TSP Research: In-vehicle connectivity services expand in the direction of cross-domain integration, all-scenario integration and cockpit-driving integration

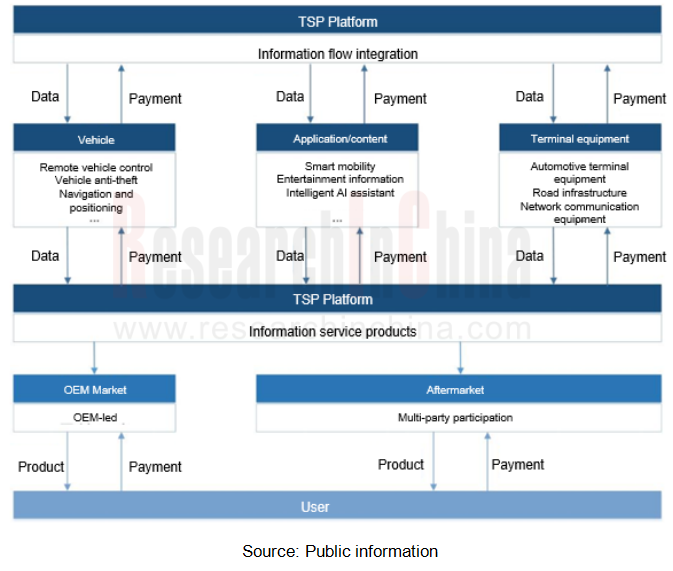

TSP (Telematics Service Provider) is mainly responsible for data collection and supply between cars and various service providers, thereby providing more diversified services to car owners. TSP services cover navigation, social contact, entertainment, remote maintenance, security, etc.

In the trend towards cross-domain integration and cockpit-driving integration, TSPs also quietly make progress, expanding from only in-car connectivity service applications to cross-domain integration, all-scenario integration and cockpit-driving integration.

In cross-domain integration, on the one hand, the modular software platform can realize the functional integration of different domains such as cockpit and intelligent driving domains. On the other hand, phone-IVI integration applications enable the computing power call and ecosystem integration of mobile phones and IVI.

All-scenario integration mainly refers to the realization of connectivity services in various scenarios such as interaction, entertainment, social contact, navigation, parking, and charging, centering on all mobility scenarios.

Cockpit-driving integration is mainly to connect the capabilities of intelligent cockpit and intelligent driving. For example, the latest maps launched by Baidu, Tencent and NavInfo link mobility maps with ADAS maps.

1. Cross-domain integration of system base

As an established TSP, ECARX provides infotainment systems, online membership services, telematics operation and maintenance services, traffic value-added services, etc. to dozens of brands. As of September 30, 2024, ECARX's technical services and products had been available in more than 7.3 million vehicles worldwide.

In the TSP business, Cloudpeak, the cross-domain system capability base released by ECARX in 2024, can form a complete product with different computing platforms, and can support the development of the state-of-the-art infotainment systems and ADAS functions.

In 2024, ECARX Cloudpeak was installed on EX30, Volvo's SUV BEV with global mass production and delivery. ECARX Cloudpeak injects rich intelligent functions into the intelligent cockpit of EX30:

Google Automotive Services (GAS): GAS makes it easy for users to experience Google Maps, Google Assistant, and massive applications in the Google Play App Store.

Phone-IVI integration: as a supplement to the application ecosystem, ECARX Cloudpeak provides EX30 with phone-IVI integration experiences such as Android Auto and Apple CarPlay.

ADAS prompt: ECARX Cloudpeak can interconnect and communicate with all ADAS functions of EX30. It can process the information perceived by radar, cameras and other sensors related to intelligent driving assistance and present it on the cluster screen in front of the driver, thereby maximizing the driver's front view, relieving the anxiety and reducing safety hazards caused by the deviation of the field of vision.

It supports 5G connectivity and OTA updates to ensure that applications and operating systems are always up to date.

Going overseas: ECARX Cloudpeak supports EX30 to be launched in more countries and regions around the world. Volvo Cars plans to increase the capacity of this model at its Ghent Plant in Belgium from 2025.

In addition, ECARX has teamed up with Xingji Meizu to integrate the "mobile phone domain" and the "vehicle domain" through IVI-phone integration. The intelligent cockpit system based on the ECARX cockpit series computing platform + Meizu FlymeAuto solution can achieve seamless connection, cross-domain cooperation, ecosystem sharing, and data interoperability between mobile phones and vehicles.

ECARX + Xingji Meizu mainly realize the integration of three major capabilities:

Data integration (data integration, account integration, ecosystem integration): Integrate the data sandbox between the mobile phone and IVI from the software level. The most basic storage data, account integration, and integration of millions of mobile phone applications create a new IVI application ecosystem for users.

Team integration (Meizu, ECARX, Lynk & Co): Integrate Meizu’s mobile phone industry, ECARX’s computing platform and the personalized needs of OEMs to connect cross-industry production processes - in the initial stage of vehicle R&D, locations have been reserved for mobile phones, chips and corresponding functions.

