China Smart Door and Electric Tailgate Market Research Report, 2024

Smart door research: The market is worth nearly RMB50 billion in 2024, with diverse door opening technologies

This report analyzes and studies the installation, market size, competitive landscape, suppliers’ strategies, OEMs’ strategies, development trends, etc. of various smart door products. The research scope mainly covers:

1. The installation, market size, model cases, etc. of smart doors, including electric suction doors, automatic opening doors, frameless doors, hidden electric door handles, double doors without B-pillars, electric sliding doors, etc.;

2. The system structure, highlight functions, supply chain, competitive landscape, installation, market size and supply of electric tailgates, kick-activated tailgates, AR smart tailgates, etc.;

3. Intelligent entry methods: PEPS, mobile APP, digital key, gesture recognition, face recognition, voice control, fingerprint recognition, finger vein recognition, touch recognition, password lock, etc.

4. Lightweight smart door and sealing strip market: lightweight door technology and solutions; door sealing strip market size, production technology, competitive landscape and suppliers;

5. Smart door application by OEMs: smart door solutions of Tesla, ZEEKR, BMW, etc.;

6. Smart door suppliers: smart door products of Brose, Magna, Dongjian, Minth, Yanfeng, etc., and models supported by them.

In the process of intelligent evolution, doors are no longer traditional opening and closing components, but constantly add functions such as automatic opening and closing, intelligent anti-collision, and intelligent interaction, and develop towards intelligent components.

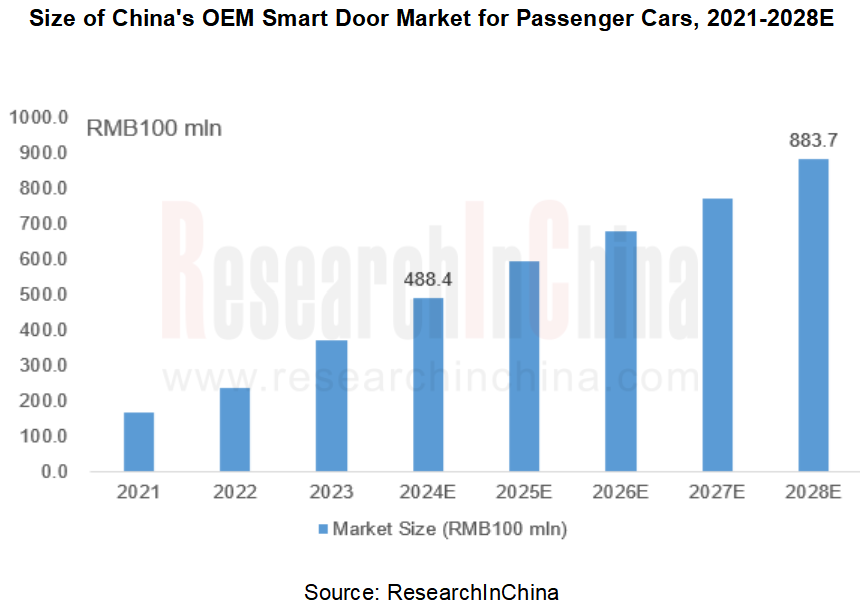

China's passenger car smart door market is valued at nearly RMB50 billion in 2024, a year-on-year surge of 31.5%. It is expected to exceed RMB80 billion in 2028, with an average annual growth rate of around 16%.

From a functional perspective, doors, as the entrance to vehicle intelligence, carry many functions and interactive experiences, such as intelligent unlocking, automatic opening, obstacle avoidance and anti-pinch, intelligent display, and intelligent interconnection. With the support of optical, acoustic, wireless positioning and other technologies, many new interactive functions have been mass-produced for cars or will be applied. For example, there are intelligent door opening methods such as AR projection, knocking, voice control, and UWB-recognized kicking.

