Global and China Automotive Turbocharger Industry Report, 2014-2017

-

Apr.2015

- Hard Copy

- USD

$2,300

-

- Pages:92

- Single User License

(PDF Unprintable)

- USD

$2,150

-

- Code:

CYH034

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,400

-

- Hard Copy + Single User License

- USD

$2,500

-

A turbocharger is actually an air compressor that increases air inflow by compressing air to reduce fuel consumption and exhaust emission and to improve output power. It is mainly used inside the engines of automobiles, engineering machinery, agricultural machinery, ships, and airplanes.

The biggest turbocharger demand in China was none other than auto industry. In 2013, 4.004 million units of automotive turbochargers were sold, accounting for 59.6% of China's turbocharger sales. Driven by policies of energy conservation and emission reduction, vehicle exhaust emission upgrade, etc., China’s automotive turbochargers are expected to speed up by registering a CAGR of 12.2% to 6.34 million units by 2017.

At present, China’s automotive turbochargers are mainly applied to diesel engines, with the installation rate hitting some 71.9% in 2013. In future, as a growing number of products are replaced and upgraded, there will be a great demand. Despite an existing installation rate of a merger 8.6%, automotive gasoline engine turbocharger will have the greatest development potential. In 2017, the sales volume of gasoline engine turbochargers will be very likely to reach 3.184 million units, with the installation rate increasing to 14.0%.

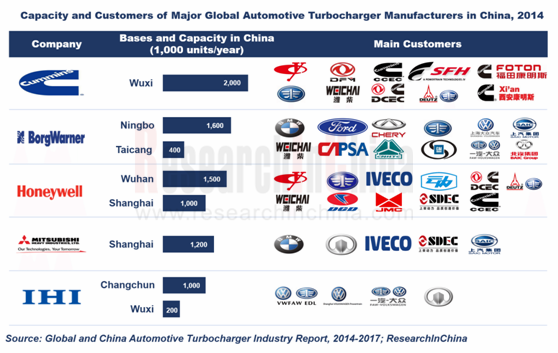

The global auto turbocharger market is mainly monopolized by the foreign giants such as Honeywell, Borgwarner, Cummins, MHI, and IHI, which occupy a combined market share of more than 80%. Being bullish on the outlook of China’s automotive turbochargers, foreign giants have expanded their capacity in China by setting up factories, with market share by farstaying above 60%.?

In September 2014, Honeywell, one of the world’s major turbocharger suppliers, opened its new plant in Wuhan, so that it increased an additional turbocharger capacity of 1.5 million units/a. In thefuture, with the business expansion, the second and third phases of the project will be initiated step by step.??

Over the same period, the famous light-duty vehicle turbocharger manufacturer Borgwarner put its second turbocharger plant in China—BorgWarner Auto Spare Parts (Jiangsu) Co., Ltd. into operation, with an extra capacity of 400,000 turbochargers/a. In the future, the company will continue to expand capacity. It is projected that by 2018 Taicang plant will achieve a capacity of 2 million units/a.?

In November 2014, Cummins Turbo Technologies, a subsidiary of Cummins,aglobal commercial vehicle engine manufacturer, put into operation the first phase of its second plant. In this way, the subsidiary’s total capacity reached 2 million units/a. The construction of the second phase is expected to start in 2020, when the company’s total capacity will rise to 3 million units/a.

In addition, the major Chinese automotive turbocharger manufacturers e,g. Hunan Tyen Machinery, Kangyue Technology, Wuxi Weifu High-technology have also stepped up financing and capacity expansion, aggressively expanding gasoline engine turbocharger market, in an attempt to improve their competitiveness.

As the largest Chinese turbocharger manufacturer, Hunan Tyen Machinery has an annual capacity of 700,000 turbochargers, of which, gasoline engine turbocharger capacity has reached 100,000 units/a and that of the projects under construction totaled 200,000 units/a (going into operation in 2016). Currently, the company has achieved small-batch delivery to Mianyang Xinchen Engine, and will very likely supply goods in small batch to Chang’an and Great Wall in the second half of 2015.

