China Automotive Shock Absorber Industry Report, 2014-2015

-

Mar.2015

- Hard Copy

- USD

$2,500

-

- Pages:105

- Single User License

(PDF Unprintable)

- USD

$2,300

-

- Code:

ZJF071

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,500

-

- Hard Copy + Single User License

- USD

$2,700

-

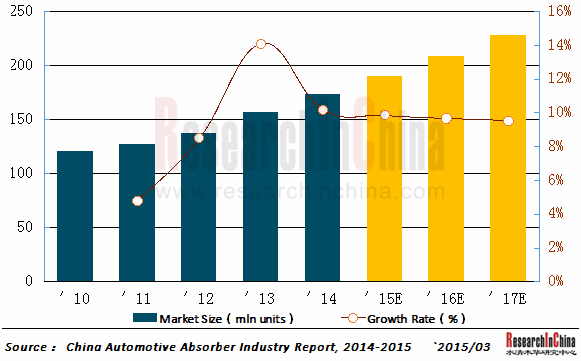

The rapid growth of China's automobile production helped propelled the fast-growing expansion in market size of spare parts including shock absorber. In 2014, the demand for automotive shock absorbers in China reached 173 million units, up 10.2% from a year earlier.

Demand for Automotive Shock Absorbers in China 2010-2017E

China's domestic shock absorber demand comes mainly from two sources: OEM market and after-sales maintenance market. And the demand for supporting shock absorbers varies according to auto production. In 2014, China's auto production rose 7.3% year on year to 23.7229 million units. Accordingly, the number of supporting shock absorbers changed, with 2014's demand for the supporting shock absorbers reaching 95.96 million units. The aftermarket is closely related to the vehicle ownership. In late 2014, the vehicle ownership in China amounted to 154 million units, up 12.4% from a year earlier. If it is calculated that two pairs of shock absorbers are replaced every eight years, the after-market demand in 2014 would reach 77 million units. Hence, the domestic demand approximated 173 million units in 2014.

Automotive shock absorber industry enjoys high marketization, with sufficient competition but low concentration. Automotive shock absorber manufacturers in China can fall into three types: The first are the sole proprietorship or joint ventures in China of the world-renowned auto/parts enterprises, mainly including Tenneco, ZF, KYB, Hitachi, Showa, and Mando, etc. They primarily provide the supporting offerings to the well-known foreign branded automakers, and supply OEM spare parts to the aftermarket. The second are some joint ventures and bigger domestic enterprises. They offer supporting products or services to domestic automakers and export these offerings to the developed countries like Europe and the United States. Their products are positioned as mid and high-end ones. Some enterprises with comparative advantages supply products via OEM/ODM to the world's famous shock absorber manufacturers, mainly including Nanyang Xijian, ADD Industry (Zhejiang) Corporation, Jiuding, etc. The third are the small and medium-sized privately owned enterprises that conduct scattered small-scale production. Their products, mainly targeted at aftermarket, are exported to emerging countries or regions, etc.

China Automotive Shock Absorber Industry Report, 2014-2015 mainly covers the following:

Overview of China's automotive shock absorber industry, including definition and classification, policies and regulations, technology trends, etc.;

Overview of China's automotive shock absorber industry, including definition and classification, policies and regulations, technology trends, etc.;

China's automotive shock absorber market, including OEM and aftermarket demand, competitive landscape, import and export, etc.;

China's automotive shock absorber market, including OEM and aftermarket demand, competitive landscape, import and export, etc.;

Profile, financial condition, output and sales volume, major customers, key products, R&D, production base distribution, technical characteristics, etc. of 10 foreign vacuum pump manufacturers—including Tenneco, ZF, KYB, Hitachi, Showa, and Mando, and 17 Chinese vacuum pump manufacturers, such as Kenflo, Shandong Huacheng Group, Sanlian Pump, Hanbell Precise Machinery, SKY Technology Development Co., Tongfang Hi-Tech, Bozhong Vacuum Equipment, Nantong Weishi Vacuum, Boshan Vacuum, as well as Feiyue Group.

