Global and China Automotive Head-up Display (HUD) and Instrument Cluster Industry Report, 2014-2015

-

Oct.2015

- Hard Copy

- USD

$2,200

-

- Pages:90

- Single User License

(PDF Unprintable)

- USD

$2,000

-

- Code:

ZYW218

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,200

-

- Hard Copy + Single User License

- USD

$2,400

-

Global and China Automotive Head-up Display (HUD) and Instrument Cluster Industry Report, 2014-2015 is primarily concerned with the following:

1 Global and China automobile market and industry

2 Global automotive display market and industry

3 Development trends in auto HUD

4 Auto HUD industry and market

5 Instrument cluster industry and market

6 Seven key auto HUD and instrument cluster manufacturers

Now that Head-up Display (HUD) manufacturers and instrument cluster manufacturers are completely coincident, we put and study them together. HUD is divided into two categories: one is display in Windshield (shortened to W-type), the other is Combiner (abbreviated as C type). The latter has poor display content and low practical value, thus leading to lower price and narrow profit. C type HUD market, as it were, has a bleak prospect, which did not appeal to both consumers and manufacturers.

W-type generally applies HB-LED as light source, and 1.5-3.1-inch TFT-LCD as picture source. Meanwhile, using complex optical engine, it projects pictures on the Windshield. Due to the large dynamic range of ambient brightness, extreme luminance and excellent brightness control are required for the HUD (depending on the brightness of the background of the virtual display) in order to produce an image that can be easily read. Any optical distortions through the shield are electronically corrected on the display. W-type has so much higher technical threshold that enterprises are required to master the knowhow of both electronics and optics. At present, only Japanese and German producers have the manufacturing capabilities. W-type display has high contrast ratio and brightness, rich content, and good practicability, hence embracing broad market prospects.

It is expected that in 2015 the shipments of W–type HUD approximate 1.9 million units and C–type 700,000 units. By 2019, W–type will surge to 10.3 million units while C-type will total only 1 million units. In the future, HUD will adopt DLP projection + Laser Diode. Moreover, HUD, or the Augmented Reality-type HUD, can perfectly match up with ADAS, which is required to use Quad-core processor, whose master frequency is not less than 1.5 GHz. At the same time, it needs extremely complicated software system, whose price will probably exceed USD2,000. Even so, it has high practicability and technological content so much so that it can be accepted by manufacturers and consumers. Therefore, the market size will balloon. It is projected that the market size will reach USD431 million in 2015 and USD1.42 billion in 2019, being the fastest-growing product in automotive electronics.

At present, there are only a few key HUD suppliers, including Japan’s Nippon Seiki and Denso and Germany’s Continental and Bosch. Denso’s major client is Toyota whereas Nippon’s client is BMW, which accounted for 80% of BMW HUD orders. Continental’s major clients consist of Benz, BMW, and Audi.

Up to 98% of HUD market is dominated by instrument cluster manufacturers, so HUD can be categorized in instrument cluster industry. HUD will also stimulate the development of instrument cluster industry.

1 Global and China Automobile Market

1.1 Global Automotive Market

1.2 Overview of Chinese Automotive Market

1.3 Latest Development of Chinese Automotive Market

2 Automotive Display Industry and Market

2.1 Trends in Automotive Display

2.2 Automotive Display Market

2.3 Automotive Display Industry

2.4 Infotainment LCD Panel

2.5 Automotive Instrument Market

2.6 Automotive Instrument Industry

2.7 China’s Automotive Instrument Market

3 Head-up Display (HUD) Market and Industry

3.1 Overview of HUD

3.2 Trend of HUD

3.3 Continental HUD

3.4 Augmented Reality Head-Up Display Overview

3.5 Continental Augmented Reality Head-Up Display

3.6 Head-Up Display Market Size

3.7 Head-Up Display Market Player

4 Automotive Instrument and HUD Manufacturers

4.1 Continental

4.2 Nippon Seiki

4.3 Visteon

4.3.1 Yanfeng Visteon (YFV)

4.4 Denso

4.5 Magneti Marelli

4.6 Shanghai Delco

4.7 Bosch

5 Automotive LCD Companies

5.1 Japan Display

5.2 Innolux

5.3 AUO

Global Automobile Sales Volume, 2010-2016E

Output of Global Light-duty Vehicles by Region, 2003-2015

China’s Automobile Sales Volume, 2005-2015

China’s Automobile Sales Volume (by Type) and YoY Growth, 2005-2014

Market Size of Automotive Display by Shipments, 2013-2019E

Market Size of Automotive Display by Revenue, 2013-2019E

Automotive Display Shipments by Application, 2015-2019E

Market Share of Major Global In-vehicle Display Screen Manufacturers by Shipments, 2015

Market Share of Major Global In-vehicle Display Screen Manufacturers by Revenue, 2015