Kangyue Technology, a major turbocharger manufacturer in China, embarked on turbocharger expansion project in 2014. Once reaching design capacity, it will see an additional capacity of 300,000 units/a. In March 2015, the company announced to construct gasoline engine turbocharger R&D and key components manufacturing technology upgrading project. It is to be put into operation in 2018, when the company will have an additional capacity of 300,000 units/a gasoline engine turbocharger assembly.?

Global and China Automotive Turbocharger Industry Report, 2014-2017 complied by ResearchInChina mainly deals with the following:

Market size, regional structure, competitive landscape, etc. of global turbochargers;

Market size, regional structure, competitive landscape, etc. of global turbochargers;

Market size, demand structure, automaker layout, price, etc. of China’s turbochargers, especially automotive turbochargers;

Market size, demand structure, automaker layout, price, etc. of China’s turbochargers, especially automotive turbochargers;

Demand for diesel and gasoline engine turbochargers in China;

Demand for diesel and gasoline engine turbochargers in China;

Operation, turbocharger business, development in China, etc. of 5 global turbocharger manufactures;

Operation, turbocharger business, development in China, etc. of 5 global turbocharger manufactures;

Operation, development strategy, etc. of 9 Chinese turbocharger manufactures;

Operation, development strategy, etc. of 9 Chinese turbocharger manufactures;

The trend prediction of China’s turbochargers, especially automotive turbochargers for the next 3 years.

