China Commercial Vehicle Exhaust Emission System Industry Report, 2015

-

Sep.2015

- Hard Copy

- USD

$2,500

-

- Pages:112

- Single User License

(PDF Unprintable)

- USD

$2,300

-

- Code:

LMX070

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,600

-

- Hard Copy + Single User License

- USD

$2,700

-

Since 2014, the output and sales volume of commercial vehicles in China have continued to decline, with the output and sales volume for Jan.-Jul. 2015 totaling 1.9837 million units and 1.9891 million units, respectively, down 14.62% and 13.89% year-on-year. That was mainly because economic downturn led to a fall in demand for commercial vehicles. On the other hand, the emission standards for diesel vehicles are so unprecedentedly strict that the industry is contracting to achieve industrial upgrading.

At present, China's mainstream line for National IV emission standard has been identified as follows: Heavy and medium-duty commercial vehicles adopt SCR system while light-duty commercial vehicles use EGR+DOC/POC system.

From the perspective of the development of SCR industry, China’s SCR industry is in the early stage of growth. Although there are much more newcomers, yet the number of excellent enterprises is still small. The autonomous enterprises include Weifu Lida, Kailong High Technology, and ZHEJIANG YINLUN MACHINERY, and the foreign-funded enterprises mainly involve Commins and TENNECO.

Among them, Weifu Lida boasts prominent SCR technical capacity. In the whole industry chain, all core parts are produced independently except carrier that is outsourced from outside. In H1 2015, the company recorded revenue of RMB1.326 billion and net income of RMB141 million, up 53.71% and 60.93%, respectively, on a year-on-year basis.

ZHEJIANG YINLUN MACHINERY specializes SCR system assembly and catalytic converters that are applicable to heavy and medium-duty diesel-powered vehicles. As one of the major SCR converter suppliers of Weichai, the company has advantages in the field of packaging. In H1 2015, the company reported revenue of RMB1.421 billion, up 18.31% year-on-year; net income of RMB104 million, up 27.79% year-on-year.

The autonomous EGR manufactures in China primarily include ZHEJIANG YINLUN MACHINERY, WUXI LONGSHENG TECHNOLOGY, and YIBIN TIANRUIDA AUTO PARTS while foreign-funded enterprises consist of Kunshan Pierburg, Ningbo BORGWARNER. Among them, WUXI LONGSHENG and YIBIN TIANRUIDA specialize in EGR valve and EGR system; ZHEJIANG YINLUN principally operates EGR cooler, which registers an around 9% market share in China. In the field of light-duty trucks, YINLUN occupies nearly a 50% share of total EGR cooler market, and thus its capacity for market penetration is increasing year by year.

The report mainly deals with the following:

Development background, industry standards and policies, as well as technology roadmap of commercial vehicle exhaust emission system industry;

Development background, industry standards and policies, as well as technology roadmap of commercial vehicle exhaust emission system industry;

Development of SCR system and EGR system industries, including their system structure, market pattern, market size, and main supported vehicle manufacturers;

Development of SCR system and EGR system industries, including their system structure, market pattern, market size, and main supported vehicle manufacturers;

Development of downstream market, including commercial vehicle production and sales, bus and truck production and sales, as well as the prediction of production and sales volume for 2015-2018;

Development of downstream market, including commercial vehicle production and sales, bus and truck production and sales, as well as the prediction of production and sales volume for 2015-2018;

10 major SCR system manufacturers, 5 EGR system manufacturers, and 5 POC/DOC catalyst manufacturers in China, including their operation, related product business, latest developments, development in China (mainly foreign enterprises), and relevant product supporting manufacturers, etc.

10 major SCR system manufacturers, 5 EGR system manufacturers, and 5 POC/DOC catalyst manufacturers in China, including their operation, related product business, latest developments, development in China (mainly foreign enterprises), and relevant product supporting manufacturers, etc.

