Skateboard chassis research: already used in 8 production models, and larger-scale production expected beyond 2025

Global and China Skateboard Chassis Industry Report, 2024-2025 released by ResearchInChina combs through and summarizes the status quo, installation, and suppliers’ product layout of skateboard chassis, and also predicts its future development trends. This article will interpret the status quo of the industry from three perspectives: OEMs, suppliers, and the capital market.

I. Skateboard chassis fades in overseas markets, while it begins to come to the fore in China.

1. As giants Arrival and Canoo exit, skateboard chassis cools down in overseas markets.

In January 2024, Arrival, a prominent British skateboard chassis player, received a delisting notice from the NASDAQ Stock Market. In February 2024, the company filed for bankruptcy protection and eventually sold its assets to another startup, Canoo. Yet Canoo’s car making dreams also came to an abrupt end this year. As the global pioneer of the model of making cars with skateboard chassis, Canoo launched pickups, sedans, and LDVs for freight, and successfully delivered products to renowned institutions such as National Aeronautics and Space Administration (NASA), the US Department of Defense, and the US Postal Service. It signed cooperation agreements with companies like Walmart. However, on January 17, 2025, Canoo announced that it had filed for bankruptcy protection and ceased operations immediately.

The exits of Arrival and Canoo, two skateboard chassis OEM giants, not only signify the end of their car making dreams but also indicate the development of skateboard chassis has a setback in the Western market.

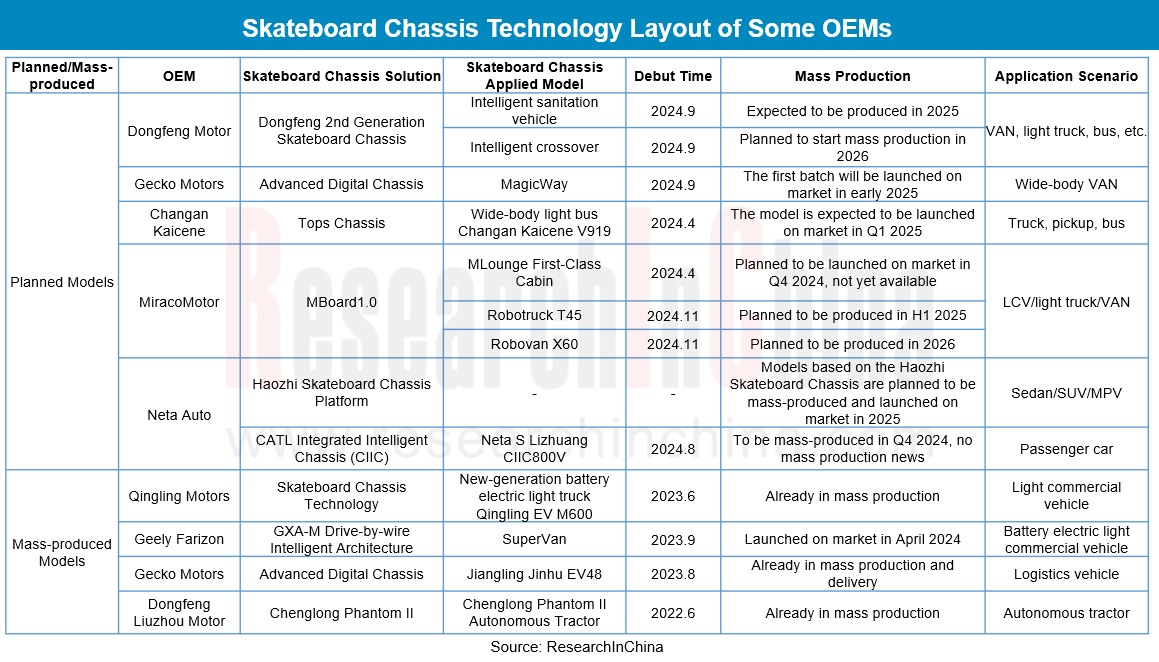

Although skateboard chassis has cooled in overseas markets, several Chinese OEMs are still working to deploy skateboard chassis technology. They not only have had multiple production models equipped with skateboard chassis technology, but unveiled several new models featuring this technology in 2024.

2. Multiple Chinese OEMs deploy skateboard chassis technology, small-scale production for light commercial vehicles expected during 2025-2026.

According to incomplete statistics, about 14 models featuring skateboard chassis technology debuted in 2024, mainly light commercial vehicles planned for mass production during 2025-2026. In the passenger car segment, the model NIO S Liezhuang CIIC800V is currently planned to adopt skateboard chassis technology.

