China Used Car Market Report, 2015-2018

-

Sep.2015

- Hard Copy

- USD

$2,050

-

- Pages:84

- Single User License

(PDF Unprintable)

- USD

$1,900

-

- Code:

RPH001

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$2,900

-

- Hard Copy + Single User License

- USD

$2,250

-

Along with the increase of car ownership, China’s used car market entered into a period of rapid development. In 2014, the volume and amount of used car trading in China were recorded at 6.05 million vehicles (up 16.3% year on year) and RMB367.6 billion (up 26.1% year on year), respectively. In H1 2015, the market continued to grow, with trading volume and amount rising 15.1% and 8.3%, respectively, on a year-on-year basis. Estimated at an average vehicle replacement cycle of 5-6 years, China’s used car market is expected to usher in accelerated growth in the next few years, with trading volume to exceed 10 million vehicles by 2017.

By segment, China’s used car market characterizes the two below:

1.Sedan becomes the subject of the market. In 2014, the volume of used sedan trading in China was 3.51 million vehicles, accounting for 58% of the total; the amount of used sedan trading came to RMB227.9 billion, representing the largest proportion (62%) of the total.

2.SUV grows at the fastest pace. In 2014, the volume of used SUV trading in China attained 200,000 vehicles, up 25% from a year ago. The growth rate will be around 38% during 2015-2018 to make SUV the fastest-growing used car market segment.

With respect to trading channels, China is intensifying the market layout of used car trading market, used car dealers, used car online trading platform, etc. Among them, used car e-commerce market has grown obviously fast, with trading volume and amount approximating 350,000 vehicles and RMB19.26 billion in 2014, a respective year-on-year surge of 58.4% and 60.3%.

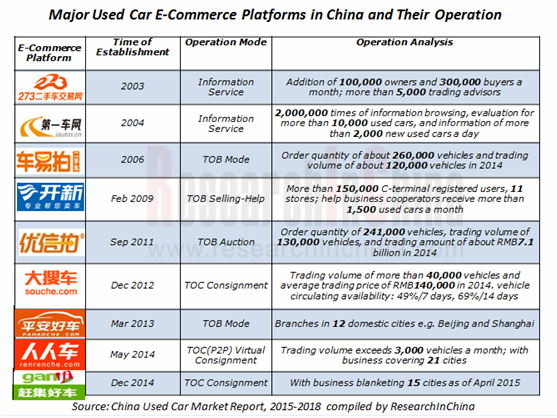

According to website features, Chinese used car e-commerce can be divided into three categories: service information-oriented, represented by www.273.cn and iautos.cn; TOB auction websites e.g. www.cheyipai.com, www.youxinpai.com, www.kx.cn, pahaoche.com, etc.; TOC consignment websites e.g. souche.com www.guazi.com, renrenche.com, etc. In 2014, www.cheyipai.com and www.youxinpai.com with used car trading volume accounting for 71.4% of the entire used car e-commerce market became the largest used car e-commerce platforms in China.

Founded in 2011, www.youxinpai.com is a used car trading services platform that integrates vehicle condition assessment, bid auction, secure payment, formalities agent and logistics & transportation and earns profits from charging detection cost, 1%-3% transaction commission, transfer fee, and logistic fee, belonging to the typical B2B auction used car trading e-commercial company. In the future, www.youxinpai.com will pay attention to regional market development, used car evaluation system construction, business partner expansion as well as construction of used car information transparency.

www.cheyipai.com was founded in 2006 and the online platform was established in 2010, in the possession of four service brands i.e. Cheyipai online trading platform, 268V used car standardized testing technology, Yunyi automakers / dealers used car e-commerce solutions, and 268V Xing certification authorization service, making profits from charging detection cost (charge the seller RMB300 for successful trade), trading commissions (charge the buyer 3% commission), 2B advertising and information service fee, and logistics service fee, providing used car trading with detection, assessment, trading, training, consulting, replacement and other services, belonging to the C/B2B used car trading e-commercial company. With the improvement of Xing certification requirements, www.cheyipai.com will give top priority to raising service standards to improve the quality of used cars, classification standard and precision.

China Used Car Market Report, 2015-2018 mainly covers the followings:

Overview of used car industry in China, involving brief introduction, development history, industry policies, etc.

Overview of used car industry in China, involving brief introduction, development history, industry policies, etc.

Research on overall used car market in China, including used car trading modes and channels, market scale, market structure, market status and trends;

Research on overall used car market in China, including used car trading modes and channels, market scale, market structure, market status and trends;

Research on used car market segments in China, including trading volume by models and trading scale by regions;

Research on used car market segments in China, including trading volume by models and trading scale by regions;

Research on used car industry chain in China, involving upstream new car market, downstream dismantling & scrapping market, and used car financial research;

Research on used car industry chain in China, involving upstream new car market, downstream dismantling & scrapping market, and used car financial research;

Research on used car dealers in China, covering operating conditions, used car business, recent news, etc.

Research on used car dealers in China, covering operating conditions, used car business, recent news, etc.