1. AR projection: The car owner only needs to step on the projection, and then the door will automatically open.

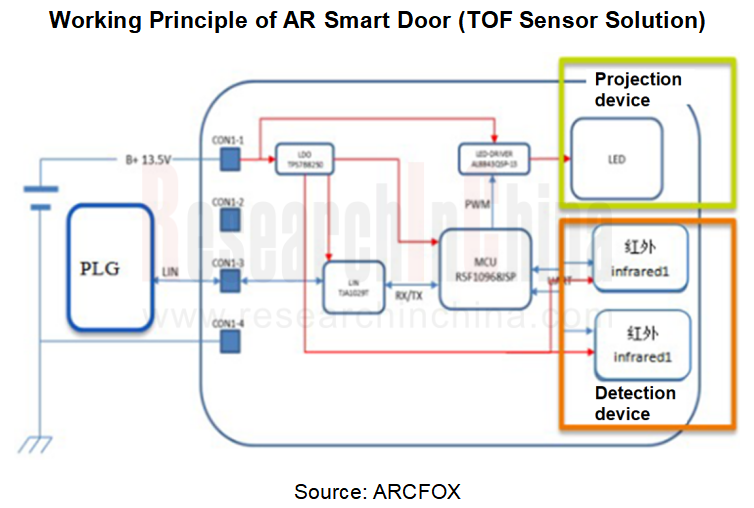

AR smart doors use AR projection to open doors. When the owner arrives near the car with the key, the AR intelligent system will sense it immediately and project the unlocking pattern on the ground through a projection device. The owner only needs to step on the projection, and then the door will automatically open. This method uses projection to indicate the door opening position, which greatly frees your hands.

In November 2024, BYD Xia, which debuted at the Guangzhou International Automobile Exhibition, demonstrated how to open doors by AR projection. When the user approaches the sliding door or tailgate of the locked car, the AR projection will turn on automatically, then the user can "open the door from a distance" by simply stepping on the flashing icon. In addition, ARCFOX Kaola, Besturn E01, Dongfeng Aeolus Huge, and ARCFOX αS (Forest Edition) among others are also equipped with this function.

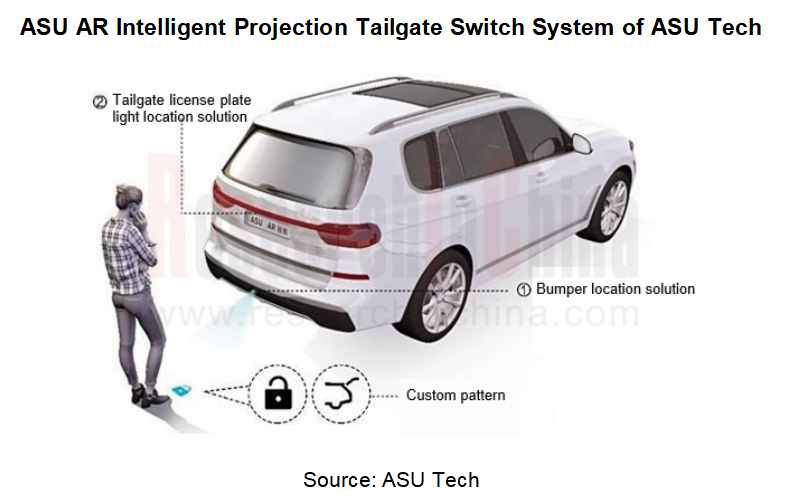

The AR projection door system is composed of projection devices, sensors, and controllers. The projection device projects a corresponding pattern after the user enters the scanning area outside the door with the smart key, and the sensor recognizes the user's stepping movement. At present, sensors mainly include TOF sensors and LiDAR. ASU Tech is a representative supplier of TOF sensor solutions, while Benewake is a main supplier of LiDAR solutions.

ASU Tech has launched the ASU AR Intelligent Projection Tailgate Switch System. When the owner reaches the rear of the car with the key, the car will automatically sense it and project the corresponding pattern on the ground through MLA optical projection technology. The owner only needs to lightly step on the pattern, then the TOF module will accurately detect it and issue a command to make the tailgate open automatically while ensuring a safe distance with the user. So far, this system has been upgraded to version 2.0, with a total of 3 products and 2 installation positions, and customized services for stepping patterns are available. It is applied in Besturn E01, Dongfeng Aeolus Huge, etc.

Benewake's light-sensing (laser) kicking solution consists of single-point LiDAR, AR projection, and main control panel. This solution uses a single-point LiDAR and an AR projection/visible light indication module and integrates an intelligent sensing device. It can be installed in the trunk. The LiDAR spot overlaps with the AR projection cursor/visible indication light cursor, then the LiDAR judges whether the user steps on the cursor according to characteristic values ??such as distance, and cooperates with the vehicle system to enable AR projection, stepping detection and tailgate opening and closing. The tailgate opens and closes automatically without needing the user to touch the car.

This solution is easier to trigger than the capacitive type, with benefits of a low false trigger rate, visible trigger projection pattern, flexible installation and layout, etc., bringing car owners convenient door opening, night lighting and other experiences.

