Research Report on Overseas Cockpit Configuration and Supply Chain of Key Models, 2025

-

Apr.2025

- Hard Copy

- USD

$4,700

-

- Pages:500

- Single User License

(PDF Unprintable)

- USD

$4,500

-

- Code:

ZXF012

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$6,800

-

- Hard Copy + Single User License

- USD

$4,900

-

Overseas Cockpit Research: Tariffs stir up the global automotive market, and intelligent cockpits promote automobile exports

- ResearchInChina has released the Research Report on Overseas Cockpit Configuration and Supply Chain of Key Models, 2025.

- The report summarizes and analyzes the status quo of China's automobile exports and forecasts trends

- It sorts out the demand and characteristics of key overseas markets such as Asia, Europe and Latin America

- It analyzes the cockpit configuration of best-selling models of Chinese brands such as Geely, SAIC, BYD, Great Wall, Chery, and Xpeng in key overseas markets.

- It expounds the cockpit configuration of popular models of international brands such as Toyota, Volkswagen, Ford, BMW, Audi, and Tesla in main overseas markets.

- It summarizes the overseas solutions, businesses and strategies of Chinese automotive cockpit suppliers

- It sums up the cockpit solutions of international automotive cockpit suppliers and their cooperation with Chinese OEMs in the global market

1. In the short term, tariffs have a significant impact on automobile exports, but we remain optimistic about the long-term prosperity

According to data from the China Passenger Car Association (CPCA), China's automobile exports swelled from 1.08 million units in 2020 to 6.41 million units in 2024. From 2021 to 2024, the annual year-on-year growth rate hit 103%, 55%, 57% and 23% respectively. In 2024, the year-on-year growth rate of exports slowed down significantly. Cui Dongshu, secretary-general of the CPCA, predicted in an interview in early 2025 that automobile exports will increase by 10% in 2025.

In April 2025, major Chinese OEMs successively released first-quarter sales data:

In the first quarter, Chery Group exported and sold 255,000 vehicles to overseas markets, rising by 4% year-on-year and accounting for 45.1% of the total sales volume.

SAIC Group exported and sold 219,000 vehicles to overseas markets in the first quarter, falling by 3.3% year-on-year and accounting for 23.2% of the total sales volume.

BYD's export volume and overseas sales volume reached 213,000 vehicles in the first quarter, swelling by by 110.7% year-on-year and accounting for 21.6% of the total sales volume.

22.6% or 159,000 vehicles of Changan Automobile's total sales volume in the first quarter came from overseas markets, with the export volume increasing by 46.5% year-on-year.

In the first quarter, Great Wall Motor exported and sold 91,000 vehicles, equivalent to 35.4% of the total sales volume, to overseas markets, jumping by 10.4% year-on-year.

Geely's export volume and overseas sales volume amounted to 90,000 vehicles in the first quarter, edging up by 2% year-on-year and making up 12.8% of the total sales volume.

In September 2023, the European Commission announced an anti-subsidy investigation on Chinese electric vehicles. On June 12, 2024, the European Commission issued an announcement stating that if no solution could be reached with China, it would impose provisional countervailing duties on imports of battery electric vehicles (BEVs) from China since July 4. The final ruling was originally scheduled to be uploaded to the Official Journal of the European Union on October 30 and take effect the next day. However, it was uploaded "in advance" in the evening of October 29. This means that the European Commission would impose definitive countervailing duties on imports of battery electric vehicles (BEVs) from China for a period of five years, starting from 00:00 on October 30 (local time).

After more than four months of negotiations, even with the combined efforts of multiple parties in China and Europe, the concessions finally made by the European Commission were still very limited. Only Tesla was able to pay additional tariffs according to a separately calculated tax rate through lobbying. The tariff on the cars exported by Tesla (Shanghai) to Europe was reduced from the original 20.8% to 9%, and finally further down to 7.8%.

After the announcement of provisional countervailing duties in June 2024, the sales volume of Chinese OEMs in the EU market (27 EU member states, excluding other non-EU countries in Europe such as the UK and Russia) declined significantly. However, from the introduction of definitive countervailing duties at the end of October to February 2025, the sales volume rebounded dramatically, and the market share of Chinese OEMs in the EU increased from 3.7% in January 2024 and 4.1% in February 2024 to 4.8% in January 2025 and 5.2% in February 2025.

In April 2025, President Donald Trump announced 25% tariffs on all cars exported to the United States, shocking the global automotive industry. Some OEMs have decided to suspend the delivery of new cars to US dealers to cope with the soaring costs caused by tariffs. According to S&P Global Mobility, US light vehicle sales reached 16.03 million units in 2024, including 8.7 million (54%) produced in the US and 7.33 million (46%) imported. Mexico was the leading exporter of automobiles to the US, with 2.96 million finished vehicles shipped in 2024 (in 2024, China exported 445,000 vehicles to Mexico, some of which were re-exported to the US under the United States-Mexico-Canada Agreement (USMCA). South Korea ranked second by exporting about 1.54 million vehicles to the US, followed by Japan with 1.38 million vehicles and Canada with 1.07 million vehicles. In 2024, China directly exported 116,000 vehicles to the US, including Tesla's cars sold back to the country.

In May 2024, the US announced that the total tariff on Chinese electric vehicles would rise to 102.5% from 27.5%. Therefore, the countervailing duties will impact little on Chinese vehicles exported to the US.

Even though the US "reciprocal tariffs" may trigger other countries to impose additional tariffs, which may further increase uncertainty in the global market, we remain optimistic about the long-term prosperity of China's automobile exports in the future.