Preface

1. Overview of Commercial Vehicle Exhaust Emission System Industry

1.1 Development Background

1.2 Standard and Policy

1.3 Technical Routes

1.3.1 Introduction

1.3.2 Technical Routes Contrast

1.3.3 Technical Routes in Major Countries

2. Development of SCR System and EGR System Industries

2.1 SCR System

2.1.1 System Composition

2.1.2 Market Pattern

2.1.3Market Size

2.1.4 Supporting Enterprises

2.2 EGR System

2.2.1 System Composition

2.2.2 Market Pattern

2.2.3 Market Size

2.2.4 Supporting Enterprises

3. Downstream Market

3.1 Overall Development

3.1.1 Definition and Classification

3.1.2 Output and Sales Volume

3.2 Truck and Incomplete Truck

3.3 Passenger Car and Incomplete Car

3.4 Forecast

4. POC and DOC Enterprises

4.1 BASF

4.1.1 Profile

4.1.2 Catalyst Products

4.1.3 Catalyst Business Revenue

4.1.4 Catalyst Business in China

4.2 UMICORE

4.2.1 Profile

4.2.2 Operation

4.2.3 Catalyst Business

4.2.4 Catalyst Business in China

4.2.5 Supporting Enterprises

4.3 ECOCAT

4.3.1 Profile

4.3.2 Supporting Enterprises

4.4 SINO-PLATINUM METALS

4.4.1 Profile

4.4.2 Operation

4.4.3 Business Structure

4.4.4 Catalyst Business

4.4.5 Supporting Enterprises

4.4.6 Performance Forecast

4.5 ACT BLUE

4.5.1 Profile

4.5.2 Supporting Enterprises

5. EGR SYSTEM ENTERPRISES

5.1 WUXI LONGSHENG TECHNOLOGY

5.1.1 Profile

5.1.2 Supporting Enterprises

5.2 YIBINTIANRUIDA AUTO PARTS

5.2.1 Profile

5.2.2 Supporting Enterprises

5.3 ZHEJIANG JOOLOONG

5.4 PIERBURG

5.4.1 Profile

5.4.2 EGR Products

5.4.3 Operation

5.4.4 Development in China

5.4.5 Supporting Enterprises

5.5 BORGWARNER

5.5.1 Profile

5.5.2 EGR Products

5.5.3 Operation

5.5.4 Development in China

5.5.5 BorgWarner expands production in China for advanced emissions technologies

5.5.6 Supporting Enterprises

6. SCR System Enterprises

6.1 WEIFU HIGH-TECHNOLOGY

6.1.1 Profile

6.1.2 Development Course

6.1.3 Exhaust Emission System

6.1.4 Operation

6.1.5 Revenue Structure

6.1.6 Gross Margin

6.1.7 R & D and Investment

6.1.8 Supporting Enterprises

6.1.9 Performance Forecast

6.2 ZHEJIANG YINLUN MACHINERY

6.2.1 Profile

6.2.2 Development Course

6.2.3 Introduction of SCR Products and EGR Products

6.2.4 Operation

6.2.5 Revenue Structure

6.2.6 Gross Margin

6.2.7 Main Clients

6.2.8 R & D and Investment

6.2.9 Supporting Enterprises

