China Driving Recorder Industry Report, 2015-2019

-

Dec.2015

- Hard Copy

- USD

$2,400

-

- Pages:100

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

YSJ092

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,500

-

- Hard Copy + Single User License

- USD

$2,600

-

Chinese driving recorder market continues to heat up amid growing concerns over traffic accident disputes, such as Pengci, a word referring to fake accidents for extorting money. Driving recorder sales volume is estimated at around 13 million sets in China in 2015, representing a year-on-year surge of 85.71%. Notwithstanding, compared with huge car ownership, the installation rate of driving recorder in China is less than 5%, far below that in Japan, Taiwan, and Russia, indicating enormous potential for market growth.

In 2015, driving recorders are no longer confined to the function of preventing Pengci, but experience significant changes in function and shape. As to the function, besides driving recording, more and more products integrate Wi-Fi, rearview reverse parking camera, voice recognition, and navigation. Regarding the shape, smart rearview mirror leads the trend. Most companies have already developed or are developing such products, and add operating system, 3G module, ADAS, navigation, voice action, and gesture recognition, with the products developing towards intelligent driver assistant system. The integration of navigation has some impact on on-board navigation market.

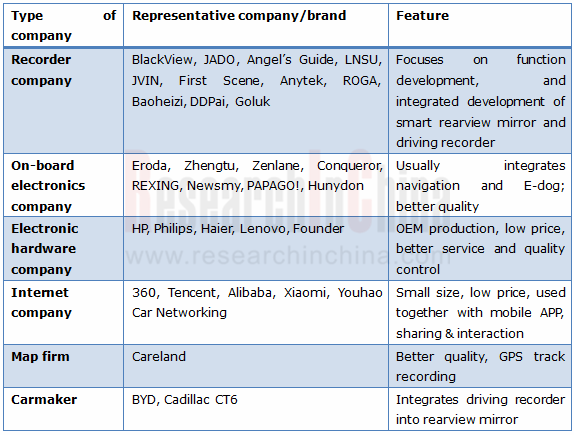

Companies are rushing into driving recorder field and use it as a medium to make layout in telematics. In addition to makers of on-board terminals including driving recorder and navigator, Internet firms, map companies, and automakers also want to get a piece of the pie. Internet and map companies aim to capture user resources, and carmakers wish to make their way into the driving recorder OEM market.

Internet companies that make aggressive actions include Qihoo 360 Technology, Tencent, Alibaba, and Xiaomi.

In May 2015, Qihoo 360 Technology launched 360 driving recorder, which has built-in Ambarella A7 image processor and 2-inch 1296P 160° wide-angle TFT display, and is sold at RMB299. 200,000 sets of the product were sold on Nov 11, 2015.

In Oct 2015, Tencent and DDPai jointly launched “QQ IoT driving recorder”. After DDPai and “QQ IoT” are connected, DDPai driving recorder can be added to “My Device” on QQ, and access and operations to the driving recorder can be gained.

In Oct 2015, JADO launched smart rearview mirror “Vision” carrying Alibaba’s YunOS operating system.

On Nov 24, 2015, Xiaoyi Technology under Xiaomi launched a driving recorder. The product has a 2.7-inch 165° wide-angle 16:9HD LED display, uses Ambarella A7LA70 chip (supposedly), supports a max. resolution of 1296P (2304×1296), and can record 60fps 1080P videos. In addition, it also carries ADAS, analyzing the data on lane, vehicle speed, and vehicle distance, and giving the alarm. The crowd-funding price is RMB289.

Representative Driving Recorder Companies in China

Source: China Driving Recorder Industry Report, 2015-2019 by ResearchInChina

China Driving Recorder Industry Report, 2015-2019 by ResearchInChina highlights the followings:

Development of global driving recorder;

Development of global driving recorder;

Driving recorder shipments, market size, development characteristics, competitive landscape, and development trends in China;

Driving recorder shipments, market size, development characteristics, competitive landscape, and development trends in China;

Development of driving recorder market segments in China;

Development of driving recorder market segments in China;

Chinese driving recorder chip market pattern;

Chinese driving recorder chip market pattern;

Development of driving recorder chip suppliers in China, including profile, operation, main driving recorder solutions and features of products;

Development of driving recorder chip suppliers in China, including profile, operation, main driving recorder solutions and features of products;

Development of driving recorder producers in China, covering profile, operation, features of products, and development strategy.

