Global and China Automotive Rearview Mirror Industry Report, 2015-2020

-

Jan.2016

- Hard Copy

- USD

$2,500

-

- Pages:135

- Single User License

(PDF Unprintable)

- USD

$2,300

-

- Code:

YSJ093

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,700

-

- Hard Copy + Single User License

- USD

$2,700

-

The market of rear-view mirror, a traditional functional part of the vehicle, continues to expand amid the growing automobile market. From the perspective of OEM market alone, global automotive rear-view mirror (exterior + interior) demand totaled 270 million pieces in 2015 and is expected to exceed 300 million pieces in 2020. China, as the world’s largest automotive market, accounts for 28% of global automotive rear-view mirror demand, with its OEM demand predicted to surpass 90 million pieces in 2020.

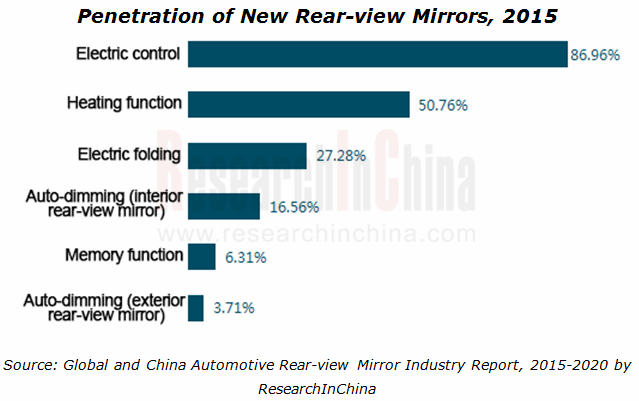

As there are some visual blind spots and inconvenient operation with traditional rear-view mirror, the demand for new rear-view mirrors, chiefly including the ones with electric control function, auto-dimming function, electric folding function, memory function, and heating function, keeps growing. The automotive rear-view mirror with electric control function has had a penetration of 86.96% and is basically installed in RMB100,000-above car models, while t]he automotive rear-view mirrors with functions of electric folding, auto-dimming, and memory are primarily assembled in mid-range and upscale models with the market remaining to be further developed.

In addition, electronic rear-view mirror and smart rear-view mirror are still in the stage of active R&D and marketing.

Electronic rear-view mirror replaces traditional rear-view mirror in the form of camera + display. Companies like Gentex, Magna, Ficosa, and Valeo are actively developing and about to mass-produce such product. The advantage of Gentex lies in CMOS camera technology with hardware having been upgraded to 4th-generation, thus generating higher pixel. Gentex carries out cooperation with mainstream carmakers including Nissan, Audi, Volkswagen, and Cadillac. The electronic rear-view mirror developed in 2014 for Nissan was showcased at the Geneva Motor Show; a similar rear-view mirror system developed in 2015 for Nissan’s racing cars was called Full Display Mirror; the electronic rear-view mirror developed in 2016 for Cadillac will be mass-produced along with volume production of vehicles.

Smart rear-view mirror extends from driving recorder and develops rapidly under the concept of Telematics. The current smart rear-view mirrors not only integrate driving recorder, GPS, electronic speed detection alerting, rear view camera, real-time online entertainment, but also are added with operating systems, 3G modules, ADAS, navigation, voice operation, and gesture recognition. Despite more than 200 smart rear-view mirror companies, the Chinese market, filled with products of varying quality, needs to be regulated. Leading players include JADO (Vision), Coagent (CASKA Cloudroute 2S), Jeavox (Angel’s Guide), and CARCAM Electronic (Black View).

Global and China Automotive Rear-view Mirror Industry Report, 2015-2020 by ResearchInChina highlights the followings:

Global, European, American, and Asian automotive rear-view mirror market size, and supporting relationship between major automotive rear-view mirror companies and carmakers;

Global, European, American, and Asian automotive rear-view mirror market size, and supporting relationship between major automotive rear-view mirror companies and carmakers;

Chinese automotive rear-view mirror market size, import & export, competitive pattern, supporting relationship;

Chinese automotive rear-view mirror market size, import & export, competitive pattern, supporting relationship;

Penetration of and demand for the automotive rear-view mirror with mainstream functions in China, including electric control, auto-dimming, electric folding, memory, and heating;

Penetration of and demand for the automotive rear-view mirror with mainstream functions in China, including electric control, auto-dimming, electric folding, memory, and heating;

Development status of electronic rear-view mirror, smart rear-view mirror, major companies, and development trends in the world and China;

Development status of electronic rear-view mirror, smart rear-view mirror, major companies, and development trends in the world and China;

Operation, types of products, production bases, production capacity, and R&D of new products of global and Chinese automotive rear-view mirror companies.