1 Overview

1.1 Definition

1.2 Classification

1.3 Product Technology Trends

2 Development of Global Automotive Turbocharger Industry

2.1 Market Size

2.2 Regional Structure

2.3 Competitive Landscape

3 Development of China’s Automotive Turbocharger Industry

3.1 Marketing Environment and Policy

3.1.1 Curbing Exhaust Emission

3.1.2 Encouraging Energy Conservation and Emission Reduction

3.2 Turbocharger

3.2.1 Market Size

3.2.2 Demand Structure

3.3 Automotive Turbocharger

3.3.1 Market Size

3.3.2 Layout of Automakers

3.3.3 Price

4 China’s Automotive Turbocharger Market Segment

4.1 Development of Auto Industry

4.2 Turbocharger for Automotive Diesel Engine

4.3 Turbocharger for Automotive Gasoline Engine

4.3.1 Demand

4.3.2 Enterprises

5 Major Global Turbocharger Manufacturers

5.1 Honeywell

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 R&D

5.1.5 Turbocharger Business

5.1.6 Development in China

5.1.7 Development Plan

5.2 BorgWarner

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 R&D

5.2.5 Customers

5.2.6 Turbocharger Business

5.2.7 Development in China

5.3 Cummins

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 R&D and Acquisition

5.3.5 Turbocharger Business

5.3.6 Development in China

5.3.7 Cummins Turbo Technologies

5.4 IHI

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 Turbocharger Business

5.4.5 Development in China

5.4.6 Changchun FAWER-IHI Turbo Co., Ltd. (FIT)

5.5 MHI

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 R&D

5.5.5 Turbocharger Business

5.5.6 Development in China

6 Major Chinese Turbocharger Manufacturers

6.1 Hunan Tyen Machinery Co., Ltd. (600698)

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Gross Margin

6.1.5 Customers and Suppliers

6.1.6 Projects under Construction

6.1.6 Turbocharger Business

6.1.7 Development Prospects

6.2 Kangyue Technology Co., Ltd. (300391)

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 Gross Margin

6.2.5 R&D and Projects under Construction

6.2.6 Customers

6.2.7 Output and Sales Volume

6.2.8 Development Prospects

6.3 Wuxi Weifu High-technology Co., Ltd.(000581)

6.3.1 Profile

6.3.2 Operation

6.3.3 Revenue Structure

6.3.4 Gross Margin

6.3.5 Projects under Construction

6.3.6 Turbocharger Business

6.4 Weifang Movgoo Energy Saving Technology Co., Ltd.

6.5 FuYuan Turbochargers Co., Ltd.

6.6 Zhejiang Rongfa Motor Engine Co., Ltd.

6.7 Hunan Rugidove Turbocharging Systems Co., Ltd.

6.8 Okiya Group Co., Ltd.

6.9 Shanghai Mitsubishi Turbocharger Co., Ltd. (SMTC)

6.9.1 Profile

6.9.2 Operation

7 Conclusion and Forecast

7.1 Enterprise Analysis

7.2 Industry Prediction

Principle of Turbocharger

Structure of Turbocharger

Turbocharger Industry Chain

Turbocharger Classification and Proportion by Fuel Type

Turbocharger Classification and Proportion by Compressor Impeller Diameter

Turbocharger Classification and Proportion by Application

Primary Technologies of Turbocharger Products

Global Automotive Turbocharger Penetration by Region, 2014 & 2019E

Market Share and Turbocharger Revenue of Global Top 5 Turbocharger Manufacturers, 2014

Turbocharger Assembly Rateof Major Global Automakers, 2014 & 2019E

China’s Automotive Emissions Standards and Effective Date

List of China’s Motor-vehicle Energy Conservation and Emission Reduction Regulations

China’s Internal Combustion Engine Output, 2008-2014

Sales Volume of Turbochargers and Turbocharger Assembly Rate of Internal Combustion Engines in China, 2008-2014

China’s Turbocharger Demand Structure by Application, 2013

Market Capacity and Assembly Rate of Automotive Turbochargers in China, 2008-2014

Percentage of Automotive Turbochargers in China’s Turbochargers, 2008-2014

Power and Fuel Consumption of Both Major Turbocharged and Naturally Aspirated Models, 2015

Major Events of Auto Makers’ Small-displacement Turbocharging Technologies, 2008-2015

Output and Sales Volume of Major Turbocharged Passenger Vehicles in China, 2013-2014

Costs and Performance of Lavida and Excelle GT Turbocharged and Naturally Aspirated Models

China’s Turbocharger Prices by Brand

Output and Proportion of Passenger and Commercial Vehicles in China by Fuel Type, 2010-2014

Turbocharger Demand and Assembly Rate of Automotive Diesel Engines in China, 2011-2017E

Turbocharger Demand and Assembly Rate of Automotive Gasoline Engines in China, 2011-2017E

Honeywell’s Net Sales and Net Income, 2010-2014

Honeywell’s Net Sales Breakdown and Percentage by Business, 2012-2014

Honeywell’s Net Sales by Region, 2009-2014

Honeywel’s R&D Costs and % of Total Revenue, 2009-2014

Net Sales and YoY Growth of Honeywell’s Turbocharging Technology, 2011-2014

Honeywell’s Major Turbocharger Customers and Product Advantage, 2014

Growth Rate of Honeywell’s Gasoline Engine Turbocharger, 2014-2018E

Honeywell’s Development History in China by Business, 1994-2014

Honeywell’s Business Plan, 2015-2020

BorgWarner’s Business Overview, 2014

BorgWarner’s Net Sales and Net Income, 2010-2014

BorgWarner’s Net SalesBreakdown by Business, 2009-2014

BorgWarner’s Net Sales Breakdown by Country/Region, 2009-2014

BorgWarner’s R&D Costs and % of Total Revenue, 2009-2014

Net Sales Proportion of BorgWarner’s Top 2 Customers, 2009-2014

BorgWarner’s Net Sales Structure by Application, 2011-2014

BorgWarner’s Net Sales from Light-duty Automotive Turbocharger and % of Total Revenue, 2009-2014