Development of driving recorder producers in China, covering profile, operation, features of products, and development strategy.

1 Definition and Classification of Driving Recorder

1.1 Definition

1.2 Development

1.3 Classification

1.4 Structure

2 Development of Driving Recorder

2.1 Global Driving Recorder Market Size

2.1.1 Global

2.1.2 Japan

2.1.3 Taiwan

2.1.4 Russia

2.2 Chinese Driving Recorder Market Size

2.2.1 Sales Volume

2.2.2 Market Size

2.2.3 Competitive Landscape

2.2.4 Sales Channel

2.2.5 Development Characteristics

2.2.6 Internet Firms’ Layout

2.2.7 M&As

2.3 Development of Industry Chain

2.3.1 Overview

2.3.2 Master Chip

3 Development of Market Segments

3.1 Display CDR

3.2 Non-display WIFI Recorder

3.3 Smart Rearview Mirror

3.3.1 Definition

3.3.2 Application

3.3.3 Major Companies

3.3.4 Functions of Product

3.3.5 Development Trends

4 Major Chip Companies

4.1 Ambarella

4.1.1 Profile

4.1.2 Operation

4.1.3 Driving Recorder Business

4.2 Novatek

4.2.1 Profile

4.2.2 Operation

4.2.3 Main Products

4.2.4 Driving Recorder Business

4.3 Allwinner Technology

4.3.1 Profile

4.3.2 Operation

4.3.3 Main Products

4.4 Sunplus Technology

4.4.1 Profile

4.4.2 Operation

4.4.3 Driving Recorder Business

4.5 Syntek

4.5.1 Profile

4.5.2 Operation

4.5.3 Driving Recorder Business

4.6 SQ Technology

4.6.1 Profile

4.6.2 Operation

4.6.3 Driving Recorder Business

5 Major Players

5.1 PAPAGO,Inc.

5.1.1 Profile

5.1.2 Operation

5.1.3 Driving Recorder

5.1.4 Supply Chain

5.1.5 Strategic Planning

5.2 Youhao Car Networking

5.2.1 Profile

5.2.2 Operation

5.2.3 Main Products

5.2.4 Suppliers

5.2.5 Strategic Planning

5.3 Shenzhen Soling Industrial

5.3.1 Profile

5.3.2 Operation

5.3.3 Primary Business

5.3.4 Strategic Planning

5.4 CARCAM Electronic.Black View

5.4.1 Profile

5.4.2 Primary Business

5.4.3 Strategic Planning

5.5 JADO.JADO

5.5.1 Profile

5.5.2 Primary Business

5.5.3 Strategic Planning

5.6 Qihoo 360

5.6.1 Profile

5.6.2 Primary Business

5.6.3 Strategic Planning

5.7 vYou.DDPai

5.7.1 Profile

5.7.2 Primary Business

5.7.3 Strategic Planning

5.8 Jeavox.Angel’s Guide

5.8.1 Profile

5.8.2 Primary Business

5.8.3 Strategic Planning

5.9 LNSU Electronic & Technology.LNSU

5.9.1 Profile

5.9.2 Primary Business

5.9.3 Strategic Planning

5.10 Shenzhen JFK Electronic.JVIN

5.10.1 Profile

5.10.2 Primary Business

5.10.3 Strategic Planning

5.11 Aladdin.First Scene

5.11.1 Profile

5.11.2 Primary Business

5.12 Jiafeng Zhuoyue.REXING

5.12.1 Profile

5.12.2 Primary Business

5.13 Anytek

5.13.1 Profile

5.13.2 Primary Business

5.13.3 Strategic Planning

5.14 Hunydon

5.14.1 Profile

5.14.2 Primary Business

5.15 Zenlane

5.15.1 Profile

5.15.2 Primary Business

5.15.3 Strategic Planning

5.16 Wei Jia Yi Technology.ROGA

5.16.1 Profile

5.16.2 Primary Business

5.17 Baoheizi

5.17.1 Profile

5.17.2 Primary Business

5.18 Careland

5.18.1 Profile

5.18.2 Primary Business

5.18.3 Strategic Planning

5.19 Coagent

5.19.1 Profile

5.19.2 Operation

5.19.3 Primary Business

5.19.4 Strategic Planning

6 Summary and Forecast

6.1 Market Size

