Global and China Electric Vehicle (BEV, PHEV) Industry Report, 2016-2020

-

Apr.2016

- Hard Copy

- USD

$2,600

-

- Pages:152

- Single User License

(PDF Unprintable)

- USD

$2,400

-

- Code:

YSJ094

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,900

-

- Hard Copy + Single User License

- USD

$2,800

-

In 2015, global and Chinese electric vehicle markets were still in the accelerated growth phase; wherein, the global electric vehicle (EV & PHEV) sales volume reached 549,000, increasing by 72.83% year on year; China sold 331,100 electric vehicles, with a year-on-year surge of 343%. From January to February of 2016, the sales volume in China totaled 35,700, going up 1.7 times year on year and marking the sustainable growth.

Affected by multiple factors such as environmental requirements, new technologies and business promotion, the future global and Chinese electric vehicle markets will maintain a rapid development pace. Global and China’s sales volume is expected to exceed the 2 million mark in 2019 and 2020 respectively, and China will become the world's leading electric vehicle (EV & PHEV) market.

From the point of view of market segments:

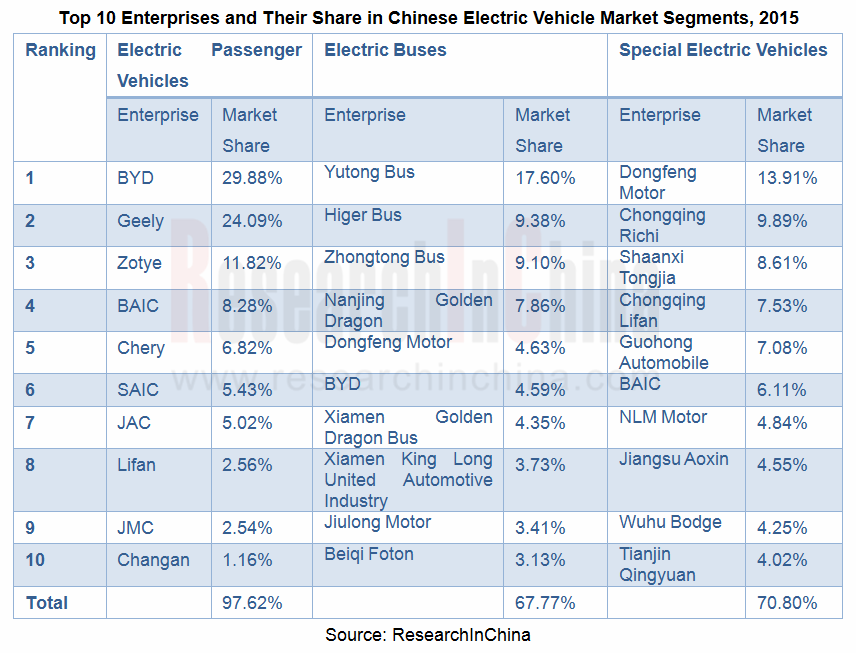

Passenger Vehicle Market: The demand for plug-in hybrid vehicles which are more in line with the current consumer habits is growing radically, with a rising market share. In 2015, the sales volume amounted to 63,700, with 30.8% market share; in the first two months of 2016, it climbed to 9,727 with 41.2% market share. Chinese plug-in hybrid passenger vehicle manufacturers mainly refer to BYD, SAIC Roewe, GAC Trumpchi, BMW Brilliance, Volvo and the like. With two models --- Qin and Tang, BYD garners the overwhelming share in this market, namely 79% in 2015 and 80% in the first two months of 2016. In future, joint ventures will perform more actively; FAW-Volkswagen (Golf plug-in, Bora plug-in, Magotan plug-in), Shanghai GM (LaCrosse plug-in), Honda (Accord plug-in), Dongfeng Peugeot, Dongfeng Yulong, DongfengYueda Kia (K5 plug-in) plan to launch plug-in hybrid models in 2020.

Bus Market: The output escalated 313% year on year to 112,400 in 2015 and rose 39.48% year on year to 4,430 in the first two months of 2016. The main reason for the slowing growth rate lied in adjusted subsidies. Currently, the market is primarily promoted by the government and subsidies, and the market size will reach about 200,000 buses in 2020. In 2015, main players in this market embraced Yutong Bus, Xiamen King Long Motor Group (including three wholly-owned subsidiaries: Higer Bus, Xiamen King Long United Automotive Industry, Xiamen Golden Dragon Bus), Zhongtong Bus, etc.. In 2016, the changes in subsidies will encourage bus companies to prioritize high-performance products with more than 8 meters.

