Automotive Digital Key (UWB, NearLink, and BLE 6.0) Industry Trend Report, 2025

Digital key research: which will dominate digital keys, growing UWB, emerging NearLink or promising Bluetooth 6.0?

ResearchInChina has analyzed and predicted the digital key market, communication technology and standard specifications, industry chain and competition landscape, OEM applications and planning, chip vendors and system integrators.

I. The digital key market hits a new high, and the installation rate will exceed 80% in 2030

In 2024, China's passenger car digital key market hit a new high, with the installations growing by 58.7% year-on-year, the market size exceeding RMB3 billion and the installation rate jumping by 15 percentage points year-on-year to 47.5%. Therefore, we raised market expectations in the Automotive Digital Key Industry Trend Report 2025. It is expected that the installation rate of digital keys for Chinese passenger cars will reach 80.8% by 2030.

II. The installation rate of digital keys for emerging brands reaches 89%, and suppliers see a reshuffle

In terms of enterprise type, emerging brands are far ahead. In 2024, the digital key installation rate of emerging brands reached 89.0%, an increase of 8.1 percentage points from 2023. Among the emerging brands surveyed, 60% installed digital keys in 100% of their vehicles.

For emerging brands, digital key system suppliers include YF Tech, Pektron, Gosuncn, UAES, Kostal, etc. The top five suppliers account for 66.7% of the market share together.

With the support of Harmony Intelligent Mobility Alliance (HIMA) (AITO, LUXEED, Maextro and STELATO) and other emerging popular brands, YF Tech boasted a market share of 27.5% in 2024, ranking first.

Thanks to Tesla, the second-ranked Pektron gained a market share of 17.2%.

Driven by Geely Galaxy, Gosuncn achieved a market share of 8.9%, ranking third.

UAES, prompted by brands such as ZEEKR and Xiaomi, secured a 7.7% share;

Due to some NIO models, Kostal achieved a 5.4% share.

III. UWB, NearLink, and BLE 6.0 will be the three major players in the future

From a technical perspective, digital keys mainly undergo four generations:

Based on NFC technology, the first-generation digital keys realized the function of vehicle entry and start.

The second generation digital key uses BLE technology, which has a longer communication distance than the first generation. At the same time, they can roughly perceive the positional relationship between vehicles and keys through the Bluetooth signal strength.

The third-generation digital keys combine UWB, BLE, and NFC technologies. UWB technology has made a qualitative leap in the position perception accuracy of the third-generation digital keys.

The fourth-generation digital keys are represented by NearLink, which has a positioning accuracy 5 times higher than Bluetooth and a locking accuracy 6 times higher (as per laboratory test data). At the same time, NearLink is dominated by Huawei, making it easier to achieve ecological synergy based on HarmonyOS.

From the perspective of the plans of OEMs and suppliers, digital keys will have three pillars - BLE, UWB, and NearLink in the next few years. Specifically:

Given the performance improvement and cost reduction, the fusion solution of BLE+NFC has outstanding cost-effectiveness and will become the mainstream of the market;

The penetration rate of the BLE solution will remain at around 20%, mainly available in economical models. After the upgrade in the future, BLE 6.0 is expected to extend the application cycle of the BLE solution;

Due to the short communication distance and limited application scenarios, the standalone NFC solution will have limited room for improvement;

