China Heavy Truck Industry Report, 2015-2018

-

July 2015

- Hard Copy

- USD

$2,300

-

- Pages:86

- Single User License

(PDF Unprintable)

- USD

$2,150

-

- Code:

YSJ088

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,300

-

- Hard Copy + Single User License

- USD

$2,500

-

In 2014, China’s heavy truck sales volume totaled 748,000 units, falling 3.32% year on year; the accumulative sales volume for Jan.-Apr. 2015 reached 193,300 units, a sharp reduction of 33.52% from the same period in 2014. That was mainly because growing economic downward pressure led to a slowdown in fixed assets investment so that the real estate market experienced volatile adjustment, thus resulting in a fall in demand for heavy trucks. Meanwhile, China began to implement national IV emission standards in January 2015, which brought cost pressure to carmakers and increased the users’ procurement costs. On the other hand, the national IV standard-related facilities were still not well-equipped, such as insufficient denitration, a lack of urea supply centers, and less technical reserves of enterprises, which made some users take a wait-and-see attitude for new products, thereby, to some extent, restraining the demand for heavy trucks.

As of June 2015, there were three major positive factors in China’s heavy truck market that would boost demand:

New projects – In 2015, China will expand the effective investment and set up the promotion mechanism of major infrastructure projects, including more than 420 projects from 7 major project packages with a proposed investment of over RMB10 trillion. And shantytown renovation, railway, road, and infrastructure projects will drive the demand for civil engineering heavy trucks

New projects – In 2015, China will expand the effective investment and set up the promotion mechanism of major infrastructure projects, including more than 420 projects from 7 major project packages with a proposed investment of over RMB10 trillion. And shantytown renovation, railway, road, and infrastructure projects will drive the demand for civil engineering heavy trucks

Energy conservation and emission reduction – In Sep. 2014, China introduced energy conservation and emissions reduction program, according to which around 600 yellow-label cars and old vehicles would be phased out, which would expand to a certain degree the new demand for heavy trucks.

Energy conservation and emission reduction – In Sep. 2014, China introduced energy conservation and emissions reduction program, according to which around 600 yellow-label cars and old vehicles would be phased out, which would expand to a certain degree the new demand for heavy trucks.

Logistics transportation – In 2014-2015, as China witnessed a rapid development in e-commerce, the express delivery demand grew at an astonishing pace, which brought huge demand for road transportation and logistics heavy trucks. Moreover, the development of free-trade zone will further promote the growth of port trailer towing vehicles, slag transport vehicles, and other market segments.

Logistics transportation – In 2014-2015, as China witnessed a rapid development in e-commerce, the express delivery demand grew at an astonishing pace, which brought huge demand for road transportation and logistics heavy trucks. Moreover, the development of free-trade zone will further promote the growth of port trailer towing vehicles, slag transport vehicles, and other market segments.

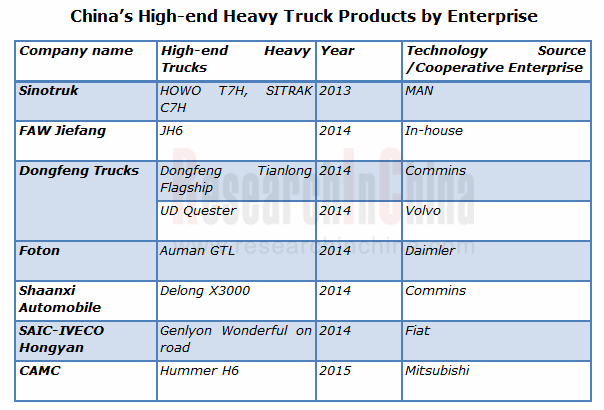

In the new normal, China is adjusting its economic growth pattern, and heavy trucks are undertaking the changes in profit model and product demand. In future, high-tech, high added-value heavy trucks will become the mainstream of development trend. Sinotruk, FAW Jiefang, Dongfeng Trucks, etc. have released high-end heavy truck products.