Special Purpose Vehicle Market: The output soared 10.7 times year on year to 47,800 in 2015; in the first two months of 2016, the output jumped by 115.55% year on year to 804. The future growth of segments will be mainly dependent on the rapid development of the logistics industry and the swelling demand for urban logistics vehicles. In 2015, Dongfeng Motor ranked first in the market, with 13.91% market share. BAIC, SAIC, BYD, Yutong and other powerful companies have also targeted this market, which will intensify the market competition.

The report highlights the followings:

Major policies about electric vehicle industry in China;

Major policies about electric vehicle industry in China;

Sales volume of electric vehicles, competitive pattern and development trend worldwide;

Sales volume of electric vehicles, competitive pattern and development trend worldwide;

Sales volume of electric vehicles, competitive pattern and development trend in China;

Sales volume of electric vehicles, competitive pattern and development trend in China;

Production and sale and competitive landscape of electric vehicle market segments in China, involving electric passenger vehicle (BEV, PHEV), electric bus (BEV, PHEV), and electric logistics vehicle;

Production and sale and competitive landscape of electric vehicle market segments in China, involving electric passenger vehicle (BEV, PHEV), electric bus (BEV, PHEV), and electric logistics vehicle;

Electric vehicle industry chain in China, covering charging pile, battery, motor, inverter, and IGBT;

Electric vehicle industry chain in China, covering charging pile, battery, motor, inverter, and IGBT;

Status quo, production bases, capacity, planning for vehicle models, development strategies, etc. of key Chinese electric vehicle manufacturers.

Status quo, production bases, capacity, planning for vehicle models, development strategies, etc. of key Chinese electric vehicle manufacturers.