Computing power integration (distributed application ecosystem, IVI-phone integration framework, protocol fusion, heterogeneous networking): reconstruct the underlying communication protocols of IVI and mobile phone, and integrate distributed application ecosystems, phone-IVI integration framework, protocol fusion and heterogeneous networking capabilities to allow the hardware capabilities of mobile phones and vehicles to share with and call each other, so as to meet more usage scenarios. The rapidly iterative mobile phone computing power can also be perfectly integrated with the IVI computing power, making the user experience more "unbounded".

2. All-scenario integration of service capabilities

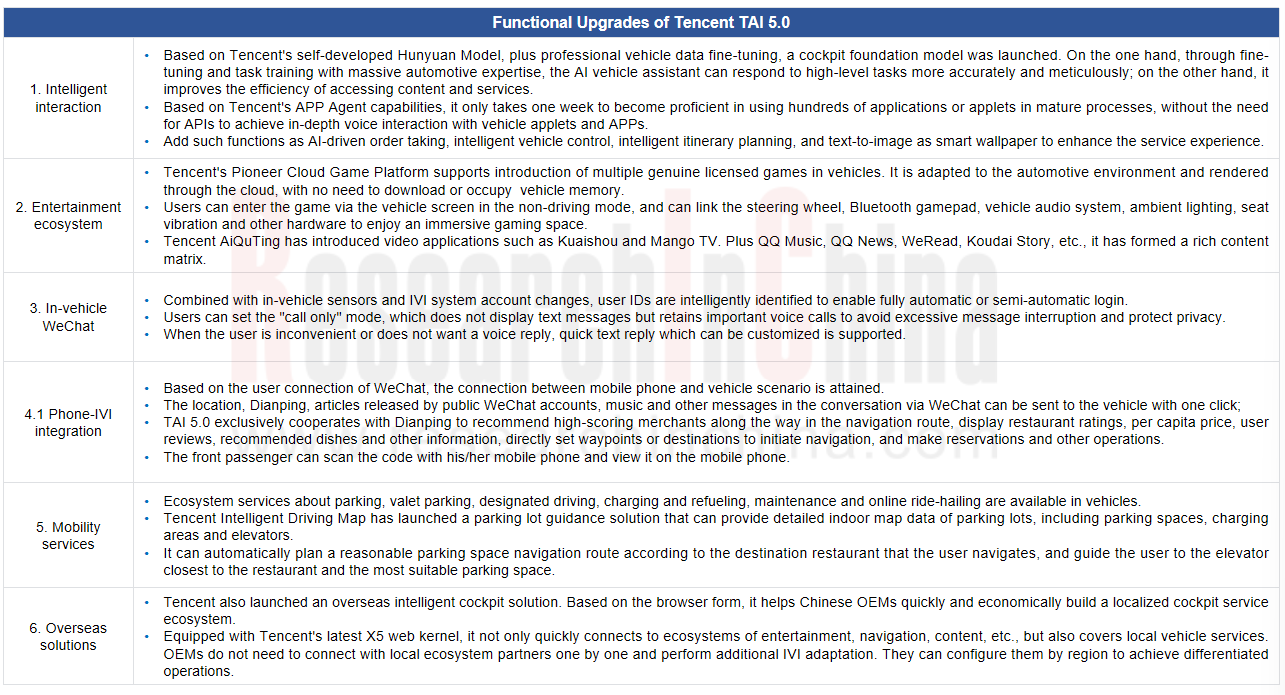

At the "TIME DAY” in April 2024, Tencent upgraded its TSP and intelligent cockpit solution to TAI 5.0, and introduced a cockpit foundation model to improve intelligent interaction and active service experiences in an all-round way. It comprehensively upgraded the entertainment ecosystem, mobility services, and phone-IVI integration, ultimately achieving all-scenario integration of service capabilities.

3. Cockpit-driving integration of maps

In 2024, Baidu, Tencent, and NavInfo all released their latest IVI maps. In addition to 3D maps and lane-level navigation, ADAS maps are also a highlight. Map services and driving assistance are thus integrated.

Baidu Maps V20

In April 2024, Baidu Maps V20 was released. It can support multiple systems such as iOS, Android, Linux, QNX and HarmonyOS. Baidu Maps V20 not only supports 3D lane-level navigation on IVI, but also enables phone-IVI synchronization, personalized voice packages, real lane-level navigation, real-time traffic lights, and real-time maps among others, regardless of system interconnection.

Phone-IVI integration: the mobile phone and the IVI share the same version, and the mobile phone map and the IVI map are updated synchronously on a perpetual basis;

Real lane-level navigation: it is available nationwide. Lane-level map data of 3.6 million kilometers of roads and 360 cities across China have been produced and launched, covering 95% of user navigation mileage;

Map agents: foundation models land on vehicles, and IVI maps can offer free questions and answers in natural language, and access a billion-POI content service ecosystem at any time;

Phone-IVI interconnection: Baidu Maps V20 breaks the system boundaries and enables connection without needing to buy a mobile phone with the car or change the mobile phone when buying a car. It allows for "use of a Huawei mobile phone to get into a Xiaomi car", and also "use of an Apple mobile phone to get into an AITO car".

