Global and China Automotive Semiconductor Industry Report, 2014-2015

-

Sep.2015

- Hard Copy

- USD

$2,400

-

- Pages:114

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

ZYW215

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,500

-

- Hard Copy + Single User License

- USD

$2,600

-

Global and China Automotive Semiconductor Industry Report, 2014-2015 mainly focuses on the following:

1. Global automotive market and industry;

2. China’s automotive market and industry;

3. Automotive semiconductor industry and market;

4. Fifteen major automotive semiconductor companies

In 2014, the global automotive semiconductor market size approximated USD28 billion, up 7.3% from 2013. It is predicted that in 2015 the market size will amount to USD29.6 billion, up 5.7% from a year earlier, and that by 2016 the growth rate will continue to decline, to only 3.7%. That was mainly attributed to the following two factors: first, remarkable deflation globally, which resulted in a substantial depreciation of the Japanese yen and the euro against the dollar; second, China, the world’s largest auto market, is very likely to go into decline. In 2015, China’s auto market is expected to edge up merely 1%, but may slide by 2% in 2016.

Automotive semiconductor falls into five categories: power semiconductor, sensor semiconductor, processor (main for MCU) semiconductor, ASSP (principally Connectivity and Amplifier) semiconductor, and logic semiconductor. In the field of traditional automobiles, the semiconductor costs for each unit approximate USD320, of which power occupies 26% and sensor 16%. In HEV, however, this figure is USD690, of which power represents as much as 75%. In EV, the semiconductor costs come to USD700, of which power accounts for 55%. But due to ongoing depressed oil prices, the market space of HEV/EV has been considerably squeezed. If the oil price returns back more than USD100, then the automotive semiconductor market will increase significantly.

In 2015, the market size of automotive sensors would reach about USD4.7 billion. Automotive sensors consist of CMOS Image Sensor, Pressure, Acceleration, Speed and Position, Magnetic (Hall effect), and Angle, among which CMOS Image Sensor mainly involves ON Semiconductor and OVT. The largest pressure sensor player is Sensata, which is also the biggest auto sensor maker worldwide. Moreover, Sensata is adept at Speed and Position. As the world’s second largest auto sensor company, Bosch specializes in Acceleration and Angle. ON Semiconductor is the world’s third largest sensor company. Infineon, the fourth largest sensor player in the world, mainly operates Magnetic (Hall effect) and Acceleration. Allegro, the world’s fifth sensor player under Sanken, is good at Magnetic (Hall effect) and Acceleration. In addition, other large auto sensor companies include Analog Devices, Melexis, Micronas, NXP, and STMicroelectronics.

In 2015, the market size of automotive processors, including MCU, DSP, and GPU, totaled some USD7 billion. In MCU market, Renesas takes absolutely the first place, with a market share of 40%, in contrast to 22% for Freescale. In the 32-Bit MCU market, Freescale accounts for the largest portion, Infineon and TI follows with 13% and 8% share, respectively. Other large players include STMicroelectronics and Spansion (Cypress).

Automotive power semiconductor mainly involves Power Management ICs, MOSFET, IGBT, and Diodes (Fast Recovery, Schottky, and High Voltage). HEV/EV needs a large quantity of IGBT, whose price is very high, thus leading to a sharp increase in costs of power semiconductor. Low-power circuit typically uses MOSFET while high-power and high-current circuit needs IGBT. SiC MOSFET is the most efficient, with high temperature resistance, far lower price than that of GaN, and more mature technology. So, it has good prospects in the future.

Automotive power semiconductor market has a low concentration, which provides a living space to some small companies. It is worth noting that to develop hybrid electric vehicle, Toyota ventured into the field of power semiconductor, so that its strength in IGBT is not inferior to specialized IGBT companies. Besides, Toyota is also not dwarfed by specialized automotive power semiconductor players in SiC MOSFET field.

Infineon, the largest automotive power semiconductor vendor, acquired IR, a move that helped bridge the gap in LV MOSFET, with the market share rising to 24%. STMicroelectronics, which specializes in Power Management, ranks second. What comes next is Renesas, Fuji Electric, and Bosch.

