Global and China Automotive Lighting Industry Report, 2014-2015

-

Sep.2015

- Hard Copy

- USD

$2,700

-

- Pages:147

- Single User License

(PDF Unprintable)

- USD

$2,500

-

- Code:

ZYW216

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,800

-

- Hard Copy + Single User License

- USD

$2,900

-

Global and China Automotive Lighting Industry Report, 2014-2015 focuses on the followings:

1. Global automobile market and industry;

2. China automobile market and industry;

3. LED industry and market;

4. Automotive lighting industry and market;

5. 18 typical automotive lighting companies.

Global automotive lighting market size was USD25.3 billion in 2014, and is expected to grow by 10.8% to USD28 billion in 2015, the highest growth rate since 2010, and reach USD30.1 billion in 2016, a year-on-year rise of 7.5%.

There are two reasons for significant expansion of automotive lighting market. One is substantial improvement in the penetration of LED. As the price of LED chip continues to drop, more and more companies adopt LED to make headlamps. Despite the price of LED chip declines, LED headlamps are still more expensive than halogen lamps. About 4% of headlamps were made of LED in 2014. The figure rose to 7% in 2015 and is expected to hit 15% in 2017 and 21% in 2020, as a growing number of companies employ LED in the pursuit of emotional or aesthetic appearance. The other reason is the use of ADB/AFS. The penetration of AFS will arrive at 15% in 2015, and that of ADB 3% in the year and is predicted to stand at 10% in 2020 and 25% in 2025. The adoption of ADB makes headlamps more complicated and raises the cost. In addition, laser headlamps and OLED tail-lamps have come into being. The penetration of laser headlamps, which are extremely expensive, is expected to reach 15% in 2025.

Global economic downturn, especially the economic slowdown in China, will prolong the downward trend in the Chinese automobile market over the next couple years, thus slowing expansion of the automotive lighting market. Moreover, the deflation has been severe.

From the perspective of industry, big companies hold an increasingly dominant position, finding a higher rate than small ones in terms of revenue growth. Valeo is expected to be the one performing best in 2015 with a growth rate of up to 19%. Valeo won nearly 90% of headlamp orders of Volkswagen’s Passat B6 platform and 1/3 of Audi’s headlamp orders. The competitor- Hella is suffering market share contraction.