Operation, types of products, production bases, production capacity, and R&D of new products of global and Chinese automotive rear-view mirror companies.

1 Overview of Automotive Rear-view Mirror Industry

1.1 Definition and Classification

1.1.1 Definition

1.1.2 Classification

1.2 Industrial Policy

2 Global Automotive Rear-view Mirror Market

2.1 Market Size

2.2 Supporting

2.2.1 European Market

2.2.2 American Market

2.2.3 Asian Market

3 Chinese Automotive Rear-view Mirror Market

3.1 Market Size

3.2 Import

3.3 Export

3.4 Competitive Pattern

4 Market Segments

4.1 Electric Rear-view Mirror

4.2 Auto-dimming Rear-view Mirror

4.3 Heatable Rear-view Mirror

4.4 Electric Foldable Rear-view Mirror

4.5 Memory Rear-view Mirror

5 Electronic and Smart Rear-view Mirror Markets

5.1 Electronic Rear-view Mirror

5.1.1 Brief Introduction

5.1.2 Application

5.1.3 Enterprises’ R&D

5.1.4 Market Space

5.2 Smart Rear-view Mirror

5.2.1 Brief Introduction

5.2.2 Status Quo of Application

5.2.3 Major Companies

5.2.4 Functions

5.2.5 Development Trends

6 Major Global Players

6.1 MAGNA

6.1.1 Profile

6.1.2 Operation

6.1.3 Rear-view Mirror Business

6.1.4 Electronic Rear-view Mirror

6.1.5 Business in China

6.2 Murakami Kaimeido

6.2.1 Profile

6.2.2 Operation

6.2.3 R&D

6.2.4 Production Bases

6.2.5 Major Customers

6.2.6 Business in China

6.3 Samvardhana Motherson

6.3.1 Profile

6.3.2 Main Products

6.3.3 Operation

6.3.4 Customers

6.3.5 Business in China

6.4 Gentex

6.4.1 Profile

6.4.2 Operation

6.4.3 Customers

6.4.4 Electronic Rear-view Mirror

6.4.5 Business in China

6.5 Ichikoh

6.5.1 Profile

6.5.2 Main Products

6.5.3 Operation

6.5.4 Major Customers

6.5.5 R&D

6.5.6 Production Bases

6.5.7 Business in China

6.6 Ficosa

6.6.1 Profile

6.6.2 Primary Business

6.6.3 Operation

6.6.4 Major Customers

6.6.5 Electronic Rear-view Mirror

6.6.6 Business in China

6.7 Tokai Rika

6.7.1 Profile

6.7.2 Primary Business

6.7.3 Operation

6.7.4 Major Customers

6.7.5 R&D

6.7.6 Production Bases

6.8 MEKRA Lang

6.8.1 Profile

6.8.2 Business in China

6.8.3 Capacity and Major Customers

7 Major Chinese Companies

7.1 Changchun FAWAY Automobile Components Co., Ltd.

7.1.1 Profile

7.1.2 Operation

7.1.3 Rear-view Mirror Business

7.1.4 Major Customers

7.2 Ningbo Joyson Electronic Corp.

7.2.1 Profile

7.2.2 Operation

7.2.3 Rear-view Mirror Business

7.2.4 Telematics Business

7.3 Ningbo Huaxiang Electronic Co., Ltd.

7.3.1 Profile

7.3.2 Business Performance

7.3.3 Rear-view Mirror Business

7.4 Shanghai Ganxiang Automobile Mirror (Group) Co., Ltd

7.4.1 Profile

7.4.2 Output

7.4.3 Subsidiaries

7.4.4 Major Customers

7.5 Beijing GoldRare Automobile Parts Co., Ltd.

7.5.1 Profile

7.5.2 Capacity, Output, and Sales Volume

7.6 Shanghai Lvxiang Automobile Parts Co., Ltd.

7.7 Jiangmen Shongli Rearview Mirror Industrial Co., Ltd.

7.8 Shanghai Yingtian Automobile Parts & Accessories Co., Ltd.

7.9 Jiangsu Tianhe Auto Parts Co., Ltd.

7.10 Wenzhou Meixinghua Car & Mirror Co. Ltd.

7.11 Shanghai Bolson Auto Parts Co., Ltd.

7.12 FLABEG Automotive Mirror (Shanghai) Co., Ltd.

7.13 Jilin FAW Industry Dongguang Automobile Mirrors Co., Ltd.

