Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2024-2025

Cockpit-driving integration is gaining momentum, and single-chip solutions are on the horizon

The Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2024-2025 released by ResearchInChina combs through and summarizes the advantages and disadvantages of driving-parking integration, cockpit-parking integration and cockpit-driving integration (cockpit-driving-parking), their implementation modes, business models, used chips, market application and distribution, OEMs’ planning and layout, competitive landscape, and suppliers, and analyzes and predicts the market size of cockpit-driving integration (cockpit-driving-parking).

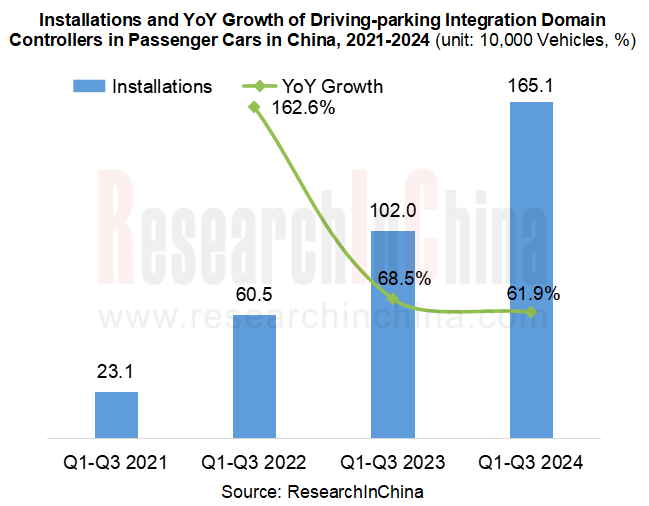

1. The installations of driving-parking integration domain controllers soared by 61.9% year on year, and the overall penetration rate exceeded 10%.

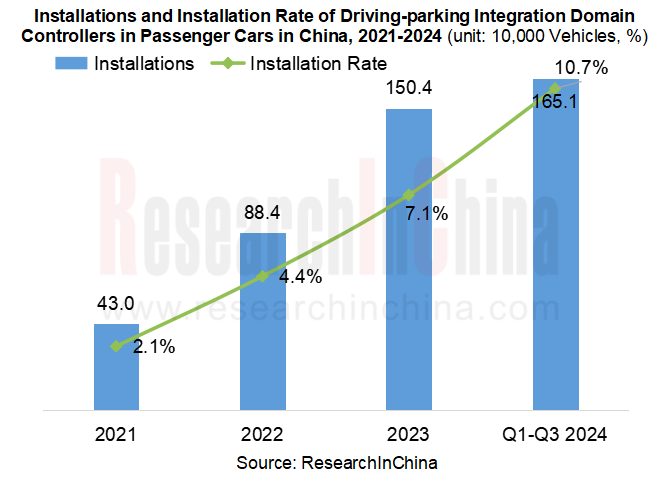

In the current general trend towards EEA centralization and OEMs' cost reduction needs, driving-parking integration, cockpit-parking integration and cockpit-driving integration (cockpit-driving-parking) domain controllers have come into being. Compared with cockpit-parking integration and cockpit-driving integration, driving-parking integration is implemented earlier and develops relatively maturely. Driving-parking integration began to be applied in 2021, and went into mass production in 2022. In the first three quarters of 2024, nearly 1.651 million vehicles installed with driving-parking integration domain controllers were sold, a like-on-like spike of 61.9%.

In the first three quarters of 2024, the penetration rate of driving-parking integration domain controllers was 10.7%, up 3.8 percentage points from the prior-year period and 3.6 percentage points versus 2023.

In the first three quarters of 2024, driving-parking integration domain controllers were largely installed on battery electric and extended-range passenger cars, which took a combined 95.1% share. Wherein, the installation rate in battery electric cars was 23.2%, mainly Tesla; the installation rate in the extended-range cars was as high as 77.3%, led by Li Auto and Harmony Intelligent Mobility Alliance (HIMA).