Tencent Maps 8.0

In September 2024, Tencent Maps was upgraded to Version 8.0, offering upgrades around scenarios such as parking, energy replenishment, and location-based services.

Updates

Parking lot and parking area recommendation

Parking lot indoor map display and floor switching

Navigation in the parking lot

Lane-level navigation extends to all urban, highway and expressway scenarios

Accompanying route and GLOSA ? Human-IVI co-driving guidance

Account system

Phone-IVI integration

WeChat location shared to IVI

More realistic 3D renderings

New energy charging radar layer

Fully automatic calculation of the continuous path

NavInfo’s latest map

With the development of vehicle intelligence, NavInfo’s map services have extended from traditional navigation maps to multiple segments, including:

SD maps: used for basic navigation

ADAS maps: serving ADAS

HD maps: providing HD map services

AVP maps: supporting automated valet parking (AVP)

NavInfo made progress in the map business in 2024:

Map business: It continued to promote lightweight HD map solutions, and has entered up to 100 cities. It launched or completed POC with multiple autonomous driving solution providers and OEMs.

Navigation products: It continued to optimize and improve the navigation experience, enhance capabilities in all scenarios, and provide accurate and reliable navigation services.

Human-machine co-driving: It formed a differentiated configuration of cockpit chips, flexibly met the needs of high-, mid- and low-end markets, and supported all-scenario capabilities with heavy maps, light maps, or no maps.

Intelligent map engine: With continuous efforts on technological innovation, it achieved continuous innovation and improvement of capabilities which can be compatible with different map strategies, including heavy maps, light maps and SD maps, and support intelligent driving on highways, urban expressways and urban roads and in parking lots.

Lane-level navigation products: Expanding from highways and urban expressways to urban areas, it attained a wider coverage.

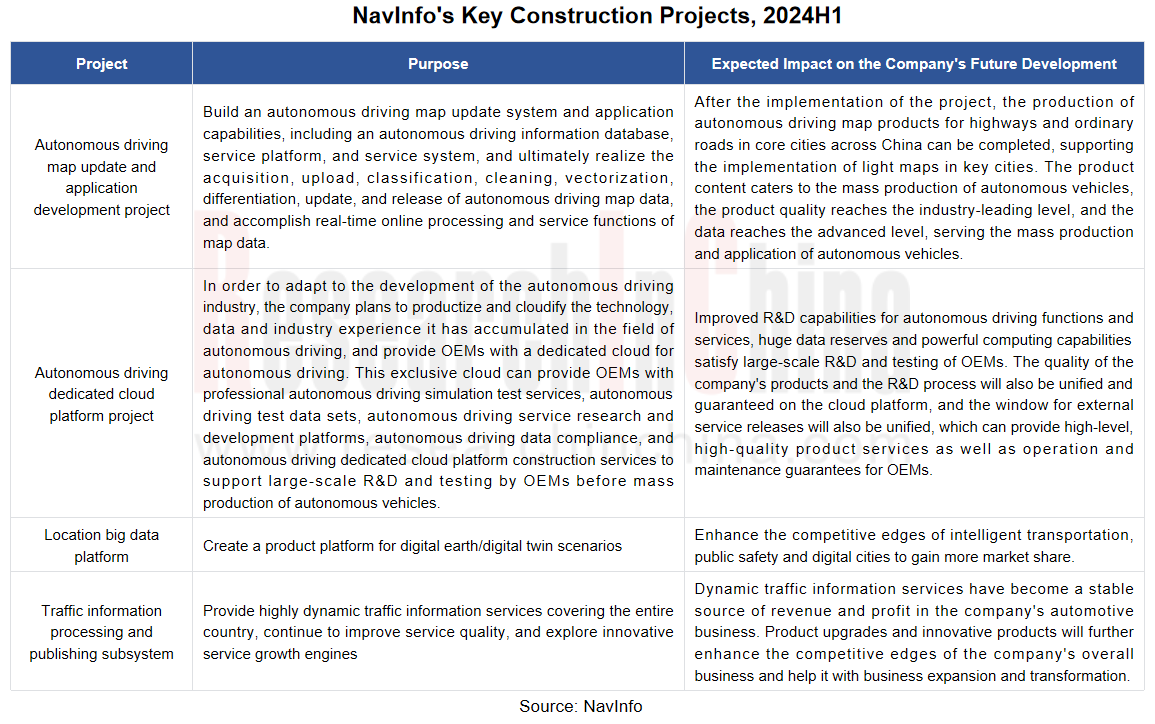

In addition, NavInfo's service capabilities based on maps are advancing from cockpits to intelligent driving. In 2024, two of its four key projects are centered on autonomous driving.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...