Profile, financial condition, output and sales volume, major customers, key products, R&D, production base distribution, technical characteristics, etc. of 10 foreign vacuum pump manufacturers—including Tenneco, ZF, KYB, Hitachi, Showa, and Mando, and 17 Chinese vacuum pump manufacturers, such as Kenflo, Shandong Huacheng Group, Sanlian Pump, Hanbell Precise Machinery, SKY Technology Development Co., Tongfang Hi-Tech, Bozhong Vacuum Equipment, Nantong Weishi Vacuum, Boshan Vacuum, as well as Feiyue Group.

1 Overview of Automotive Shock Absorber Industry

1.1 Definition and Classification

1.1.1 Definition

1.1.2 Classification

1.2 Trends in Automotive Shock Absorber Technology

1.3 Industry Policy

2 Overview of Global and China Automobile Market

2.1 Global Automobile Industry

2.2 China's Automobile Industry

2.2.1 Automobile Market

2.2.2 Passenger Car Market and Market Segments

2.2.3 Commercial Vehicle Market and Market Segments

3 Overview of China Automotive Shock Absorber Market

3.1 Total Market

3.2 OEM Market

3.3 Aftermarket

3.4 Import and Export

3.5 Competitive Landscape

4 Main Production Enterprises Abroad

4.1 TENNECO

4.1.1 Profile

4.1.2 Operation

4.1.3 Main Business

4.1.4 Supported Models

4.1.5 Tenneco (Beijing) Ride Control Systems Co., Ltd.

4.1.6 Tenneco (Suzhou) Ride Control Systems Co., Ltd.

4.2 ZF

4.2.1 Profile

4.2.2 Operation

4.2.3 Main Business

4.2.4 R&D

4.2.5 Supported Models

4.2.6 Shanghai Sachs Huizhong Shock Absorber Co. Ltd.

4.2.7 ZF Dongfeng Shock Absorber Shiyan Co. Ltd.

4.3 KYB

4.3.1 Profile

4.3.2 Operation

4.3.3 Main Business

4.3.4 Shock Absorber Business

4.3.5 Production and Sales

4.3.6 Wuxi KYB Top Absorber Co., Ltd.

4.3.7 KYB Industrial Machinery (Zhenjiang) Ltd.

4.4 Mando

4.4.1 Profile

4.4.2 Operation

4.4.3 Development Plan for 2015

4.4.4 Supported Models

4.5 Gabriel

4.5.1 Profile

4.5.2 Main Products

4.6 ACDelco

4.6.1 Profile

4.6.2 Products and Applications

4.7 Hitachi

4.7.1 Profile

4.7.2 Operation

4.7.3 Development in China

4.7.4 Tokico Automotive (Suzhou) Co., Ltd.

4.8 ThyssenKrupp(BILSTEIN)

4.8.1 Profile

4.8.2 Operating Review

4.8.3 Main Business

4.8.4 Gross Margin

4.8.5 Main Products

4.8.6 ThyssenKrupp Presta Shanghai Co., Ltd.

4.9 SHOWA Corporation

4.9.1 Profile

4.9.2 Operation

4.9.3 Development in China

4.9.4 Supported Models

4.9.5 Guangzhou Showa Auto Parts Co., Ltd.

4.9.6 Shanghai Showa Auto Parts Co., Ltd.

4.9.7 Chengdu Ningjiang Showa Auto Parts Co. Ltd.

5 Main Automotive Shock Absorber Enterprises in China

5.1 China Vehicle Components Technology Holdings Limited

5.1.1 Profile

5.1.2 Operation

5.1.3 Main Business

5.1.4 Sales Volume

5.1.5 Gross Margin

5.1.6 R&D

5.1.7 Production Base

5.2 Chengdu Jiuding Science & Tech.(Group) Co., Ltd.

5.2.1 Profile

5.2.2 Main Products and Capacity

5.2.3 Production Base

5.3 ADD Industry (Zhejiang) Corporation Limited

5.3.1 Profile

5.3.2 Operation

5.3.3 Main Business

