulic Coupling Redundant Steer-by-wire System", with patent number CN118466158A;

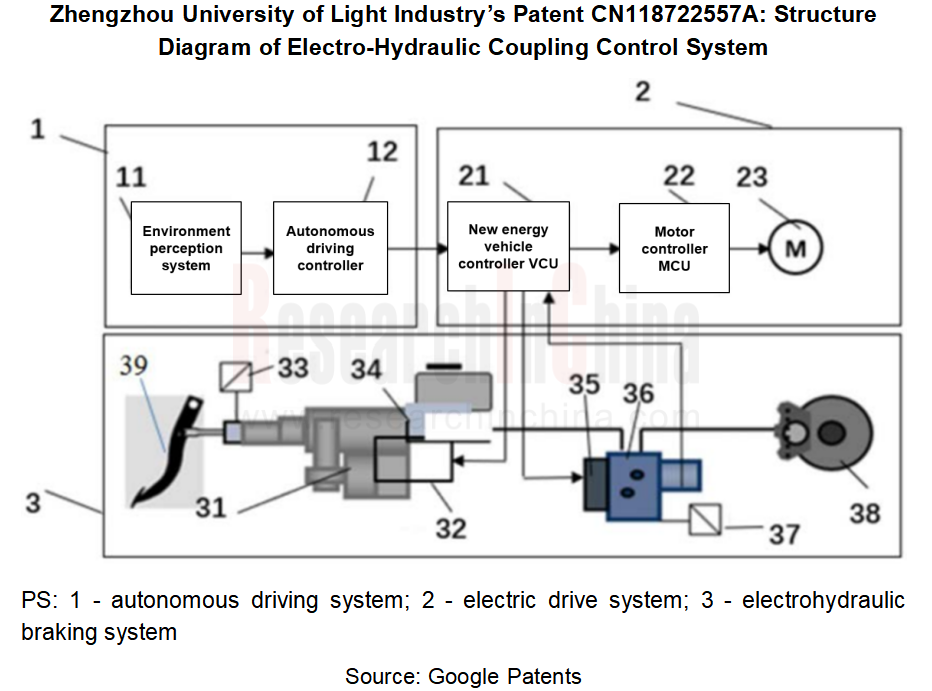

In October 2024, Zhengzhou University of Light Industry announced its patent for "An Electro-Hydraulic Coupling Braking System and Integrated Control Method for Autonomous Commercial Vehicles", with patent number CN118722557A.

Bosch: Servotwin Electro-Hydraulic Hybrid Power Steering System

In April 2023, at the Auto Shanghai, Bosch unveiled its third-generation electro-hydraulic hybrid power steering system, Servotwin Gen3, and its fourth-generation fully redundant electro-hydraulic hybrid power steering system, Servotwin Gen4.2. In April 2024, at the Auto China, Bosch showcased its fourth-generation electro-hydraulic hybrid power steering system, Servotwin Gen4, which will come into mass production in the second half of 2024.

Servotwin Gen4 has following functions:

Supports higher-level L4 or L5 autonomous driving at all speeds and all times, and in all scenarios;

Some additional comfort functions such as active self-centering and speed-dependent power steering;

Multiple compensation functions, for example, when the vehicle encounters side winds and may bump, some torque can be applied to keep the vehicle balanced to achieve "side wind compensation";

Supports encrypted communication, CAN-FD variable rate communication, high-speed communication, and online flashing;

Adopts AUTOSAR open system architecture.

Brake suppliers: multiple Chinese and foreign suppliers have completed the EBS product layout, promoting large-scale application of EBS