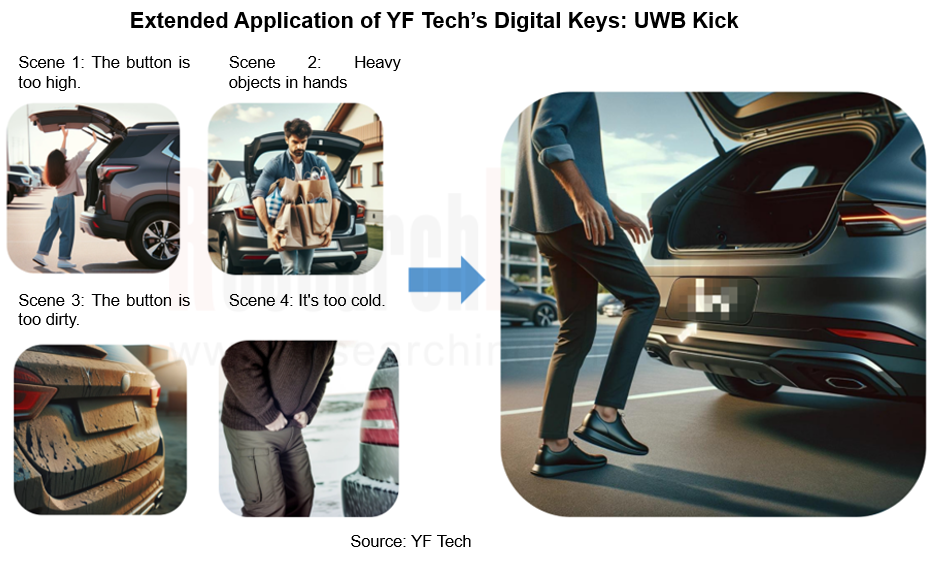

With its performance advantages, high-precision positioning and radar, the UWB solution will integrate future digital keys with other functions, such as multiplexing functions like monitoring and kick radar to make the overall cost optimal. However, UWB still has bottlenecks like high system cost and limited mobile phone support.

The NearLink solution will be put into mass production in 2025, and will gradually land on vehicles on a large scale in 2025-2030.

1. Growing UWB

In 2024, UWB keys for passenger cars entered mass production in China, with the installations increasing by 354.6% year-on-year. NIO, Zeekr, Harmony Intelligent Mobility Alliance (HIMA) , Mercedes-Benz, BMW, etc. are the main UWB carriers, and the top 5 of them accounted for 77.1% of the installations. In the next three years, more OEMs, such as domestic brands (SAIC Passenger Vehicle, SAIC GM, etc.) and joint venture brands (like Audi and Toyota), will carry UWB to upgrade the digital key system. It is expected that the application of UWB in vehicles will continue to grow in the next few years.

In the process of UWB installation, sensor multiplexing has become a highlight. Based on unique characteristics, UWB brings more possibilities for the functional integration of digital keys. On the one hand, UWB can locate occupants and cars with high precision, thereby providing intelligent and personalized services, such as intelligent adjustment of audio and lighting according to the position of the occupants, automated parking according to the position of the cars, and active location-based recommendations.

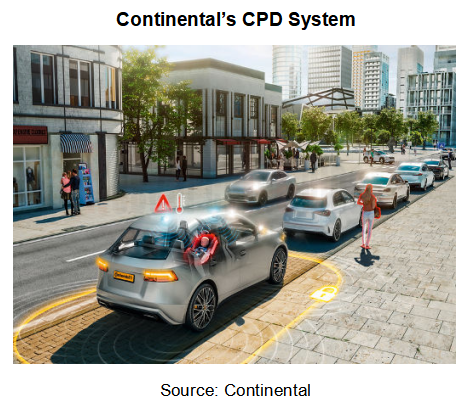

On the other hand, UWB can act as radar used for in-cabin liveness detection, kicking open the trunk and other functions. The C-NCAP Management Regulations 2024 includes the Child Presence Detection (CPD) as a bonus item, which will become an important functional extension of UWB.

Among foreign suppliers, Continental, Valeo, Hella, etc. have launched system solutions integrating UWB keys and in-cabin monitoring. For example, Hella added the Smart Presence Detection function to the Smart Car Access solution. Continental has embedded CPD into the already existing CoSmA UWB Digital Access Solution, which enables drivers to use their smartphone as a car key for hands-free access. Even the tiniest motion like the movement of a child’s chest while breathing can be detected by the sensors. Based on unique respiration rates and micro-body-movements, the CPD with UWB system can classify passengers as infants, children or adults. If children are left behind in the car, the CPD system can send an audible, visual or haptic alert to the driver after ten seconds at the latest.