5.3.4 Gross Margin

5.3.5 Capacity and Output

5.3.6 R&D

5.3.7 Customers and Suppliers

5.3.8 Supported Models

5.4 Chongqing Endurance Zhongyi Shock Absorber Liability Co., Ltd.

5.4.1 Profile

5.4.2 Main Products

5.5 Shanghai Powered Auto Parts Co., Ltd.

5.5.1 Profile

5.5.2 Main Products

5.5.3 Production Base

5.6 Jinzhou Lide Shock Absorber Co., Ltd.

5.6.1 Profile

5.6.2 Main Products

5.6.3 Market Structure

5.7 Tianjin Tiande Suspension Systems Co., Ltd.

5.7.1 Profile

5.7.2 Main Products

5.8 Fawer Automotive Parts Limited Company

5.8.1 Profile

5.8.2 Operation

5.8.3 Main Business

5.8.4 Gross Margin

5.8.5 R&D

5.8.6 Customers and Suppliers

5.8.7 FAW-Tokico Shock Absorber Co., Ltd.

5.8.8 Supported Models

5.9 Guangxi Huali Group Co., Ltd.

5.9.1 Profile

5.9.2 Main Products

5.9.3 Liuzhou Keleila Automobile Absorber Co., Ltd.

5.10 BWI Group

5.10.1 Profile

5.10.2 Main Products and Technology

5.10.3 Production Layout

Structure of Typical Binoculars Shock Absorber

Classification of Active Suspension System

China's Policies on Auto Parts Industry, 2004-2014

World’s Output of Passenger Cars, YoY Growth and % in Automobile Output, 2007-2018E

Top 20 Countries (based on 2012-year rankings) by Cars Output, 2011-2014

Number of Automobile Makers and YoY Growth in China, 2003-2014

Revenue and YoY Growth of China’s Automobile Manufacturing Industry, 2003-2014

Total Profit and YoY Growth of China’s Automobile Manufacturing Industry, 2003-2014

Gross Margin of China’s Automobile Manufacturing Industry, 2003-2014

China’s Automobile Output and Sales Volume (by Passenger Vehicle and Commercial Vehicle), 2009-2017E

China’s Passenger Vehicle Output, YoY Growth, 2005-2017E

Market Share of Various Models by Sales Volume in China’s Passenger Vehicle Market, 2008-2014

China’s Top10 Manufacturers by Passenger Vehicle Sales Volume, 2008-2014

China’s Bus Output (by Model), 2009-2017E

China’s Bus Sales Volume (by Model), 2009-2017E

China’s Top10 Manufacturers Based on Bus Output and Sales Volume (by Model), 2012-2013

China’s Top10 Manufacturers Based on Bus Output and Sales Volume (by Model), 2014

China’s Truck Output (by Model), 2009-2017E

China’s Truck Sales Volume (by Model), 2009-2017E

China’s Top10 Manufacturers Based on Truck Output and Sales Volume (by Model), 2012-2013

China’s Top10 Manufacturers Based on Truck Output and Sales Volume (by Model), 2014

China’s Automotive Shock Absorber Market Size, 2009-2017E

China’s Automotive Shock Absorber Aftermarket Size, 2009-2017E

China’s Automotive Shock Absorber Maintenance & Replacement Market Size, 2008-2017E

China’s Automotive Shock Absorber Import and Export Volume, 2010-2014

China’s Automotive Shock Absorber Import and Export Value, 2010-2014

China’s Automotive Shock Absorber Import/Export Volume and Value by Continent, 2014

Supported Models and Output & Sales Volume of Automotive Shock Absorber Manufacturers in China, 2013