2. Intelligent cockpit configuration and overseas market differentiation strategy are the key to the constant growth of China's automobile exports

The global automotive market shows significant regional differences due to factors such as economic level, policy orientation, consumer culture and industrial foundation. Chinese OEMs have transformed their exports from the past extensive mode to the intensive mode, and have built a full automotive industry chain overseas, including innovation and R&D centers, production bases, marketing centers, supply chain centers, financial companies and self-built logistics systems. For example, SAIC Group has three innovation and R&D centers, multiple vehicle manufacturing bases, more than 100 parts production and R&D bases and over 2,800 marketing and service outlets overseas. Geely boasts more than 500 sales and service outlets in 70 countries around the world, adopting parallel strategies of self-built networks and dealer networks, and making full use of Volvo's production capacity and service network in European factories.

Chinese OEMs are pushing smart cockpits to global car users with their technological innovation and cost advantages. The global market has rigid demand for smart cockpits. Chinese OEMs have gradually improved their brand awareness in overseas markets through global cooperation, localization strategies and digital marketing.

Cockpit Configuration of BYD ATTO 3 Sold in Thailand

3. The competition in intelligent cockpits is fierce, and export models begin to pack AI cockpit applications.

From CES 2025, it’s evident that automotive technology is booming, and AI leads the new trend. Intelligent cockpits have become a natural carrier of black automotive technologies and AI, drawing much attention. In comparison to previous years, electrification and charging systems become less hot, while Intelligent cockpits, vehicle displays/HUDs, and occupant monitoring systems (OMS) gain greater popularity.

Globally, international OEMs are also accelerating the adoption of intelligent cockpits. Even for traditional models in non-European and non-American markets, cockpit intelligence is advancing.

The push for intelligent cockpits isn’t limited to new energy vehicles, and traditional fuel-powered vehicle companies are also following up. In March 2025, at its Intelligent Strategy Conference themed with "Smart Integration of Fuel and Electric, Global Journey Together", Chery announced that starting in 2025, all models across its brands, covering fuel, hybrid, range-extended, and all-electric power types, will be promoted simultaneously in global markets, achieving "four equalities": global equality, oil-electric equality, scenario equality, and urban-rural equality.

AI has already been implemented in Chinese OEMs’ export models. However, as governments worldwide tighten AI regulation, the use of AI in export vehicles must comply with local regulations and policies. Amid rising trade protectionism in Europe and the US, Chinese OEMs expanding overseas need to more meticulously study the regulations and policies of target markets and ensure compliance while competing in these regions.