Research on used car e-commerce market in China, covering operation mode, market scale, competition pattern, and financing analysis;

Research on used car e-commerce market in China, covering operation mode, market scale, competition pattern, and financing analysis;

Research on used car online trading platform, including profile of platforms, business model, operation analysis.

Research on used car online trading platform, including profile of platforms, business model, operation analysis.

1 Overview

1.1 Introduction to Used Cars

1.1.1 Definition

1.1.2 Characteristics

1.1.3 Development History

1.2 Industry Policy

1.3 Policy for Foreign Merchants

2 Overall Used Car Trading Market

2.1 Trading Modes and Channels

2.1.1 Trading Pattern

2.1.2 Used Car Trading Market

2.1.3 Other Used Car Trading Channels

2.2 Market Transaction Scale

2.2.1 Trading Volume

2.2.2 Trading Amount

2.2.3 Trading Price

2.3 Market Structure

2.3.1 By Model

2.3.2 By Service Life

2.3.3 Nature of Transaction

2.4 Brand Used Car Identification

2.5 Market Status and Problems

2.6 Market Trends

3 Used Car Trading Market Segments

3.1 By Model

3.1.1 Sedan

3.1.2 Bus

3.1.3 Truck

3.1.4 SUV

3.2 By Region

3.2.1 Regional Distribution

3.2.2 East China

3.2.3 South Central China

3.2.4 North China

3.2.5 Southwest China

3.2.6 Northeast China

3.2.7 Northwest China

3.2.8 Major Cities

4 Used Car Industry Chain

4.1 New Car Market

4.1.1 Market Scale

4.1.2 Market Structure

4.2 Scrap & Dismantling Market

4.2.1 Market Briefs

4.2.2 Market Scale

4.3.3 Industry Structure

4.3 Used Car Finance

4.3.1 Brief Introduction

4.3.2 Corporate Business Model

4.3.3 Development and Expectation

5 Used Car Dealers

5.1 China Grand Automotive Services Co., Ltd.

5.1.1 Profile

5.1.2 Financial Situation

5.1.3 Revenue Structure

5.1.4 Used Car Business

5.1.5 Recent News

5.2 Sinomach Automobile Co. Ltd.

5.2.1 Profile

5.2.2 Financial Situation

5.2.3 Revenue Structure

5.2.4 Used Car Business

5.2.5 Recent News

5.3 Pangda Automobile Trade Co., Ltd.

5.3.1 Profile

5.3.2 Financial Situation

5.3.3 Revenue Structure

5.3.4 Used Car Business

5.4 Shengda Used Car Supermarket

5.4.1 Profile

5.4.2 Used Car Business

5.5 Anji Used Car of SAIC

5.5.1 Profile

5.5.2 Used Car Business

6 China Used Car E-Commerce Market

6.1 Market Overview

6.1.1 Description and Features

6.1.2 Circulation Channels

6.1.3 Industry Chain

6.1.4 Operation Mode

6.2 Market Scale

6.3 Market Structure

6.3.1 Hot-Selling Brands

6.3.2 Hot-Selling Models

6.3.3 Hot-Selling Displacements

6.4 Competition Pattern

6.5 Summary of Used Car E-Commerce Financing

7 Used Car Online Trading Platforms

7.1 Auction Websites

7.1.1 www.youxinpai.com

7.1.2 www.cheyipai.com

7.1.3 www.kx.cn

7.1.4 pahaoche.com

7.2 Consignment Websites

7.2.1 souche.com

7.2.2 www.guazi.com

7.2.3 zhuo.com

7.2.4 renrenche.com

7.2.5 youche.com

7.3 Information Service Websites

7.3.1 iautos.cn

7.3.2 www.che168.com

7.3.3 www.273.cn

7.3.4 51auto.com

Policies on China Used Car Industry

Used Car Trading Modes

Platform Construction of China Used Car Market

Used Car Management Region of Beijing Used Motor Vehicle Market

Sales Regional Division of Beijing Zhonglian Used Car Trading Market

Trading Volume and Amount of Shanghai Used Motor Vehicle Trading Market, 2009-2015

Used Car Dealers

Main Functions of Used Car Website

Monthly Trading Volume of Used Cars in China, 2014-2015 (unit: 1,000 vehicles)

China Used Car Trading Volume and New Car Sales Volume, 2009-2018E (unit: mln vehicles)

China Used Car Trading Amount and % of Total Trading Amount by Model, 2009-2018E (unit: RMB bn)

Average Trading Price of Used Cars in China, 2009-2018E

Average Monthly Trading Price of Used Cars in China, 2013-2015

China Used Car Trading Volume by Model, Jan-Jun 2015 (unit: 1,000 vehicles)

China Used Car Trading Volume by Model, 2009-2018E (unit: mln vehicles)

China Used Car Trading Volume Structure by Model, 2009-2018E

China Used Car Trading Volume and % of Total Trading Volume by Vehicle Age, 2009-2014 (unit: mln vehicles)

China Used Car (< 3 Years) Trading Volume Segmentation, 2009-2013 (unit: mln vehicles)

China Used Car (3-10 Years) Trading Volume Segmentation, 2009-2013 (unit: mln vehicles)