In China, 8 production models have already adopted skateboard chassis technology, of which most are light commercial vehicles such as logistics vehicle, light bus, and light truck, and a few are heavy trucks and passenger cars. Below are two application cases:

1) Qingling EV M600, a battery electric light truck launched in June 2023, utilizes skateboard chassis, a technology that integrates the three core components—battery, motor, and electronic control system—along with brake-by-wire, steering, and thermal management systems into three major domains on the chassis. This significantly reduces redundancy, breaks through existing technical boundaries, and decouples hardware and software by advanced functional modules such as power, drive, control, cockpit, and upper structure, ultimately creating a modular and universal chassis platform architecture.

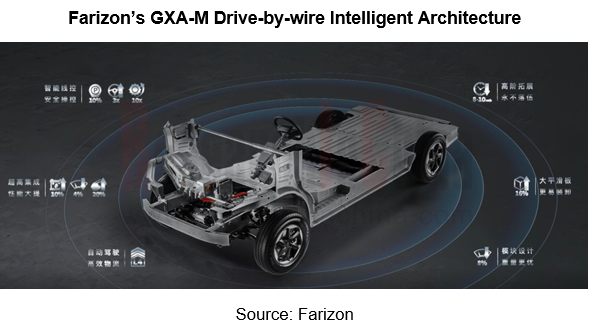

2) In April 2024, Geely Farizon officially rolled out SuperVAN. The new vehicle is built on the GXA-M Drive-by-wire Intelligent Architecture, enabling L4 and higher levels of autonomous driving to follow future development trends in autonomous driving. Thanks to the modular technology of the drive-by-wire intelligent architecture, the body and chassis are completely decoupled, allowing for flexible adjustments in wheelbase, front overhang, and rear overhang, and free combinations of power, braking, suspension, and steering systems. As a result, users can design the body freely as they need, and flexibly choose vehicle configurations. Farizon SuperVAN is positioned as a battery electric light commercial vehicle, with the X-VAN model featuring high customization and 10kW power supply capability for the upper structure, bringing the superiority of skateboard platform into full play.

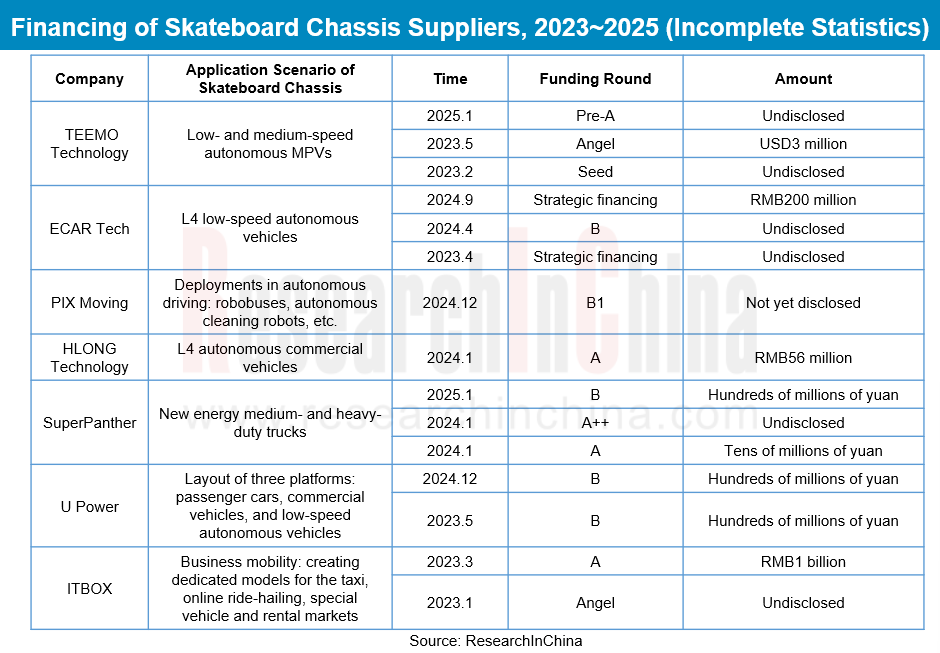

II. 2023 to Early 2025: 7 suppliers secured 15 funding rounds, raising over RMB1.6 billion.

In addition to OEMs which vigorously make layout, the capital market has also shown strong enthusiasm, with high confidence in skateboard chassis:

Skateboard chassis technology solution suppliers making layout in low-speed autonomous vehicles: both TEEMO Technology and ECAR Tech closed three funding rounds between 2023 and 2025, and PIX Moving closed its B1 funding round in December 2024.

Skateboard chassis technology solution suppliers making layout in commercial vehicles: SuperPanther and HLONG Technology closed a total of four funding rounds between 2024 and 2025, three of which were secured by SuperPanther.

U Power, which covers passenger cars, commercial vehicles, and low-speed autonomous vehicles, closed two funding rounds between 2023 and 2024.