1 Status Quo of Chinese Automobile Export

1.1 Status Quo of Chinese Automobile Export (1): Export Volume Statistics, 2019-2024

1.1 Status Quo of Chinese Automobile Export (2): New Energy Vehicle Exports

1.1 Status Quo of Chinese Automobile Export (3): Top 10 Companies by Automobile Export, 2024

1.1 Status Quo of Chinese Automobile Export (4): Top 10 Brands by Automobile Export, 2024

1.1 Status Quo of Chinese Automobile Export (5): Top 10 Models by Automobile Export, 2024

1.1 Status Quo of Chinese Automobile Export (6): Top 10 Export Destinations, 2024

1.1 Status Quo of Chinese Automobile Export (7): Change in Key Export Markets for Chinese Automobiles, 2009-2024

1.2 China’s Passenger Car Export Volume, 2025E-2030E

1.3 Top 15 Countries by Automobile Sales, 2020-2024

1.4 Global Passenger Car Sale Volume, 2025E-2030E

1.5 Trends in Chinese Automobile Export (1)

1.5 Trends in Chinese Automobile Export (2)

1.5 Trends in Chinese Automobile Export (3)

1.5 Trends in Chinese Automobile Export (4)

1.5 Trends in Chinese Automobile Export (5)

1.5 Trends in Chinese Automobile Export (6)

1.5 Trends in Chinese Automobile Export (7)

1.5 Trends in Chinese Automobile Export (8)

1.5 Trends in Chinese Automobile Export (9)

1.5 Trends in Chinese Automobile Export (10)

2 Major Overseas Automobile Markets

2.1 Europe

2.1.1 Top 20 Auto Brands by Sales in Germany, 2020-2024 (Part 1/2)

2.1.1 Top 20 Auto Brands by Sales in Germany, 2020-2024 (Part 2/2)

2.1.1 Top 20 Models by Sales in Germany, 2020-2024 (Part 1/2)

2.1.1 Top 20 Models by Sales in Germany, 2020-2024 (Part 2/2)

2.1.1 Top 10 Chinese Auto Brands by Export to Germany, 2020-2024

2.1.1 Top 10 Chinese Models by Export to Germany, 2020-2024

2.1.2 Top 20 Auto Brands by Sales in the UK, 2020-2024 (Part 1/2)

2.1.2 Top 20 Auto Brands by Sales in the UK, 2020-2024 (Part 2/2)

2.1.2 Top 20 Models by Sales in the UK, 2020-2024 (Part 1/2)

2.1.2 Top 20 Models by Sales in the UK, 2020-2024 (Part 2/2)

2.1.2 Top 10 Chinese Auto Brands by Export to the UK, 2020-2024

2.1.2 Top 10 Chinese Models by Export to the UK, 2020-2024

2.1.3 Top 20 Auto Brands by Sales in Belgium, 2020-2024 (Part 1/2)

2.1.3 Top 20 Auto Brands by Sales in Belgium, 2020-2024 (Part 2/2)

2.1.3 Top 20 Models by Sales in Belgium, 2020-2024 (Part 1/2)

2.1.3 Top 20 Models by Sales in Belgium, 2020-2024 (Part 2/2)

2.1.3 Top 10 Chinese Auto Brands by Export to Belgium, 2020-2024

2.1.3 Top 10 Chinese Models by Export to Belgium, 2020-2024

2.1.4 Top 30 Auto Brands by Sales in Russia, 2020-2024 (Part 1/2)

2.1.4 Top 30 Auto Brands by Sales in Russia, 2020-2024 (Part 2/2)

2.1.5 Layout Models of Chinese OEMs in Europe

2.1.6 Chinese OEMs’ Important Measures to Address Risks in Export to Europe

2.1.7 Key Target Markets for Chinese Automobile Exports to Europe

2.1.8 Implementation of EU Tariff Increase

2.1.8 EU’s Regulations and Policies Concerning Digital Security and Cybersecurity

2.1.8 Germany’s 2030 Electric Vehicle Plan

2.1.8 Germany’s Tax/Subsidy Policies

2.1.9 German Consumer Survey

2.1.10 UK’s 2030 Electric Vehicle Plan

2.1.10 UK’s Intelligent Connected Vehicle Development Roadmap

2.1.10 UK’s Tax/Subsidy Policies

2.1.10 UK Consumer Survey

2.1.11 France’s 2030 Electric Vehicle Plan

2.1.11 France’s Tax/Subsidy Policies

2.1.11 French Consumer Survey

2.1.12 Norway’s Overall Electricity Price Is Relatively Low

2.1.12 Norway’s 2025 Goal of 100% Zero-Emission Vehicle Sales

2.1.12 Norway’s Tax/Subsidy Policies

2.1.12 Norwegian Consumer Survey

2.1.13 Denmark’s 2030 Ban on New Internal Combustion Engine Vehicles

2.1.13 Denmark’s Tax/Subsidy Policies

2.1.13 Danish Consumer Survey

2.2 Asia

2.2.1 Top 20 Auto Brands by Sales in Thailand, 2020-2024 (Part 1/2)

2.2.1 Top 20 Auto Brands by Sales in Thailand, 2020-2024 (Part 2/2)

2.2.1 Top 20 Models by Sales in Thailand, 2020-2024 (Part 1/2)

2.2.1 Top 20 Models by Sales in Thailand, 2020-2024 (Part 2/2)

2.2.1 Top 10 Chinese Auto Brands by Export to Thailand, 2020-2024

2.2.1 Top 10 Chinese Models by Export to Thailand, 2020-2024

2.2.2 Top 20 Auto Brands by Sales in Turkey, 2020-2024 (Part 1/2)

2.2.2 Top 20 Auto Brands by Sales in Turkey, 2020-2024 (Part 2/2)

2.2.2 Top 20 Models by Sales in Turkey, 2020-2024 (Part 1/2)

2.2.2 Top 20 Models by Sales in Turkey, 2020-2024 (Part 2/2)

2.2.2 Top 10 Chinese Auto Brands by Export to Turkey, 2020-2024

2.2.2 Top 10 Chinese Models by Export to Turkey, 2020-2024