7.14 Changzhou Yuyi Mirrors Co., Ltd.

7.15 Hebei Guangying Auto Parts Manufacturing Co., Ltd.

7.16 Jiangsu Feituo Auto Mirrors System Co., Ltd.

7.17 Sichuan Sky-view Automobile Mirror Co., Ltd.

7.18 Shanghai Huidie Automobile Mirror Co., Ltd.

8 Summary and Forecast

8.1 Market Space

8.2 Auto Models Supported by Products

8.3 Development Trends of Products

8.3.1 Electrification

8.3.2 Diversified Functions

8.3.3 Addition of Safety Functions like Anti-dazzling

8.3.4 Smart Rear-view Mirror

8.3.5 Substitution of Camera and Lidar for Rear-view Mirror

View of Automotive Rear-view Mirror in Different Locations

Polices on Automotive Rear-view Mirror Industry

Global Automotive Rear-view Mirror OEM Demand, 2010-2020E

Global Automotive Rear-view Mirror Demand Structure, 2015-2020E

Automotive Rear-view Mirror OEM Demand in Europe, 2010-2020E

Major European Exterior Rear-view Mirror Suppliers and Auto Models Supported

Major European Interior Rear-view Mirror Suppliers and Auto Models Supported

Automotive Rear-view Mirror OEM Demand in Americas, 2010-2020E

Major American Exterior Rear-view Mirror Suppliers and Auto Models Supported

Major American Interior Rear-view Mirror Suppliers and Auto Models Supported

Automotive Rear-view Mirror OEM Demand in Asia Pacific, 2010-2020E

Market Share of Major Japanese Exterior Rear-view Mirror Companies, 2015

Major Japanese Exterior Rear-view Mirror Suppliers and Auto Models Supported

Major Chinese Exterior Rear-view Mirror Suppliers and Auto Models Supported

Major Exterior Rear-view Mirror Suppliers in Other Asian countries and Auto Models Supported

Major Japanese Interior Rear-view Mirror Suppliers and Auto Models Supported

Major Chinese Interior Rear-view Mirror Suppliers and Auto Models Supported

Major Interior Rear-view Mirror Suppliers in Other Asian Countries and Auto Models Supported

Automotive Rear-view Mirror OEM Demand in China, 2010-2020E

China’s Automotive Rear-view Mirror Imports (Volume & Value), 2011-2015

Top10 Sources of Imported Automotive Rear-view Mirror in China by Import Value, Jan-Oct 2015

China’s Automotive Rear-view Mirror Exports (Volume & Value), 2011-2015

Top10 Destinations of Exported Automotive Rear-view Mirror from China by Export Value, Jan-Oct 2015

Market Share of Major Chinese Automotive Rear-view Mirror Companies, 2015

OEM Demand for Exterior Electric Rear-view Mirror for Passenger Vehicle in China, 2012-2020E

Penetration of Exterior Electric Rear-view Mirror for Passenger Vehicle in China, 2011-2020E

Installation Rate of Exterior Electric Rear-view Mirror for Passenger Vehicle in China by Price, 2015

Penetration of and OEM Demand for Exterior Auto-dimming Rear-view Mirror for Passenger Vehicle in China, 2012-2020E

Installation Rate of Exterior Auto-dimming Rear-view Mirror for Passenger Vehicle in China by Price, 2015

Penetration of and OEM Demand for Interior Auto-dimming Rear-view Mirror for Passenger Vehicle in China, 2012-2020E

Installation Rate of Interior Auto-dimming Rear-view Mirror for Passenger Vehicle in China by Price, 2015

Penetration of and OEM Demand for Heatable Rear-view Mirror for Passenger Vehicle in China, 2012-2020E