1 Global Semiconductor Industry

1.1 Market Status

1.2 Supply Chain

1.3 Industry Overview

2 Global and China Automobile Market

2.1 Global Automobile Market

2.2 Automobile Market Overview in China

2.3 Latest Development of Automobile Market in China

3 Automotive Semiconductor Market and Industry

3.1 Automotive Semiconductor Market Size

3.2 Overview of Automotive Sensor

3.3 Automotive CMOS imaging sensor

3.4 Automotive Sensor Industry

3.5 Automotive Processor

3.6 Automotive Processor Industry

3.7 Automotive Power Semiconductor

3.8 HEV/EV Power Semiconductor

3.9 Automotive Power Semiconductor Industry

3.10 Distribution of ADAS, Infotainment, and Body Semiconductor

3.11 Ranking of Automotive Semiconductor by Revenue

4. Automotive Semiconductor Companies

4.1 Infineon

4.2 Bosch Semiconductor

4.3 Rohm

4.4 ON SEMI

4.5 TI

4.6 STMicroelectronics

4.7 Renesas

4.8 Freescale

4.9 NXP

4.10 Melexis

4.11 Sensata

4.12 Fuji Electric

4.13 TDK

4.14 Murata

4.15 Allegro

Global Semiconductor Market Size, 2013-2019E

Global Semiconductor Market Distribution by Product, 2013-2016E

Growth Rate of Global Semiconductor Products, 2013-2016E

Semiconductor Outsourced Supply Chain

Semiconductor Company Systems

Semiconductor Outsourced Supply Chain Example

Food Chain IC CAD Design Industry

Top 25 Semiconductor Sales Leaders, 1Q2014

Top25 Semiconductor Sales Leaders, 1Q2015

Global Automobile Sales Volume, 2010-2015

Global Light Vehicle Output by Region, 2003-2015

Automobile Sales Volume in China, 2005-2015

Output YoY Growth of Vehicles in China by Model, 2008-2015

Global Automotive Semiconductor Market Size, 2012-2018E

Automotive Semiconductor Distribution by Product, 2014

Automotive Semiconductor Distribution by Application, 2012-2018E

Automotive Sensor Distribution

Sensors in Powertrain Applications

Sensors in Safety Applications

Shipments of Automotive CMOS Imaging Sensors, 2009-2018E

Market Share of Major Automotive CMOS Imaging Sensor Manufacturers, 2015

Ranking of Automotive Sensor Player by Revenue, 2014-2015

Ranking of Global MEMS Manufacturers by Revenue, 2013-2014

Automotive Processor Market Size, 2012 vs 2019E

Automotive Processor Per Vehicles, 2007 vs 2012 vs 2020E

Market Share of Major Automotive MCU Manufacturers, 2015

EV Vehicles Current Block Diagram

Power Semiconductor Devices in Toyota Prius

Power Semiconductor Devices in Toyota Lexus Ls600H

Market Share of Major Power Semiconductor Companies, 2014

ADAS Semiconductor by Type, 2013

Infotainment Semiconductor by Type, 2013

Body Semiconductor by Type, 2013

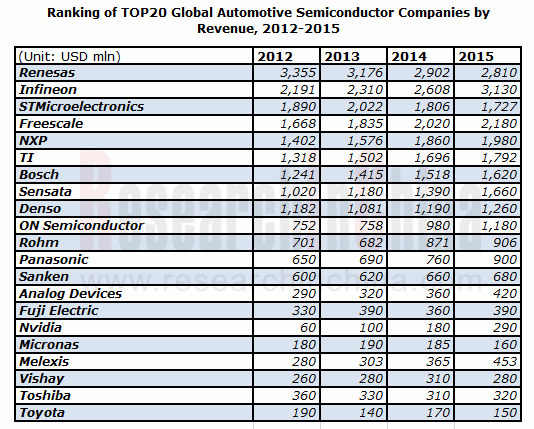

Ranking of Top 20 Automotive Semiconductor Companies by Revenue, 2012-2015

Infineon’s Revenue vs Gross Margin, FY2010-FY2015

Infineon’s Operation Margin and Net Margin, FY2010-FY2015

Infineon’s Assets and Liabilities, CY2015 H1

Infineon’s Employee by Region, CY2015 H1

Infineon’s Revenue by Region, FY2010-FY2015

Infineon’s Revenue by Segment, FY2011-FY2015

Infineon’s Operation Profit by Segment, FY2011-FY2015

Infineon’s Automotive Semiconductors Position

Infineon’s Automotive Segment Revenue by Region

Infineon’s Automotive Segment Revenue by Product

Infineon’s Automotive Segment Revenue by Application

Infineon’s Investments, FY2009-FY2015

Rohm’s Sales and Operation Margin, FY2011-FY2016

Rohm’s Sales by Segment, FY2011-FY2016

Rohm’s Operation Profit by Segment, FY2011-FY2016