ITBOX, oriented to business mobility and creating exclusive models for taxi, ride-hailing, special vehicle, and rental markets, closed two funding rounds in 2023.

The train of financing events highlights the capital market’s great attention to and support for the skateboard chassis segment. On one hand, the highly integrated and modular design of skateboard chassis can effectively shorten R&D cycles and reduce costs for automakers, aligning with the current trend towards intelligence and electrification in the automotive industry. On the other hand, its application potential in logistics, sanitation, public transport, and other fields is immense, making it a promising market. The influx of capital will further drive innovation and iteration in skateboard chassis technology, and accelerate commercialization of related companies, giving a big boost to the entire industry.

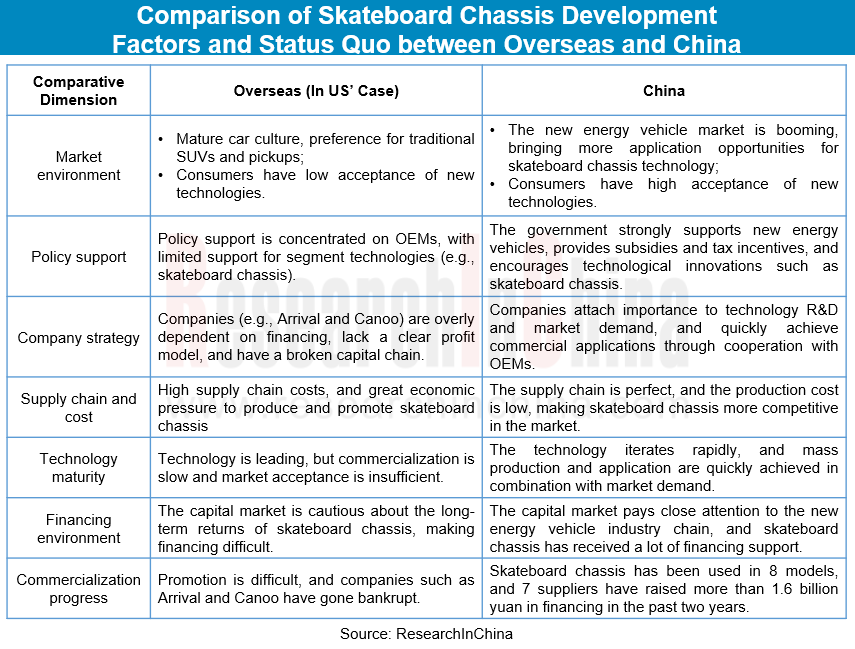

While skateboard chassis face challenges in overseas markets, it thrives in China. The reasons for this contrast include low penetration of new energy vehicles, insufficient policy support, and high supply chain costs overseas. The boom in China is credited to policy support, a mature supply chain, capital favor, and rapid technological iteration. Below is a comparative analysis table showing why skateboard chassis is hard to promote overseas but develop rapidly in China:

III.Skateboard chassis solution suppliers target end scenarios, with multiple models in operation.

Skateboard chassis technology suppliers such as REE, PIX Moving, TEEMO Technology, ECAR Tech, and Seektop Automobile primarily apply their products to last-mile scenarios, including autonomous retail vehicles, autonomous cleaning robots, and autonomous logistics vehicles. Take PIX Moving and TEEMO Technology as examples:

In December 2024, PIX Moving, TIS, and the Hot Okinawa Research Institute formed a partnership. In this collaboration, TIS is responsible for introduction and planning, PIX Moving provides autonomous vehicles and technology, the Hot Okinawa Research Institute operates autonomous retail services, and Kanucha Resort (a resort in Nago City, Okinawa) provides application scenarios. PIX’s autonomous retail vehicle Robo-Shop (eagle wing door version) has been put into operation in Okinawa, Japan, offering innovative unmanned mobile retail services to tourists. It can be intelligently dispatched according to tourist flow, automatically moving to crowded areas to sell snacks, beverages, and other goods, and supporting cashless payments.

TEEMO Technology’s AutoBots-W7 mid-size intelligent skateboard chassis is designed for medium- and low-speed autonomous MPVs which are applicable to scenarios such as urban and campus delivery, unmanned logistics, factory logistics, and urban and rural sanitation. Its commercially produced skateboard chassis, AutoBots-W7, has been successfully installed on Zelos (Suzhou) Technology’s urban autonomous distribution vehicles. Currently, Zelos has achieved large-scale deployment in over 20 provinces in China and more than 100 cities globally, covering scenarios like fresh food delivery, laundry delivery, cold chain distribution, and express delivery. Zelos finds broad application in express delivery, and partners with multiple express companies such as SF Express, China Post, YTO Express, ZTO Express, and STO Express.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...