Installation Rate of Exterior Heatable Rear-view Mirror for Passenger Vehicle in China by Price, 2015

Penetration of and OEM Demand for Electric Foldable Rear-view Mirror for Passenger Vehicle in China, 2012-2020E

Installation Rate of Exterior Electric Foldable Rear-view Mirror for Passenger Vehicle in China by Price, 2015

Penetration of and OEM Demand for Memory Rear-view Mirror for Passenger Vehicle in China, 2012-2020E

Installation Rate of Exterior Memory Rear-view Mirror for Passenger Vehicle in China by Price, 2015

Feasible Electronic Rear-view Mirror Solutions

Electronic Rear-view Mirror R&D of Major Global Companies

Market Potential for In-vehicle Camera

Global ADAS Market Size, 2011-2019E

Chinese ADAS Market Size, 2011-2019E

Smart Rear-view Mirrors of Major Chinese Companies

Telematics Functions of Main Smart Rear-view Mirrors in China

Revenue and Net Income of Magna, 2010-2015

Revenue Breakdown of Magna by Product, 2010-2014

Revenue Breakdown of Magna by Region, 2010-2015

Main Products of Magna Mirrors

Major Customers for Magna’s Rear-view Mirrors

Magna’s Automotive Rear-view Mirror Production Bases in China

Main Products and Customers of Magna Donnelly (Shanghai) Automotive Systems

Main Automotive Rear-view Mirrors of Murakami Kaimeido

Business Performance of Murakami Kaimeido, FY2010-FY2015

Revenue Breakdown of Murakami Kaimeido by Region, FY2010-FY2015

R&D Costs of Murakami Kaimeido, FY2013-FY2015

Technical Cooperation Agreements of Murakami Kaimeido

Main Automotive Rear-view Mirror Production Bases of Murakami Kaimeido

Major Subsidiaries of Murakami Kaimeido

Percentage of Murakami Kaimeido’s Sales from Toyota Motor, FY2013-FY2015

Customers of and Auto Models Supported by Murakami Kaimeido

Production Capacity of Murakami Kaimeido (Jiaxing)

Main Products and Customers of Murakami Kaimeido (Jiaxing)

Main Products of Motherson Sumi Systems

Global Operation of Automotive Rear-view Mirror Business of Motherson Sumi Systems

Business Performance of Motherson Sumi Systems, FY2011-FY2015 (Unit: INR mln)

Revenue Breakdown of Motherson Sumi Systems by Division, FY2011-FY2015 (Unit: INR mln)

Revenue Breakdown of Motherson Sumi Systems by Region, FY2011-FY2015 (Unit: INR mln)

Customers for and Auto Models Supported by Rear-view Mirrors of Motherson Sumi Systems