6.2 Market Structure

6.3 Development Trend

Representative Driving Recorders and Prices

Global Driving Recorder Market Size, 2014-2019E

Driving Recorder Sales Volume in China, 2013-2019E

Baidu Search Index of Driving Recorder, 2012-2015

Chinese Driving Recorder Market Size, 2013-2019E

Ranking of Driving Recorders by Sales Volume on Tmall on Nov 11, 2015

Top10 Driving Recorder Brands on JD, 2015

Market Share of Driving Recorders in China, 2015Q1

Major Driving Recorder Companies in China

Sales Channels for Driving Recorders in China

Representative Driving Recorder Companies in China

M&As in Driving Recorder (Including Smart Rearview Mirror) Field

Chinese Driving Recorder Master Chip Market Size, 2014-2019E

Global Driving Recorder Master Chip Market Size, 2014-2019E

Driving Recorder Industry Structure in China

Main Products of Chip Makers and Corresponding Video Pixel

Representative Chips and Identification Codes of Driving Recorder Main Control Solutions

Advantages of Mainstream Driving Recorder Companies

Parameters of Main Display Driving Recorders in China

Parameters of Main Non-display Driving Recorders in China

Smart Rearview Mirrors of Major Companies in China

Telematics Functions of Main Smart Rearview Mirrors in China

Revenue and Net Income of Ambarella, FY2011-FY2015

Revenue and Profit of Novatek, 2012-2015

Novatek’s Sales in Major Regions, 2013-2014

Main Products of Novatek

Applications of Novatek’s Main Products

Output and Output Value of Novatek’s Main Products, 2013-2014

Sales Volume and Value of Novatek’s Main Products, 2013-2014

Revenue and Profit of Allwinner Technology, 2012-2015

Gross Margin of Allwinner Technology, 2012-2015

Allwinner Technology’s Main Products and Their Applications

Operating Revenue Structure of Allwinner Technology by Product, 2012-2014

Smart Terminal Process Chip Business Revenue Structure of Allwinner Technology by Application, 2012-2014

Revenue and Profit of Sunplus Technology, 2013-2015

Operational Outlets of Sunplus Technology in Mainland China

Revenue and Profit of Syntek, 2012-2015

Revenue and Profit of SQ Technology, 2012-2015

Revenue and Profit of PAPAGO, 2013-2015

PAPAGO’s Sales in Major Regions, 2013-2014

Main Suppliers of PAPAGO

Top3 Suppliers of PAPAGO, 2013-2015

Top3 Trade Debtors of PAPAGO, 2013-2015

Revenue and Profit of Youhao Car Networking

Main Products of Youhao Car Networking

Revenue from Main Products of Youhao Car Networking, 2013-2015

Major Suppliers of Youhao Car Networking

Top5 Suppliers of Youhao Car Networking, 2013-2015

Revenue and Profit of Shenzhen Soling Industrial, 2012-2015

Gross Margin of Shenzhen Soling Industrial’s Smart CID System, 2013-2014

Major Partners of BlackView

Main Products of Jeavox

Revenue and Profit of Coagent, 2013-2015

Operating Revenue Structure of Coagent by Segment, 2013-2015

Operating Revenue Structure of Coagent by Product, 2013-2015

Global and Chinese Driving Recorder Market Size and Growth Rate, 2013-2019E

Chinese Driving Recorder Market Structure, 2015&2019E

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...