Source: ResearchInChina

As one of the major three heavy truck enterprises in China, Sinotruk developed and manufactured the country’s first heavy-duty truck, and has successfully brought in Steyr heavy-duty truck production project. Its independently developed HOWO product takes a crucial position in the Chinese heavy truck market. In 2014 and Jan.-Apr. 2015, the company ranked separately first and second with the sales volume of 120,000 units and 35,000 units. In January 2013, Sinotruk cooperated with MAN to launch SITRAK brand, and with the support from MAN, Sinotruk has entered the field of high-end heavy truck with HOWO T7H and SITRAK C7H.

A middle and heavy-duty truck maker under FAW Group, FAW Jiefang ranked first in heavy truck market with the sales volume of 37,000 units in Jan.-Apr. 2015, with a market share of 19.13%, 0.78 percentage points more than Sinotruk. In November 2014, JH6, a high-end heavy truck developed by FAW Jiefang, was released in FAW Jiefang Qingdao Automobile and delivered to the first batch of users. The model adopts the mainstream Aowei 11L 6DM2 National IV engine of FAW Jiefang Automotive Co., Ltd. Wuxi Diesel Engine Works, representing the company’s top level, and will promote the overall sales in the future.

China Heavy Truck Industry Report, 2015-2018 by ResearchInChina mainly covers the following:

Overview of China heavy truck industry, including definition, classification, technology introduction, etc.;

Overview of China heavy truck industry, including definition, classification, technology introduction, etc.;

Study of China’s overall heavy truck market, including ownership, output, sales volume, competition pattern and the latest market characteristics;

Study of China’s overall heavy truck market, including ownership, output, sales volume, competition pattern and the latest market characteristics;

Analysis on China’s heavy truck market segments (complete heavy trucks, incomplete heavy trucks and semi-trailer towing vehicles), consisting of output and sales volume, competition pattern, import and export;

Analysis on China’s heavy truck market segments (complete heavy trucks, incomplete heavy trucks and semi-trailer towing vehicles), consisting of output and sales volume, competition pattern, import and export;

Study of China’s heavy truck industry chain, including key parts market, raw material market and downstream market;

Study of China’s heavy truck industry chain, including key parts market, raw material market and downstream market;

Study of major heavy truck companies in China, covering their operation, output, sales volume, customers, new products, etc.

Study of major heavy truck companies in China, covering their operation, output, sales volume, customers, new products, etc.