Infotainment Vendors vs LCD Panel Suppliers

Market Share of Major Global Infotainment Display Screen Manufacturers, 2015

OEM-Infotainment Shipments by Size, 2015 vs 2019E

Instrument Cluster Shipments by Size, 2015 vs 2019E

Market Size of Instrument Cluster, 2013-2019E

TFT-LCD Instrument Cluster Shipments, 2015-2019E

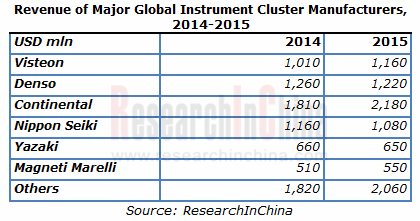

Revenue of Major Global Instrument Cluster Manufacturers, 2014-2015

Key Customers of Instrument Cluster Manufacturers

Market Share of Chinese Instrument Cluster Manufacturers, 2015

Structure of HUD

Basic HUD Geometry

Structure of Audi A6 HUD

Trends in HUD

HUD Block Diagram w/ DLP

Structure of Continental HUD

Continental’s HUD Application

Market Size of Automotive HUD, 2013-2019E

Automotive HUD Shipments, 2013-2019E

Market Share of Major Automotive HUD Companies, 2015

Global Distribution of Continental’s Automotive Interior

Revenue and Operating Margin of Continental’s Automotive Interior, 2007-2015

Revenue Breakdown of Continental’s Automotive Interior by Region, 2009-2014

Continental’s Instrument Cluster Product List

Continental’s OLED Instrument Cluster

Multi Viu Professional 12

Continental’s Instrument Cluster Market Position

Continental’s Combiner HUD

Revenue and Operating Income of Nippon Seiki, FY2008-FY2016

Revenue Breakdown of Nippon Seiki by Product, FY2010-FY2015

Revenue Breakdown of Nippon Seiki by Region, FY2012-FY2015

Global Location of Nippon Seiki

Sales Mix of Nippon Seiki by Customer, FY2015

Revenue and EBITDA of Visteon, 2013-2015

Visteon’s Quarterly Revenue and Gross Margin, 1Q/2014-2Q/2015

Visteon’s Quarterly EBITDA, 1Q/2014-2Q/2015

Revenue of Visteon’s Automotive Electronics by Product, 2013-2014

Revenue of Visteon’s Automotive Electronics by Product, 2015

Revenue of Visteon’s Automotive Electronics by Region, 2013-2015

Revenue of Visteon’s Automotive Electronics by Customer, 2013-2014

Visteon’s 3D Instrument Cluster

YFV’s Organization

Structure of YFV

Organization of Yanfeng Visteon Electronics

Distribution of YFVE Production Bases

Revenue Breakdown of Visteon Electronics in China by Customer, 2015

Revenue and Operating Margin of Denso, FY2006-FY2016

Distribution Proportion of Denso’s OEM Customers, FY2008-FY2015

Revenue of DENSO by Product, FY2012-FY2015

Revenue and Operating Income of Denso by Region, FY2014 vs FY2015

Revenue and Operating Income of Denso by Region, FY2015 vs FY2016

Denso’s ADAS

Revenue and EBIT Margin of Magneti Marelli, 2006-2015

Revenue Breakdown of Magneti Marelli by Product, 2013

Revenue and Operating Income of JDI, FY2013-FY2016

The JDI Group in Transition

Quarterly Revenue of JDI by Business, 2013Q2-2015Q2

Quarterly Operating Margin of JDI, 2013Q2-2015Q2

Revenue and Operating Margin of INNOLUX, 2010-2015

INNOLUX Area Shipments and TFT LCD ASP Trends, 3Q13-2Q15

INNOLUX’s Small & Medium Size Unit Shipments and Sales Trends, 3Q13-2Q15

INNOLUX Sales Breakdown by Size, 3Q2013-2Q2015

Revenue Breakdown of INNOLUX by Application, 3Q2013-2Q2015

Overview of INNOLUX’s TFT-LCD Fabs

Overview of Touch Sensor Fabs

Organization Structure of AUO

Revenue and Gross Margin of AUO, 2009-2015

Revenue of AUO by Region, 2012-2014

Revenue of AUO by Application, 2012-2014

Shipments of AUO by Application, 2012-2014

Major Suppliers of Key Raw Materials and Components

Revenue Breakdown of AUO Display by Application, 2Q14-2Q15

Revenue Breakdown of AUO Display by Size, 2Q14-2Q15

Shipments and ASP of AUO, 2Q14-2Q15

AUO’s Small & Medium-sized Panel Shipments by Region & Revenue, 2Q14-2Q15

AUO’s Production Line List

AUO’s LCM Base

AUO’s Automotive Panel List

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...