1 Overview of Electric Vehicle Industry

1.1 Introduction and Classification of Electric Vehicle

1.1.1 Introduction

1.1.2 Classification

1.1.3 Technology Roadmap

1.2 Electric Vehicle Industry Chain

2 Policies on Electric Vehicle

2.1 Policy of Fiscal Subsidies

2.1.1 Subsidies for Electric Passenger Vehicle

2.1.2 Subsidies for Electric Bus

2.1.3 Subsidies for Fuel Cell Bus

2.2 Catalogue for the Recommended Models of New Energy Vehicle Popularization and Application (New Edition)

2.3 Policy about Battery Recovery Technologies

2.4 Policy of Tax Preferences

2.5 Policy of Production Permit

3 Electric Vehicle Market

3.1 Global Market

3.1.1 Overview

3.1.2 European Market

3.1.3 American Market

3.2 Chinese Market

3.2.1 Output

3.2.2 Sales Volume

3.2.3 Competitive Landscape

3.2.4 Market Structure

3.2.5 Import Market

4 Chinese Electric Passenger Vehicle Market

4.1 Output

4.2 Sales Volume

4.3 Competitive Landscape

4.4 Enterprise Layout

5 Chinese Electric Commercial Vehicle Market

5.1 Overview

5.2 Electric Bus

5.3 Electric Truck

6 Chinese Electric Vehicle Manufacturers

6.1 SAIC Motor

6.1.1 Profile

6.1.2 Operation

6.1.3 Output and Sale Volume of Electric Vehicle

6.1.4 Development Strategy

6.1.5 Planning for Vehicle Models

6.1.6 Layout of Industrial Chain

6.2 FAW Group

6.2.1 Profile

6.2.2 Operation

6.2.3 Electric Vehicles

6.2.4 Electric Vehicle Development Strategy

6.3 Dongfeng Motor Corporation

6.3.1 Profile

6.3.2 Operation

6.3.3 Output and Sale Volume of Electric Vehicle

6.3.4 Electric Vehicle Development Strategy

6.4 BYD

6.4.1 Profile

6.4.2 Operation

6.4.3 Output and Sale Volume of Electric Vehicle

6.4.4 Planning for Vehicle Models

6.4.5 Strategic Layout

6.4.6 Overseas Markets

6.4.7 DENZA

6.5 Changan Automobile

6.5.1 Profile

6.5.2 Operation

6.5.3 Electric Vehicles

6.5.4 Planning for Vehicle Models

6.5.5 Production Bases

6.5.6 Electric Vehicle Development Strategy

6.6 Chery Automobile

6.6.1 Profile

6.6.2 Operation

6.6.3 Output and Sales Volume of Electric Vehicle

6.6.4 Key Projects

6.6.5 Planning for Vehicle Models

6.6.6 Yiqitaixing

6.6.7 Electric Vehicle Development Strategy

6.7 GEELY

6.7.1 Profile

6.7.2 Operation

6.7.3 Output of Electric Vehicle

6.7.4 Joint Ventures

6.7.5 Electric Vehicle Development Strategy

6.8 BAIC Group

6.8.1 Profile

6.8.2 Operation

6.8.3 Output and Sales Volume of Electric Vehicle

6.8.4 Production Bases

6.8.5 Joint Ventures

6.8.6 Planning for Vehicle Models

6.8.7 Development Strategy

6.8.8 Partnership with Shandong Baoya New Energy Vehicle Co., Ltd.

6.9 GAC Group

6.9.1 Profile

6.9.2 Operation

6.9.3 Electric Vehicles

6.9.4 Sales Objective

6.9.5 Technology Roadmap

6.9.6 Electric Vehicle Development Strategy

6.9.7 Cooperation with UBER

6.10 Brilliance Auto

6.10.1 Profile

6.10.2 Operation

6.10.3 Output and Sales Volume of Electric Vehicle

6.10.4 Electric Vehicle Development Strategy

6.10.5 Cooperation with Neusoft

6.11 Great Wall Motor

6.11.1 Profile

6.11.2 Operation

6.11.3 Electric Vehicles

6.11.4 Electric Vehicle Development Strategy

6.11.5 Wireless Charging System

6.11.6 Key Projects

6.12 JAC

6.12.1 Profile

6.12.2 Operation

6.12.3 Electric Vehicles

6.12.4 Key Projects

6.12.5 Electric Vehicle Development Strategy

6.13 Zotye

6.13.1 Profile

6.13.2 Sales Volume of Electric Vehicle

6.13.3 Electric Vehicle Development Strategy

7 Electric Vehicle Industry Chain

7.1 Infrastructure

7.1.1 Quantity of Charging Stations and Charging Piles

7.1.2 Construction in Major Cities

7.1.3 Development Plan

7.1.4 Suppliers of Charging Equipment

7.2 Key Components

7.2.1 Battery

7.2.2 Motor

7.2.3 Inverter

7.2.4 IGBT

8 Summary and Prediction

8.1 Market Forecast

8.1.1 Market as a Whole

8.1.2 Market Segments

8.1.3 Competitive Landscape

8.2 Summary of Enterprises

8.2.1 Production Layout of Key Players

8.2.2 Plans of Key Players

8.2.3 Vehicle Models to be Launched in 2016

Main Types of New Energy Vehicle

Classification of Hybrid Cars

Emphases of Electric Vehicle Technologies in Key Countries and Regions Worldwide

Technology Roadmap for New Energy Vehicle in China

Electric Vehicle Industry Chain

Subsidy Standards for Electric Passenger Vehicle, 2013-2020E

Subsidy Standards for Electric Bus, 2016

Subsidy Standards (Central Finance) for Electric Bus in China, 2014-2015

Subsidy Standards for Fuel Cell Vehicle in China, 2016

Number of Models of the Catalogue for the Recommended Models of New Energy Vehicle Popularization and Application (New Edition) (1st-2nd Batch)

Manufacturers of theCatalogue for the Recommended Models of New Energy Vehicle Popularization and Application (New Edition) (1st Batch)

Manufacturers of the Catalogue for the Recommended Models of New Energy Vehicle Popularization and Application (New Edition) (2nd Batch)

China ICE and EV Taxes

Catalogue for the Models Exempted from New Energy Vehicle Purchase Tax (1st Batch)

Catalogue for the Models Exempted from New Energy Vehicle Purchase Tax (2nd, Batch)

Catalogue for the Models Exempted from New Energy Vehicle Purchase Tax (3rd Batch)