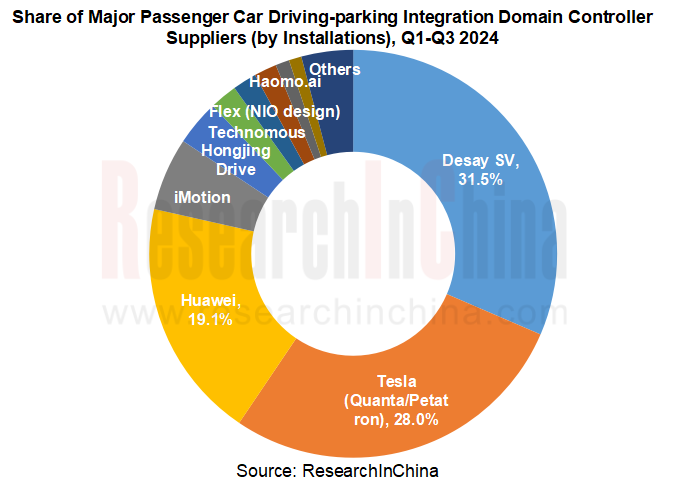

Driving-parking integration domain controller suppliers: Desay SV is far ahead, alone commanding over 30% of the market.

At present, some OEMs design driving-parking integration domain controllers by themselves, and outsource production to third-party suppliers, for example, Tesla (Quanta/Pegatron) and NIO (Flex); some large strong OEMs like Great Wall Motor (Haomo.ai) and BYD (BYD Research Institute) self-develop and self-produce the controllers; Li Auto, HIMA, Zeekr, Xiaomi, IM Motors, and Xpeng among others choose to cooperate with third-party suppliers.

Among the driving-parking integration domain controller suppliers, Desay SV holds a safe lead, alone taking a 30% share in the market. It has formed partnerships with Li Auto, Xiaomi, Zeekr, and Xpeng. Its best-selling products include IPU03 (Horizon J5/NVIDIA Xavier) and IPU04 (NVIDIA Orin X).

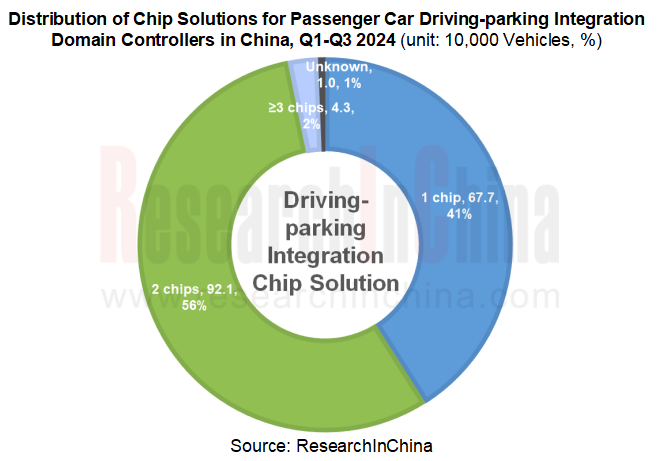

The share of single-chip solutions for driving-parking integration domain controllers reached 41%.

Driving-parking integration domain controllers generally adopt multi-chip solutions, but single-chip solutions have already taken a favorable market share (41%), and are expected to prevail in the market soon in the general trend for reducing costs and improving efficiency.

Driving-parking Integration Chip Solution

In the first three quarters of 2024, driving-parking integration domain controllers for passenger cars used a total of 2.68 million chips. Only Tesla (self-use), NVIDIA, and Huawei HiSilicon (mainly for HIMA) together sweep 76% of the market, showing a high market concentration. As concerns chip compute and process, the mainstream chips Tesla’s second-generation FSD, Nvidia Orin-X, and Huawei HiSilicon Ascend 610 all boast higher than 100 TOPS and 7nm process.

2. 2024 is the first year for mass production of cockpit-parking integration.

Cockpit-parking integration solutions lower costs and improve efficiency mainly by saving a parking chip and exploiting the compute redundancy of the cockpit chip. For mainly processing image display and audio functions, the cockpit chip has relatively high GPU compute, but limited NPU compute. It is more suitable for integrating basic parking functions and targets vehicle models priced below RMB200,000. The two cockpit-parking integration models launched in August 2024 are both priced within RMB150,000:

The full range of Geely Galaxy E5, launched in early August, uses ECARX’s cockpit domain controllers with 1 SiEngine Longying No.1 chip. Only the top-end starship edition adopts a cockpit-parking integration solution, with the manufacturer's suggested retail price (MSRP) of RMB145,800.