2.2.3 Top 20 Auto Brands by Sales in Australia, 2020-2024 (Part 1/2)

2.2.3 Top 20 Auto Brands by Sales in Australia, 2020-2024 (Part 2/2)

2.2.3 Top 20 Models by Sales in Australia, 2020-2024 (Part 1/2)

2.2.3 Top 20 Models by Sales in Australia, 2020-2024 (Part 2/2)

2.2.3 Top 10 Chinese Auto Brands by Export to Australia, 2020-2024

2.2.3 Top 10 Chinese Models by Export to Australia, 2020-2024

2.2.4 Overview of Automobile Production Base Development in Thailand

2.2.4 Thailand: Automotive Industry Regulations (1)

2.2.4 Thailand: Automotive Industry Regulations (2)

2.2.4 Thailand: Automotive Industry Regulations (3)

2.2.4 Thailand: EV Subsidies/Tax Incentives (1)

2.2.4 Thailand’s EV Development Plan

2.2.4 Thailand: EV Subsidies/Tax Incentives (2)

2.2.5 Japan’s Automobile Market Access Policies

2.2.5 Japan: New Energy Vehicle Subsidies/Market Access Regulations

2.2.5 Japan: Detailed Regulations on Automobile Market Access (1)

2.2.5 Japan: Detailed Regulations on Automobile Market Access (2)

2.2.5 Japan: Detailed Regulations on Automobile Market Access (3)

2.2.5 Japan: Detailed Regulations on Automobile Market Access (4)

2.2.6 South Korea’s Automobile Market Access Policies

2.2.6 South Korea: Vehicle Certification System (1)

2.2.6 South Korea: Vehicle Certification System (2)

2.2.6 South Korea: Vehicle Certification System (3)

2.2.6 South Korea: Automotive Subsidy Regulations

2.2.6 South Korea: New Energy Vehicle Promotion Regulations

2.3 Latin America

2.3.1 Top 20 Auto Brands by Sales in Brazil, 2020-2024 (Part 1/2)

2.3.1 Top 20 Auto Brands by Sales in Brazil, 2020-2024 (Part 2/2)

2.3.1 Top 20 Models by Sales in Brazil, 2020-2024 (Part 1/2)

2.3.1 Top 20 Models by Sales in Brazil, 2020-2024 (Part 2/2)

2.3.1 Top 10 Chinese Auto Brands by Export to Brazil, 2020-2024

2.3.1 Top 10 Chinese Models by Export to Brazil, 2020-2024

2.3.2 Top 20 Auto Brands by Sales in Mexico, 2020-2024 (Part 1/2)

2.3.2 Top 20 Auto Brands by Sales in Mexico, 2020-2024 (Part 2/2)

2.3.2 Top 20 Models by Sales in Mexico, 2020-2024 (Part 1/2)

2.3.2 Top 20 Models by Sales in Mexico, 2020-2024 (Part 2/2)

2.3.2 Top 10 Chinese Auto Brands by Export to Mexico, 2020-2024

2.3.2 Top 10 Chinese Models by Export to Mexico, 2020-2024

2.3.3 Mexico’s Automotive Industry Landscape

2.3.3 Mexico’s Automotive Market Environment

2.3.3 Mexico’s Free Trade Agreements (1)

2.3.3 Mexico’s Free Trade Agreements (2)

2.3.3 Mexico’s Automotive Market Access Policies

2.3.3 Mexico’s Automotive Supply Chain Landscape

2.3.4 Chile’s Automotive Market Environment

2.3.4 Chile’s Automotive Market Access Policies

2.3.4 Chile: Vehicle Type Approval (1)

2.3.4 Chile: Vehicle Type Approval (2)

2.3.4 Chile: Vehicle Type Approval (3)

2.3.4 Chile: Vehicle Type Approval (4)

3 Overseas Cockpit Configurations of Chinese OEMs

3.1 Intelligent Cockpit Platform Supply Relationships of New Energy Vehicle Brands

3.2 Intelligent Cockpit Platform Supply Relationships of Chinese Independent Brand OEMs (1)

3.2 Intelligent Cockpit Platform Supply Relationships of Chinese Independent Brand OEMs (2)

3.2 Intelligent Cockpit Platform Supply Relationships of Chinese Independent Brand OEMs (3)

3.2 Intelligent Cockpit Platform Supply Relationships of Chinese Independent Brand OEMs (4)

3.2 Intelligent Cockpit Platform Supply Relationships of Chinese Independent Brand OEMs (5)

3.3 Geely

3.3.1 Geely’s Overseas Market Layout and Sales

3.3.2 Geely’s Overseas Market Brands and Localization Strategies

3.3.3 Geely’s Overseas Market Intelligent Cockpit Configuration Strategies

3.3.4 Lynk & Co’s Overseas Market Layout

3.3.4 Lynk & Co’s Overseas Market Cockpit Configurations

3.3.5 Zeekr’s Overseas Market Layout

3.3.5 Zeekr’s Overseas Market Cockpit Configurations

3.3.6 Top 10 Geely Models by Sales in Malaysia, 2020-2024

3.3.6 Top 10 Geely Models by Sales in the US, 2020-2024

3.3.6 Top 10 Geely Models by Sales in the UK, 2020-2024

3.3.6 Top 10 Geely Models by Sales in Germany, 2020-2024

3.3.6 Top 10 Geely Models by Sales in Sweden, 2020-2024

3.3.6 Top 10 Geely Models by Sales in the Netherlands, 2020-2024

3.3.6 Top 10 Geely Models by Sales in Belgium, 2020-2024

3.3.6 Top 10 Geely Models by Sales in Italy, 2020-2024

3.3.6 Top 10 Geely Models by Sales in France, 2020-2024

3.3.6 Top 10 Geely Models by Sales in Spain, 2020-2024

3.3.6 Top 10 Geely Models by Sales in South Korea, 2020-2024

3.3.6 Top 10 Geely Models by Sales in Norway, 2020-2024