6.2.10 SAIC Capital Takes Shares

6.2.11 Performance Forecast

6.3 KAILONG HIGH TECHNOLOGY

6.3.1 Profile

6.3.2 Main Clients

6.4 POWER GREEEN

6.4.1 Profile

6.4.2 Main Products

6.4.3 Supporting Enterprises

6.5 LIUZHOU LIHE EXHAUST SYSTEMS CONTROL

6.6 TIANJIN CATARC AUTO

6.7 BEIJING GREENTEC ENVIRONMENTAL PROTECTION EQUIPMENT

6.7.1 Profile

6.7.2 Operation

6.7.3 Analysis of Strength and Weakness

6.7.4 Development Plan

6.8 GUANGXI SUNLIGHT TECHNOLOGY

6.8.1 Profile

6.8.2 Supporting Enterprises

6.9 TENNECO

6.9.1 Profile

6.9.2 Operation

6.9.3 Development in China

6.9.4 Supporting Enterprises

6.10 CUMMINS

6.10.1 Profile of Cummins

6.10.2 Cummins Emission Solutions

6.10.3 Supporting Enterprises

Main Air Pollution Accidents in the Global History

Share Ratio of Pollution Emission of Automobile in China (by Fuel), 2013

Exhaust Emission Standard and Execution Plan of Heavy Vehicle in the World

Emission Regulation Upgrading Process of Heavy Vehicle in China

Related Policies on Commercial Vehicle Exhaust Emission System Industry in China

Main Environmental Measures during “12th Five-Year Plan”

Sketch Map of EGR and SCR Routes

Contrast Between SCR and EGR Routes

Development Course of Exhaust Emission Routes in Western Countries

Exhaust Emission Routes of Commercial Vehicle Manufacturers in Europe after European IV Standard Implementing

Exhaust Emission Routes in China after National IV Standard Phase

SCR System Composition

Cost Structure and Main Enterprises of Parts of SCR System

Major SCR System Enterprises and Capacities in China

SCR System Market Shares in China, 2013

Market Size of SCR System in China, 2014-2018E

SCR Catalytic Converter Suppliers of Major Chinese Automobile Manufacturers (National IV Standard)

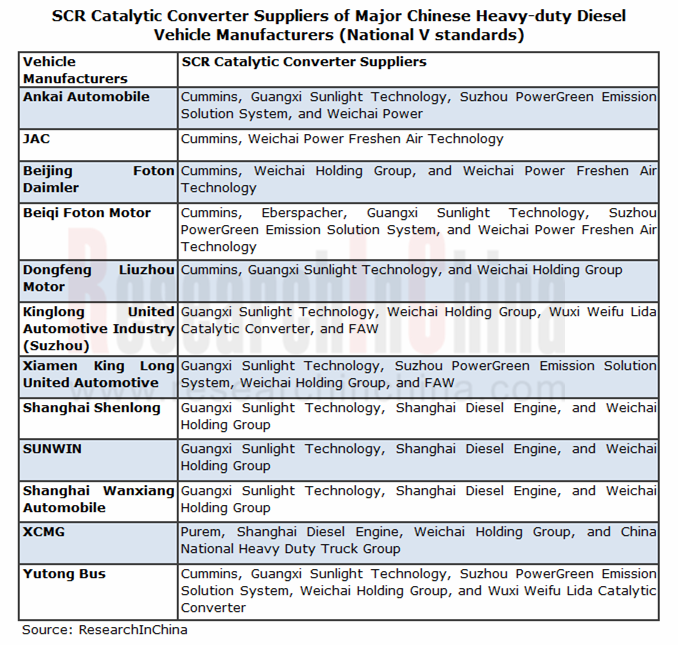

SCR Catalytic Converter Suppliers of Major Chinese Automobile Manufacturers (National V Standard)

EGR System Composition

Contrast among DOC, POC and DPF Routes

Major EGR Enterprises and Output in China

Major POC and DOC Enterprises in China

POC and DOC Market Shares in China, 2013

Market Size of EGR System in China, 2014-2018E

EGR Products Suppliers of Major Chinese Automobile Manufacturers (National IV Standard)

DOC Suppliers of Major Chinese Automobile Manufacturers (National IV Standard)

DOC Suppliers of Major Chinese Automobile Manufacturers (National V Standard)