1. Overview of Heavy Truck Industry

1.1 Definition and Classification

1.2 Technology Introduction

1.3 Emission Standards

1.4 Product Trends

2. Overall Heavy Truck Market

2.1 Ownership

2.2 Output and Sales Volume

2.2.1 Output

2.2.2 Sales Volume

2.3 Market Structure

2.4 Competition Pattern

2.4.1 Market Share

2.4.2 Sales Targets

2.5 LNG Heavy Truck

2.5.1 Sales Volume

2.5.2 Competition

2.5.3 Market Potential

2.6 High-end Heavy Truck

3. Heavy Truck Market Segments

3.1 Complete Heavy Truck

3.1.1 Output and Sales Volume

3.1.2 Import and Export

3.1.3 Competition Pattern

3.2 Incomplete Heavy Truck

3.2.1 Output and Sales Volume

3.2.2 Import and Export

3.2.3 Competition Pattern

3.3 Semi-trailer Towing Vehicle

3.3.1 Output and Sales Volume

3.3.2 Import and Export

3.3.3 Competition Pattern

3.3.4 Market Segments

4. Heavy Truck Industry Chain

4.1 Overview

4.2 Key Components

4.2.1 Cost Structure

4.2.2 Supporting

4.3 Raw Materials Market

4.3.1 Steel Market

4.3.2 Rubber Market

4.4 Downstream Market

4.4.1 Infrastructure Construction

4.4.2 Real Estate Construction

4.4.3 Highway Freight

5. Key Companies

5.1 FAW Jiefang Automotive Company, Ltd.

5.1.1 Profile

5.1.2 Output and Sales Volume

5.1.3 Product Launch

5.1.4 Production Base

5.2 China National Heavy Duty Truck Group Co., Ltd. (SINOTRUK)

5.2.1 Profile

5.2.2 Operation

5.2.3 Heavy Truck Business

5.2.4 Overseas Expansion

5.3 Dongfeng Motor Corporation

5.3.1 Profile

5.3.2 Operation

5.3.3 Heavy Truck Business

5.4 Beiqi Foton Motor Co., Ltd.

5.4.1 Profile

5.4.2 Operation

5.4.3 Heavy Truck Business

5.4.4 Production Capacity

5.5 Shaanxi Automobile Group Co., Ltd.

5.5.1 Profile

5.5.2 Main Products

5.5.3 Heavy Truck Business

5.6 Anhui Jianghuai Automobile Co., Ltd.

5.6.1 Profile

5.6.2 Operation

5.6.3 Heavy Truck Business

5.7 Anhui Hualing Automobile Co., Ltd.

5.7.1 Profile

5.7.2 Operation

5.7.3 Heavy Truck Business

5.7.4 Business Objectives for 2015

5.8 Qingling Motors (Group) Co., Ltd.

5.8.1 Profile

5.8.2 Operation

5.8.3 Heavy Truck Business

5.9 Chengdu Dayun Automotive Group Company Limited

5.9.1 Profile

5.9.2 Heavy Truck Business

5.10 BEIBEN Trucks Group Co.,Ltd

5.10.1 Profile

5.10.2 Heavy Truck Business

5.11 SAIC-IVECO Hongyan Commercial Vehicle Co., Ltd

5.11.1 Profile

5.11.2 Heavy Truck Business

5.11.3 The First High-end Heavy Truck Model – New Stralis Hi-Way Launched

5.12 Hubei Tri-Ring Special Vehicle Co., Ltd.

5.12.1 Profile

5.12.2 Heavy Truck Business

5.13 Nanjing Xugong Automobile Manufacturing Co., Ltd.

5.13.1 Profile

5.13.2 Heavy Truck Business

5.14 GAC Hino Motors Co., Ltd.

5.14.1 Profile

5.14.2 Operation

5.14.3 Heavy Truck Business

5.14.4 New 700-Series Products Complying with National Ⅳ Emission Standards Launched

5.15 Zhejiang Feidie Automobile Manufacturing Co., Ltd.

5.15.1 Profile

5.15.2 Heavy Truck Business

6. Summary and Forecast

6.1 Market Size

6.2 Market Structure

6.3 Competition Pattern

6.4 Trends

Classification of Heavy Truck Industry

Technology Introduction of Key Heavy Truck Manufacturers in China

China Vehicle Emission Standards

China's Heavy Truck Ownership, 2005-2018E

China's Heavy Truck Output, 2005-2018E

China's Heavy Truck Sales Volume, 2005-2018E

China's Heavy Truck Output and Growth Rate by Model, 2014-2015

China's Heavy Truck Sales Volume and Growth Rate by Model, 2014-2015

Sales Volume and Market Share of Top 10 Heavy Truck Enterprises in China, 2014-2015

Sales Target of Major Heavy Truck Enterprises in China, 2015

Sales Volume of LNG Heavy Trucks in China, 2012-2018E

Major LNG Heavy Truck Manufacturers in China

International Crude Oil and Liquefied Natural Gas Price, 2011-2015

High-end Heavy Truck Products in China by Enterprise

China's Complete Heavy Truck Output and Sales Volume, 2005-2018E

China's Complete Heavy Truck Import and Export Volume and Value, 2009-2015

Sales Volume and Market Share of Top 10 Complete Heavy Truck Enterprises in China, 2014-2015

China's Incomplete Heavy Truck Output and Sales Volume, 2005-2018E

China's Incomplete Heavy Truck Import and Export Volume and Value, 2009-2015

Sales Volume and Market Share of Top 10 Incomplete Heavy Truck Enterprises in China, 2014-2015

China's Semi-trailer Towing Vehicle Output and Sales Volume, 2005-2018E

China's Semi-trailer Towing Vehicle Import and Export Volume and Value, 2009-2015

Sales Volume and Market Share of Top 10 Semi-trailer Towing Vehicle Enterprises in China, 2014-2015

Market Structure of Semi-trailer Towing Vehicles in China, 2005-2018E

Output and Sales Volume of Semi-trailer Towing Vehicles (≤25 Tonnage)in China, 2005-2018E

Sales Volume and Market Share of Top 10 Semi-trailer Towing Vehicle (≤25 Tonnage) Enterprises in China, 2014-2015