Sales Volume of Electric Passenger Vehicle (EV & PHEV) Worldwide, 2013-2015

Ranking of World’s New Energy Passenger Vehicle Makers by Sales Volume, 2015

Ranking of World’s Electric Vehicle Models (EV & PHEV) by Sales Volume, 2015

World’s Top 10 Electric Vehicle Models (EV & PHEV) by Sales Volume, 2016

Sales Volume of Electric Passenger Vehicle (EV & PHEV) Worldwide, 2016-2020E

Ranking of New Energy Vehicle (EV & PHEV) by Sales Volume in Europe, 2015

Ranking of New Energy Vehicle (EV & PHEV) by Sales Volume in Europe, 2016

Ranking of New Energy Vehicle (EV & PHEV) by Sales Volume in the United States, 2015

Ranking of New Energy Vehicle (EV & PHEV) by Sales Volume in the United States, 2016

Output of New Energy Vehicle (EV & PHEV) in China, 2015-2016

Sales Volume of Electric Vehicle in China, 2011-2015

Sales Volume of New Energy Vehicle in Market Segments in China, 2015

Sales Volume of Electric Vehicle in China, 2016-2020E

Competitive Pattern of Electric Passenger Vehicle (EV & PHEV) in China, 2015

Competitive Pattern of Electric Bus in China, 2015

Competitive Pattern of Electric Truck in China, 2015

Electric Vehicle Market Structure in China, 2015

Electric Vehicle Market Structure (by Type of Power) in China, 2011-2020E

Electric Vehicle Market Structure (by Vehicle Model) in China, 2011-2020E

BYD Tang PHEV, BMW X5 PHEV, and Volvo SC90 PHEV

Import Volume of Energy-saving and New Energy Passenger Vehicle (EV, PHEV & HEV) in China, 2015

Output of New Energy Passenger Vehicle (EV & PHEV) (by Vehicle Model) in China, 2015-2016

Sales Volume of New Energy Passenger Vehicle in China, 2015-2016

Sales Volume of Energy-saving and New Energy Passenger Vehicle (EV, PHEV & HEV) (by Vehicle Model) in China, 2015-2016

Sales Volume of New Energy Passenger Vehicle (EV & PHEV) (by Class) in China, 2015-2016

Sales Volume of New Energy Passenger Vehicle (EV) (by Class) in China, 2015-2016

Sales Volume of New Energy Passenger Vehicle (PHEV) (by Class) in China, 2015-2016

Market Shares of New Energy Passenger Vehicle (EV & PHEV) Manufacturers in China, 2015

Market Shares of New Energy Passenger Vehicle (EV & PHEV) Manufacturers in China, Jan-Feb., 2016