Among domestic suppliers, YF Tech, TsingCar , UbiTraq and so on have similar solutions. For example, YF Tech's UWB keys already allow functions such as kick sensing for opening trunks and liveness monitoring, and have been mass-produced for Hyper, AITO M9, etc.

The liveness detection function developed by YF Tech for the 2025 AITO M9 reuses the anchor points in the car to offer a liveness detection solution with better performance, safety and reliability. Whether it is the front passenger seat, the back seat or the rear trunk, the system can detect liveness.

At the same time, YF Tech's liveness detection system can provide a series of functional services including early warning, alarm, intervention and care, improving intelligence and humanity.

Early warning: When locking, the system reminds the car owner to pay attention to children left behind through sound and light;

Alarm: Via the mobile phone, it reminds the car owner that there is a child left behind and s/he should return as soon as possible;

Intervention: If the car owner fails to acknowledge the alarm for a long time, the air conditioner will be turned on or the windows will be lowered automatically;

Attention: It can automatically activate lighting, audio, video, entertainment, etc. to care for the child left behind.

The multiplexing of digital key modules can bring more functions while reducing system costs and power consumption. For example, in the sentinel monitoring solution of YF Tech, the UWB node performs pre-monitoring, and the camera can be turned off until an object is found approaching, thereby reducing the overall power consumption. Assuming that the sentinel mode is activated for 10 hours per night and the alarm is triggered during 5% of the time, 2kWh of power can be saved approximately per night.

2. Emerging NearLink

With its unique technical route, the NearLink digital car key can achieve more accurate positioning, more stable unlocking, stronger anti-interference capability and concurrency of more devices, avoiding the embarrassing scenario of "standing by the locked doors" or the "ping-pong problem" (doors repeatedly unlocked and locked) caused by traditional digital key solutions, and greatly improving the convenience, safety and reliability of user experience from getting on the car to controlling the car.

YF Tech is currently the first supplier that has achieved mass production of NearLink digital keys. In November 2024, YF Tech and Shanghai HiSilicon developed the world's first digital car key solution with the NearLink standard. This solution uses one master module inside the vehicle and four slave modules outside the vehicle to realize functions such as active welcome, locking/unlocking without feeling, key sharing, RPA, keyless start, multi-user connection, and OTA updates. In March 2025, the first batch of NearLink digital keys were mass-produced and installed on vehicles.

In the NearLink digital key solution, YF Tech has further improved the security, compatibility, positioning accuracy, multi-scenario intelligent interaction and anti-interference of digital car keys by deploying a high-difficulty architecture that is compatible with both NearLink (SLE) and Bluetooth (BLE) communication protocols on the same chip. So far, YF Tech has been designated by 5 OEMs. In the first three quarters of 2025, 7 models equipped with YF Tech's NearLink digital car key technology will be launched. Overall, NearLink keys are rising and will be installed on a large scale in the next 5 years.

3. Promising Bluetooth 6.0

In September 2024, the Bluetooth Technology Alliance released Bluetooth 6.0 whose biggest highlight lies in a new Bluetooth high-precision positioning technology: Channel Sounding (CS for short). Bluetooth CS combines two different distance measurement methods: Phase-Based Ranging (PBR) + Round-Trip Time (RTT). It is positioned as a safer and more accurate positioning technology than Bluetooth RSSI.

From the test results, Bluetooth CS can cover 100 meters, with the accuracy error within ±50 cm; when the distance is less than 5 meters, the accuracy error can even be theoretically close to 10 cm. With this "centimeter-level" perception capability, Bluetooth CS is expected to be first applied to digital keys, enhancing its "competitiveness" in the digital key system.

Bluetooth 6.0 is expected to be implemented in 2026-2027, and its application in digital keys is promising.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...