China Used Car (> 10 Years) Trading Volume Segmentation, 2009-2013

China Used Car Trading Volume and % of Total Trading Volume by Nature of Transaction, 2009-2014 (unit: mln vehicles)

Brand Used Car Certification Launched by China Automotive Suppliers

Classification of China Used Car E-Commerce Operation Modes

China Used Sedan Trading Volume, Trading Amount and Average Trading Price, 2009-2018E

China Used Bus Trading Volume, Trading Amount and Average Trading Price, 2009-2018E

China Used Truck Trading Volume, Trading Amount and Average Trading Price, 2009-2018E

China SUV Output and Sales Volume, 2009-2018E (unit: mln vehicles)

China Used SUV Trading Volume, Trading Amount and Average Trading Price, 2009-2018E

China Used Car Trading Volume by Region, 2009-2018E (unit: mln vehicles)

East China Used Car Trading Volume by Province, 2009-2014 (unit: mln vehicles)

South Central China Used Car Trading Volume by Province, 2009-2014 (unit: mln vehicles)

North China Used Car Trading Volume by Province, 2009-2014 (unit: mln vehicles)

Southwest China Used Car Trading Volume by Province, 2009-2014 (unit: mln vehicles)

Northeast China Used Car Trading Volume by Province, 2009-2014 (unit: mln vehicles)

Northwest China Used Car Trading Volume by Province, 2009-2014 (unit: mln vehicles)

Beijing Used Car Trading Volume, 2009-2014 (unit: mln vehicles)

Shanghai Used Car Trading Volume, Trading Amount and Average Trading Price, 2009-2015

Shanghai Used Car Trading Volume, Trading Amount and Average Trading Price by Trading Market, H1 2015

Guangzhou Used Car Trading Volume, 2009-2015

China Automotive Output and Sales Volume, 2009-2018E (unit: mln vehicles)

China Passenger Car Output and Sales Volume, 2009-2018E (unit: mln vehicles)

China Commercial Car Output and Sales Volume, 2009-2018E (unit: mln vehicles)

Dismantling & Recycling Material Structure of Scrapped Cars

Basic Statistics of China Scrapped Car Dismantling & Recycling Industry, 2011-2013

China Scrapped Motor Vehicle Recycling Volume by Type, 2011-2013 (unit: 1,000 vehicles)

Enterprises’ Sales, 2012-2013

Relevant Indices of Top 50 Enterprises by Scrapped Car Recycling Volume, 2012-2013

Distribution of Top 50 Enterprises by Scrapped Car Recycling Volume, 2013

Car Recycling Volume of Top 50 Chinese Enterprises by Scrapped Car Recycling Volume, 2013 (unit: 1,000 vehicles)

China Car Recycling Volume by Region, 2012-2013 (unit: 1,000 vehicles)

China Sales by Region, 2012-2013 (unit: RMB bn)

Relevant Indices of China Car Recycling Market by Region, 2013

Operational Indicators of Chinese Dismantling-Recycling Enterprises by Scale, 2013

Scope of Used Car Financial Service

Business Features of Major Used Car Financial Service Providers

Comparison of Used Car E-Commerce Consumption Loan Business

Operating Performance of China Grand Automotive Services, 2011-2014 (unit: RMB bn)

Revenue Breakdown of China Grand Automotive Services by Division, 2011-2014 (unit: RMB bn)

Used Car Business of China Grand Automotive Services

Operating Performance of Sinomach Automobile, 2010-2015 (unit: RMB bn)

Revenue Breakdown of Sinomach Automobile by Product, 2010-2014 (unit: RMB bn)

Revenue Breakdown of Sinomach Automobile by Region, 2010-2014 (unit: RMB bn)

Used Car Related Subsidiaries of Sinomach Automobile

Operating Performance of Pangda Group, 2010-2015 (unit: RMB bn)

Revenue Breakdown of Pangda Group by Division, 2010-2014 (unit: RMB bn)

Used Car Related Subsidiaries of Pangda Group

Circulation Channels of China Used Car E-Commerce Market

Classification of Used Car E-Commerce Platforms

China Used Car E-Commerce Industry Structure

Used Car E-Commerce Operation Modes

Trading Scale of Used Car E-Commerce Market, 2012-2014

Hot-Selling Brands of Used Car Online Trading, 2014

Hot-Selling Models of Used Car Online Trading, 2014

Hot-Selling Displacements of Used Car Online Trading, 2014

Main Used Car E-Commerce Platforms in China

Summary of China Used Car E-Commerce Platform Financing

Business Model of www.youxinpai.com

Main Products of www.youxinpai.com

C/B2B Mode Chart of www.cheyipai.com

Used Car E-Commerce Solution “Yunyi” of www.cheyipai.com

Business Model of www.kx.cn

C2B/B2B Whole Industry Chain Ecosystem Model of pahaoche.com

Business Model of souche.com

Main Services of souche.com

Used Car C2C Online Trading Mode of www.guazi.com

Business Model of iautos.cn

Main Products of iautos.cn

Operating Performance of www.273.cn, 2012-2013

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...