Xpeng MONA M03, launched in late August, uses Desay SV’s cockpit domain control hardware and AutoAI’s software, and packs Qualcomm Snapdragon 8155P. This model has three editions: Long-range Edition with MSRP of RMB119,800, Ultra-long-range Edition with MSRP of RMB129,800, and Ultra-long-range MAX Edition with MSRP of RMB155,800.

Among them the long-range and the ultra-long-range editions adopt a cockpit-parking integration solution, and the driving chip is Mobileye EyeQ4H. The Ultra-long-range MAX Edition with a price of higher than RMB150,000 adopts a driving-parking integration solution, and the driving chip is 2*NVIDIA Orin-X.

It is reported that the above two models have been available on market for only more than three months, but the cumulative delivery has been about 80,000 units, successfully bringing cockpit-parking integration into the mass production stage. In addition, quite a few OEMs such as Dongfeng Forthing, FAW Hongqi, GAC, NIO, Changan, BAIC Arcfox and Neta have already planned to use cockpit-parking integration, and the related suppliers have also introduced multiple cockpit-parking integration domain controllers, including ECARX Antora 1000/Antora 1000 Pro, Desay SV’s Gen4 Series, Yuanfeng Technology's Cockpit-parking Integration Controller 1.0/2.0, AutoLink AL-N1/AL-C2, and Foryou Cockpit Platform 3.0.

3. Cockpit-driving integration develops better than expected, skyrocketing by 1071.9% year on year.

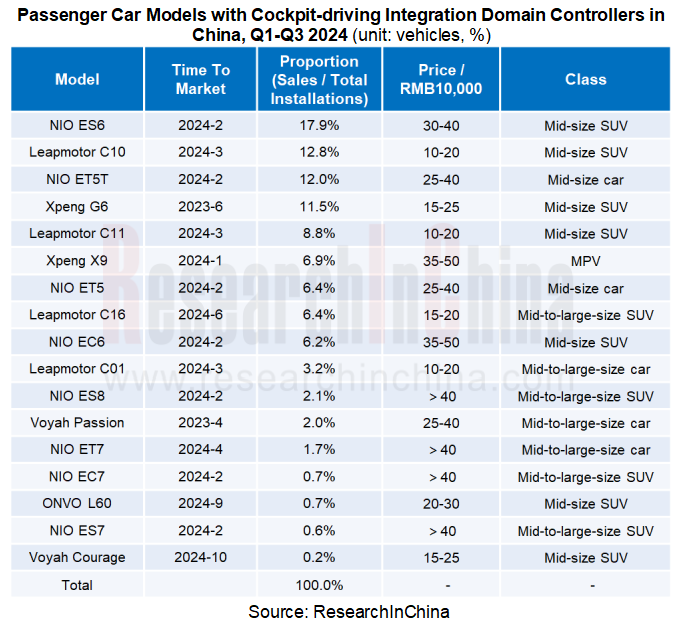

As an advanced form of cross-domain integration, cockpit-driving integration is the focus of the layout by players. It was put into use in 2023, ahead of cockpit-parking integration. In April 2023, Voyah Passion, the first model packing a cockpit-driving integration domain controller, was rolled off on market. In just one and a half years, models that actually apply cockpit-driving integration function have numbered up to 17.

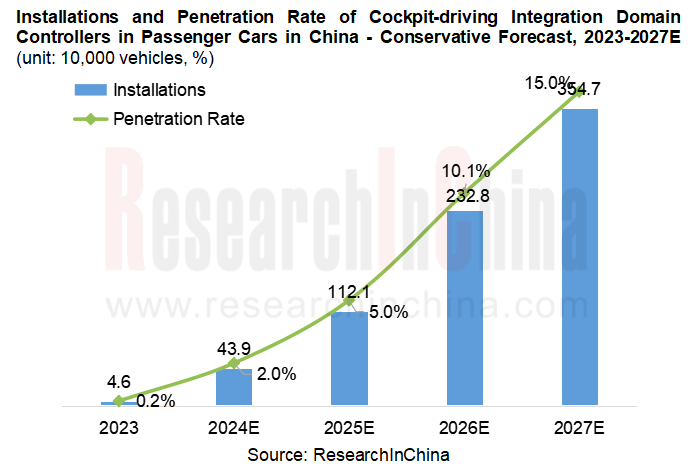

In the first three quarters of 2024, cockpit-driving integration domain controllers were installed in 246,600 cars, soaring by 1071.9% on a like-on-like basis. Of course, cockpit-driving integration products are in the introduction stage, and the installation in 246,600 cars suffices to show that cockpit-driving integration has officially entered the mass production and application stage.