Layout of Joint Venture Models in China

Output of New Energy Commercial Vehicle in China, 2015-2016

Output of Electric Buses in China, 2015-2016

Top 10 by New Energy Bus Output in China, 2015-2016

Top 10 by Battery Electric Bus Output in China, 2015-2016

Top 10 by PHEV Bus Output in China, 2015-2016

Top 20 by Battery Electric Bus(by Model) Output in China, 2015-2016

Top 20 by PHEV Bus (by Model) Output in China, 2015-2016

Output of Electric Trucks in China, 2015-2016

Output of Battery Electric Trucks (by Enterprise) in China, 2015-2016

Top 20 by Battery Electric Truck (by Model) Output in China, 2015-2016

Automobile Output and Sales Volume of SAIC Group, 2010-2016

Revenue and Net Income of SAIC Group, 2010-2015

Gross Margin of SAIC Group, 2010-2015

Revenue (by Product) of SAIC Group, 2010-2015

Gross Margin (by Product) of SAIC Group, 2010-2015

Output and Sales Volume of Main Electric Vehicles of SAIC Group, 2012-2016

Electric Vehicle Planning of SAIC ROEWE

Automobile Output and Sales Volume of FAW Group, 2010-2016

Revenue of FAW Group, 2009-2014

Automobile Output and Sales Volume of Dongfeng Motor, 2010-2016

Revenue and Net Income of Dongfeng Motor, 2010-2015

Gross Margin of Dongfeng Motor, 2010-2015

Revenue of Dongfeng Motor (by Product), 2010-2015

Gross Margin of Dongfeng Motor (by Product), 2010-2015

Output and Sales Volume of Main Electric Vehicles of Dongfeng Motor, 2013-2016

Automobile Output and Sales Volume of BYD, 2010-2016

Revenue and Net Income of BYD, 2010-2015

Gross Margin of BYD, 2010-2015

Revenue of BYD (by Product), 2010-2015

Gross Margin of BYD (by Product), 2010-2015

Output and Sales Volume of Main Electric Vehicles ofBYD, 2012-2016

Supply Chain of Core Parts of BYD Electric Vehicles

Planning for BYD Electric Vehicle Models, 2016

Output and Sales Volume of Changan Automobile, 2010-2016

Revenue and Net Income of Changan Automobile, 2010-2015

Gross Margin of Changan Automobile, 2010-2015

Total Assets, Revenue and Net Income of Chongqing Changan New Energy Automobile, 2009-2014

Planning for Changan Electric Vehicle Models, 2017-2020

Layout of Changan New Energy Vehicle R&D and Production Bases

Changan New Energy Vehicle Development Path

Output and Sales Volume of Chery Automobile, 2010-2016

Output and Sales Volume of Main Electric Vehicles of Chery Automobile, 2011-2015

Chery Electric Vehicle Models to be Launched, 2016-2017

Automobile Output and Sales Volume of Geely, 2010-2016

Revenue and Net Income of Geely, 2009-2015

Output of Main Electric Vehicle Models of Geely, 2015-2016

Geely Electric Vehicle Sales Volume by Models, 2015

Automobile Output and Sales Volume of BAIC Motor, 2010-2016

Revenue and Total Profit of BAIC Motor, 2009-2015

BEV Output of BAIC BJEV, 2012-2016

Output of BAIC BJEV by Models, 2015-2016

New Energy Vehicle Industry Layout of BAIC Motor

New Energy Vehicle Production Bases of BAIC Motor

Corporate Structure of BAIC BJEV

Product Planning of BAIC BJEV

Automobile Output and Sales Volume of GAC Group, 2010-2016

Revenue and Net Income of GAC Group, 2011-2015

Gross Margin of GAC Group, 2011-2015

Output and Sales Volume of Brilliance Auto, 2010-2016

Revenue of Brilliance Auto, 2012-2015

EV Sales Volume of Brilliance Auto,2015-2016

Output and Sales Volume of Great Wall Motors, 2010-2016

Revenue and Net Income of Great Wall Motors, 2010-2015

Gross Margin of Great Wall Motors, 2010-2015

Main EV Products of Great Wall Motors

Four New Energy Projects of Great Wall Motors

Output and Sales Volume of JAC, 2010-2016

Revenue and Net Income of JAC, 2010-2015

Gross Margin of JAC, 2010-2015

Sales Volume of JAC iEV BEV, 2014-2016

Output and Sales Volume of Zotye Auto, 2010-2016

EV Sales Volume of Zotye Auto, 2015-2016

China’s EV Charging Station Ownership, 2010-2020E

China’s Charging Pile Ownership, New Energy Vehicle Ownership and Vehicle-Pile Ratio, 2010-2015

China’s EV Charging Pile Ownership, 2010-2020E

Statistics of Charging Piles (by Purpose) as of 2015

Quantitative Statistics of Charging Piles in Major Domestic Cities, 2014-2015

China EV Charging Pile Construction Plan, 2015-2020

State Grid EV Charging Station Construction Plan, 2009-2020

Contrast Analysis of Product Schemes of 41 Chinese Charging Equipment Suppliers

Output of Major Battery Companies, 2014-2015

Major Global and Chinese Lithium-ion Battery Companies

Major Global and Chinese Drive Motor Manufacturers and Their Supporting Customers

Major Global and Chinese Electric Vehicle Inverter Manufacturers

Major Global Electric Vehicle IGBT Manufacturers

Global and China’s Electric Vehicle Sales Volume and Growth, 2013-2020E

China’s Electric Passenger Vehicle Sales Volume, 2013-2020E

Top10 Electric Passenger Vehicle Enterprises in China, 2015

Top10 Electric Bus Enterprises in China, 2015

Top10 Electric Truck Enterprises in China, 2015

EV Business Layout of Major Enterprises in China

(Targeted) EV Sales Volume of Major Enterprises, 2015, 2016, 2020

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...