1. Global and Chinese Automotive Market

1.1 Global Automotive Market

1.2 Overview of Chinese Automotive Market

1.3 Recent Development of Chinese Automotive Market

2 Automotive Lighting Technology

2.1 Profile of HID Xenon Lamps

2.2 Typical Automotive Headlight Design

2.3 Headlight Design Trends

2.4 Laser Automotive Lighting

2.5 OLED Automotive Light

2.6 ADB/AFS

3 LED Industry

3.1 LED Automotive Lighting Market

3.2 Automotive Interior LED Lighting

3.3 Automotive Exterior LED Lighting

3.4 LED Industry Chain

3.5 Geographical Distribution of LED Industry

3.6 Ranking of Global Top 30 LED Companies by Revenue, 2012-2014

3.7 Taiwan LED Industry

3.8 Summary of LED Industry in Mainland China, 2014

4. Automotive Lighting Industry and Market

4.1 Automotive Lighting Market Overview

4.2 Automotive Lighting Market Size

4.3 Global Automotive Lighting Industry

4.4 Global Automotive Lighting OEM System

4.5 China Automotive Lighting Industry

4.6 China's Automotive Lighting OEM System

5. Automotive Lighting Companies

5.1 Hella

5.1.1 Changchun Hella

5.2 Koito

5.2.1 Shanghai Koito

5.2.2 Guangzhou Koito

5.3 Ichikoh

5.4 Stanley

5.4.1 Guangzhou Stanley

5.4.2 Tianjin Stanley Electric Co., Ltd.

5.5 Valeo

5.6 VARROC

5.6.1 Changzhou Damao Visteon

5.7 Automotive Lighting (Magneti Marelli)

5.8 TYC

5.9 DEPO

5.10 Ta Yih Industrial

5.11 Changzhou Xingyu

5.12 Jiangsu Tongming

5.13 ZKW

5.14 Liaowang Automotive Lamp

5.15 SL

5.16 Zhejiang Tianchong

5.17 Laster Tech

5.18 FIEM

6. Automotive Lighting LED Companies

6.1 Nichia Chemical

6.2 Toyoda Gosei

6.3 OSRAM

Sales Volume of Major Global Automobile Brands, 2010-2015

Production of Light Vehicles by Region , 2013-2015

Sales Volume of Automobile in China, 2005-2015

China's Automobile Output YoY Growth Rate by Type, 2008-2015

Audi A6 3.5 FSI Headlamp

BMW 730Li Headlamp

Mercedes-Benz S320L Headlamp

Honda 9-generation Accord Headlamp

Peugeot 508 Headlamp

Global Sedan Headlamp Light Source Distribution, 2009-2016E

China’s Sedan Headlamp Light Source Distribution, 2009-2016E

Audi Sport Quattro Laserlight Concept

Audi OLED Swarm System

ADB/AFS Penetration Rates, 2010-2025E

AFS System Architecture of the Reference Design

Global LED Automotive Lighting Market Size, 2010-2016E

Geographical Distribution of Global LED Output Value, 2013-2014

Rankin of Top 30 LED Companies Worldwide by Revenue, 2012-2014

Operating Margin of Taiwan LED Companies, 2012-2014

Gross Output Value of China LED Industry, 2013-2014

Ownership of MOCD in China LED Industry, 2010-2014

Output Value of LED Epitaxial Chip in China, 2010-2014

Output Value of LED Packaging in China, 2010-2014

LED Output Value by Application in China, 2010-2014

LED Application Structure by Output Value, 2013-2014

LED Output Value by Application in China, 2014

Automotive Lighting Market by type, 2015

LED Penetration, 2007-2015

Automotive Headlamp Source by technology, 2013-2015

Automotive Taillamp Source by technology, 2013-2015

Global Automotive Lighting Market Size, 2010-2018E

Global Automotive Lighting Market Size by End Market, 2010-2016E

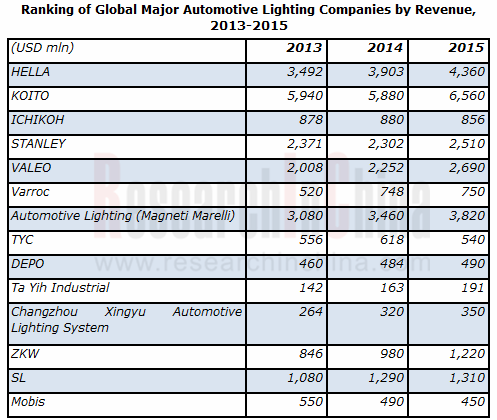

Ranking of Global Major Automotive Lighting Companies by Revenue, 2013-2015

Automotive Lighting System Supply Structure of Toyota, 2014

Automotive Lighting System Supply Structure of Honda, 2014

Automotive Lighting System Supply Structure of Nissan Renault, 2014

Automotive Lighting System Supply Structure of GM, 2014

Automotive Lighting System Supply Structure of Ford, 2014

Automotive Lighting System Supply Structure of VW, 2014

Automotive Lighting System Supply Structure of Hyundai, 2014

Market Share of Major Sedan Lighting Companies in China, 2014

Top 20 Automotive Light Companies in China by Sales, 2013

Koito’s Client Distribution, 2014

Major clients of Chinese Automotive Light Companies

Hella’s Milestone, 1899-2014

Hella’s Revenue and EBIT, FY2007-FY2015

Hella Quarterly Comparison, FY2015

Hella Gross Profit Margin Bridge, FY2014-FY2015

Hella’s Organizational Structure

Hella’s Revenue by Division, FY2010-FY2015

Hella’s Revenue by Region, FY2007- FY 2012

Hella’s Revenue by Region, FY2013- FY 2015

Favorable Customer Mix and Regional Exposure of Hella, FY2014

Global Distribution of Hella's Staff

Global Layout of Hella, 2007-2013

Hella Automotive Lighting Revenue Segment by Product, FY2015