BorgWarner’s Net Sales Breakdown and Percentage in China, 2009-2014

Cummins’ Net Sales and Net Income, 2010-2014

Cummins’ Net Sales Breakdown and Percentage by Business, 2012-2014

Cummins’ Net Sales Breakdown by Country/Region, 2012-2014

Cummins’ R&D and % of Total Revenue, 2009-2014

Cummins’ Key Acquisitions, 2012-2014

Cummins’s Sales from Turbocharger and % of Total Revenue, 2011-2014

Cummins’s Net Sales Breakdown and Percentage in China, 2011-2014

Cummins Turbo Technologies’ Development History,1996-2014

IHI’s Major Business Segments and Main Products, 2014

IHI’s Net Sales and Net Income, FY2008-FY2014

IHI’s Net Sales Breakdown by Business, FY2012-FY2014

IHI’s Net Sales Breakdown by Country/Region, FY2008-FY2013

IHI’s Subsidiaries that Produce Turbochargers, 2014

IHI’s Net Sales fromTurbocharger and YoY Growth, FY2010-FY2014

IHI’s Turbocharger High-tech Products

IHI’s Turbocharger Business Breakdown by Main Customer

FIT’s Revenue and Net Income, 2013-2014

MHI’s Net Sales and Net Income, FY2008-FY2014

MHI’s Net Sales by Business, FY2012-FY2014

MHI’s Net Sales by Country/Region, FY2009-FY2014

MHI’s R&D Costs and % of Total Revenue, FY2010-FY2014

Revenue and Net Income of Hunan Tyen Machinery, 2009-2014

Operating Revenue of Hunan Tyen Machinery by Product, 2009-2014

Operating Revenue of Hunan Tyen Machinery by Country/Region, 2012-2014

Gross Margin of Hunan Tyen Machinery by Product, 2012-2014

Name List and Revenue Contribution of Hunan Tyen Machinery’s Top 5 Customers, 2014H1

Hunan Tyen Machinery’s Procurement from Top 5 Suppliers and % of Total Procurement, 2013

Hunan Tyen Machinery’s Major Projects under Construction as of the end of June 2014

Hunan Tyen Machinery’s Turbocharger Output, Sales Volume, and Sales-output Ratio, 2009-2014

Hunan Tyen Machinery’s Gasoline Engine Turbochargers and Supported Models

Hunan Tyen Machinery’s Revenue and Net Income, 2013-2017E

Kangyue Technology’s Revenue and Net Income, 2011-2014

Kangyue Technology’s Turbocharger Sales Volume and Operating Revenue by Compressor Impeller Diameter, 2010-2013

Kangyue Technology’s Turbocharger Sales Volume and Operating Revenue by Sales Model, 2011-2013

Kangyue Technology’s Operating Revenue Breakdown and Percentage by Application, 2011-2013

Kangyue Technology’s Gross Margin by Product, 2010-2013

Kangyue Technology’s R&D Costs and % of Total Revenue,2011-2013

Kangyue Technology’s Major Projects under Construction, 2015

Kangyue Technology’s Turbocharger-Supported Customers by Application, 2014

Name List and Revenue Contribution of Kangyue Technology’s Top 5 Customers, Jan.-Sep. 2014

Kangyue Technology’s Turbocharger Capacity, Output, Sales Volume, and Sales-output Ratio, 2011-2013

Kangyue Technology’s Revenue and Net Income, 2013-2017E

Revenue and Net Income of Wuxi Weifu High-technology, 2010-2014

Operating Revenue of Wuxi Weifu High-technology by Business, 2010-2014

Operating Revenue of Wuxi Weifu High-technology by Region, 2010-2014

Gross Margin of Wuxi Weifu High-technology by Business, 2010-2014

Wuxi Weifu High-technology’s Major Projects under Construction as of the End of June 2014

Wuxi Weifu High-technology’s Turbocharger Output, Sales Volume, and Sales-output Ratio, 2011-2013

Weifang Movgoo Energy Saving Technology’s Turbocharger Output, Sales Volume, and Sales-output Ratio, 2012-2013

Output, Sales Volume, and Sales-output Ratio of FuYuan Turbochargers, 2009-2014

Zhejiang Rongfa Motor Engine’s Turbocharger Output and Sales Volume, 2009 & 2013

Okiya’s Turbocharger Output and Sales Volume, 2008-2012

SMTC’s Revenue and Net Income, 2012-2014

SMTC’s Turbocharger Output and Sales Volume, 2009-2013

Turbocharger Output, Sales Volume, and Market Share of Major Chinese Turbocharger Manufacturers, 2012-2013

Turbocharger Capacity and Supported Customers of Major Chinese Turbocharger Manufacturers, 2014

Major Foreign Enterprises’ Turbocharger Construction Projects in China, 2014

Turbocharger Revenue of Major Enterprises in China and Beyond, 2013-2014

Market Capacity of Turbochargers and Automotive Turbochargers in China, 2013-2017E

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...