2. Knock sensing: The user taps the door surface to make the door open automatically

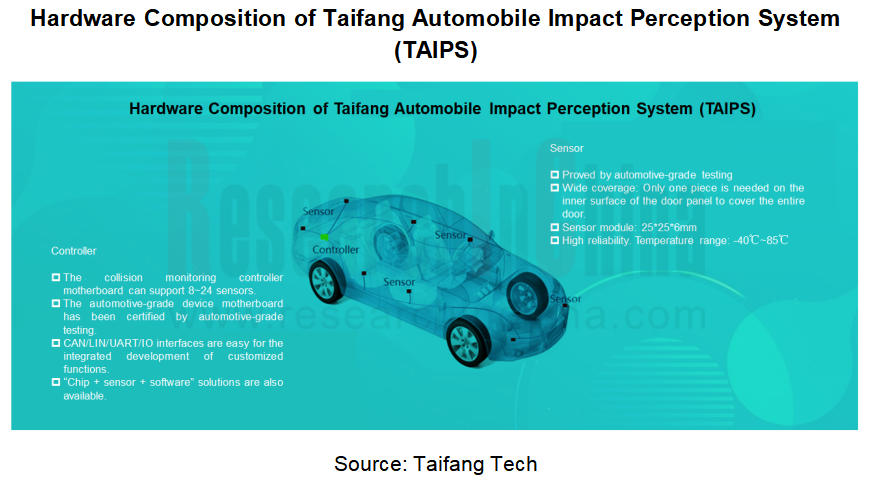

Taifang Tech's KK (Knock-knock) interaction is an innovative function that enables door control by simple knocking. This function uses the latest elastic wave intelligent touch sensing technology to allow the entire door panel to sense touch. The user only needs to tap lightly anywhere on the door surface, then the door will open or close automatically.

Knocking on the door is user-friendly and intuitive. For the entire door surface can sense touch, users do not need buttons or precise positioning. Any position is available for interaction. When it rains and the surface of the car body is dirty, or when hands are not free, KK interaction offers great convenience to users. In addition, OEMs can choose double clicks or triple clicks to match their own functional needs. All opening and closing parts of the car body, such as doors, tailgate, front trunk lid and charging port cover, can be controlled using this function.

KK Interaction is based on the Taifang Automobile Impact Perception System (TAIPS) developed by Taifang Tech, which can provide multiple human-vehicle interaction methods, including finger pressing, tapping, finger or palm sliding and is expected to spread to the center console, display, steering wheel, buttons, door handles, tailgate, charging port cover, seats, armrest screen, etc. in the future.

TAIPS adopts a "sensor + chip" hardware solution. The device is small in size, simple in structure, and easy to install. It can not only cater to the needs for crushing prevention in collision, parking safety and human-vehicle interaction in new autonomous driving scenarios, but also make up for the blind spots of various existing sensors.

3. Voice control: The body panel sound and vibration perception system opens the door

Out-of-car voice allows intelligent interaction between people and cars to move from the inside to the outside of the cars. Since 2023, OEMs like Jiyue, ZEEKR and Changan Nevo have installed out-of-car voice functions in cars, for example, voicing to play music outside the cars, opening and closing the doors, and starting the car.

In terms of door opening and closing, both Jiyue 01 and Jiyue 07 enable out-of-car voice recognition to open the doors. Jiyue 07, launched in September 2024, is equipped with Baidu's latest AI foundation model and SIMO (intelligent voice assistant). When the owner stands outside the car and says "open the door", the door will open automatically.

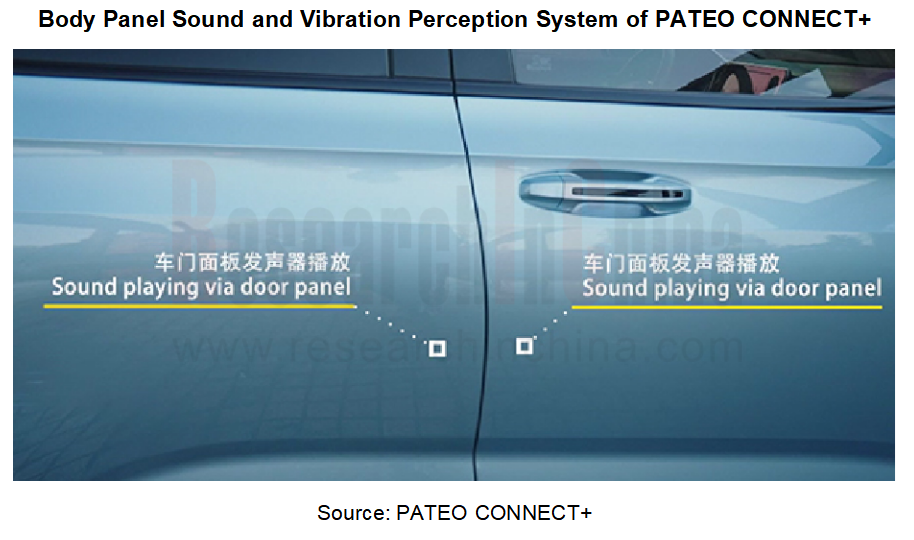

In April 2024, PATEO CONNECT+ unveiled the world's first solid-state sound field intelligent system that uses body panels to generate sound and integrates body panel vibration perception. This system allows users to talk to the vehicle by simply tapping on the door. For example, tapping a body panel can directly activate voice recognition to open the trunk or door.