Classification of Commercial Vehicle in China

Output and YoY Change of Commercial Vehicle in China, 2005-2015

Sales Volume and YoY Change of Commercial Vehicle in China, 2005-2015

Output of Commercial Vehicle in China (by Types), 2005-2015

Sales Volume of Commercial Vehicle in China (by Types), 2005-2015

Output and YoY Change of Truck in China, 2005-2015

Sales Volume and YoY Change of Truck in China, 2005-2015

Output of Truck in China (by Types), 2005-2015

Output of Incomplete Truck in China (by Types), 2005-2015

Output and YoY Change of Passenger Car in China, 2005-2015

Sales Volume and YoY Change of Passenger Car in China, 2005-2015

Output of Passenger Car in China (by Types), 2005-2015

Output of Incomplete Passenger Car in China (by Types), 2005-2015

Output and YoY Change of Commercial Vehicle in China, 2015E-2018E

Output and YoY Change of Passenger Car in China, 2015E-2018E

Output of Passenger Car in China (by Types), 2015E-2018E

Output of Incomplete Passenger Car in China (by Types), 2015E-2018E

Output and YoY Change of Truck in China, 2015E-2018E

Output of Truck in China (by Types), 2015E-2018E

Output of Incomplete Truck in China (by Types), 2015E-2018E

Main Financials of BASF, 2014-2015

Financial Data of Functional Materials & Solutions Segment of BASF

Catalysts Revenue of BASF, 2011-2015

Revenue Structure of BASF (by Regions), 2014

Catalyst Capacity Expansion of BASF, 2011-2014

Organization Structure of Umicore

Global Business Distribution of Umicore

Main Financials of Umicore, 2010-2015

Revenue Structure of Umicore (by Business Units), H1 2015

Global Automobile Catalyst Business Distribution of Umicore

Main Financials of Catalysis Business of Umicore, 2010-2015

Development of Umicore in China

Basic Information of UmicoreAutocat (China) Co., Ltd

Some Supporting Enterprises of DOC of UmicoreAutocat (China) Co., Ltd

Basic Information of Nanjing ECOCAT Auto Catalyst Co., Ltd

Some Supporting Enterprises of DOC of Nanjing ECOCAT Auto Catalyst Co., Ltd

Revenue and YoY Change of Sino-Platinum Metals, 2010-2015

Net Income and YoY Change of Sino-Platinum Metals, 2010-2015

Main Products and Application of Sino-Platinum Metals

Revenue and Gross Margin of Sino-Platinum Metals (by Business Units), 2010-2015

Basic Information of SPMC

Some Supporting Enterprises of DOC of SPMC

Revenue and Net Income of Sino-Platinum Metals, 2015E-2017E

Some Supporting Enterprises of POC and DOC of Act Blue

Some Supporting Enterprises of EGR Products of Wuxi Longsheng Technology

Some Supporting Enterprises of EGR Products of YibinTianruida Auto Parts

Development Course of Zhejiang Jooloong

Sales Network of Zhejiang Jooloong

EGR Valve of Pierburg

Basic Information of Pierburg Shanghai Nonferrous Components Co., Ltd

Some Supporting Enterprises of EGR Products of Pierburg Automotive Components (Kunshan) Co., Ltd

Operating Indicators of BorgWarner

EGR Products of BorgWarner

Development Course of BorgWarner Emissions Systems

Main Financials of BorgWarner, 2014-2015

Revenue Breakdown of BorgWarner (by Business Units), 2012-2015

Ningbo Plant of BorgWarner

Basic Information of BorgWarner Auto Parts and Components (Ningbo) Co., Ltd

Some Supporting Enterprises of EGR Products of BorgWarner Automotive Components (Ningbo) Co., Ltd

Development Course of Weifu High-technology

Exhaust Emission Business of Weifu High-technology

Main Operating Indicators of WeifuLida Catalytic Converter, 2011-2015

Output, Sales Volume and Inventory of Exhaust Emission System of Weifu High-technology, 2011-2014