3.3.6 Top 10 Geely Models by Sales in Turkey, 2020-2024

3.3.6 Top 10 Geely Models by Sales in Australia, 2020-2024

3.3.6 Top 10 Geely Models by Sales in Thailand, 2020-2024

3.3.6 Top 10 Geely Models by Sales in Mexico, 2020-2024

3.3.6 Top 10 Geely Models by Sales in Brazil, 2020-2024

3.3.7 Zeekr ZEEKR 009’s Cockpit Configuration in Malaysia (Part 1/2)

3.3.7 Zeekr ZEEKR 009’s Cockpit Configuration in Malaysia (Part 2/2)

3.3.7 Zeekr ZEEKR X’s Cockpit Configuration in Indonesia

3.3.8 Zeekr 001’s Cockpit Configuration in Mexico

3.3.9 XC60’s Cockpit Configuration in France

3.3.9 XC60’s Cockpit Configuration in the Netherlands

3.3.9 XC60’s Cockpit Configuration in South Korea

3.3.9 XC60’s Cockpit Configuration in Thailand

3.3.9 2026 XC60 Overseas Cockpit Configurations

3.3.10 EX30’s Cockpit Configuration in the Netherlands

3.3.10 EX30’s Cockpit Configuration in Japan

3.3.11 Polestar 2’s Cockpit Configuration in Europe

3.3.12 LYNK & CO 01’s Cockpit Configuration in Saudi Arabia

3.3.13 Intelligent Cockpit System Solutions of Geely’s Brands (1)

3.3.13 Intelligent Cockpit System Solutions of Geely’s Brands (2)

3.3.14 Geely Lynk & Co’s Intelligent Cockpit System Solutions and Evolution

3.3.15 Geely’s Cockpit Domain Controller Supplier System (1)

3.3.15 Geely’s Cockpit Domain Controller Supplier System (2)

3.3.15 Geely’s Cockpit Domain Controller Supplier System (3)

3.3.16 Geely’s Intelligent Cockpit OS Planning

3.4 SAIC

3.4.1 SAIC Group's Overseas Organizational Structure Strategy: Overseas and Domestic Markets in Parallel

3.4.2 SAIC Group's Overseas Market Layout and Sales

3.4.3 SAIC's Overseas Market Brands and Localization Strategies

3.4.4 SAIC's Overseas Market Intelligent Cockpit Configuration Strategies (Part 1/2)

3.4.4 SAIC's Overseas Market Intelligent Cockpit Configuration Strategies (Part 2/2)

3.4.5 Top 10 SAIC Models by Sales in the UK, 2020-2024

3.4.5 Top 10 SAIC Models by Sales in Mexico, 2020-2024

3.4.5 Top 10 SAIC Models by Sales in Australia, 2020-2024

3.4.5 Top 10 SAIC Models by Sales in Italy, 2020-2024

3.4.5 Top 10 SAIC Models by Sales in Spain, 2020-2024

3.4.5 Top 10 SAIC Models by Sales in France, 2020-2024

3.4.5 Top 10 SAIC Models by Sales in Germany, 2020-2024

3.4.5 Top 10 SAIC Models by Sales in Thailand, 2020-2024

3.4.5 Top 10 SAIC Models by Sales in Turkey, 2020-2024

3.4.6 MG ZS’ Cockpit Configuration in France

3.4.6 MG ZS’ Cockpit Configuration in India

3.4.6 MG ZS’ Cockpit Configuration in Malaysia

3.4.7 MG HS’ Cockpit Configuration in the UK

3.4.7 MG HS’ Cockpit Configuration in Mexico

3.4.7 MG HS’ Cockpit Configuration in the Philippines

3.4.7 MG EHS’ Cockpit Configuration in Turkey

3.4.8 SAIC's Intelligent Cockpit Layout

3.4.8 SAIC's Intelligent Cockpit Solutions

3.4.9 SAIC Motor Passenger Vehicle’s Intelligent Cockpit Software System Evolution

3.5 BYD

3.5.1 BYD’s Overseas Market Layout and Sales

3.5.2 BYD’s Overseas Market Brands and Localization Strategies

3.5.3 BYD’s Overseas Market Intelligent Cockpit Configuration Strategies (Part 1/2)

3.5.3 BYD’s Overseas Market Intelligent Cockpit Configuration Strategies (Part 2/2)

3.5.4Top 10 BYD Models by Sales in Brazil, 2020-2024

3.5.4Top 10 BYD Models by Sales in Thailand and Indonesia, 2020-2024

3.5.4Top 10 BYD Models by Sales in the UK and Australia, 2020-2024

3.5.5 Atto 3’s Cockpit Configuration in Europe

3.5.5 Atto 3’s Cockpit Configuration in India

3.5.5 Atto 3’s Cockpit Configuration in the Philippines

3.5.5 Atto 3’s Cockpit Configuration in Japan

3.5.6 Dolphin’s Cockpit Configuration in Malaysia

3.5.6 Dolphin’s Cockpit Configuration in Vietnam

3.5.6 Dolphin’s Cockpit Configuration in Japan

3.5.7 BYD's New DiLink Cockpit Platform

3.5.7 BYD's New DiLink Cockpit Platform and Hardware Planning

3.5.7 BYD's New DiLink Cockpit Platform Software and Hardware Evolution

3.5.8 BYD Cockpit Software Architecture: Full-stack Self-developed Technology

3.5.9 BYD’s Intelligent Cockpits by Brand

3.5.9 Intelligent Cockpit of BYD Dynasty Series

3.5.9 Intelligent Cockpit of BYD Ocean Series

3.5.9 Intelligent Cockpit of BYD Yangwang Brand

3.5.9 Intelligent Cockpit of BYD Denza: Denza Link Ultra-Intelligent Interactive Cockpit

3.5.9 Intelligent Cockpit of BYD Fangchengbao

3.6 Great Wall Motor

3.6.1 Great Wall Motor’s Overseas Market Layout and Sales

3.6.2 Great Wall Motor’s Overseas Market Brands and Localization Strategies

3.6.3 Great Wall Motor’s Overseas Market Intelligent Cockpit Configuration Strategies (Part 1/2)