Companies Founded by Samvardhana Motherson in China

Global Operations of Gentex

Types of Main Rear-view Mirrors of Gentex

Business Performance of Gentex, 2011-2015

Revenue Breakdown of Gentex by Division, 2011-2015H1

Revenue Breakdown of Gentex by Region, 2011-2014

Rear-view Mirror Shipments of Gentex, 2011-2014

Revenue Structure of Gentex by Customer, 2012-2014

Auto Models Supported by Main Rear-view Mirrors of Gentex

Main Products and Customers of Gentex (Shanghai) Electronics Technology

Equity Structure of Ichikoh

Main Products of Ichikoh

Business Performance of Ichikoh, FY2011-FY2015

Revenue Breakdown of Ichikoh by Division, FY2011-FY2015

Revenue Breakdown of Ichikoh by Region, FY2011-FY2015

Percentage of Ichikoh’s Revenue from Major Customers, FY2013-FY2015

Companies for and Auto Models Supported by Ichikoh’s Vehicle Mirrors

R&D Costs of Ichikoh, FY2013-FY2015

Key R&D Projects of Ichikoh, 2015

Local Production Bases of Ichikoh in Japan

Major Subsidiaries of Ichikoh

Main Products of Ficosa

Revenue and Growth Rate of Ficosa, 2008-2014

Auto Models Supported by Main Rear-view Mirrors of Ficosa

Ficosa’s Factories in China

Equity Structure of Tokai Rika

Main Products of Tokai Rika

Revenue, Net Income, and Employees of Tokai Rika, FY2011-FY2015

Revenue Breakdown of Tokai Rika by Product, FY2013-FY2015

Revenue Breakdown of Tokai Rika by Region, FY2013-FY2015

Percentage of Tokai Rika’s Revenue from Major Customers, FY2013-FY2015

Customers for and Auto Models Supported by Tokai Rika’s Rear-view Mirrors

R&D Costs of Tokai Rika, FY2013-FY2015

Key R&D Projects of Tokai Rika, 2015

Local Production Bases of Tokai Rika in Japan

Major Subsidiaries of Tokai Rika

Applications of MEKRA Lang’s Vehicle Mirrors

Equity Structure and Main Products of MEKRA Lang’s Subsidiaries in China

Production Capacity and Main Customers of MEKRA Lang’s Subsidiaries in China

Customers and Products of Shanghai Mekra Lang Vehicle Mirror

Major Customers of and Auto Models Supported by Changchun MEKRA Lang FAWAY Vehicle Mirror

Equity Structure of Changchun FAWAY Automobile Components

Main Products of Changchun FAWAY Automobile Components

Revenue and Net Income of Changchun FAWAY Automobile Components, 2010-2015

Revenue Breakdown of Changchun FAWAY Automobile Components by Region, 2010-2015

Major Subsidiaries of Changchun FAWAY Automobile Components

Operational Indicator of Changchun MEKRA Lang FAWAY Vehicle Mirror, 2009-2015

Customers for and Auto Models Supported by Changchun FAWAY Automobile Components’ Products

Main Products of Ningbo Joyson Electronic

Revenue and Net Income of Ningbo Joyson Electronic, 2010-2015

Revenue Breakdown of Ningbo Joyson Electronic by Product, 2011-2015

Revenue Breakdown of Ningbo Joyson Electronic by Region, 2010-2015

Rear-view Mirror Subsidiaries of Ningbo Joyson Electronic

Auto Models Supported by Electronic Rear-view Mirrors of Ningbo Joyson Electronic

Revenue and Net Income of Ningbo Huaxiang Electronic, 2011-2015

Operating Revenue and Gross Margin of Ningbo Huaxiang Electronic by Product, 2014-2015

Operating Revenue and Gross Margin of Ningbo Huaxiang Electronic by Region, 2014-2015

Customers of Rear-view Mirror Business of Ningbo Huaxiang Electronic

Automotive Rear-view Mirror Output of Shanghai Ganxiang Automobile Mirror, 2009-2014 (mln pcs)

Major Subsidiaries of Shanghai Ganxiang Automobile Mirror

Major Joint Ventures of Shanghai Ganxiang Automobile Mirror

Major Customers for Automotive Rear-view Mirrors of Shanghai Ganxiang Automobile Mirror

Capacity of Beijing GoldRare Automobile Parts

Automotive Rear-view Mirror Output and Sales Volume of Beijing GoldRare Automobile Parts, 2011-2013

Rear-view Mirror Output and Sales Volume of Shanghai Lvxiang Automobile Parts, 2009-2013 (mln pcs)

Main Products and Customers of Shanghai Lvxiang Automobile Parts

Automotive Rear-view Mirror Output and Sales Volume of Jiangmen Shongli Rearview Mirror Industrial, 2009-2018E

Auto Models Supported by Rear-view Mirrors of Jiangsu Tianhe Auto Parts

Major Customers of and Auto Models Supported by Shanghai Bolson Auto Parts

Main Products and Customers of FLABEG Automotive Mirror (Shanghai)

Main Products and Customers of Jilin FAW Industry Dongguang Automobile Mirrors

Main Products and Customers of Changzhou Yuyi Mirrors

Main Products and Customers of Hebei Guangying Auto Parts Manufacturing

Main Products and Customers of Jiangsu Feituo Auto Mirrors System

Main Products and Customers of Sichuan Sky-view Automobile Mirror

Main Products and Customers of Shanghai Huidie Automobile Mirror

Global and China’s Demand for Automotive Rear-view Mirror and Growth Rate, 2010-2020E

Supply Relationship between Major Global Rear-view Mirror Companies and Carmakers

Supply Relationship between Major Chinese Rear-view Mirror Companies and Carmakers

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...