Output and Sales Volume of Semi-trailer Towing Vehicles (25-40 Tonnage) in China, 2005-2018E

Sales Volume and Market Share of Top 5 Semi-trailer Towing Vehicle (25-40 Tonnage) Enterprises in China, 2014-2015

Output and Sales Volume of Semi-trailer Towing Vehicles (>40 Tonnage) in China, 2005-2018E

Sales Volume and Market Share of Semi-trailer Towing Vehicles (>40 Tonnage) in China by Enterprise, 2014-2015

Automotive Industry Chain

Transmission, Axle and Engine Supply of Major Heavy Truck Manufacturers in China

China's Galvanized Sheet (Strip) Output and Sales Volume, 2005-2015

China's Galvanized Coil Price, 2013-2015

China's Cold-rolled Thin Sheet Output and Sales Volume, 2005-2015

China's Cold-rolled Coil Price, 2013-2015

China's Natural Rubber Spot Price, 2013-2015

China's Investment in Fixed Assets, 2005-2015

China's Investment in Real Estate Development, 2005-2015

China's New Housing Construction Area and Sales Area, 2004-2014

Proportion of Logistics Heavy Truck to Engineering Heavy Trucks in China by sales volume,, 2005-2018E

China's Highway Freight Volume and Turnover, 2005-2015

FAW Jiefang’s Heavy Truck Output and Sales Volume, 2009-2015

Sinotruk’s Revenue and Net Income, 2010-2015

Sinotruk’sGross Margin, 2010-2015

Sinotruk’s Revenue Structure by Business, 2014

Sinotruk's Heavy Truck Output and Sales Volume, 2009-2015

Dongfeng Motor's Revenue and Net Income, 2010-2015

Dongfeng Motor's Gross Margin, 2010-2015

Dongfeng Motor's Revenue from Major Regions, 2013-2014

Dongfeng Motor's Heavy Truck Output and Sales Volume, 2009-2015

Foton's Revenue and Net Income, 2010-2015

Foton's Gross Margin, 2010-2015

Foton's Revenue and Gross Margin by Business, 2013-2014

Foton's Heavy Truck Output and Sales Volume, 2009-2015

Capacity of Beijing Foton Daimler, 2015

Main Heavy Truck Products of Shaanxi Automobile Group

Shanxi Automobile Group’s Heavy Truck Output and Sales Volume, 2009-2015

JAC’s Revenue and Net Income, 2010-2015

JAC’s Gross Margin, 2010-2015

JAC's Overseas Revenue and % of Total, 2009-2014

JAC’s Heavy Truck Output and Sales Volume, 2009-2015

Hualing Automobile’s Assets and Net Income, 2012-2014

CAMC’s Products Series

Hualing Automobile’s Heavy Truck Output and Sales Volume, 2009-2015

Hualing Automobile’s Production and Operation Target, 2015

Qingling Motors’ Revenue and Net Income, 2010-2014

Qingling Motors’ Gross Margin, 2010-2014

Qingling Motors’ Heavy Truck Output and Sales Volume, 2009-2015

Dayun Automotive’s Heavy Truck Output and Sales Volume, 2009-2015

BEIBEN Trucks’ Heavy Truck Output and Sales Volume, 2009-2015

SAIC-IVECO Hongyan’s Heavy Truck Output and Sales Volume, 2009-2015

Main Heavy Truck Products of Tri-Ring Special Vehicle

Tri-Ring Special Vehicle’s Heavy Truck Output and Sales Volume, 2009-2015

Xugong Automobile’s Heavy Truck Output and Sales Volume, 2009-2015

GAC Hino Motors’s Assets, Liabilities, and Revenue, 2012-2014

GAC Hino Motors’s Heavy Truck Output and Sales Volume, 2009-2015

Feidie Automobile’s Heavy Truck Output and Sales Volume, 2009-2015

Growth Rate of China's Heavy Trucks in Sales Volume, 2006-2015

China's Heavy Truck Market Structure, 2005-2018E

China's Heavy Truck Market Concentration, 2009-2015

Market Share of Major Heavy Truck Enterprises in China, 2009-2015

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...