3.6.3 Great Wall Motor’s Overseas Market Intelligent Cockpit Configuration Strategies (Part 2/2)

3.6.4 Top 10 Great Wall Models by Sales in Australia, 2020-2024

3.6.4 Top 10 Great Wall Models by Sales in South Africa, 2020-2024

3.6.4 Top 10 Great Wall Models by Sales in Brazil and Mexico, 2020-2024

3.6.4 Top 10 Great Wall Models by Sales in Thailand, 2020-2024

3.6.4 Top 10 Great Wall Models by Sales in Germany, 2020-2024

3.6.5 H6’s Cockpit Configuration in Australia

3.6.5 H6’s Cockpit Configuration in the Middle East

3.6.5 H6 HEV’s Cockpit Configuration in Mexico

3.6.5 H6 Hybrid’s Cockpit Configuration in Vietnam

3.6.6 Jolion’s Cockpit Configuration in Australia

3.6.6 Jolion’s Cockpit Configuration in Russia

3.6.6 Jolion’s Cockpit Configuration in the Middle East

3.6.6 Jolion’s Cockpit Configuration in Mexico

3.6.7 Great Wall Motor’s Intelligent Cockpit Layout

3.6.7 Great Wall Motor’s Intelligent Full Industry Chain Layout

3.6.8 Intelligent Cockpit Platform Iteration Roadmap

3.6.8 Great Wall Motor’s Next-Generation Intelligent Cockpit System

3.6.8 Great Wall Motor’s Self-developed Cockpit OS GC-OS

3.6.9 Coffee Intelligence Cockpit 2.0

3.6.10 Great Wall Motor’s Cockpit-Driving Integration Plan

3.6.11 Great Wall Motor’s Central Computing SOA Software Architecture

3.7 Chery Auto

3.7.1 Chery’s Overseas Sales

3.7.2 Chery’s Overseas Market Layout and Localization Strategies (Part 1/2)

3.7.2 Chery’s Overseas Market Layout and Localization Strategies (Part 2/2)

3.7.3 Chery’s Intelligent Cockpit Configuration Strategies (Part 1/2)

3.7.3 Chery’s Intelligent Cockpit Configuration Strategies (Part 2/2)

3.7.4 Top 10 Chery Models by Sales in Brazil, 2020-2024

3.7.4 Top 10 Chery Models by Sales in Mexico, 2020-2024

3.7.4 Top 10 Chery Models by Sales in South Africa, 2020-2024

3.7.4 Top 10 Chery Models by Sales in Turkey and Malaysia, 2020-2024

3.7.5 Tiggo 7’s Cockpit Configuration in Malaysia

3.7.5 Tiggo 8’s Cockpit Configuration in Malaysia

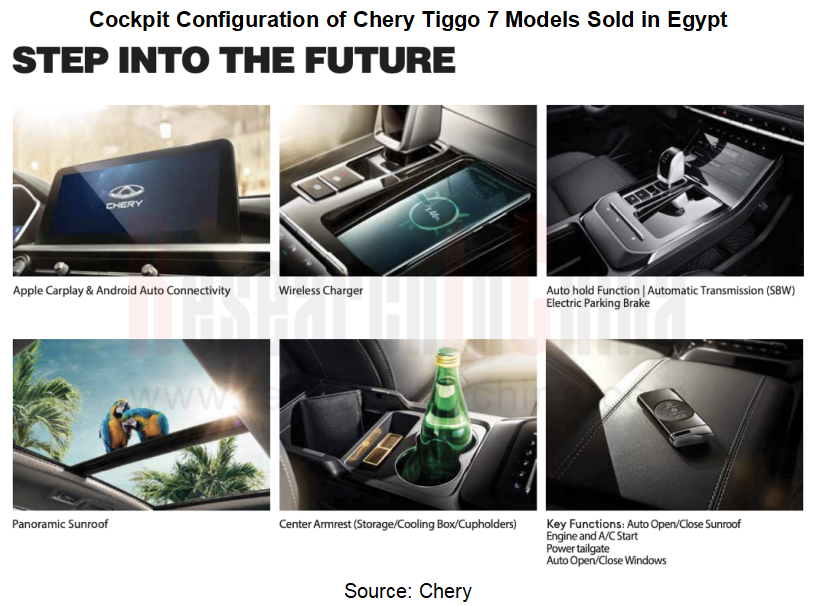

3.7.6 Tiggo 7’s Cockpit Configuration in Egypt

3.7.6 Tiggo 8’s Cockpit Configuration in Egypt

3.7.7 Tiggo 7’s Cockpit Configuration in Turkey

3.7.8 Tiggo 8’s Cockpit Configuration in Turkey

3.8 XPeng

3.8.1 Top 10 XPeng Models by Sales in Israel, Sweden, and France, 2020-2024

3.8.1 Top 10 XPeng Models by Sales in Norway and the Netherlands, 2020-2024

3.8.2 XPeng G6’s Cockpit Configuration in Malaysia

3.8.3 XPeng X9’s Cockpit Configuration in Malaysia

3.8.3 XPeng G6’s Cockpit Configuration in Indonesia

3.8.3 XPeng X9’s Cockpit Configuration in Indonesia

3.8.4 XPeng Provides Cockpit Platform Support for Volkswagen Group in Global Markets

3.8.4 XPeng's New Cockpit Display

3.8.5 Intelligent Cockpit Systems of XPeng's Major Models

3.8.6 XPeng's Intelligent Cockpit System Evolution

3.8.7 XPeng's Intelligent Cockpit System Development Strategy: Full-stack Self-development of Software

3.8.8 XPeng's Intelligent Cockpit System Team

3.8.9 XPeng's Deployment in Intelligent Cockpit System Hardware and Software Supply Chain

3.8.10 XPeng's Latest Intelligent Cockpit System Architecture: Software Is Moving towards SOA Software Architecture

3.8.10 XPeng's Latest Intelligent Cockpit System Features: AI Dimensity System

3.8.11 XPeng's Cockpit-Driving Integration Layout

4 Overseas Cockpit Configurations of International OEMs

4.1 Intelligent Cockpit Platform Supply Relationships of International OEMs (1)

4.1 Intelligent Cockpit Platform Supply Relationships of International OEMs (2)

4.2 Toyota

4.2.1 Global Sales Statistics (By Model)

4.2.1 Top 10 Global Markets of RAV4 by Sales

4.2.1 Top 10 Global Markets of Corolla Cross by Sales

4.2.2 RAV4’s Cockpit Configuration in the US

4.2.2 RAV4’s Cockpit Configuration in the US

4.2.2 RAV4’s Cockpit Configuration in the US

4.2.2 RAV4’s Cockpit Configuration in the US

4.2.2 RAV4’s Cockpit Configuration in Japan

4.2.2 RAV4’s Cockpit Configuration in Japan

4.2.2 RAV4’s Cockpit Configuration in Japan

4.2.2 RAV4’s Cockpit Configuration in the UK

4.2.2 RAV4’s Cockpit Configuration in the UK

4.2.2 RAV4’s Cockpit Configuration in the UK

4.2.2 RAV4’s Cockpit Configuration in the UK

4.2.3 Corolla Cross’s Cockpit Configuration in the US

4.2.3 Corolla Cross’s Cockpit Configuration in Thailand

4.2.3 Corolla Cross’s Cockpit Configuration in Malaysia

4.2.4 Toyota Strategic Planning: Electrification

4.2.4 Toyota Strategic Planning: Intelligence