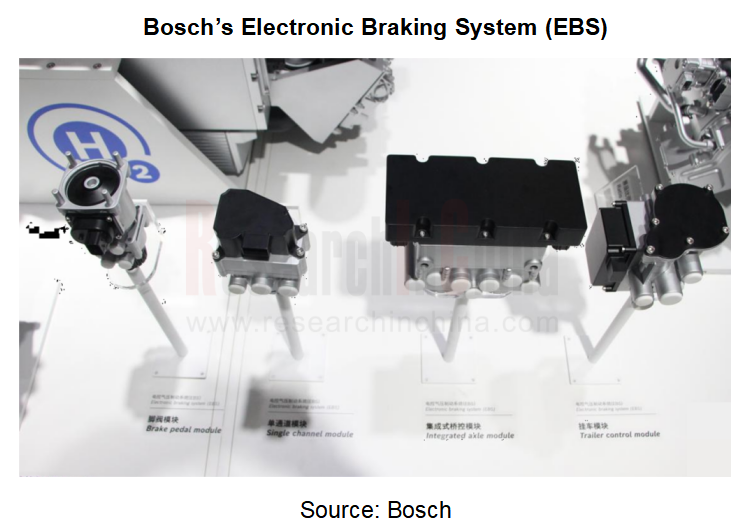

At present, WABCO, KNORR, Ruili Kormee, and Trucknow Technology have mass-produced EBS systems; Wanxiang Qianchao's EBS system has been designated and mass-produced; EBS systems of Bosch and Tsintel Technology are expected to be spawned by the end of 2024. Many Chinese and foreign suppliers have completed the EBS product layout, promoting the large-scale application of EBS.

In April 2024, Bosch's Electronic Braking System (EBS) debuted at the Auto China. It controls braking via electronic signals, achieving safer and more efficient braking with more intelligent and precise control, and can better cooperate with electronic auxiliary functions such as anti-lock braking system (ABS) on the vehicle. The system, developed by Bosch's local core team in cross-domain cooperation, is being tested by China’s first-tier OEMs, and is scheduled to be produced in quantities by the end of 2024.

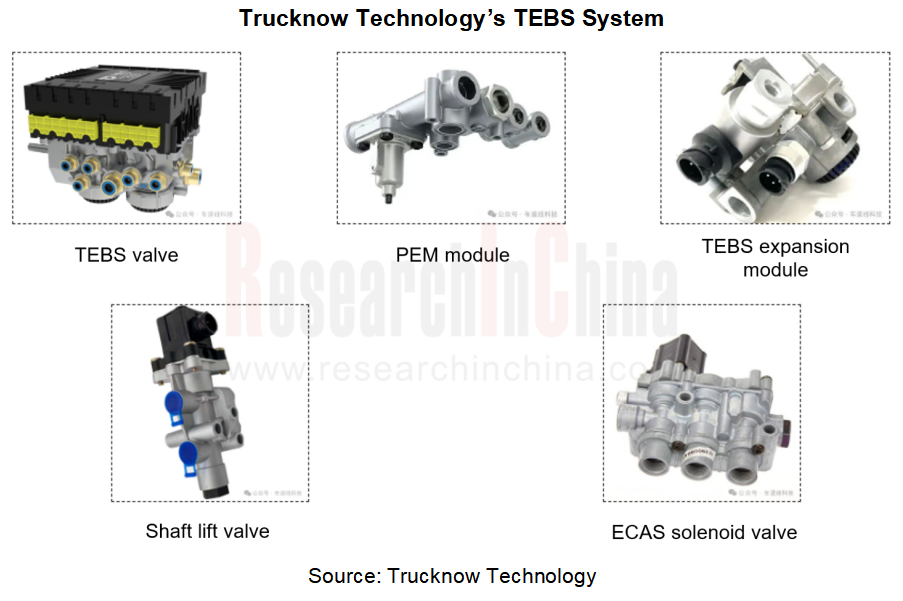

Trucknow Technology focuses on the research of "full-stack independent controllable chassis-by-wire intelligent driving solutions" for commercial vehicles. It has currently mass-produced EBS systems, trailer TEBS, and AEB systems. Its EBS system has advantages of quick braking response, short pressure build-up time, reasonable braking force distribution, and consistent braking of main body and trailer. In March 2024, the EBS system, self-developed, calibrated and tested by Trucknow Technology, met the customer's requirements and standards in all test items, and was successfully accepted.

Trucknow Technology's trailer TEBS is a braking control system evolved from the ABS system. It adds additional auxiliary functions for intelligent trailers, significantly improving the braking stability and safety of semi-trailers.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...