Revenue Breakdown of Tenneco by Segment, 2013-2014

Revenue Breakdown of Tenneco by Region, 2013-2014

Revenue Structure of ZF by Segment, 2012-2013

Revenue Structure of ZF by Region, 2009-2013

R&D Expenditure of ZF, 2009-2013

Revenue and Net Income of KYB, FY2009-2014

Revenue Structure of KYB by Business, FY2012-2014

Revenue Structure of KYB by Region, FY2012-2013

Automotive Shock Absorber Product of KYB

Aftermarket Units Sold and Its Ratio to Total of KYB, FY2010-2020

Unit production by aftermarket area of KYB, FY2013-FY2014

Major Capacity Increasing Projects of KYB, 2014-2015

Organizational Structure of Mando

Sales Revenue of Mando, 2013-2014

Order Intake of Mando, 2010-2014

Customer Distribution of Mando

Capex Trend of Mando, 2010-2015

Capex Distribution of Mando by Region, 2015

Main Shock Absorbers of Gabriel

Main Compressor Product of AC Delco

Customer Architecture of Hitachi Automotive Systems, FY2013

Sales of Hitachi Automotive Systems in China, FY2010/2013/2015

Revenue and Net Income of ThyssenKrupp, FY2010-2014

Order Intake Structure of ThyssenKrupp by Product, FY2013-2014

Revenue Structure of ThyssenKrupp by Product, FY2013-2014

Revenue Structure of ThyssenKrupp by Region, FY2013-2014

Revenue Structure of ThyssenKrupp by Market, FY2014

Gross Margin of ThyssenKrupp, FY2010-2014

Main Product of ThyssenKrupp Bilstein

Auto Parts of Showa

Global Distribution of Showa

Operating Performance of Showa, FY2011-2014

Sales and Operating Income of Showa by Department, FY2014

Showa’s Branches in China

Automotive Steering Gear Production Equipments of Guangzhou SHOWA Absorber

Revenue and Net Income of CVCT, 2009-2014

Revenue Structure of CVCT by Segment, 2012-2014

Sale Volume of CVCT by Segment, 2012-2014

Average Selling Price of CVCT by Segment, 2012-2014

Gross Margin of CVCT by Segment, 2012-2014

Gross Margin of CVCT by Segment, 2012-2014

Capacity Change for the Upgraded Shock Absorber of Jiuding Science & Tech, 2014

Revenue and Net Income of Add Industry, 2012-2014

Revenue Structure of Add Industry by Product, 2012-2014

Revenue Structure of Add Industry by Region, 2012-2014

Gross Margin of Add Industry by Product, 2012-2014

Shock Absorber Capacity and Output of ADD Industry (Zhejiang) Corporation, 2012-2014

Selling Prices for Main Shock Absorber Products of ADD Industry (Zhejiang) Corporation, 2012-2014

R&D Costs and % of the Total Revenue of ADD Industry (Zhejiang) Corporation, 2012-2014

Revenue from Top 5 Customers and % of Total Revenue of ADD Industry (Zhejiang) Corporation, 2012-2014

Procurement from Top 5 Customers and % of Total Procurement of ADD Industry (Zhejiang) Corporation, 2012-2014

Shock Absorber-supported Brands of ADD Industry (Zhejiang) Corporation

Main Products and Customers of Shanghai Powered

Major Shock Absorber-supported Models of Jinzhou Lide

Market Structure of Jinzhou Lide

Major Supported Models of Tianjin Tiande

Revenue and Net Income of Fawer, 2011-2014

Revenue Structure of Fawer by Product, 2012-2014

Revenue Structure of Fawer by Region, 2012-2014

Gross Margin of Fawer by Product, 2012-2014

Fawer's R&D Costs and % of Total Revenue, 2013-2014

Fawer’s Revenue from Top 5 Customers and % of Total Revenue, 2013

Fawer's Procurement from Top 5 Customers and % of Total Procurement, 2013

Shock Absorber-supported Models and Brands of FAW-Tokico

Main Supported Models of Guangxi Huali

Suspension System Products of BWI Group

Major Production Base Distribution of BWI Group

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...