The key component of this system is PATEO CONNECT+’s high-power piezoelectric vibrator sound generator that supports sound generation from body panels. The device is ultra-light, ultra-thin, waterproof, dustproof, corrosion-resistant, and resistant to high/low temperatures, and features a wide sound frequency band and a long service life, making it suitable for out-of-car sound generation.

The automotive all-scenario intelligent interactive system that integrates sound vibrators and control units has multi-modal interaction capabilities such as multi-directional sound generation and perception outside the car. The system supports more than 50 new scenario applications, covering leisure and entertainment, reminder services, safe vehicle control, vehicle communication, advertising sales, new business models, etc., and including vehicle collision warning, local rescue, megaphones inside and outside the car, out-of-car sound waves, out-of-car karaoke, out-of-car speeches, keyless entry, and smart marketing.

4. Kick sensing: Capacitive solutions are widely used, and UWB solutions are just emerging.

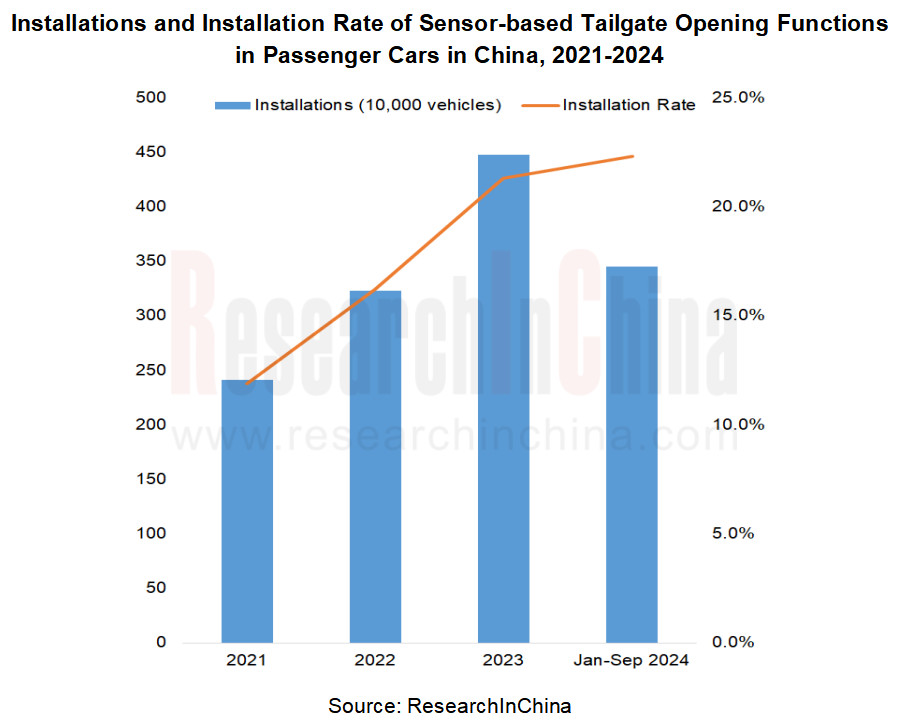

The inductive tailgate is commonly known as "one-kick". As the name suggests, the trunk is opened by sweeping the sensor under the car with your foot. With the rapid development of vehicle intelligence, kick-activated tailgates have gradually become a standard feature of mid-to-high-end models thanks to their unique ease of use and intelligence. In recent years, the installation rate of sensor-based tailgate opening functions has been on the rise, increasing from 11.9% in 2021 to 22.3% in September 2024.