4.2.5 Toyota Cockpit SoC

4.2.6 Representative Models with Toyota Connect

4.2.6 Highlights of Toyota Connect

4.2.7 Toyota Arene OS Ecosystem Resources

4.3 Volkswagen

4.3.1 Volkswagen’s Global Sales Statistics (By Model)

4.3.1 Top 10 Global Markets of Polo by Sales

4.3.1 Top 10 Global Markets of Tiguan by Sales

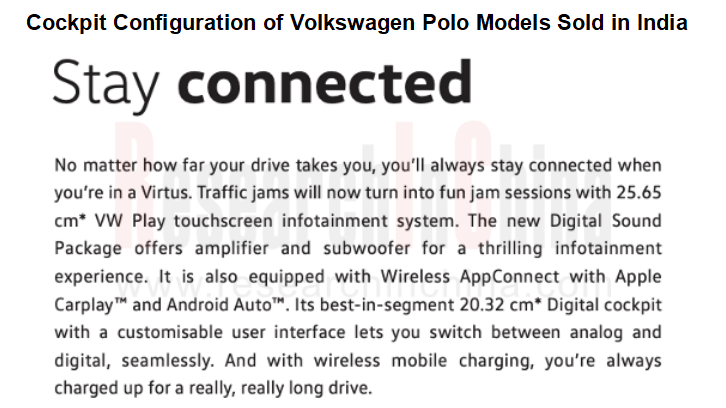

4.3.2 Polo’s Cockpit Configuration in India

4.3.3 Tiguan’s Cockpit Configuration in Canada

4.3.3 Tiguan’s Cockpit Configuration in India

4.3.3 Tiguan’s Cockpit Configuration in South Korea

4.3.4 ID.4’s Cockpit Configuration in Singapore

4.3.4 ID.4’s Cockpit Configuration in Canada

4.3.4 ID.4’s Cockpit Configuration in South Korea

4.3.5 Volkswagen’s Sales and Global Market Share, 2024

4.3.5 Volkswagen’s New Energy Vehicle Penetration Rate, 2024

4.3.6 Volkswagen’s Intelligent Cockpit Layout

4.3.7 Volkswagen’s Intelligent Cockpit Evolution

4.3.8 Volkswagen’s Self-Developed Operating System VW.OS

4.3.9 Volkswagen’s Software Platform Planning and Layout

4.3.10 Volkswagen’s ICAS3 Cabin Domain Controller System

4.4 Ford

4.4.1 Global Sales Statistics (By Model)

4.4.1 Top 10 Global Markets of Ford Ranger by Sales

4.4.1 Top 10 Global Markets of Ford Explorer by Sales

4.4.2 Ford Ranger’s Cockpit Configuration in Australia

4.4.2 Ford Ranger’s Cockpit Configuration in Malaysia

4.4.3 Ford Explorer’s Cockpit Configuration in Mexico

4.4.3 Ford Explorer’s Cockpit Configuration in Philippines

4.4.4 Cockpit System Evolution

4.4.5 Next-Generation Vehicle Cockpit Domain Controller: SG5PHX

4.4.6 All-New In-Vehicle Infotainment System: Ford and Lincoln Digital Experience

4.4.7 Ford SYNC 4.0

4.5 BMW

4.5.1 Global Sales Statistics (By Model)

4.5.1 Top 10 Global Markets of BMW X5 by Sales

4.5.1 Top 10 Global Markets of BMW 5 Series by Sales

4.5.2 BMW X5’s Cockpit Configuration in France

4.5.2 BMW X5’s Cockpit Configuration in India

4.5.2 BMW X5’s Cockpit Configuration in Thailand

4.5.3 BMW 5 Series’ Cockpit Configuration in France

4.5.3 BMW 5 Series’ Cockpit Configuration in Thailand

4.5.3 BMW 5 Series’ Cockpit Configuration in India

4.5.4 Cockpit Software Domain Layout

4.5.5 Intelligent Cockpit Platform Evolution and Suppliers (1)

4.5.5 Intelligent Cockpit Platform Evolution and Suppliers (2)

4.5.6 Latest-Generation Cockpit Domain Controller

4.5.7 Latest Cockpit Software System

4.5.8 Android-Based Cockpit System ID9.0

4.5.9 Intelligent Cockpit Human-Machine Interaction Evolution

4.5.10 Next-Generation Cockpit Software System

4.6 Audi

4.6.1 Global Sales Statistics (By Model)

4.6.1 Top 10 Global Markets of Audi Q5 by Sales

4.6.1 Top 10 Global Markets of Audi A6 by Sales

4.6.2 Audi Q5’s Cockpit Configuration in Singapore

4.6.2 Audi Q5’s Cockpit Configuration in Thailand

4.6.3 Audi A6’s Cockpit Configuration in Malaysia

4.6.3 Audi A6’s Cockpit Configuration in Japan

4.6.4 Intelligent Cockpit Layout

4.6.5 Software and Hardware Layout

4.6.5 Software and Hardware Layout

4.6.5 Software and Hardware Layout

4.6.6 Cockpit Software System Evolution

4.7 Tesla

4.7.1 Global Sales Statistics (By Model)

4.7.1 Top 10 Global Markets of Model Y by Sales

4.7.1 Top 10 Global Markets of Model 3 by Sales

4.7.2 Intelligent Cockpit Platform Evolution

4.7.3 Intelligent Cockpit R&D Timeline

4.7.4 Intelligent Cockpit Software System Suppliers

4.7.5 HW4.0 Cockpit Domain

4.7.6 Cockpit Software Platform

5 Intelligent Cockpit Suppliers in Overseas Markets

5.1 Main Product Solutions of Overseas Intelligent Cockpit Platforms

5.1.1 Overseas Demand for Intelligent Cockpits

5.1.1 Key Challenges in Overseas Layout of Intelligent Cockpit Platforms

5.1.1 Overseas Layout Path of Intelligent Cockpit Platforms

5.1.1 Chinese OEMs’ Great Efforts on Overseas Layout Facilitate Overseas Layout of Chinese Intelligent Cockpit Platforms

5.1.2 Overseas Intelligent Cockpit Platform Solutions of Main Suppliers

5.1.2 Overseas Cockpit Platform Product Solutions (1)

5.1.2 Overseas Cockpit Platform Product Solutions (2)

5.1.2 Overseas Cockpit Platform Product Solutions (3)

5.1.2 Overseas Cockpit Platform Product Solutions (4)

5.1.2 Overseas Cockpit Platform Product Solutions (5)

5.1.2 Overseas Cockpit Platform Product Solutions (6)

5.1.2 Overseas Cockpit Platform Product Solutions (7)

5.1.2 Overseas Cockpit Platform Product Solutions (8)

5.1.3 Evolution of Cockpit Platform Solutions of Major Chinese Suppliers (1)