Revenue and YoY Change of Weifu High-technology, 2010-2015

Net Income and YoY Change of Weifu High-technology, 2010-2015

Revenue Breakdown of Weifu High-technology (by Business Unit), 2009-2015

Revenue Structure of Weifu High-technology (by Regions), 2009-2015

Gross Margin of Weifu High-technology, 2011-2015

R&D Costs and % of Total Revenue of Weifu High-technology, 2012-2014

Some Supporting Enterprises of SCR Catalytic Converter of WeifuLida Catalytic Converter Co., Ltd (National IV Standard)

Some Supporting Enterprises of SCR Catalytic Converter of WeifuLida Catalytic Converter Co., Ltd (National V Standard)

Some Supporting Enterprises of DOC of WeifuLida Catalytic Converter Co., Ltd

Some Supporting Enterprises of DOC of Wuxi Weifu Environmental Catalysts Co., Ltd

Revenue and Net Income of Weifu High-technology, 2015E-2017E

Development Course of Zhejiang Yinlun Machinery

Market Strategy of EGR Business of Zhejiang Yinlun Machinery

EGR Products of Zhejiang Yinlun Machinery

Revenue and YoY Change of Zhejiang Yinlun Machinery, 2010-2015

Net Income and YoY Change of Zhejiang Yinlun Machinery, 2010-2015

Output and Sales Volume of Zhejiang Yinlun Machinery, 2013

Revenue Structure of Zhejiang Yinlun Machinery (by Products), 2010-2015

Revenue Structure of Zhejiang Yinlun Machinery (by Regions), 2010-2015

Gross Margin of Zhejiang Yinlun Machinery (by Products), 2010-2015

Main Clients of Zhejiang Yinlun Machinery

R&D Costs and % of Total Revenue of Zhejiang Yinlun Machinery, 2010-2015

Fund-raising Projects of Zhejiang Yinlun Machinery

Some Supporting Enterprises of SCR Catalytic Converter of Zhejiang Yinlun Machinery

Revenue and Net Income of Zhejiang Yinlun Machinery, 2015E-2017E

Main Clients of Kailong High Technology

Development Course of Power Greeen

Main Products of Power Greeen

Main Clients of Power Greeen

Some Supporting Enterprises of SCR Catalytic Converter of Power Greeen

Main Clients of SCR System of Beijing Greentec Environmental Protection Equipment

Operating Indicators of Beijing Greentec Environmental Protection Equipment, 2011-2015

Revenue Structure of Beijing Greentec Environmental Protection Equipment (by Business Units), 2011-2015

Revenue from Top Five Clients of Beijing Greentec Environmental Protection Equipment and % of Total Revenue, H1 2015

Some Supporting Enterprises of SCR Catalytic Converter of Guangxi Sunlight Technology (National IV Standard)

Some Supporting Enterprises of SCR Catalytic Converter of Guangxi Sunlight Technology (National V Standard)

Some Supporting Enterprises of EGR Products of Guangxi Sunlight Technology (National V Standard)

Introduction of Tenneco

Global Business Distribution of Tenneco

Main Financials of Tenneco, 2014-2015

Revenue Structure of Tenneco, 2014

Main Financials of Tenneco, 2009-2014

Revenue Structure of Tenneco, 2013-2014

Basic Information of Tenneco (China) Co., Ltd

Basic Information of Shanghai Tenneco Exhaust System Co., Ltd

Basic Information of Tenneco (Dalian) Exhaust System Co., Ltd

Basic Information of Tenneco Auto Industry (Suzhou) Co., Ltd

Some Supporting Enterprises of SCR Catalytic Converter of Tenneco (China) (National IV Standard)

Some Supporting Enterprises of DOC of Tenneco (China) (National IV Standard)

Some Supporting Enterprises of DPF of Tenneco (China) (National IV Standard)

Some Supporting Enterprises of DOC of Tenneco (China) (National V Standard)

Four Business Divisions of Cummins

Emission Standard of Cummins Emission Solutions

Some Supporting Enterprises of SCR Catalytic Converter of Cummins Emission Solutions (China)

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...