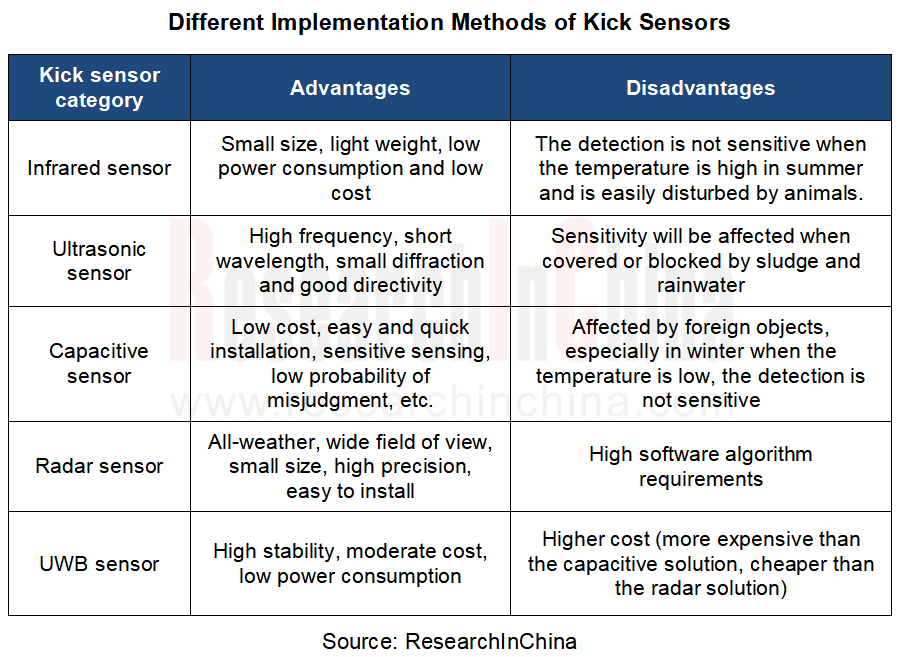

The key component of the inductive tailgate is the kick sensor, which is usually installed inside the rear bumper of the vehicle. There are diverse solutions for kick sensors, including infrared, capacitive, ultrasonic, radar, and UWB radar solutions.

Among them, the infrared solution is being phased out, and the capacitive solution is currently the most popular solution in the market. The UWB solution, characterized by high stability (compared to the capacitive solution), moderate cost (more expensive than the capacitive solution, and cheaper than the radar solution) and low power consumption (lower than the radar solution), is gradually emerging.

In November 2024, Linked Intelligent Technology published its patented kick sensor which aims to simplify the installation method of the (capacitive) leg sweep sensing device and improve the sensitivity and reliability during its detection process. Linked Intelligent Technology is a supplier of capacitive kick sensors. The controller housing of its second-generation capacitive kick sensor uses laser welding technology and a dedicated capacitance detection chip to support action recognition such as leg sweeps and oblique kicks. And it can effectively avoid the probability of false triggering such as water splashing, pets and pedestrians passing by. At present, Linked Intelligent Technology's second-generation capacitive kick sensor has been mass-produced for 8 models, and the first-generation capacitive kick sensor has been spawned for 10 models.

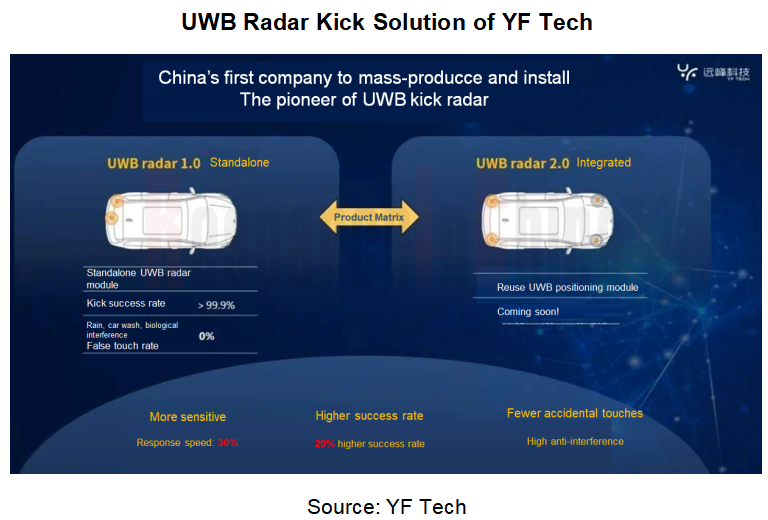

In 2024, YF Tech launched a UWB radar kick solution, an expansion of its UWB digital key. YF Tech's UWB radar kick solution reuses the UWB module of the digital key system to recognize kicking movements through algorithms without any additional hardware. According to the test data from the company's CNAS laboratory, this solution can accurately and quickly recognize the user's kicking movements (forward kicks and sweeps), with a success rate of higher than 99.9% and a response time of less than 300ms; also it can completely avoid possible interference caused by water droplets splashing, pets and pedestrians passing by, etc. in the sensing area, with nearly 0% false touch rate by kicking.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...