In the first three quarters of 2024, the penetration rate of cockpit-driving integration domain controllers was only 1.6%. Yet seen from the application layout of cockpit-driving integration by many OEMs, suppliers, and chip companies, most of them plan volume production and application of it in 2025. We hence speculate that 2025-2027 will be a boom period for cockpit-driving integration, and its penetration rate is expected to reach between 15% and 25% in 2027.

There is a huge market space for cockpit-driving integration suppliers in the future.

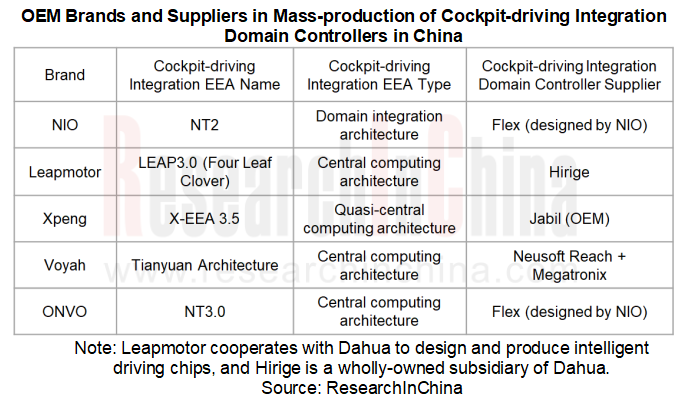

From the supplier side, in current stage cockpit-driving integration domain controllers are primarily developed and designed by OEMs, and produced by third parties. Voyah, a subsidiary of the traditional OEM Dongfeng, however adopts the cooperative product of the third-party suppliers Neusoft Reach and Megatronix. Geely, Changan, BAIC and GAC, which plan to set foot in the market in 2025, have established relations with different suppliers on R&D of cockpit-driving integration. There is still huge market space left for suppliers in the future.

Desay SV signed cooperation agreements with GAC Hyper and Chery in April and October 2024, respectively, on cockpit-driving integration domain controllers. In October, it also brought related products to Geely to exchange and share technological innovation and application.

Single-chip solutions for cockpit-driving integration are expected to land in 2025.

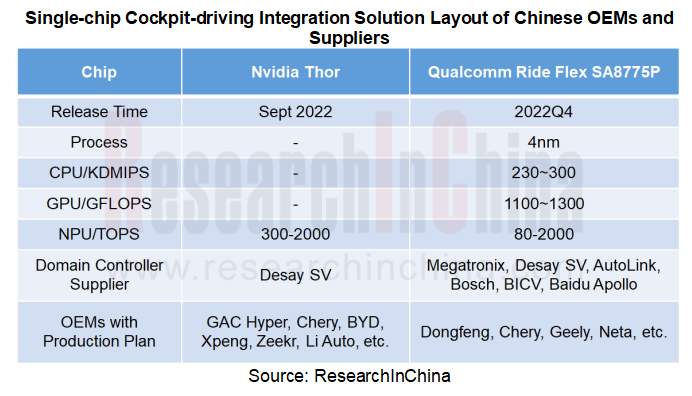

Among the current cockpit-driving integration models, except for the low-end edition (within RMB200,000) of Leapmotor C Series, all other models have adopted a multi-chip solution, with a typical configuration of mainstream intelligent cockpit chip (Qualcomm 8155/8295) + mainstream intelligent driving chip (Nvidia Orin-X). Regarding single-chip solutions, multiple OEMs and suppliers prefer Nvidia Thor and Qualcomm Ride Flex SA8775P chips, both of which are scheduled to come into mass production in 2025.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...