Rohm’s Revenue by Application, FY2004-FY2016

ON Semi’s Revenue vs Operation Income, 2010-2015

Revenue of ON Semi by Segment, 2010-2015

Revenue Structure of ON Semi by Geographic Location, 2012-2014

Revenue Structure of ON Semi by Application, 2012-2017E

On Semi’s Major Product Application and Customer

On Semi’s Automotive Semiconductor Focus, 2014

On Semi’s Major Products

On Semi’s SPG Segment by Application, 2014

On Semi’s Position

On Semi’s SSG Segment by Application, 2014

ON SEMI’s ISG Segment Milestone

ON SEMI’s APG Segment Automotive Revenue, 2012-2014

TI’s Revenue vs Gross Margin, 2010-2015

TI’s Revenue by Segment, 2010-2014

TI’s Operation Profit by Segment, 2010-2014

TI’s Revenue by Application, 2013-2015

TI’s Automotive Infotainment Block Diagram

TI’s Automotive Charging Spot

STMicro Revenue vs Gross Margin, 2010-2015

STMicro’s Revenue by Region, 2014

STMicro’s Revenue by Product, 2014

STMicro’s APG Segment Revenue, 2005-2014

STMicro’s Automotive Semiconductor Market Position

Renesas’ Revenue vs Gross Margin, FY2011-FY2016

Renesas’ Gross Margin, Q2/CY2013-Q2/CY2015

Renesas’ Operation Margin, Q2/CY2013-Q2/CY2015

Renesas’ Automotive Business Revenue, Q2/CY2013-Q2/CY2015

Renesas’ General-purpose Business Revenue, Q2/CY2013-Q2/CY2015

Renesas Automotive Focus

Renesas HEV/EV Automotive Focus

Renesas HEV/EV Automotive MCU Roadmap

Renesas Powertrain MCU Roadmap

Renesas Chassis MCU Roadmap

Renesas Airbag MCU Roadmap

Renesas ADAS MCU Roadmap

Renesas Instrument Cluster MCU Roadmap

Renesas Car Audio MCU Roadmap

Freescale’s Revenue vs Operation Margin, 2007-2015

Freescale’s Revenue Breakdown by business, 2012-2015

Freescale’s Revenue Breakdown by customer, 2014

Freescale’s Revenue Breakdown by region, 2011 vs 2014

Freescale’s Major Product and Application

Freescale ADAS

Major Locations of Freescale

NXP Revenue Vs Operation Margin, 2010-2015

NXP Consolidated Balance Sheet Data, 2010-2014

NXP Automotive Sales by Product, 2014

NXP Automotive Sales by Region, 2014

NXP Customers

Major NXP Automotive Facilities

Melexis’ Financial Position, CY 2015H1

Melexis’ Revenue by Region, 2013-2014

Sensata’s Revenue vs Operation Income, 2010-2015

Sensata’s Capital Expenditures, 2004-2014

Sensata’s Revenue by Segment, 2012-2015

Sensata’s Revenue by Region, 2012-2014

Sensata+CST’s Revenue by Application

Sensata’s Sensor Revenue by Type, 2012-2014

Structure of Fuji Electric Electronic Devices Segment

Sales and Operation Income of Electronic Devices Segment, FY2013-FY2015

Sales of Fuji Electric Electronic Devices Segment by Application, FY2013-FY2014

New Products of Fuji Electric Electronic Devices Segment

TDK’s Net Sales, FY2006-FY2015

TDK’s Sales by Segment, FY2014-FY2015

TDK’s Operation Income, FY2006-FY2015

TDK’s R&D Costs, FY2006-FY2015

TDK’s Capex, FY2006-FY2015

TDK’s Sales by application, FY2012-FY2015

TDK’s Passive Components Sales by Application, FY2012-FY2015

Quarterly Sales of TDK by applications, 1Q/FY2015-1Q/FY2016

Quarterly Sales of TDK For Automobiles, 1Q/FY2015-1Q/FY2016

Murata’s Sales and Operation Margin, FY2009-FY2016

Murata’s Sales by product, FY2013-FY2016

Murata’s Major Products

Murata’s sales by Application, FY2013-FY2016

Murata’s Operation Income Bridge, FY2014-FY2015

Murata’s Quarterly Sales, Order and Backlog, 2012Q2-2015Q1

Murata’s Sales by Region, FY2014-FY2015

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...