5.1.3 Evolution of Cockpit Platform Solutions of Major Chinese Suppliers (2)

5.1.3 Evolution of Cockpit Platform Solutions of Major Chinese Suppliers (3)

5.1.3 Evolution of Cockpit Platform Solutions of Major Chinese Suppliers (4)

5.1.3 Evolution of Cockpit Platform Solutions of Major Chinese Suppliers (5)

5.1.4 Competitive Edges of Major Chinese Cockpit Platform Suppliers (1)

5.1.4 Competitive Edges of Major Chinese Cockpit Platform Suppliers (2)

5.1.4 Competitive Edges of Major Chinese Cockpit Platform Suppliers (3)

5.1.5 Evolution of Cockpit Platform Solutions of Major Foreign Suppliers (1)

5.1.5 Evolution of Cockpit Platform Solutions of Major Foreign Suppliers (2)

5.1.6 Competitive Edges of Major Foreign Cockpit Platform Suppliers (1)

5.1.6 Competitive Edges of Major Foreign Cockpit Platform Suppliers (2)

5.2 Overseas Cockpit Business of Chinese Suppliers

5.2.1 PATEO CONNECT+’s Intelligent Cockpit Platform Roadmap

5.2.1 Desay SV’s Intelligent Cockpit Platform Layout Trends

5.2.1 Hangsheng Electronics’ Intelligent Cockpit Platform Roadmap

5.2.1 Joyson Electronics’ Intelligent Cockpit Platform Evolution Trends

5.2.1 Evolution of NavInfo’s Intelligent Cockpit Platform Products

5.2.1 ADAYO’s Intelligent Cockpit Domain Control Platform Evolution

5.2.1 Evolution of ECARX’s Cockpit Computing Platform Products

5.2.2 Neusoft Group’s Overseas Layout Strategy

5.2.3 Hynex’s Overseas Layout Strategy

5.2.4 PATEO’s Overseas Layout Strategy

5.2.4 PATEO’s Overseas Business

5.2.5 ECARX’s Overseas Layout Strategy

5.2.6 Huawei’s Overseas Layout Strategy

5.2.7 Tencent Cloud’s Overseas Layout Strategy

5.2.7 Tencent’s Overseas Business

5.2.8 ECARX’s Overseas Business

5.2.9 Baidu’s Overseas Business

5.2.10 China Mobile’s Overseas Business

5.2.11 NavInfo’s Overseas Services

5.2.12 Soling’s Overseas Business

5.2.13 ECar’s Overseas Business

5.2.14 Yoocar’s Overseas Business

5.2.15 Neusoft NAGIVI

5.2.15 Neusoft OneCoreGo?

5.3 Intelligent Cockpit Solutions of International Companies

5.3.1 Harman

5.3.1 Intelligent Cockpit Platform

5.3.1 Intelligent Cockpit Hardware Platform Solutions

5.3.1 Scalable Intelligent Cockpit Solutions

5.3.1 Intelligent Cockpit Product: Ready Upgrade

5.3.1 Latest Cockpit Domain Control Products: Ready Upgrade Base & Advanced

5.3.1 Proposed Modular and Combinable Cockpit Cooperation Model

5.3.1 Cockpit Domain Control Concept

5.3.1 Next-Generation Cockpit Software Platform Architecture

5.3.1 Pre-Integrated ADAS Functions in Intelligent Cockpits

5.3.1 Development Trends of Intelligent Cockpit Underlying Architecture: Intelligent Cockpit Underlying Architecture

5.3.1 Roadmap for Integration of Intelligent Cockpit and ADAS Functions

5.3.2 Visteon

5.3.2 Cockpit of the Future

5.3.2 SmartCore Versions

5.3.2 Evolution of Intelligent Cockpit Domain Control Products

5.3.2 Fourth-Generation SmartCore Cockpit Platform

5.3.2 SmartCore Cockpit Platform Architecture

5.3.2 In-Vehicle Infotainment (IVI) System Software Architecture

5.3.3 FORVIA

5.3.3 Faurecia’s Latest Cross-Domain Integrated Cockpit Solution

5.3.3 Faurecia’s Intelligent Cockpit Platform

5.3.3 Faurecia’s Cockpit Domain Controller

5.3.3 Faurecia’s Cockpit Domain Controller Planning Goals

5.3.3 Faurecia’s Future Cockpit Development Trends

5.3.3 FORVIA Supports SAIC in Layout of Overseas Intelligent Cockpit Ecosystem of Overseas Mobility

5.3.4 Bosch

5.3.4 Intelligent Cockpit

5.3.4 Evolution of Intelligent Cockpit Platform Products

5.3.4 Upgraded Intelligent Cockpit Platform

5.3.4 Personalized Intelligent Cockpit Solutions

5.3.4 Cockpit-Driving Integration Evolution Roadmap

5.3.4 Cockpit-Driving Integration Solution Design

5.3.4 Single-Chip-Based Cockpit-Driving Integration Solution

5.3.4 Cross-Domain Integrated Cockpit Computing Platform

5.3.4 Support Chinese OEMs in Overseas Layout

5.3.5 Denso

5.3.5 Cockpit Development Plan

5.3.5 Integrated Control of the Cockpit System

5.3.5 Integrated Control of the Cockpit System Based on Virtualization Technology

5.3.5 Cockpit Domain Controller Harmony Core

5.3.5 Cross-Domain Layout

5.3.5 Software Layout Under CASE Strategy

5.3.5 Under the 2035 "Peace of Mind" Strategy, Future Cockpits and Intelligent Driving Will Deeply Integrate

5.3.5 Peace of Mind Intelligent Cockpit System

5.3.5 Peace of Mind Intelligent Cockpit System Development Blueprint

5.3.5 Global R&D System

5.3.5 2030 Strategic Plan

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...