Hella Automotive Electronics Revenue Segment by Product, FY2015

Hella Aftermarket Revenue Segment by Business, FY2015

Koito’s Revenue and Operating Margin, FY2006- FY 2016

Assets and Equity of Koito, 2011-2015

Koito’s Revenue by Region, FY2008- FY2013

Koito’s Revenue by Region, FY2013- FY2015

Koito’s Plants in China

ADB of Koito

Koito LED Roadmap, 2007-2015

Major Vehicle Models Supported by Koito

LED light Sales of Shanghai Koito, 2005-2009

Shanghai Koito’s Revenue and Operating Margin, 2004-2013

Ichikoh’s Revenue and Operating Margin, FY2006- FY 2016

Ichikoh’s Revenue by Region, FY2007- FY2014

Ichikoh's Distribution in the World

Ichikoh's Distribution in Japan

Major Vehicle Models Supported by Ichikoh

Stanley’s Main Products

Stanley’s Revenue and Operating Margin, FY2006- FY 2016

Stanley’s Assets and Liabilities, FY2010- FY 2014

Stanley’s Automotive Lighting Revenue and Operating Margin, FY2006- FY 2015

Stanley’s Revenue by Region, FY2008- FY 2014

Guangzhou Stanley’s Revenue and Operating Margin, 2004-2013

Valeo’s Revenue and Gross Margin, 2005-2014

Valeo’s Revenue by Division, 2009-H1 2015

Valeo’s EBITDA by Division, 2012-2014

Valeo’s Clients by Region, 2007-2014

Valeo’s Automotive Lighting Main Customer

Varroc’s Revenue by Product, FY2013

Varroc’s Revenue by Segment, 2014

Global Distribution of Technical Centers of Visteon’s Automotive Lighting Division

Global Distribution of Production Bases of Visteon’s Automotive Lighting Division

Major Vehicle Models Supported by Visteon’s Automotive Lighting Division

Global Distribution of Magneti Marelli

Revenue of Magneti Marelli by Product, 2013

Revenue and EBIT Margin of Magneti Marelli, 2006-2015

Auotomotive Lighting Revenue of Magneti Marelli, 2007-2015

Automobiles Equipped with Automotive Lighting

Lights Used by Mercedes-Benz S

Lights Used by BMW 4 Series

TYC’s Revenue and Operating Margin, 2005-2015

TYC’s Monthly Revenue and Growth Rate, July 2013-July 2015

Financial Status of TYC's Subsidiary in Mainland China, 2010

Financial Status of TYC's Subsidiary in Mainland China, 2011

Financial Status of TYC's Subsidiary in Mainland China, 2012

Financial Status of TYC's Subsidiary in Mainland China, 2013

Financial Status of TYC's Subsidiary in Mainland China, 2014

DEPO’s Revenue and Operating Margin, 2006-2015

DEPO’s Monthly Revenue, July 2013-July 2015

DEPO’s Revenue by Region, 2009-2012

DEPO Global Distribution Network

Financial Data of DEPO’s Subsidiary in Mainland China, 2012

Revenue and Operating Margin of Ta Yih Industrial, 2004-2015

Monthly Revenue and Growth Rate of Ta Yih Industrial, July 2013-July 2015

Distribution of Ta Yih Industrial

Industrial Products of Ta Yih Industrial

Clients of Ta Yih Industrial

Equity Structure of Changzhou Xingyu

Output of Changzhou Xingyu, 2013-2014

Revenue and Operating Margin of Changzhou Xingyu, 2007-2015

Client Structure of Changzhou Xingyu, 2007-2014

Distribution of Staff Positions of Changzhou Xingyu, 2014

Major Clients of Jiangsu Tongming

ZKW's Organizational Structure

Geographical Distribution of ZKW's Staff, 2014-2015

SL’s Revenue and Operating Margin, 2008-2014

SL’s Revenue by Product, 2010-2014

Structure of Laster Tech

Revenue and Gross Margin of Laster Tech, 2008-2015

Monthly Revenue of Laster Tech, July 2013-July 2015

Revenue of Laster Tech by Business, 2011-2013

Products of Laster Tech

Fiem’s Revenue and Profit, FY2011-FY2014

Revenue Structure of Fiem by Product, FY2014

Fiem’s Manufacturing Unit

Fiem’s Major Clients

Revenue and Operating Margin of Nichia Chemical, 2003-2014

Revenue and Operating Margin of Nichia Chemical LED Division, 2004-2014

Revenue and Operating Margin of Toyoda Gosei, FY2006-FY2015

Revenue of Toyoda Gosei by Product, FY2006-FY2015

Revenue of Toyoda Gosei by Region, FY2006-FY2015

Revenue and Operating Margin of Toyoda Gosei in Asia-Pacific, FY2006-FY2015

Revenue and Operating Margin of Toyoda Gosei LED Business, FY2008-FY2015

OSRAM’S Quarterly Revenue and EBITA Margin, Q1 2012-Q1 2015

Osram’s Revenue by Division, 20012-2014

Osram’s Revenue by Division, 20014-2015

Osram’s EBITA by Division, 20012-2014

Osram’s SP Revenue and EBIT, Q3 2013-Q1 2015

Osram’s OS Revenue and EBIT, Q3 2013-Q1 2015

Osram’s Revenue by Region, 20012-2014

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...